The Federal Reserve just announced a 25 basis point interest rate cut—its third in a row this year. But why did Powell emphasize that the Fed has no plans to hold Bitcoin?

What’s next for the market after this rate cut? How do the Fed’s actions impact your investment decisions? And does Powell’s latest statement suggest rising risks for the crypto market?

While the answer may not be simple, let’s dive into the key takeaways from this rate change.

📉 How is the Market Reacting to the Fed's Rate Cut?

On December 19, the Fed reduced the benchmark interest rate by 25 basis points to 4.25%-4.50%. This cut, much anticipated by the market, signals the Fed’s cautious optimism about the economy. Despite falling inflation, it's still at elevated levels, and the room for further cuts is limited. Powell also made it clear that future rate cuts will be slow and measured.

However, the Fed has made it clear it has "no intention" of holding Bitcoin, reinforcing its stance against involving traditional financial institutions in crypto. This comment has stirred emotions in the market, especially among those hoping for increased institutional interest in crypto assets.

📊 What Are the Emerging Trends in the Market?

Along with rate adjustments, the market is focused on the Fed's future actions. Slower rate cuts suggest the market environment may stabilize, but reactions have been mixed. The stock market has shown muted responses, while Bitcoin and other crypto assets have seen declines, especially after Powell’s reaffirmation that the Fed won’t invest in Bitcoin.

That said, not all market movements are negative. Gold has seen slight declines, while oil prices have been trending upward. This highlights that even in a cautious interest rate environment, the global economy is still evolving with both risks and opportunities.

🔍 How Should You Navigate This Market?

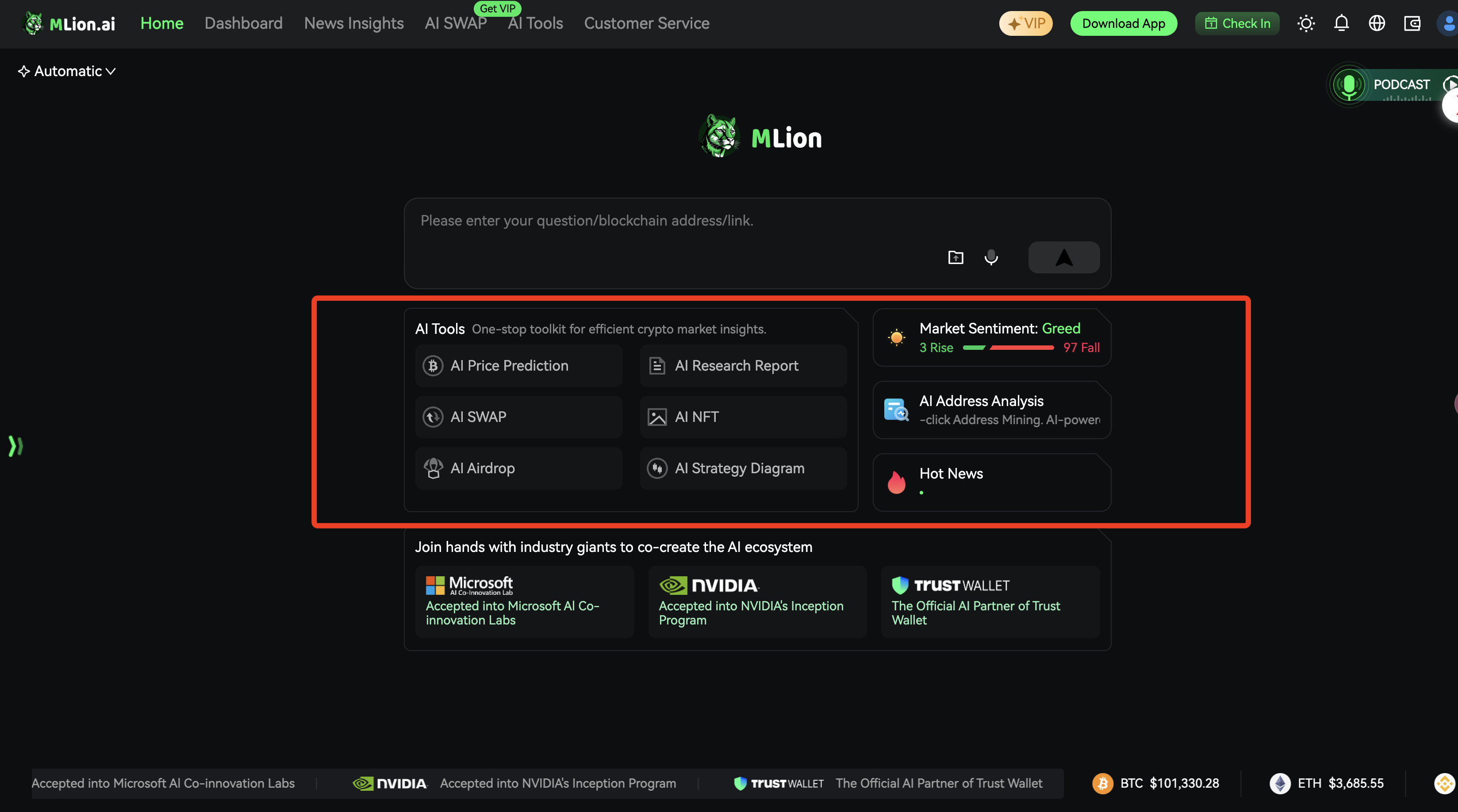

With a complex economic backdrop, how can you stay ahead? Beyond following the Fed’s policies, it’s essential to monitor real-time news, shifts in market sentiment, and currency price forecasts. This is where Mlion.ai steps in as your AI-powered investment research assistant, delivering quick, accurate market insights.

Mlion.ai Features:

-

Real-Time News Summary: Stay updated with concise summaries of the latest financial news to keep pace with the market.

-

Currency Price Predictions: Mlion.ai uses advanced AI to predict major currency trends, helping you plan your next moves.

-

Market Data Dashboard: Access real-time AI analysis and market sentiment, enabling smarter investment decisions.

🚀 Why Choose Mlion.ai?

Mlion.ai is a cutting-edge AI research assistant tailored for the Web3 space. Combining top-tier AI models, it offers deep market analysis and cutting-edge investment advice. Whether you're a newcomer or a seasoned investor, Mlion.ai supports smarter, more secure investment decisions every step of the way.

Start using Mlion.ai today to experience the future of investment research! Visit mlion.ai for a fast, streamlined experience to guide your investment journey.

What opportunities does this latest Fed rate cut present? Should you take advantage of the potential in the crypto market? Don’t wait—unlock smart investment tools with Mlion.ai and get ahead of the next opportunity!

Welcome to join our community: @mlion_group. Feel free to share any questions or feedback in the group!

Disclaimer: The above content is for informational purposes only and does not constitute investment advice.

Follow me for daily market insights and updates!

评论 (0)