The Mitosis Solution to Bridge the Gap: Empowering Retail LPs and Revolutionizing Liquidity Markets

Introduction

In the rapidly evolving world of decentralized finance (DeFi), the need for innovative solutions to optimize liquidity management has never been more pressing. Mitosis introduces a groundbreaking approach to this challenge with its Ecosystem-Owned Liquidity (EOL) model. Mitosis aims to empower retail liquidity providers (LPs) and bridge the gap between different types of LPs by enhancing the overall efficiency of the initial liquidity market. This article explores how Mitosis achieves this goal and the unique features that set it apart in the DeFi landscape.

Understanding the Mitosis Ecosystem - L1 Chain and Mitosis Vaults

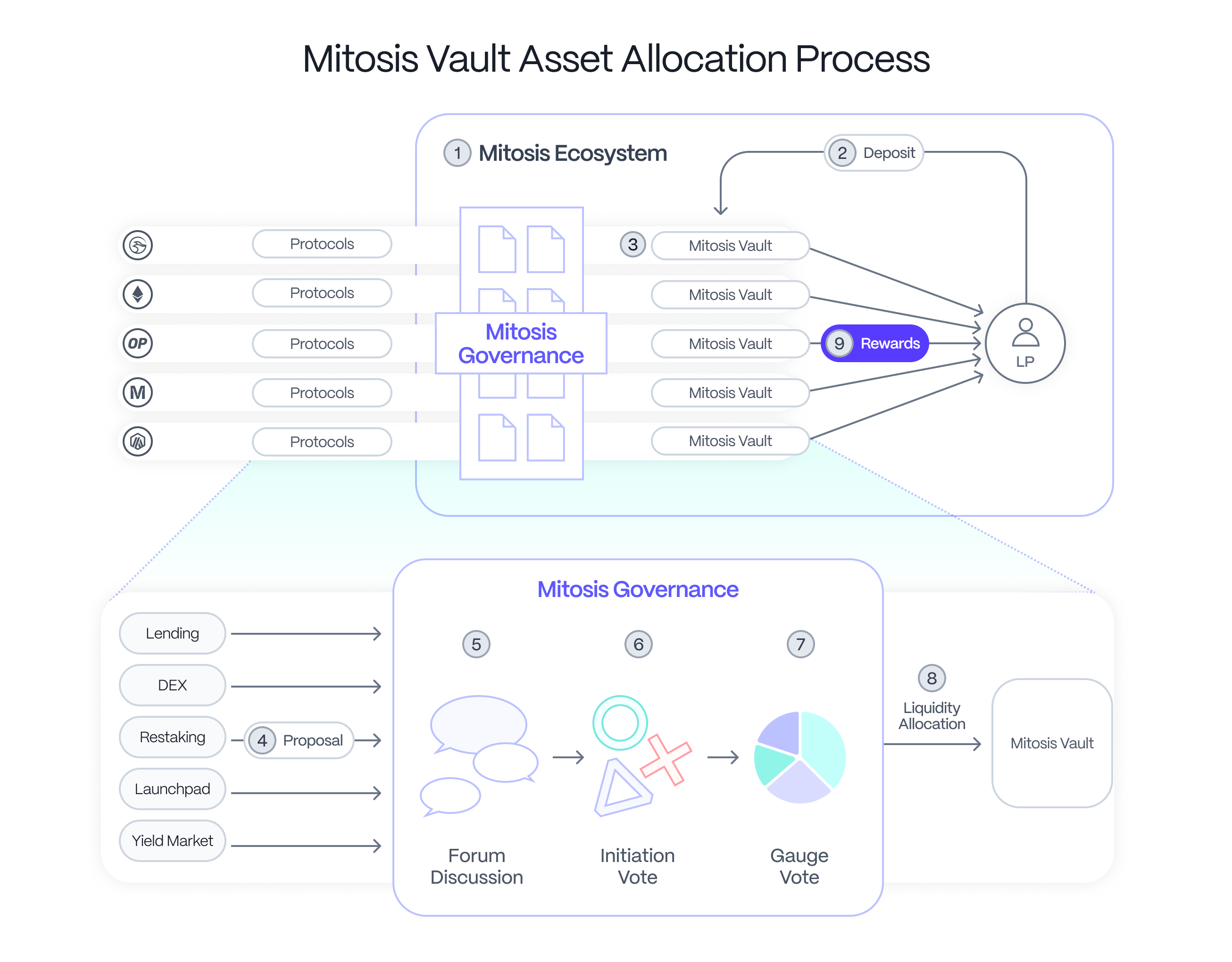

At the heart of the Mitosis solution lies a robust ecosystem built on an L1 chain, complemented by Mitosis Vaults deployed across various networks. These vaults are the key to Mitosis' innovative liquidity management strategy. LPs on different networks can deposit their liquidity into any Mitosis Vault, regardless of the network they prefer. This flexibility allows LPs to participate in the Mitosis Ecosystem from multiple entry points, making it more accessible and attractive to a broader range of participants.

Once liquidity is deposited into the Mitosis Vaults, the ecosystem takes charge of its allocation. The decision-making process is guided by community governance, ensuring that the distribution of liquidity is transparent, efficient, and aligned with the interests of all stakeholders.

The Asset Allocation Governance - A Collaborative Approach

One of the most distinctive features of Mitosis is its decentralized and collaborative approach to asset allocation. Protocols that wish to leverage the Mitosis EOL must first initiate a forum discussion. In this forum, participants, including LPs and protocol representatives, can share their insights and opinions on the proposal. This stage is crucial as it covers various aspects of the protocol, such as its security profile and the feasibility of its offering.

Once the forum discussion has matured, LPs are invited to vote on an Initiation Proposal. This proposal determines whether the Mitosis Ecosystem will allocate a portion of its EOL to the protocol in question. If the Initiation Proposal is approved, the protocol is added to the Gauge Proposal list. LPs then vote again to decide how much EOL each protocol on the list will receive.

This governance structure ensures that liquidity allocation is a democratic process, with all participants having a say in where their pooled assets are directed. It also adds a layer of security and trust, as only protocols that pass the rigorous scrutiny of the Mitosis community can benefit from the ecosystem's liquidity.

Reward Distribution - Multi-Chain Yield Exposure

Another key benefit of the Mitosis model is its approach to reward distribution. After the Gauge Proposal results are finalized, the Mitosis Vaults distribute liquidity to the approved protocols. The earnings generated from these allocations are then accumulated in the Mitosis Vaults.

What makes Mitosis particularly advantageous for LPs is its multi-chain yield exposure. Regardless of the network where they initially deposited their liquidity, all Mitosis LPs receive rewards from the pooled earnings. This approach not only enhances the potential returns for LPs but also provides a more diversified and resilient investment strategy, reducing the risks associated with single-chain exposure.

The Mitosis Advantage - Bridging the Gap Between Retail and Institutional LPs

Mitosis is designed to address the disparities between retail and institutional liquidity providers. Traditionally, retail LPs have been at a disadvantage compared to their institutional counterparts due to smaller capital allocations and limited access to high-yield opportunities. Mitosis levels the playing field by integrating the strengths of both types of LPs within its Ecosystem-Owned Liquidity model.

By pooling liquidity across networks and distributing it based on community-driven governance, Mitosis ensures that retail LPs can participate in lucrative opportunities that were previously out of reach. Simultaneously, institutional LPs benefit from the decentralized decision-making process and the increased liquidity that Mitosis brings to the market.

Conclusion

The Mitosis solution represents a significant step forward in the evolution of DeFi liquidity management. By bridging the gap between retail and institutional LPs and offering a transparent, community-driven approach to asset allocation, Mitosis not only empowers individual participants but also enhances the overall efficiency and resilience of the liquidity market. As the DeFi landscape continues to grow and evolve, Mitosis is poised to play a pivotal role in shaping its future.

评论 (0)