Hello Bufferinos 🐙,

V2.6 is live on Arbitrum Mainnet. It bring smol but powerful updates laying the foundation for our next wave of adoption. Here’s a smol brief on all the updates, with a lot of images. 😉

If you are one of the rarities who loves reading big blocks of text and in-depth information, you’d probably want to look into updated Buffer docs.

1-Click Trading is now Global!

A/B traders you’ve been left out haven’t you! Not anymore.

Trading experience with Up/Down markets is currently unparalleled industry-wide. So we brought it to Above/Below.

You already know the drill, but for those who are new -

You complete a quick and easy 1-Click setup - account creation and registration and one-time approval. Once that’s done you will never need to spend any ETH from your wallet, or click on any wallet approvals at any part of your journey on Buffer to place a trade.

1-Click, Gasless, Instant Trading Everywhere! ✨

Expiries - Give Me More!

One of the most requested updates for above/below markets. We have added 3 daily expiries and 3 weekly expiries.

UI Updates:

#1.

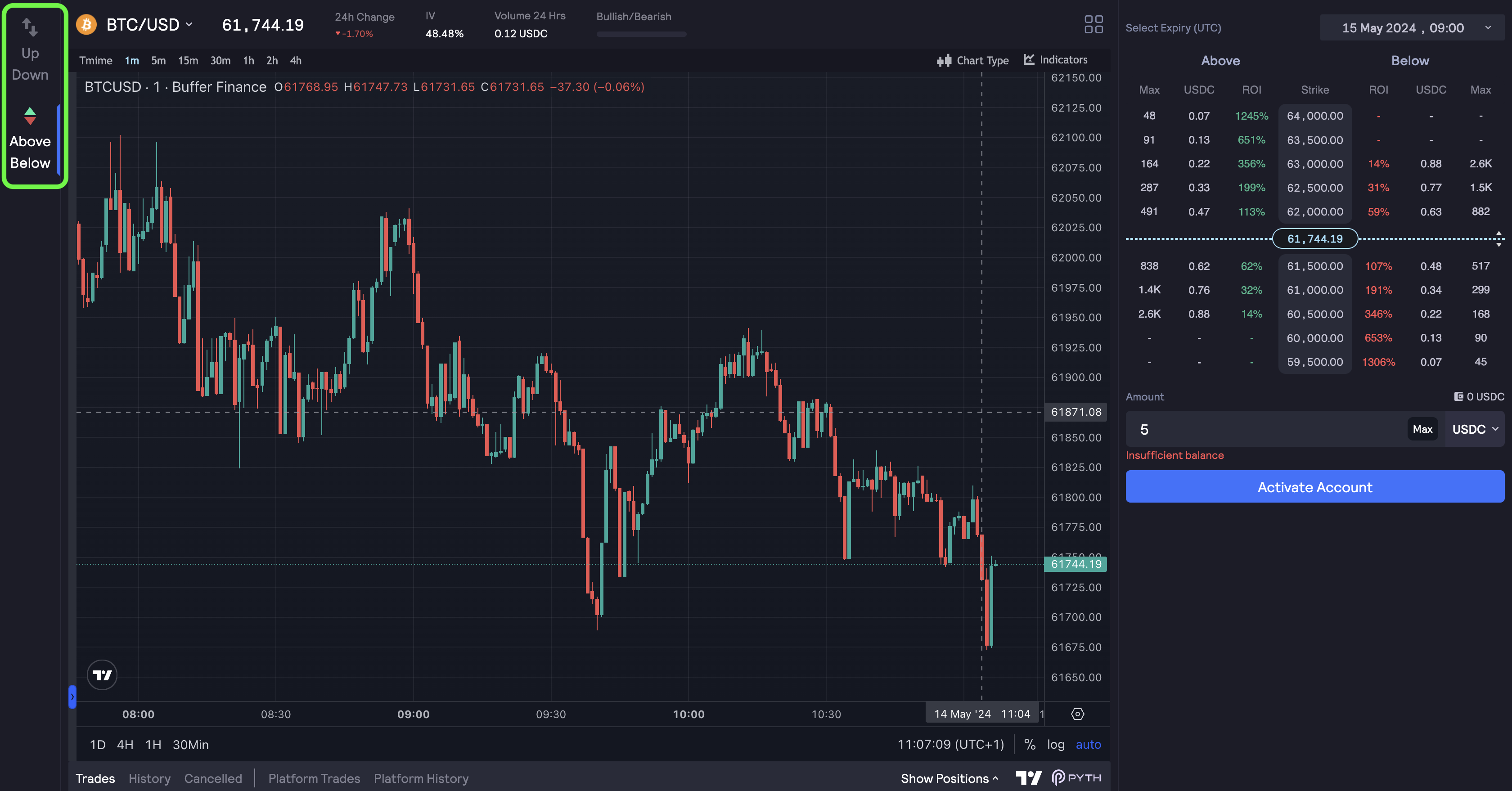

See that cute and very functional toggle bar on the left? Switch seamlessly between Up/Down and Above/Below markets.

#2.

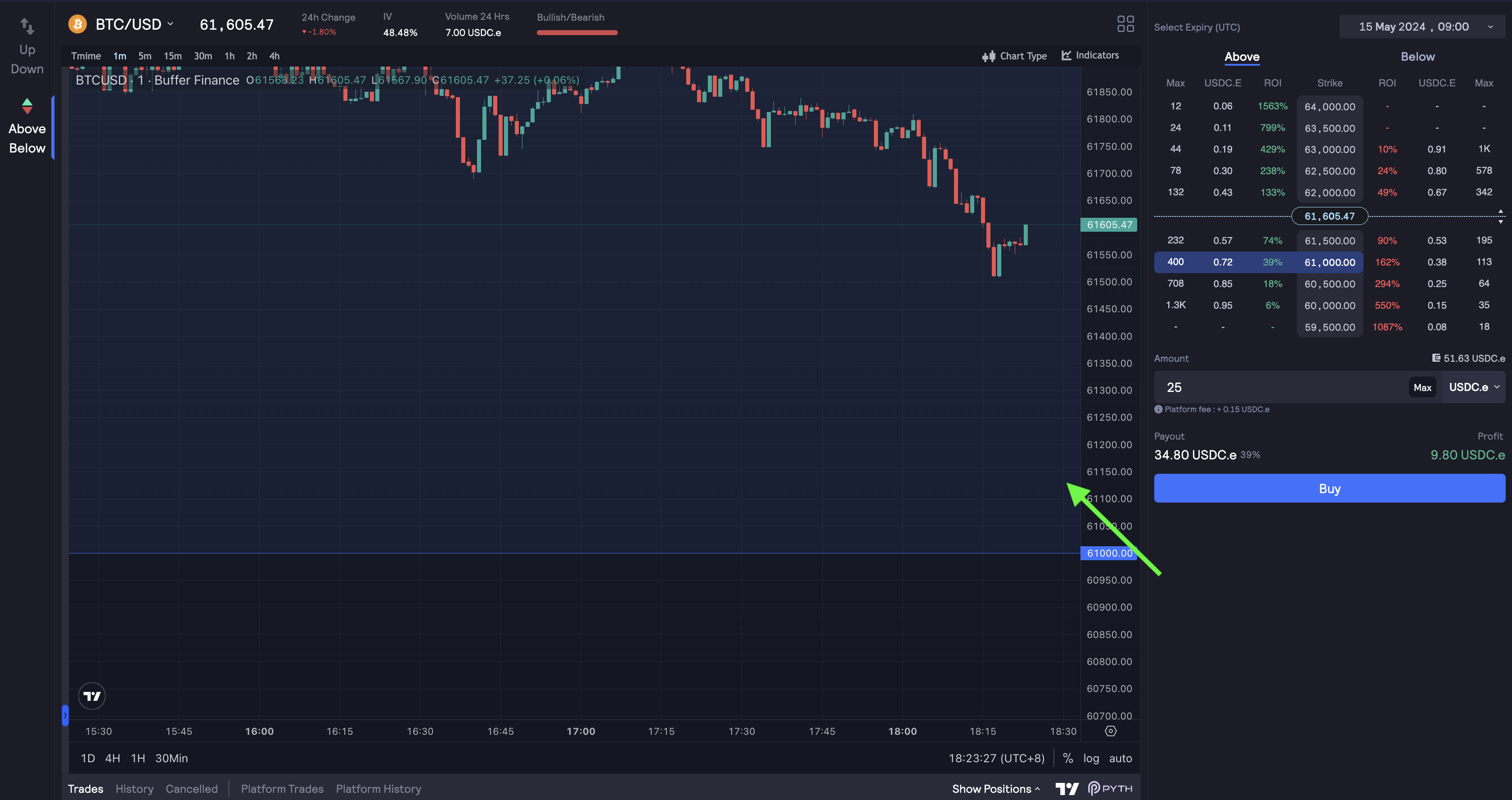

Shiny new trading dashboard for Above/Below markets - wider span and more granular view for each market:

-

Max: max trade size for that market/contract

-

Price per contract

-

ROI

-

Strike

Too stunning, images not cutting it? Oke go get the first hand experience:

https://app.buffer.finance/#/ab/BTC-USD/

#3.

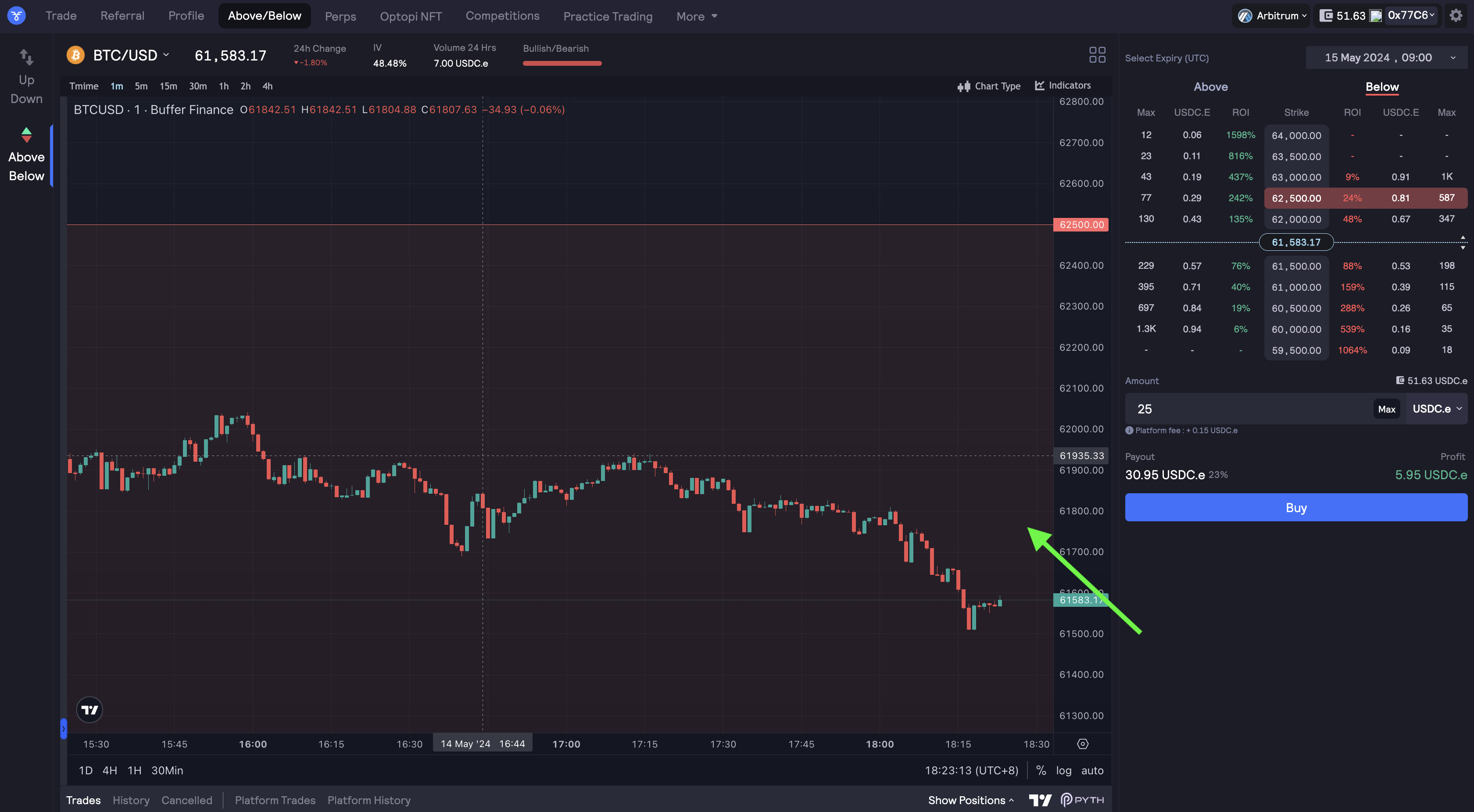

Here’s another bit of pixel magic 🪄 - depending on the direction you choose, it paints the chart red or blue - just making sure you never accidentally choose the wrong direction.

#4.

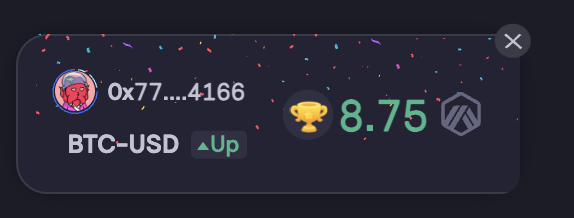

Oh if you see these tiny pops, it notifies you of the winner with best PnL or the most recent wins. Inspiration everywhere! ✨

That’s too much fun wasn’t it? Let’s balance it with some serious stuff.

Risk Management:

These updates to risk management ensure that the max buy-in across both Buffer markets is based on market demand and supply - instead of relying on deterministic formulae:

-

For Up/Down: max Trade Size adjusts dynamically based on the % of funds available in the BLP pool.

-

For Above/Below: max Skew adjusts dynamically based on the % of funds available in the BLP pool.

That Tech Stuff

- Pyth direct contract integration

When a trader opens a position on Buffer, the keepers fetch the price from Pyth and publish it to the contract. Direct integration allows the contract to internally verify the data with Pyth, removing any trust assumption on the keeper.

- Router allows both direct contract integration and 1 click trading

This update enhances the composability of Up/Down and Above/Below Markets - laying the foundation for Buffer to reach a seamlessly integratable infrastructure.

Integrating the markets still requires Buffer API to send trades to support 100% gasless trading - we plan on making these APIs available in the future.

That’s V2.6 for you. Thank you for reading.

P.S. - User feedback is the best and most efficient way for us to improve Buffer - don’t forget to test the new version and share your thoughts.

-

Trade Up/Down Markets: https://app.buffer.finance

-

Trade Above/Below Markets: https://ab.buffer.finance

评论 (0)