Introduction

On April 22, 2025 (Tuesday), U.S. President Trump announced a “significant reduction” in the existing 145% tariffs on Chinese imports, though he emphasized that tariffs would not drop to zero. Following this statement, Bitcoin (BTC) broke through $93,000 and climbed to $94,000 by April 23, signaling a robust market response. This report examines the potential effects of Trump’s tariff adjustment on the Bitcoin market, provides price trend forecasts, offers Harspider Capital’s investment recommendations, and evaluates long-term cryptocurrency market trends from a research perspective. Drawing on current market data, expert insights, and historical patterns, this report integrates Harspider Capital’s analytical framework to deliver actionable insights for investors. It addresses the policy context, immediate market reactions, future price projections, recommended investment areas, and broader trend perspectives.

1. Background and Adjustment of Trump’s Tariff Policy

1.1 Current Tariff Status and Adjustment Direction

Tariffs serve as a critical instrument for governments to manage trade, directly impacting global supply chains and economic dynamics.As of mid-April 2025, the U.S. maintained tariffs as high as 145% on Chinese imports, a policy built under the Trump administration to safeguard domestic industries and counter geopolitical rivalry. However, these elevated tariffs have strained U.S.-China trade relations, driven up global commodity prices, and heightened inflation pressures.

On April 22, 2025, Trump declared a “significant reduction” in these tariffs, though the exact new rate remains unspecified. Based on market analysis and past policy shifts, Harspider Capital estimates the adjusted rate could fall to approximately 50%. This move likely reflects progress in U.S.-China negotiations or a strategic push by the Trump administration to boost economic growth. Reuters reported on April 17, 2025, that Trump signaled intentions to stimulate the economy by easing trade barriers, while retaining some tariffs to maintain leverage against China (Reuters, 2025-04-17).

1.2 Initial Assessment of Policy Impact

Reducing tariffs could alleviate global trade tensions, enhance cross-border commodity flows, and invigorate economic activity. For financial markets, this shift may strengthen risk assets like stocks, commodities, and cryptocurrencies. However, with tariffs remaining above zero, trade policy uncertainty lingers, potentially leading to short-term market fluctuations.

2. Current Bitcoin Market and the Link to Tariff Adjustments

2.1 Current Market Performance

Since Trump’s tariff reduction announcement, Bitcoin has exhibited strong upward momentum. Per Coinbase data (Coinbase Bitcoin Price), Bitcoin’s price increased from $93,000 to $94,000 as of April 23, 2025, with a 24-hour trading volume of roughly $5.581 billion, reflecting robust market activity. Technical indicators show Bitcoin’s 50-day simple moving average (SMA) at $84,642 and its 200-day SMA at $93,964, underscoring a solid short-term trend (CoinCodex, 2025).

2.2 Historical Relationship Between Tariffs and Bitcoin

Bitcoin is widely regarded as a hedge against economic uncertainty and inflation. Historically, trade policy changes have influenced Bitcoin prices in varied ways. During the 2018-2020 U.S.-China trade war, Bitcoin rose from $6,000 to $12,000, bolstered by its safe-haven status amid instability (Blockhead, 2025-01-30). In early 2025, when Trump escalated tariffs, Bitcoin briefly declined but swiftly recovered, highlighting market resilience (Investopedia, 2025).

This tariff reduction may further propel Bitcoin’s ascent. Harspider Capital posits that reduced trade tensions could enhance economic optimism, increasing investor interest in alternative assets like Bitcoin. Nonetheless, short-term market dynamics may remain intricate, with volatility anticipated.

3. Future Price Forecasts and Impact Analysis

3.1 Summary of Expert Predictions

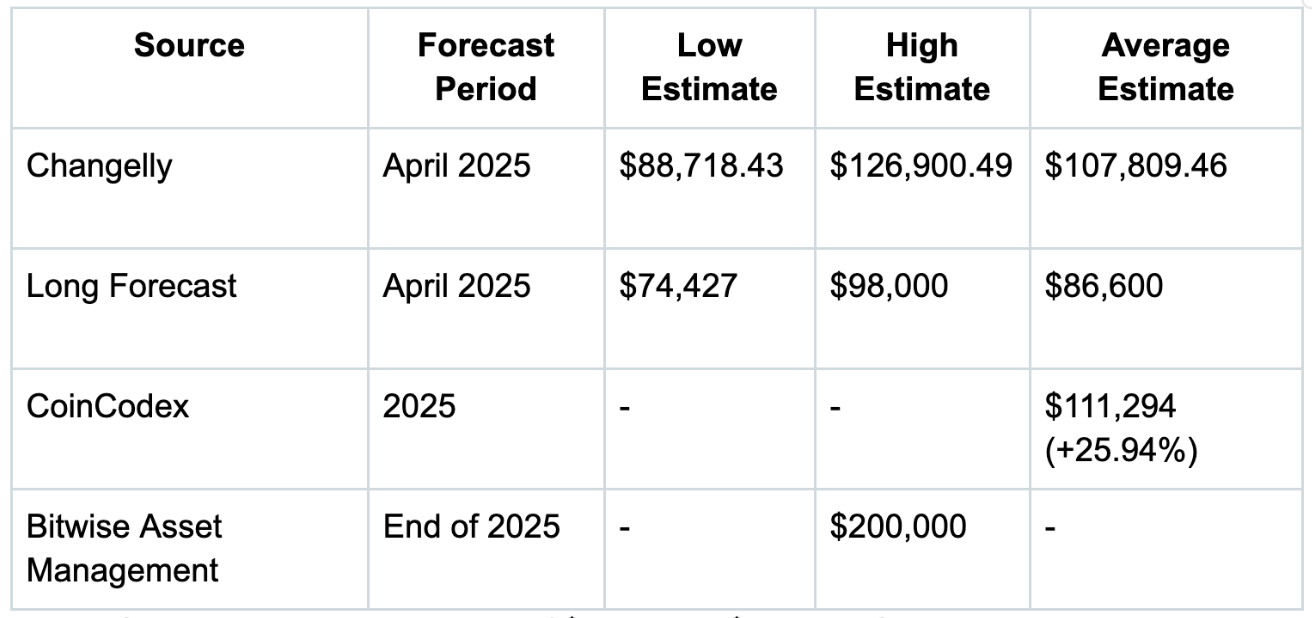

Expert projections for Bitcoin’s 2025 price vary, reflecting market uncertainty. Key forecasts include:

-

Changelly predicts a range of $88,718 to $126,900 for April 2025, averaging $107,809 (Changelly Bitcoin Price Prediction).

-

Long Forecast offers a conservative estimate of $74,427 to $98,000 for April (Long Forecast).

-

CoinCodex projects a 25.94% rise to $111,294 for 2025.

-

Bitwise forecasts an optimistic $200,000 by year-end (Forbes, 2025-01-01).

3.2 Analysis of Influencing Factors

Harspider Capital identifies several drivers of Bitcoin’s future price:

-

Global Economic Environment: Tariff cuts may spur growth, boosting liquidity and risk appetite, which could lift Bitcoin prices.

-

Inflation and Monetary Policy: Reduced tariffs might temper inflation, allowing accommodative Federal Reserve policies that favor Bitcoin as an inflation hedge.

-

Regulatory Policies: Evolving U.S. and global cryptocurrency regulations remain pivotal, with tighter rules potentially curbing growth.

-

Institutional Adoption: Rising institutional investment could drive demand, especially post-halving when Bitcoin’s supply tightens.

Bitcoin may exceed $100,000 in 2025, potentially approaching $200,000 in bullish scenarios, though short-term volatility is expected.

4. Harspider Capital’s Investment Recommendations: Focus Areas and Risk Management

Based on the tariff adjustment and Bitcoin trends, Harspider Capital suggests:

4.1 Cryptocurrency-Related Sectors

-

Bitcoin and Exchanges: Invest directly in Bitcoin, targeting $100,000-$200,000, and focus on exchanges like Coinbase, which benefit from higher trading volumes.

-

Blockchain Technology Companies: Target firms enhancing Bitcoin’s ecosystem, such as Layer 2 providers or on-chain analytics firms.

4.2 Sectors Benefiting from Trade Growth

-

Technology Sector: Tariff reductions may aid semiconductor and electronics supply chains; consider Nvidia and Apple.

-

Financial Services: As cryptocurrency adoption rises, traditional institutions like Goldman Sachs and JPMorgan may expand offerings, meriting attention.

4.3 Renewable Energy Opportunities

Bitcoin mining’s energy intensity, paired with potential energy market growth from tariff shifts, points to renewable energy investments (e.g., solar, wind) for long-term gains.

4.4 Risk Management

-

Diversified Investments: Allocate assets across sectors to mitigate concentration risk.

-

Dynamic Monitoring: Track inflation, regulatory shifts, and China’s trade responses, adjusting strategies accordingly.

5. Future Trend Outlook

5.1 Bitcoin as an Inflation Hedge

Harspider Capital anticipates Bitcoin strengthening as an inflation hedge. If tariff reductions fuel recovery with mild inflation, Bitcoin’s capped supply (21 million coins) enhances its appeal.

5.2 Short-Term Volatility and Long-Term Potential

Short-term price swings may occur as markets process the tariff changes, particularly until the new rate is confirmed. Long-term, a stabilizing global economy could drive institutional inflows and safe-haven demand for Bitcoin.

5.3 Regulatory and Competitive Risks

Global regulatory uncertainty poses a key risk. Stricter U.S. crypto tax policies could undermine confidence, while traditional assets like gold or stocks might compete for capital in an improving economy.

Conclusion

President Trump’s April 22, 2025, announcement to significantly lower the 145% tariffs on Chinese imports could reduce trade friction, benefiting the global economy and indirectly supporting Bitcoin’s rise. Bitcoin’s climb from $93,000 to $94,000 reflects

market optimism. Harspider Capital projects Bitcoin could surpass $100,000 in 2025, potentially nearing $200,000, contingent on economic and regulatory factors.

To capitalize on this, Harspider Capital recommends targeting cryptocurrency sectors (e.g., exchanges, blockchain), trade-growth beneficiaries in tech and finance, and renewable energy, with diversified investments to manage risks. Bitcoin’s role as an inflation hedge is likely to grow, though short-term uncertainties require vigilance. Harspider Capital will continue tracking developments to provide investors with forward-looking guidance.

评论 (0)