Author of the article: L1S

Gm people!!

Today we are going to talk about yield-bearing stablecoins. You may have already heard about stablecoins and even used them, but what is this new format of stablecoins that also generate income?

Why is it so important and what does it have to do with the Injective?

I'll try to explain it all here, and all you have to do is read and absorb this information.

In this article, we will understand what stablecoins are, how they work, what they are and how exactly yield-bearing stablecoins can change the cryptocurrency market. And most importantly, why Injective has become home to this technology and how Paxos had something to do with it.

Structure of the article

-

What are stablecoins? -

How does this work? -

What kinds of stablecoins exist? -

Benefits of stablecoins -

What are yield-bearing stablecoins? -

Paxos integration -

How it can be useful to users -

Why is this direction promising for Injective? -

Useful links

What are stablecoins?

Let's begin with the easiest one. Stable coins (or stablecoins) are cryptocurrencies which are connected to some real asset value, such as the US dollar, euro, or gold. Their principal purpose is to keep the price stable in order to enable people to use them as a kind of digital analog to real money.

How does this work?

When referring to the stable coins, every such coin usually is real collateral. Referring for instance to the dollar-linked stablecoins, each such coin, such as USDT, USDC or wUSDL, would be backed by a dollar that is kept in the reserve account. This will be done with an objective of ensuring that users can exchange their digital coin for a real dollar at any time they want with a fixed rate.

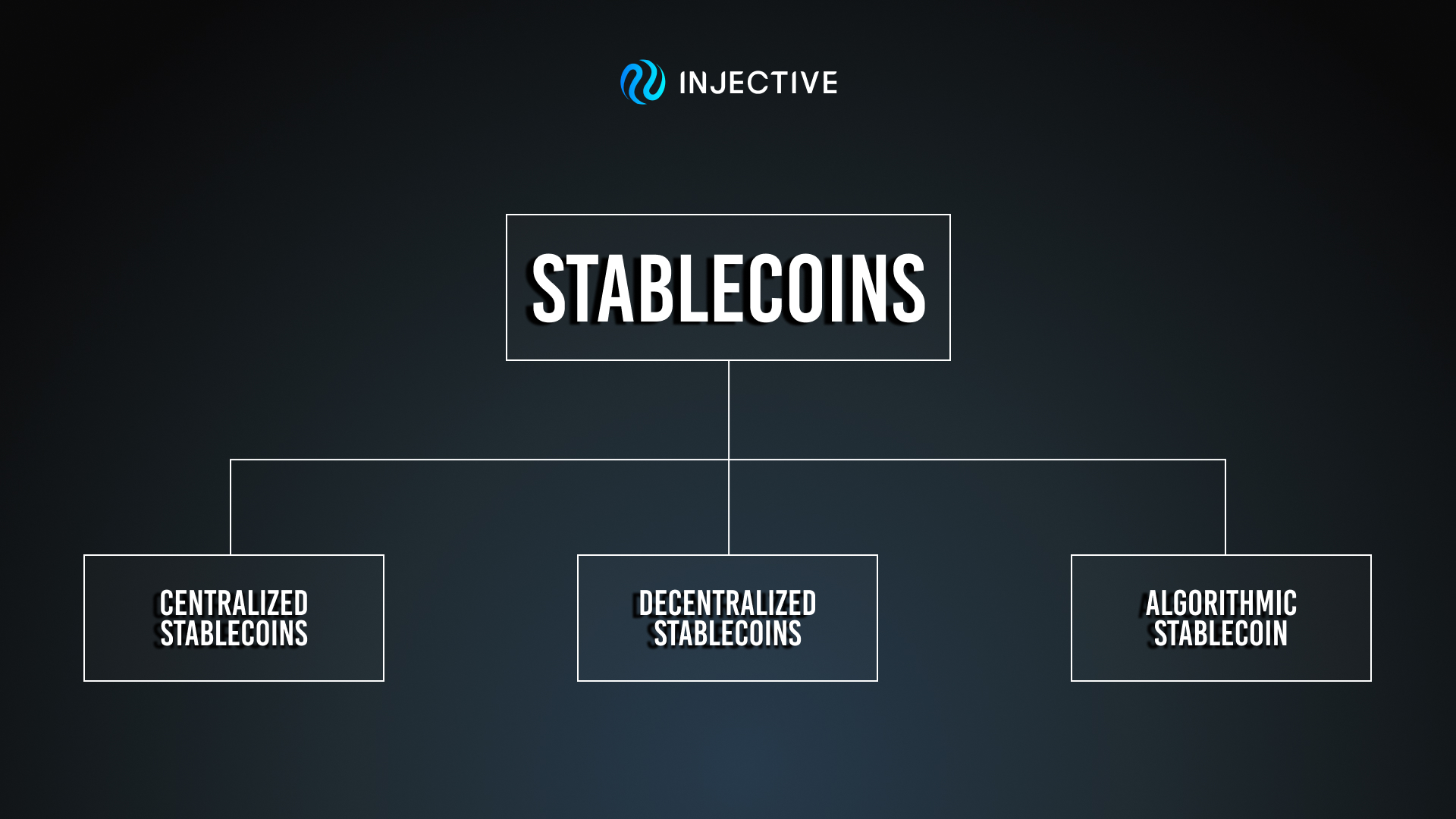

What kinds of stablecoins exist?

There are a few kinds of stablecoins, to wit:

-

Centralized Stablecoins: In these kinds of coins, real assets, like US dollars, are their backing and handled by firms at their core. They guarantee stability and maximum transparency because their reserves are periodically audited by auditors.

-

Decentralized Stablecoins: These are collateralized with other cryptocurrency, hence managed by a protocol. They are less dependent on trusting a single company but more volatile if the value of the collateral drops sharply.

-

Algorithmic Stablecoin: This type of stablecoin does not have direct collateral but relies on algorithms for maintaining value. More complex, this model involves a number of risks associated with the instability of prices.

Benefits of stablecoins

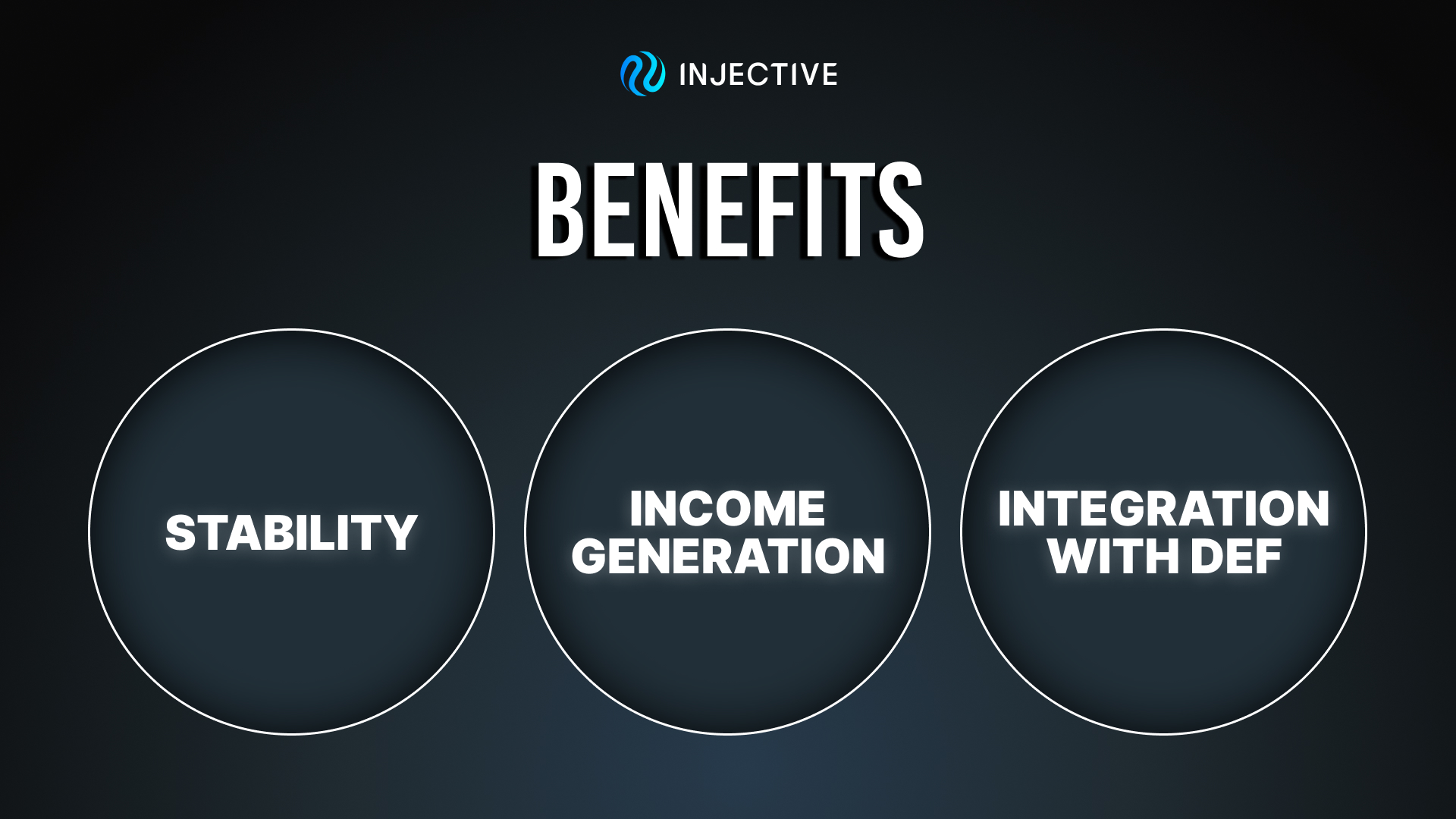

Now that we understand what the nature of stable coins is, let us understand why they are even needed and what their main benefits are.

Stability protection from volatility

Chief among stablecoin benefits is their stability.

Virtual currencies like bitcoin and ether can surge up and down wildly in value, sometimes rendering them ill-suited for day-by-day use.

Stablecoins retain their value flat and maintain that value fine for storing or transferring funds.

Affordability and ease of use:

Stablecoins are used by many as some sort of digital substitute for actual money.

It can be easily and quickly transferred between users without some intermediary link, like banks.

That is extremely useful in performing international transfers, where the traditional system has proved to be very slow and expensive.

Integration with DeFi

They also form an integral part of Decentralized Finance. Many DeFi protocols, including lending and staking protocols, are using stablecoins as the major settlement means for it to enable users to earn some returns from their assets and participate in a wide class of financial products.

What are yield-bearing stablecoins?

But now, let's proceed to the main topic of our article-yield-bearing stablecoins.

This class of stablecoins actually enables users to store funds not only in a stable currency but also to generate some income from their assets. Sounds great, doesn't it?

How does that work?

An easy concept of yield-paying stablecoins is that in case of holding such a coin, your money does not just lie idle but is invested in one or another financial product, be it lending or staking.

For example, protocols can use your funds to lend to other users and earn interest distributed later to the holders of the stablecoins.

Paxos Example

One such example of steablecoins is Paxos, which now has an integration with Injective. Paxos is a centralized stablecoin allowing people to create revenue from their various assets. This is through the allowance given to Paxos reserves to be used in investing in high-yielding financial instruments, such as treasuries or corporate bonds. The returns are then distributed to the holders of the given stable coins.

What does this have to do with Injective?

And now, let's speak to why Injective has become home to such innovation and how all that works in the Injective ecosystem.

Injective is an L1 blockchain built to support the needs of DeFi and trading. The blockchain's high transaction speed, combined with its low fees and support for smart contracts, has made it ideal to build financial products like yield-bearing stablecoins.

Paxos integration

Injective now integrates with Paxos to provide yield-bearing stablecoins to users for the first time, not only backed by real assets but also bringing in interest income. It opens up entirely new opportunities for users who want to store their assets in a stable currency but still generate additional income.

Why is this necessary for Injective?

The question is unskippable: "Why does Injective need this?" And the answer is straightforward: Injective is actively building up the DeFi ecosystem, and it claims to become a real hub for trading and working with real assets.

Yield-bearing stablecoins enable users not just to store their funds but also to use them for generating income and thus turn Injective into an even more appealing platform.

Interestingly, the integration of yield-bearing stablecoins is closely related to the sphere of real asset tokenization, which Injective is actively developing.

If you read my previous articles, you probably know that Injective is actively supportive of the tokenization of such assets as real estate, bonds, and other securities.

Yield-paying stablecoins and RWA tokenization go hand in hand.

This means that a user can keep their money in a stable currency while generating yield and at the same time invest in tokenized real-world assets. In such a way, the Injective ecosystem is unique and feature-rich by combining the best of DeFi and tokenization.

How it can be useful to users

The benefits that the addition of such tokens can have for Injective users are highlighted below.

-

Stability Stablecoins with some form of yield, such as Paxos, allow users to hold their funds in a type of stable currency pegged to a real-world asset. This protects funds from the volatility that marks cryptocurrencies.

-

Income generation The main advent of yield-bearing stablecoins is the possibility of earning some passive income with your assets. Instead of just keeping your money, you can get such coins and receive an interest income, which in this light puts them in a more advantageous position compared to regular stablecoins.

-

Integration with DeFi Injective provides the broadest possible opportunities for the use of stablecoins in DeFi applications. Using yield-bearing stablecoins for staking, lending, and participating in liquidity opens a whole new stream of revenue.

Why is this direction promising for Injective?

Having received an idea of how yield-bearing stablecoins work and why they are so important, let's consider why this direction is so promising for the Injective.

The development of the DeFi ecosystem Injective seeks to position itself as a platform that, in the future, is to become a hub of trading and work with real assets.

Yield-bearing stablecoins perfectly match this strategy, since they give users both stability and the possibility to get income.

Hence, Injective turns out to be an extremely convenient platform for investors and traders who want to manage their assets efficiently and with minimal risk.

Injective actively supports innovative solutions, and among the new technologies integrated into the platform are yield-bearing stablecoins and real asset tokenization. That means the service tries not just to follow the trend but create a new standard and open new opportunities for its users.

Such stablecoins grant users the possibility of holding their funds in a stable currency and making a profit at the same time. Thus, it is a pretty unique and effective tool.

Injective team actively develops this trend by integrating the solution from Paxos and supporting tokenization of the real assets. This opens completely new opportunities for Injective users and makes its ecosystem even more interesting.

Website Injectvie: https://injective.com

Discord: https://discord.gg/injective

Twitter: https://twitter.com/Injective

评论 (0)