EIP-4844 is now live, introducing 'Proto-Danksharding,' enabling blob transactions for rollups.

With blob txs, rollups will have their own fee market and therefore won't have to compete with mainnet apps. As a result, posting rollup data is much cheaper and fees on rollups are decreased by orders of magnitude.

Gas Fee Reductions:

-

Zora: 0.54 -> 0.001

-

Base: 0.59 -> 0.003

-

Starknet: 0.96 -> 0.025

-

OP Mainnet: 0.53 -> 0.007

But what are the implications for Ethereum's profitability?

-

Despite the reduction in fees paid by rollups to Ethereum Mainnet, Ethereum's fee generation is unlikely to plummet.

-

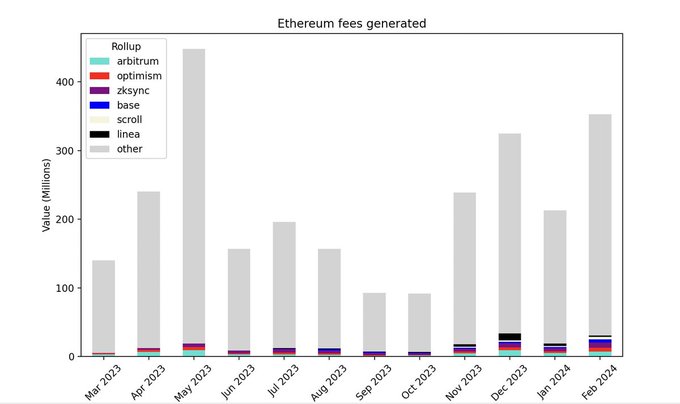

Because, Rollup settlement fees accounted for only ~7-10% of Ethereum's total fees in February, amounting to $33m out of $355m.

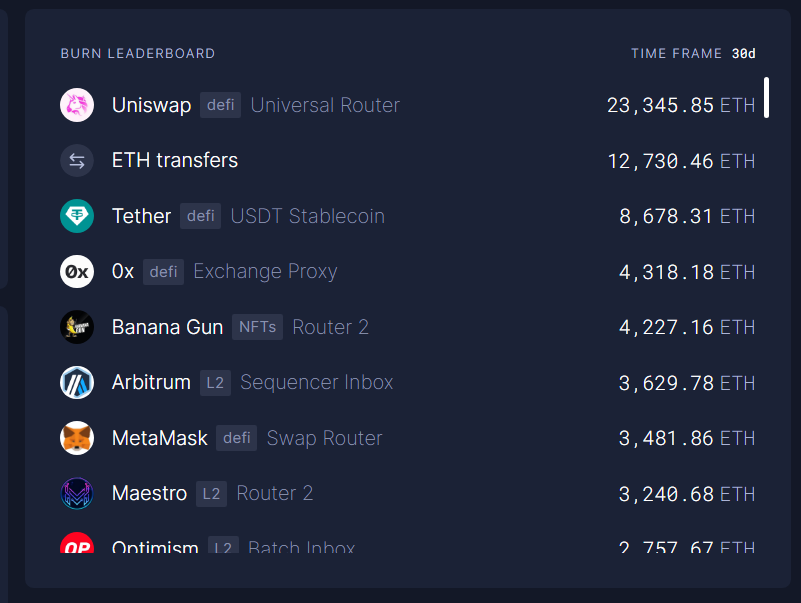

Major Contributors to Ethereum Fees: Uniswap V3 routers, ETH transfers, Tether transfers, 0x, Banana Gun, MetaMask, and Maestro are significant contributors.

Short-term, EIP-4844 may lead to a loss of $30m in monthly fees, but this is not detrimental to Ethereum's deflationary nature.

Long-Term Impact:

-

In the long run, EIP-4844 is beneficial as reduced rollup fees unlock diverse use cases such as gaming, AI, NFTs, high-performance order-book DEXs, Depin, and social apps.

-

With Eth as the gas fee token in most rollups, the value-driven to Ethereum exceeds the monthly fee reduction.

User Growth on Layer2s:

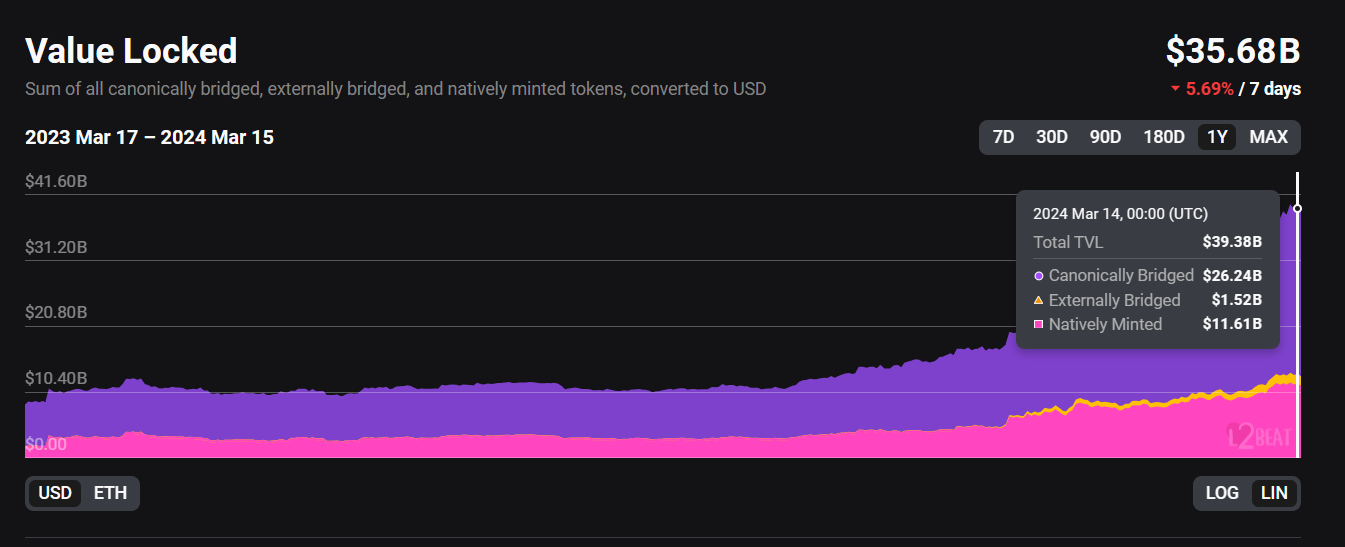

- There are currently an average of 12m monthly active users on Layer2s, predominantly holding Ethereum to pay for gas fees. As more users join this layer2s they only increase the demand for ETH as it is the gas fee token.

The total ETH bridged to Layer2s stands at 26B and continues to grow steadily.

Conclusion:

-

While there may be a short-term negative impact on Ethereum's fee generation, long-term benefits are substantial.

-

ETH becomes the settlement asset across various rollups and Appchains, reinforcing its value proposition.

Thanks for reading and Let’s connect on X

评论 (0)