Recent global market developments—both political and financial—have captured widespread attention, particularly the U.S. government’s expansive tariff policies. While daily headlines demand scrutiny, it’s crucial to step back and assess broader trends shaping the global economy and their implications for cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Web3 operators.

The Looming U.S. Recession

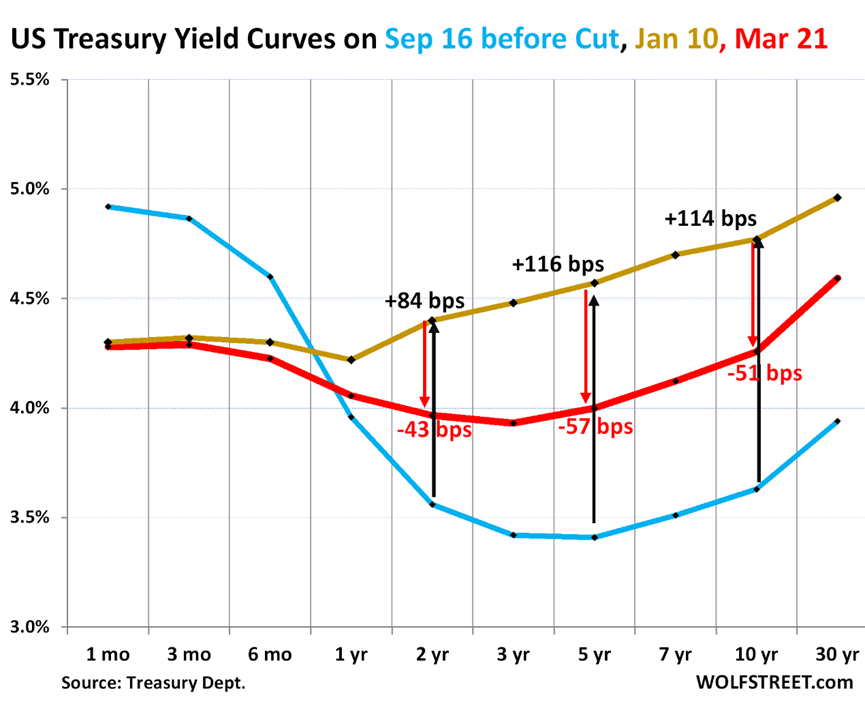

The Federal Reserve’s aggressive interest rate hikes to curb inflation have yielded mixed results. Despite some success, inflation remains stubbornly high, anchoring the U.S. economy in a prolonged "higher for longer" rate environment. This has fueled fears of stagflation, with long-term U.S. Treasury bond yields surging even after rate cuts last year. Rising long-term yields signal investor skepticism about economic stability, demanding higher returns for perceived risks.

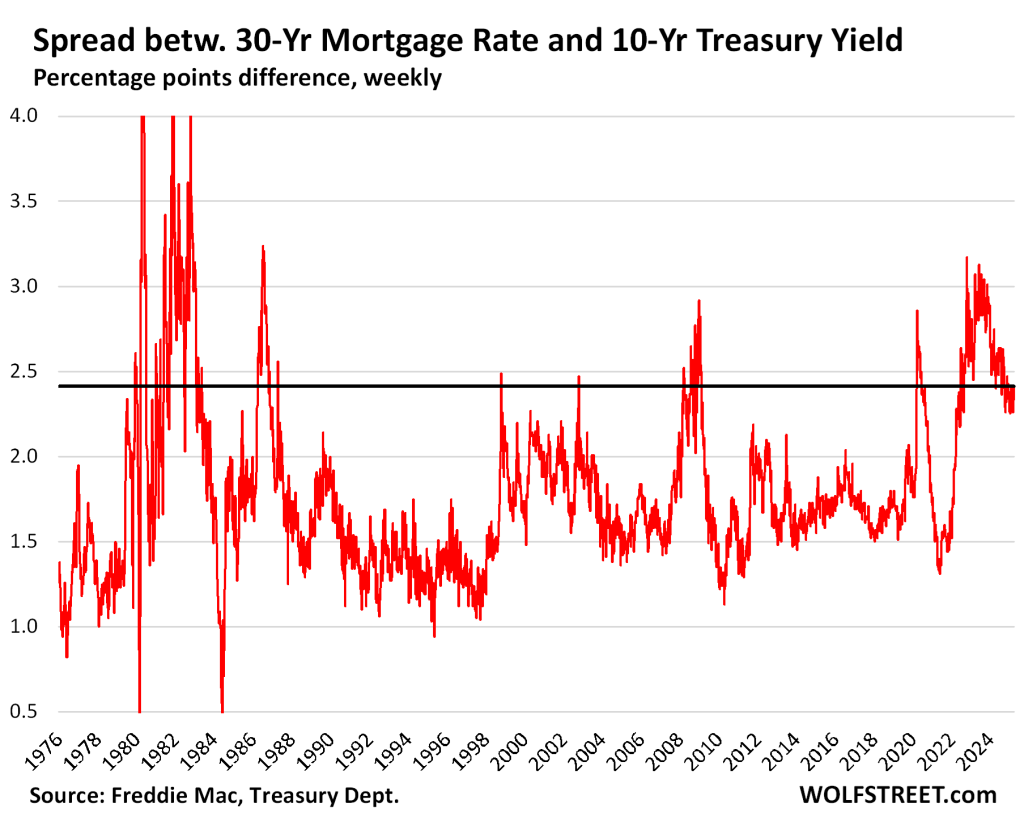

These yields critically influence sectors like housing, where the widening gap between 30-year mortgage rates and the 10-year Treasury yield mirrors patterns seen before historical recessions. The persistence of this spread underscores deepening economic fragility.

The Erosion of USD Dominance

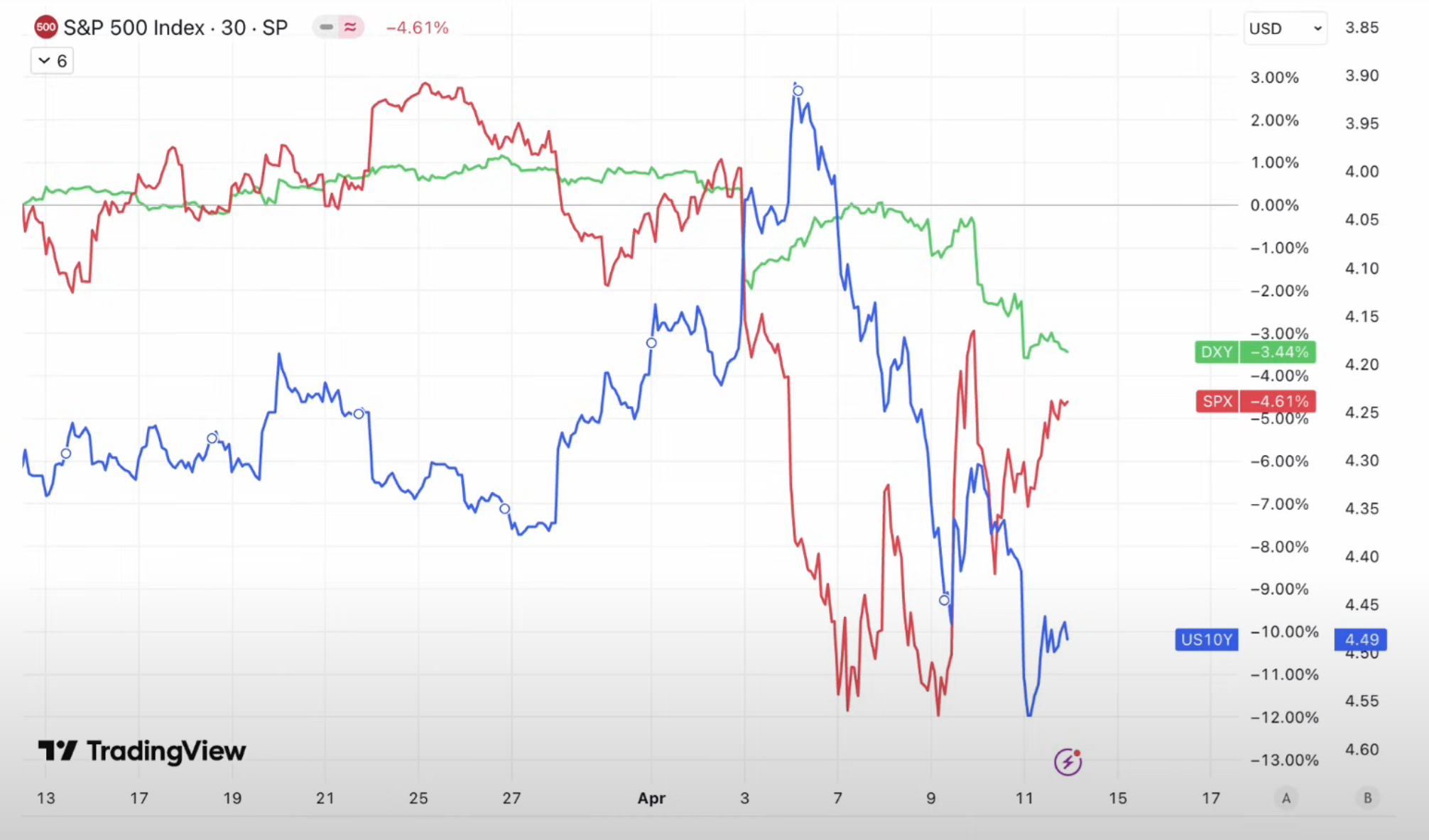

Traditionally, investors flocked to U.S. Treasuries as a safe haven during market turmoil, driving bond prices up and yields down. However, recent trends defy this norm. Following the U.S. tariff announcements, the 10-year Treasury yield rose alongside declines in the S&P 500 (SPX) and U.S. Dollar Index (DXY). As Minneapolis Fed President Neel Kashkari noted, this inversion suggests eroding confidence in the USD’s role as the ultimate shelter during crises—a paradigm shift with global implications.

Sustained Global Tensions

Though tariff policies were partially deferred after bond yields spiked, geopolitical tensions are unlikely to dissipate. U.S.-China trade relations remain strained, with tariffs poised to stay elevated. In response, China and its allies may forge new trade blocs, fracturing the global economic landscape. Reduced international trade volumes could diminish demand for reserve currencies, including the USD, reshaping financial ecosystems.

Crypto’s Rise as a Store of Value

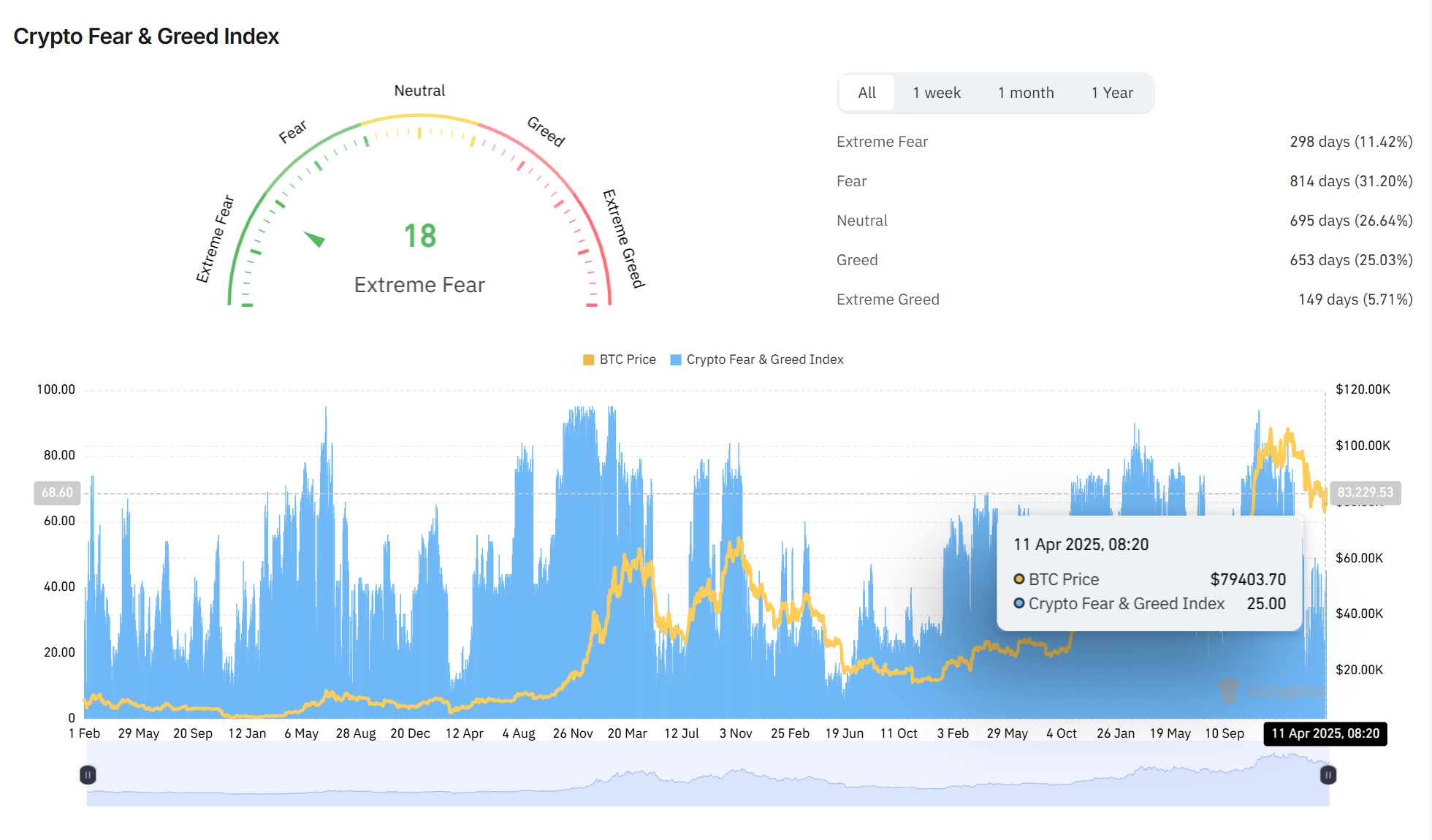

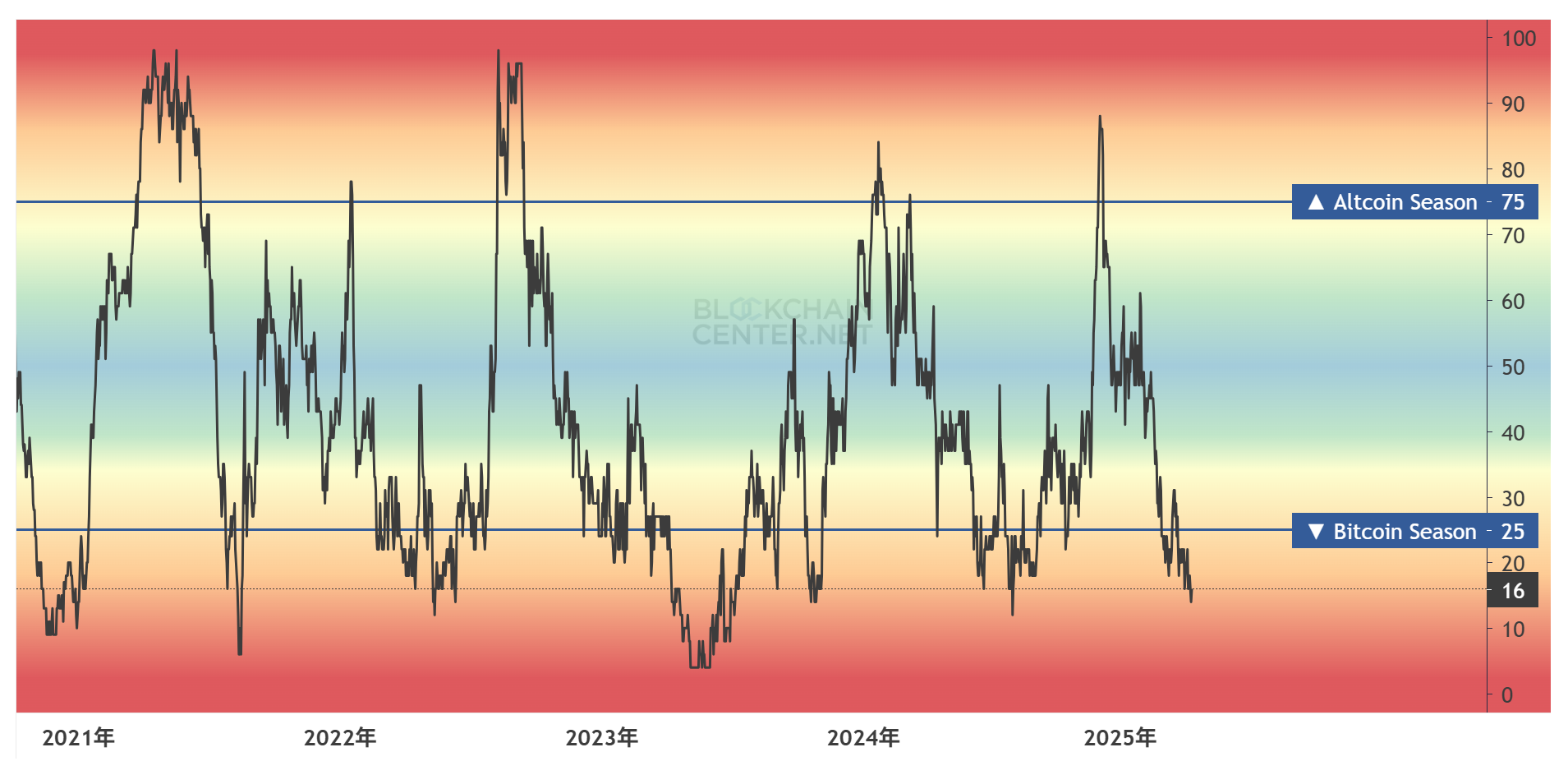

In this climate, Bitcoin and Ethereum stand to gain traction. Bitcoin’s capped supply reinforces its appeal as “digital gold,” while Ethereum’s utility in digital ownership (e.g., NFTs in gaming and music) positions it as a cornerstone of Web3. Current market indicators hint at upside potential: the Crypto Fear & Greed Index reflects levels of fear last seen during Bitcoin’s 2022 lows, while altcoin metrics suggest a possible market bottom.

Implications for Web3 Operators

As crypto adoption grows, Web3 operators face intensifying competition. Success will hinge on leveraging AI, talent, and infrastructure to deliver superior services. Operators must also monitor macroeconomic shifts and their cascading effects on crypto markets.

Quantifying precise price targets for BTC and ETH requires sophisticated modeling. For Ethereum, a multi-factor approach—incorporating Bitcoin’s price, altcoin indices, Total Value Locked (TVL), and gas fees—could offer deeper insights, a topic worth exploring in future analyses.

评论 (0)