Hey crypto enthusiasts! Big news just hit the Bitcoin world, and it's a game-changer. BlackRock, the world's largest asset manager, is now the top Bitcoin holder. But that's not all – other financial heavyweights are jumping in too. Let's break it down:

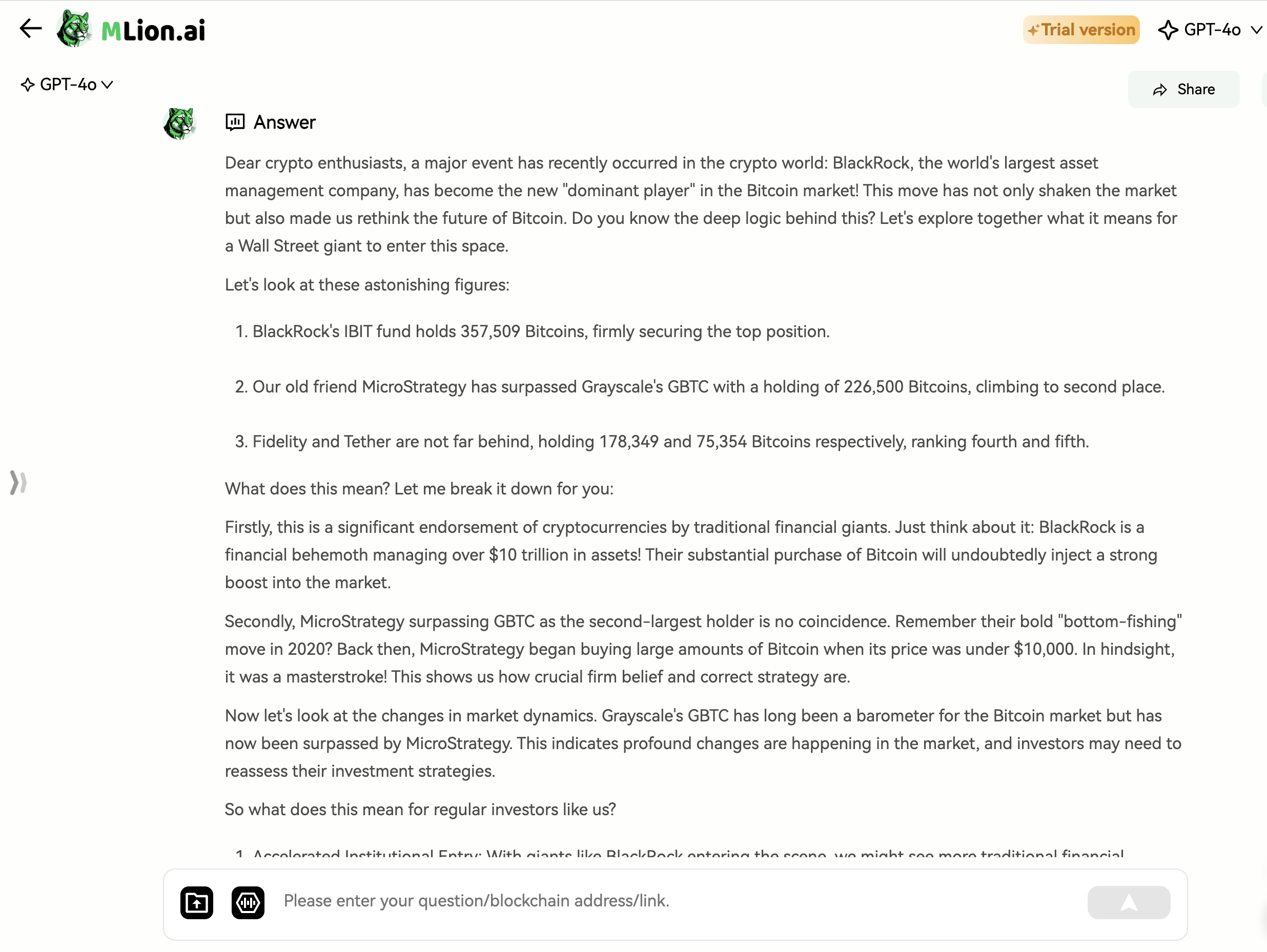

The New Bitcoin Leaderboard:

-

BlackRock's IBIT fund: 357,509 BTC

-

MicroStrategy: 226,500 BTC

-

Grayscale's GBTC: (now in 3rd place)

-

Fidelity: 178,349 BTC

-

Tether: 75,354 BTC

What's the Big Deal?

-

Wall Street's Seal of Approval: When a $10 trillion asset manager like BlackRock bets on Bitcoin, it's huge. This could open the floodgates for other institutions.

-

MicroStrategy's Vindication: Remember their 2020 Bitcoin buying spree at under $10k? Looks pretty smart now, doesn't it?

-

Market Shift: Grayscale's GBTC is no longer the top dog. The crypto landscape is changing fast.

What It Means for You:

-

More Institutional Money: Expect more big players to follow BlackRock's lead, potentially driving up Bitcoin's price.

-

Buckle Up for Volatility: These big investors can cause major market swings. Be prepared for a wild ride.

-

Long-term Bullish Signal: Major institutions investing suggests Bitcoin is here to stay.

-

Rethink Your Strategy: Consider adding Bitcoin ETFs to your portfolio, following the pros' lead.

The Bottom Line:

While this news is exciting, remember – the crypto market is still unpredictable. Stay informed, be vigilant, and always manage your risk.

Want more insights? Check out mlion.ai for real-time analysis and price predictions.

Remember: This is info, not investment advice. Crypto is risky – invest wisely!

Follow for daily market updates!

评论 (0)