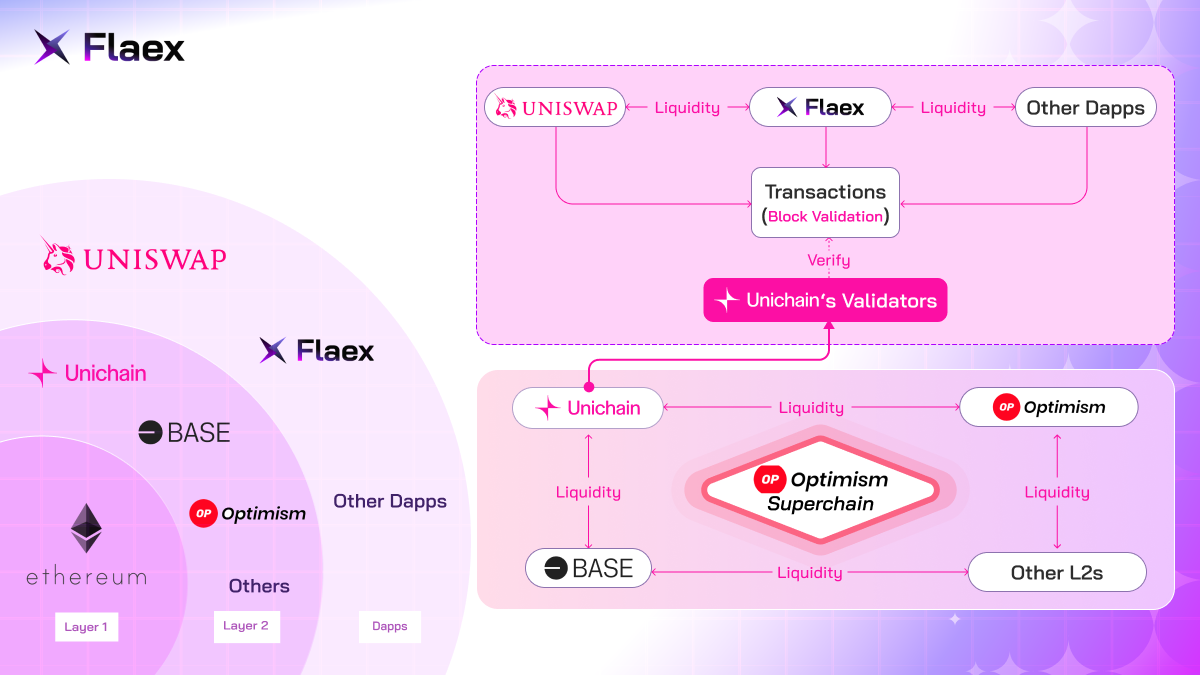

Uniswap, one of the most widely-used decentralized exchanges, has launched Unichain, an Ethereum Layer 2 blockchain specifically crafted to enhance scalability and cut down transaction fees for decentralized finance (DeFi).

As part of the Optimism Superchain, Unichain promises to slash costs by up to 95%, providing faster transactions with block times as short as one second. Its seamless interoperability with other chains within the Superchain framework is aimed at addressing Ethereum's known bottlenecks, such as high gas fees and slower transactions, making DeFi participation smoother and more cost-effective.

The Benefits of Unichain for DeFi

The introduction of Unichain brings a range of advantages for the broader DeFi sector. One major upside is the drastic reduction in transaction fees, which makes DeFi more accessible by lowering the financial barriers to entry.

Additionally, the improved transaction speeds (with block times as low as one second) will significantly enhance user experiences, making operations feel almost instantaneous and reducing the risk of failed trades during network congestion. Furthermore, cross-chain liquidity enabled by Unichain’s integration into the Optimism Superchain ensures that users can access deeper liquidity pools across multiple chains, fostering a more cohesive and efficient DeFi ecosystem.

Potential Downsides of Unichain for DeFi

However, the launch of Unichain is not without challenges. A key concern is the risk of fragmenting liquidity, as liquidity providers may find their assets split between Ethereum’s Layer 1 and Unichain, which could potentially lead to higher slippage and less efficient trading.

Another challenge is the increased complexity for users, especially those accustomed to using Uniswap solely on Ethereum. The introduction of a new Layer 2 chain may require users to navigate additional layers of technical complexity. Lastly, in its early phases, Unichain’s validator network will be controlled by Uniswap Labs, raising concerns around centralization until the network matures into a more decentralized structure.

How Flaex Can Benefit from Unichain’s Launch

For Flaex, which relies on Uniswap for decentralized trading and protocols like Aave for lending, Unichain presents several promising opportunities. First, the reduced transaction fees and faster execution times will enhance the overall user experience on Flaex, making trading more efficient and cost-effective.

Additionally, Unichain’s access to cross-chain liquidity within the Optimism Superchain will allow Flaex to tap into a broader and more diverse liquidity pool, improving trading conditions. Moreover, the protection against Miner Extractable Value (MEV) that Unichain offers will ensure fairer and more secure trade execution for Flaex users, making it a valuable upgrade.

Looking Ahead: Flaex and Unichain’s Future

While Unichain is still in its test phase and will take time to fully roll out, its potential to reshape DeFi is substantial. The Flaex team will continue to prioritize its current development efforts, ensuring the platform is prepared for whatever comes next.

As Unichain matures, Flaex looks forward to leveraging its advantages to improve the trading and liquidity experience. For now, we’ll be watching closely to see how Unichain evolves and what it will bring to the broader web3 landscape, as Flaex remains committed to staying at the forefront of these exciting developments.

Also learn more about Flaex at: Website | Whitepaper | TG contact

评论 (0)