Abstract

This paper examines the potential for implementing a revenue-based corporate tax on multinational companies as a means of addressing tax avoidance and ensuring fair contributions to national economies. It explores the feasibility of the U.S. leading this initiative, the implications of a globally coordinated tax system, and the operational challenges involved, including revenue audits and cross-border cooperation.

Introduction

Corporate tax avoidance has become a prominent issue as large multinational companies increasingly shift profits across borders to minimize tax burdens. Traditional profit-based tax systems allow for strategic deductions and expenses that can reduce taxable income substantially, raising questions about fairness and economic sustainability. This paper considers a revenue-based tax structure as a viable alternative, focusing on the role of the U.S. and other leading economies in setting a global standard.

Section 1: Background on Corporate Taxation and Profit Shifting

In the current global economy, multinational corporations (MNCs) play a substantial role in generating economic activity across borders. However, their presence in multiple jurisdictions enables complex financial structures that facilitate tax minimization strategies, including profit shifting. This practice involves reallocating profits to low-tax countries, allowing companies to reduce their overall tax burden. Profit shifting has become a significant concern for national governments, as it can erode tax bases and reduce public revenue, limiting funds available for public services.

Traditional profit-based corporate tax systems are particularly vulnerable to profit shifting. Companies are allowed to deduct operational expenses, investment costs, and other business expenses from their income before calculating their taxable profit. While these deductions support legitimate business investments, they also create opportunities for aggressive tax planning. Many large MNCs use intricate transfer pricing mechanisms and intercompany loans to shift profits to subsidiaries in tax-friendly countries. This trend is evident among technology companies, such as Google and Amazon, which have extensive international operations and frequently engage in cross-border transactions within their corporate structures.

Several studies estimate the scale of global tax avoidance to be in the hundreds of billions of dollars annually, with significant economic consequences for countries that rely on corporate taxes as a revenue source. Efforts to combat profit shifting, such as the OECD’s Base Erosion and Profit Shifting (BEPS) project, have made strides in addressing certain loopholes. However, many experts argue that these initiatives have not yet eliminated the root causes of profit shifting. Consequently, there is increasing interest in alternative tax structures, including revenue-based taxation, which may offer a more straightforward and resilient solution.

Section 2: Concept and Rationale of Revenue-Based Taxation

Revenue-based taxation is an alternative approach to corporate tax that focuses on taxing a company’s gross income rather than its net profit. By shifting the tax base from profit to revenue, this model aims to reduce opportunities for tax avoidance. Unlike profit, which is calculated after expenses and deductions, revenue is a direct measure of a company’s total income. This approach would, in theory, simplify the tax system, as it would eliminate many of the deductions and complex accounting methods currently used to minimize taxable income.

Advantages of Revenue-Based Taxation

The primary advantage of a revenue-based tax is its resistance to manipulation. Because revenue is less susceptible to adjustments than profit, taxing gross income can close many loopholes that companies exploit through deductions and profit-shifting mechanisms. By focusing on top-line income, governments can create a more consistent and reliable source of tax revenue that is less vulnerable to aggressive tax planning.

This model may also lead to greater tax transparency and compliance, as revenue figures are easier to verify and audit than complex calculations of taxable profit. Given the rise of digital economies and the intangible nature of many MNCs’ assets, particularly among tech giants, a revenue-based tax could provide a fairer method for taxing companies that generate significant income in a country without physically operating there.

Challenges and Criticisms

Despite its potential benefits, revenue-based taxation poses several challenges. One significant concern is its impact on businesses with high operational costs or thin profit margins. In industries such as retail, manufacturing, and transportation, large revenues are often matched by equally large expenses. Taxing revenue without considering expenses could disproportionately affect companies in these sectors, potentially leading to financial strain or even insolvency for businesses with modest profit margins. This concern highlights the need for nuanced tax policy that considers the diverse financial profiles of different industries.

Another criticism of revenue-based taxation is that it may discourage business investments and innovation. Companies that reinvest heavily in research and development (R&D) or infrastructure improvements might face reduced incentives if these expenditures do not reduce their tax obligations. This potential trade-off between fairness and economic efficiency underscores the need for carefully crafted policies that balance the benefits of revenue-based taxation with the realities of business operations.

Section 3: Potential Models for Implementing Revenue-Based Taxation

The implementation of a revenue-based corporate tax system presents two primary pathways: a unilateral approach led by the U.S. and a coordinated global framework. Each option has unique benefits and challenges, and the choice between them will have significant implications for international tax policy, corporate behavior, and economic competitiveness.

Option A: U.S.-Led Initiative

In this model, the U.S. would establish a revenue-based tax structure that applies to American multinational companies on their worldwide income, including revenue generated through foreign subsidiaries. By taking the lead, the U.S. could set an example for other nations, encouraging them to adopt similar revenue-based taxes.

A unilateral approach offers several benefits:

-

Global Influence: As one of the world’s largest economies, the U.S. has the potential to influence global tax policy by setting a precedent. If American companies are subject to a revenue tax on their worldwide income, other countries might be motivated to adopt similar measures to prevent losing tax revenue to the U.S.

-

Simplicity in Policy Rollout: By implementing the tax within its own jurisdiction, the U.S. could create and enforce a straightforward policy without needing extensive international negotiations. This would allow for quicker implementation and avoid the potential delays associated with multilateral agreements.

-

Economic Fairness: Given that many tech giants and other large multinationals are U.S.-based, a revenue tax would ensure that these companies contribute more equitably to the domestic economy.

However, a unilateral revenue tax would also have drawbacks:

-

Competitiveness Concerns: U.S. companies might experience higher tax burdens compared to their foreign competitors, potentially impacting their ability to invest, expand, or compete globally.

-

Risk of Double Taxation: Without global cooperation, U.S. companies could face revenue taxes in multiple countries, creating a complex web of overlapping tax obligations. This could lead to double taxation, where companies are taxed on the same revenue in multiple jurisdictions.

-

Potential for Tax Avoidance: While revenue is harder to manipulate than profit, companies might still attempt to adjust their financial structures to minimize revenue in higher-tax jurisdictions, reducing the effectiveness of the policy.

Option B: International Coordination through Global Bodies (e.g., G7, G20)

An alternative approach would be for the U.S. to work with international bodies, such as the G7 or G20, to establish a global standard for revenue-based taxation. This could involve setting a minimum tax rate on revenue that all member countries would implement, similar to recent global agreements on a minimum corporate tax rate.

The coordinated approach offers distinct advantages:

-

Uniform Taxation Across Borders: A globally coordinated revenue tax would create a level playing field for multinational companies, reducing incentives to shift revenue or operations to low-tax jurisdictions. This would ensure fairer contributions from corporations regardless of where they operate.

-

Simplified Compliance and Reduced Double Taxation: With consistent rules across countries, companies would have fewer opportunities for tax avoidance, and cross-border tax issues would be simplified. Coordinated rules would also minimize instances of double taxation, as countries would adhere to agreed standards.

-

Enhanced International Cooperation: This model aligns with the trend toward global economic interdependence and the need for cooperative approaches to solve international issues, such as climate change, cybersecurity, and tax avoidance. A globally standardized tax structure could strengthen international relations and set the stage for future collaborations.

Nonetheless, this approach also faces considerable challenges:

-

Complexity and Delays in Agreement: Achieving consensus among countries with differing economic interests, tax structures, and political priorities could be time-consuming and complex. Nations may resist adopting a revenue tax that could impact local industries or reduce foreign investment.

-

Enforcement and Compliance Issues: Coordinating enforcement across multiple countries would require significant regulatory alignment, transparency, and data-sharing mechanisms, which can be difficult to establish.

-

Political and Sovereignty Concerns: Some nations may view a global revenue tax as an infringement on their fiscal sovereignty. Smaller or low-tax countries, which attract foreign investment through favorable tax policies, may resist international standards that limit their competitive advantage.

Pros and Cons Summary

Each approach presents a unique set of trade-offs. While a U.S.-led initiative could act as a powerful first step, an internationally coordinated revenue-based tax system could ultimately lead to a fairer and more sustainable tax structure worldwide. The decision will likely depend on the balance between the desire for immediate action and the need for global cooperation.

Section 4: Operational and Logistical Considerations

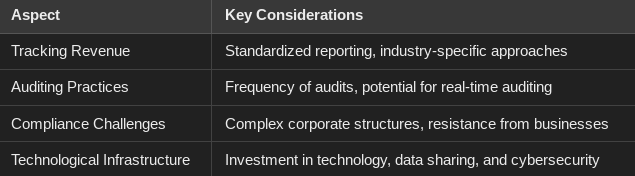

Implementing a revenue-based tax system—whether through a U.S.-led initiative or global coordination—requires careful consideration of operational and logistical aspects. Key areas to address include the mechanisms for tracking revenue, auditing practices, compliance challenges, and the technological infrastructure necessary to support such a system.

1. Tracking Revenue

To effectively implement a revenue tax, it is essential to have robust mechanisms for tracking the revenue generated by corporations. This could involve:

-

Standardized Reporting Requirements: Establishing clear guidelines for how companies must report their revenue, including definitions of what constitutes revenue across various sectors. This standardization would help ensure consistency and transparency in reporting.

-

Data Collection and Analysis: Governments would need to invest in data collection and analysis capabilities to accurately assess the revenue reported by corporations. This might involve leveraging existing financial reporting frameworks or developing new data-sharing agreements with companies.

-

Industry-Specific Considerations: Different industries may have unique revenue structures, requiring tailored approaches to revenue tracking. For instance, subscription-based businesses might report revenue differently than traditional retail companies. Understanding these nuances is crucial for effective tax policy.

2. Auditing Practices

Auditing will play a crucial role in ensuring compliance with the revenue tax. Some key considerations include:

-

Frequency and Scope of Audits: Governments must determine how often companies will be audited and the scope of these audits. Regular audits could help deter tax evasion, but excessive auditing might strain resources and create an administrative burden for businesses.

-

Real-Time Auditing Systems: Implementing real-time auditing systems could enhance compliance by allowing governments to monitor transactions as they occur. While this approach may increase administrative demands on both governments and companies, it could significantly improve transparency and accuracy.

-

Third-Party Auditors: Engaging independent third-party auditors could enhance credibility and objectivity in the auditing process. Companies could be required to use certified auditors to verify their revenue reports, ensuring accountability.

3. Compliance Challenges

Ensuring compliance with a revenue-based tax system presents various challenges:

-

Complex Corporate Structures: Many large corporations operate through complex corporate structures, making it difficult to determine the appropriate revenue to tax. Addressing issues related to subsidiaries, joint ventures, and foreign operations will be essential.

-

Resistance from Businesses: Companies may resist changes to their tax obligations, particularly if they perceive a revenue tax as an additional financial burden. Education and engagement will be crucial in helping businesses understand the benefits of the new system and encouraging compliance.

-

Legal and Regulatory Barriers: Implementing a revenue tax may require significant legal and regulatory changes, which could be met with opposition from various stakeholders. Navigating this landscape will be essential for successful implementation.

4. Technological Infrastructure

A successful revenue-based tax system will likely rely on advanced technological infrastructure to support tracking, reporting, and auditing processes:

-

Investment in Technology: Governments may need to invest in new technologies to streamline data collection, processing, and analysis. This could include developing sophisticated software for tracking revenue or leveraging blockchain technology for enhanced transparency.

-

Interoperability and Data Sharing: Establishing interoperability between government systems and corporate reporting platforms will be vital for efficient data sharing. This could facilitate real-time monitoring and enhance compliance efforts.

-

Cybersecurity Measures: As tax systems increasingly rely on digital infrastructure, robust cybersecurity measures will be necessary to protect sensitive financial data from potential threats and breaches.

Summary of Operational Considerations

The successful implementation of a revenue-based tax system will require careful planning and coordination across various operational and logistical dimensions. By addressing these challenges head-on, governments can create a fair and effective taxation framework that promotes accountability, enhances revenue generation, and supports economic growth.

Section 5: Conclusion and Recommendations

As the global economy continues to evolve, the need for innovative tax solutions becomes increasingly evident. A revenue-based tax system presents a promising alternative to traditional profit-based taxation, offering a more equitable and transparent approach to taxation. This section concludes the discussion by summarizing key insights and offering recommendations for policymakers.

Conclusion

-

Equity and Fairness: A revenue-based tax system can promote fairness by ensuring that all companies contribute to public finances based on their revenue-generating capacity, rather than allowing the ability to minimize taxes through profit manipulation.

-

Simplicity and Transparency: By shifting the focus from profits to revenue, a revenue tax simplifies the taxation process, reducing opportunities for loopholes and evasion. This approach enhances transparency, allowing for more accurate assessments of corporate contributions.

-

Operational Considerations: Successful implementation will require careful planning around tracking revenue, establishing auditing practices, addressing compliance challenges, and investing in technological infrastructure to support these initiatives.

-

Global Coordination: Given the interconnected nature of the global economy, a revenue-based tax system will likely necessitate international collaboration to ensure consistency across borders and prevent tax base erosion.

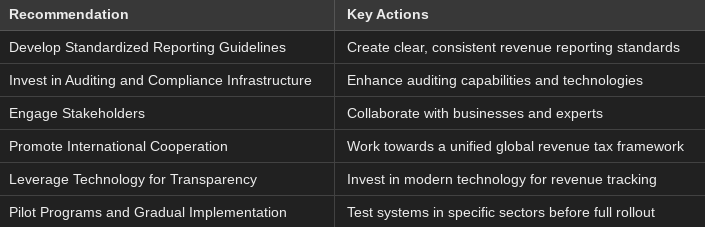

Recommendations

-

Develop Standardized Reporting Guidelines: Policymakers should work towards creating clear, standardized reporting requirements for revenue across different sectors. This would ensure consistency and reduce ambiguity in revenue reporting.

-

Invest in Auditing and Compliance Infrastructure: Governments must allocate resources to enhance auditing capabilities and compliance monitoring. This may include adopting real-time auditing technologies and training personnel to conduct effective audits.

-

Engage Stakeholders: Collaboration with businesses, industry associations, and tax experts is essential to foster understanding and support for the new tax system. Engaging stakeholders can help identify potential challenges and solutions early in the implementation process.

-

Promote International Cooperation: Countries should collaborate on establishing a unified revenue-based tax framework that accommodates the complexities of global operations while ensuring that multinational corporations contribute fairly to public finances. Initiatives similar to the G7 discussions on corporate tax can serve as a foundation for this cooperation.

-

Leverage Technology for Transparency: Governments should invest in modern technology and data-sharing platforms to facilitate the efficient tracking of revenue and enhance transparency in the taxation process. Utilizing blockchain and other innovative technologies can improve accuracy and security in tax administration.

-

Pilot Programs and Gradual Implementation: To address potential challenges, governments might consider implementing pilot programs to test the effectiveness of a revenue-based tax system in specific sectors before a full-scale rollout. This approach allows for adjustments based on real-world feedback.

Summary of Recommendations

评论 (0)