Puffer Finance is a pioneering decentralized native Liquid Restaking Protocol (nLRP) built on EigenLayer that simplifies native restaking on Ethereum, dramatically lowering barriers to entry for validators while enhancing yields and security through its innovative architecture and anti-slashing technology.

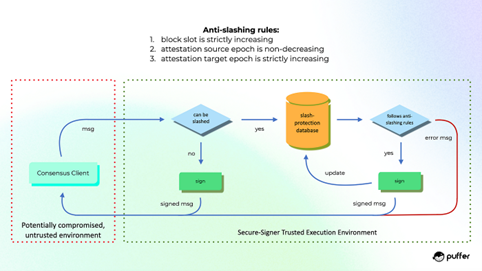

Puffer Finance's novel anti-slashing technology, Secure-Signer, is a remote signing tool designed to prevent slashable offenses using Intel SGX Trusted Execution Environments (TEEs). Secure-Signer generates and stores all BLS validator keys in its encrypted memory, only accessible during runtime, protecting against accidental slashes from double-signing even if the node's operating system is compromised. It enforces strict checks on proposals and attestations to maintain the integrity of signed materials. By reducing the risk of correlated slashing events across Ethereum, Secure-Signer allows Puffer to lower the collateral requirement for node operators to just 1-2 ETH, significantly less than the 32 ETH required for solo staking. This robust slash protection mechanism, combined with Puffer's validator ticket system, offers consistent rewards and increased security for ETH stakers and validators, promoting greater decentralization of the Ethereum network.

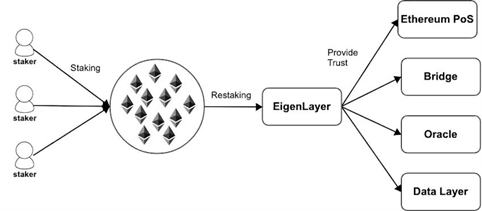

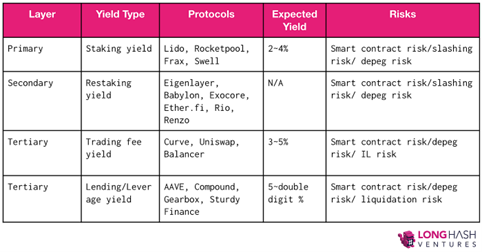

Liquid restaking protocols like Puffer Finance enable stakers to earn dual yield streams by combining Proof-of-Stake (PoS) rewards from Ethereum with additional rewards from restaking activities. When a user stakes ETH through Puffer, they earn standard PoS rewards for securing the Ethereum network (currently around 3 % APR). Simultaneously, their staked ETH is restaked within EigenLayer, generating extra rewards from providing security and liquidity to other applications and services (AVS). This dual functionality optimizes capital efficiency, as the same staked assets can participate in multiple earning opportunities without additional investment. Restaking rewards are determined by the demand for security from AVS and can range from 2-20% APR, with the potential for even higher returns as the EigenLayer ecosystem grows. By leveraging liquid restaking, stakers can achieve significantly higher overall yields compared to traditional solo staking or liquid staking alone.

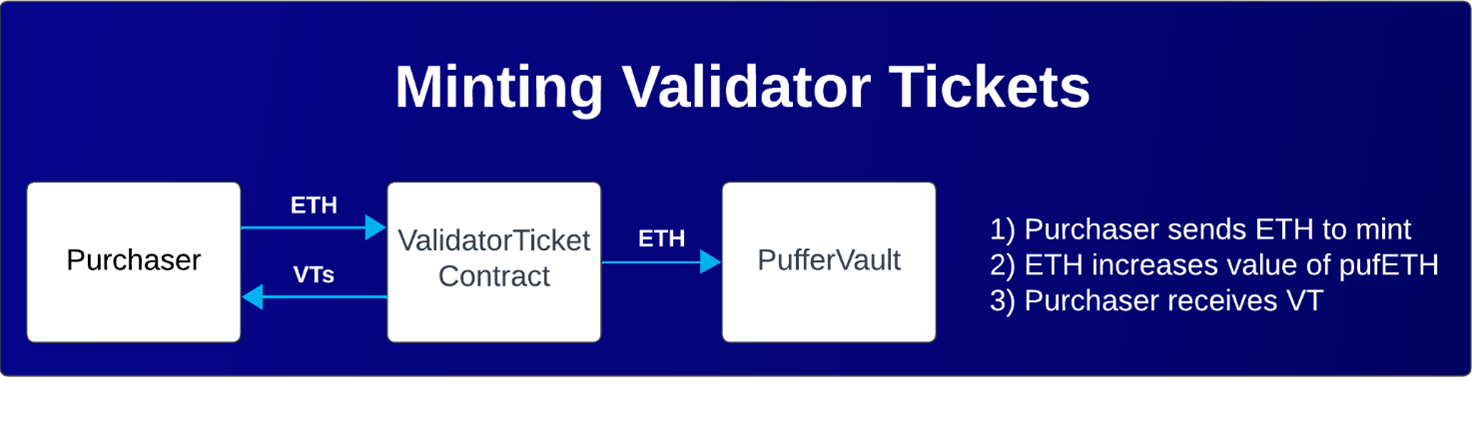

Puffer Finance introduces an innovative concept called Validator Tickets (VTs) to ensure consistent returns for stakers, regardless of individual validator performance. VTs are issued to initial registrants who sign up during specific periods and guarantee a fixed share of the total staking rewards generated by the protocol. By holding a VT, stakers are entitled to a portion of the aggregated rewards from all validators, mitigating the impact of any single validator's downtime or poor performance. This system aligns incentives between stakers and validators, as both parties benefit from the overall success and growth of the network. Moreover, VTs foster the creation of new markets by providing a reliable source of rewards that can be used as collateral or traded on secondary markets. Puffer's VT mechanism offers a unique solution to the challenges faced by traditional staking models, ensuring a more stable and predictable return for participants while promoting the long-term health and decentralization of the Ethereum ecosystem.

Puffer Finance's dual yield streams can be optimized by carefully balancing PoS and restaking rewards to maximize overall returns while minimizing risk. Stakers can employ various strategies to achieve this, such as:

Diversifying restaking activities across multiple Actively Validated Services (AVSs) to spread risk and capture opportunities in different sectors of the EigenLayer ecosystem.

Dynamically adjusting the allocation of staked ETH between PoS and restaking based on market conditions and the relative yields of each stream. For example, if AVS demand is high and restaking rewards exceed PoS returns, stakers may choose to allocate a larger portion of their ETH to restaking.

Utilizing advanced tools and analytics to monitor the performance of different AVSs and identify the most profitable restaking opportunities. This may involve analyzing factors such as AVS adoption, transaction volume, and historical yields.

Implementing automated strategies using smart contracts or off-chain bots to continuously optimize the distribution of staked ETH based on predefined criteria, such as target yield thresholds or risk tolerance levels.

By leveraging these techniques, stakers can potentially enhance their overall returns while maintaining a balanced risk profile. However, it is essential to regularly review and adapt these strategies as market dynamics evolve and new AVSs emerge within the expanding EigenLayer ecosystem.

评论 (0)