Behold! Pure stupid. The IST V1 is a version of infinitely scaling tokens to meet the needs of any epoch-oriented ecosystem or highly inflationary ecosystem.

The IST standard is based on both Escrow Staked Tokens (es-) and a Vote Escrow Token (ve-). First and foremost, here is how the es- scaling works, a division of time table is created and broken up into unique timestamps. No two timestamps can be identical. Epochs can be both linear or nonlinear.

Linear vested es- token schedule

Nonlinear vested es- token schedule

The token system contains a bonus multiplier for ve- token emission, based on the amount of the base token staking for ve- token per address. this encourages more to staked for a higher multiplier bonus. The Base token then has multiple escrow-staked versions which can accrue simultaneously or can be asynchronously emitted. Let’s use an example to break down this concept.

Let’s created a token called Down Only (DO). veDO, es1DO, es2DO, es3DO, and DO are the tokens involved in the system. es1DO will act as the reward for providing liquidity to the DO/AVAX pair. The vesting time period for unlocking es1DO to DO is 1 month. es2DO is our reward token for single-sided staking. Those that lock up DO for es2DO must vest rewards for 3 months. Lastly, we have es3DO for veDO staking incentives. The vesting period for es3DO will be 6 months. Portioning the total supply of locked DO into given vesting contracts at TGE allows for guaranteed backing of each es token in the system.

Now, let’s take it up a notch. Each staking contract (Single-sided, LP, ve token) can receive multiple es tokens consecutively, in tandem, or have overlaying windows of rewards. As long as es token contracts are adequately backed with proper amounts of claimable DO, the system remains intact. If the total supply of DO is 1 billion, and we maintain 40% for ecosystem incentives, that means we have 400 million tokens to back given es token vesting contract. In theory, we could develop es1DO through es400DO with 1 million redeemable tokens behind each es token.

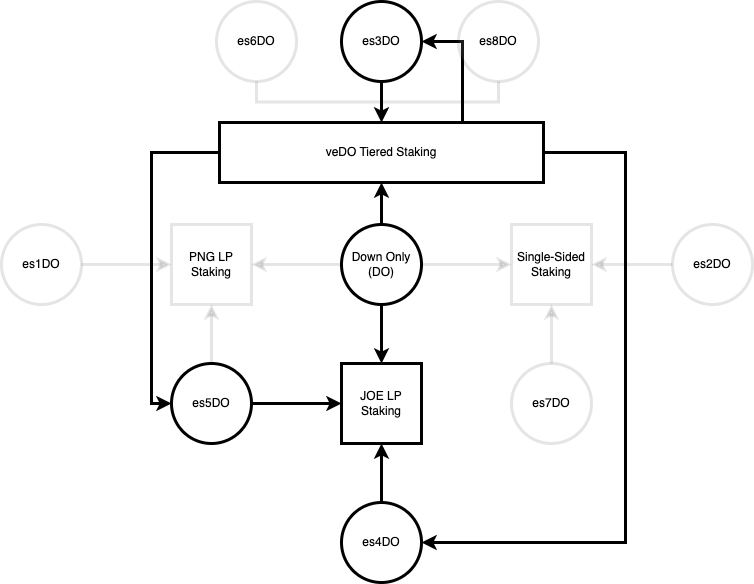

What sort of issues could arise from a 400 token escrow system, well for start clunky and unnecessary UI/UX issues. Luckily, there is a highly manageable way to convey the relevant vesting contracts. When users connect wallets, have the default state present only vesting contracts for owned es tokens. If a user has obtained es1, es42, and es369 from participation in various portions of the token ecosystem, the vesting website should display only these unique vesting contracts for the user, with the ability to unhide all irrelevant vesting contracts. Below is a flow chart omitting pathways User X is not participating in.

Now to tie it all together, you can base all or certain es token emissions directly off of veDO accrual. What this does is it rewards veDO holders that staked more DO for a longer duration.

The final flow chart shows us the exact rewards User X is eligible for and which are hypothetically boosted by staking DO for veDO based on a given tier-based multiplier.

If you read this far, thank you (and I’m sorry?).

评论 (0)