Tesla's FSD 12 is an architectural revamp of their existing FSD software. FSD 12 is in essence a neural net, video inputs go in and it decides the response (while learning) this is similar to deepmind with the whole alphago thing. What tesla was doing earlier, was essentially hard coding responses based on inputs from video (this is a simplified understanding of the old architecture in order to highlight the difference between the two). For FSD 12, more than 330k lines of code were removed as per Elon.

FSD 12 then becomes a question of “when” and not “if” for fully autonomous driving. Essentially the system learns exponentially (refer alphago), the bound is then processing bandwidth in a sense.

Now the main factor for implementation FSD 12 and fully autonomous vehicles is regulatory. And as such I cannot take a call on how that pans out.This same ai tech is being used in Optimus too. Tesla could end up being (already is based on my limited understanding) the leader in video--in—ai brain--output. Tesla have a very meaningful lead here, and its tough for competitors to catch up due to the nature of the technology and the training of it.

Further on robots (a car is a robot on 4 wheels as per Musk's analogy), manufacturing is a bottleneck for a lot of startups in this space and Tesla is leaps and bounds ahead of everyone on this front. So that is a physical constraint for most and that is a meaningful moat for tesla. With Tesla, we could probably see a global leader in ai & robotics that is fully vertically integrated, while most just see them as a high growth ev leader with a thriving energy business. (their energy business has not yet been fully appreciated by the market either).

Humanoids (Tesla’s optimus program), their time has come.

Actuator technology coupled with other hardware needs of humanoids have materially evolved over the past decade. This has meant that robots can now be built at a meaningfully low cost, making them economically useful. With the advancement of neural nets & ai technology, these humanoids now have capable software to enable them to learn and execute labour. (I’m not going to compare and contrast the benefits of robots working vis a vis human labour as they are quite obvious an can be quantified, the objective of this note is solely to time stamp an investment idea an informal form).

We now come onto the manufacturing side, as of today no start-up in the robotics space with a useful humanoid (there only a handful) have the manufacturing capabilities & financial resources that Tesla have. * a side note on teslaone – it is novel, I encourage you to read into it to fully grasp Tesla’s manufacturing prowess today.

This creates a meaningful advantage for Tesla, as they begin to deploy more humanoids than any other competitor, further strengthening their product. Tesla also has an after-sales and maintenance infrastructure in place due to their other lines of business, that is a very important feature for customers.

RaaS (Robots as a service) – This explains the business model that I believe Tesla will initially deploy. It is pretty self-explanatory.

It is prudent to note that the value of the Optimus project is basically non-existent in the current market cap that Tesla claims today (~$600b, $200 per share). We are essentially not paying for Optimus (and FSD/autonomous transport), one could value the Automobile business + Energy and Other services to meaningfully protect downside even if these new businesses don’t work at all. With regards to timelines, I personally feel like the next 5-15 years is when the Optimus business should come on stream in a meaningful way, markets however will begin discounting things a lot earlier.

Back of the envelope for Optimus : (Please note that these numbers are not what I’m basing my investment thesis on, as I do believe that they are to be taken with bucket of salt to say the least. However, they do give you a very rough idea of the potential of this industry, that as per ARK invest’s latest 2024 report is set to be a potential $24T. It is with that in mind that believe that this industry and Tesla’s Optimus business presents a compelling optionality that is not adequately priced in today)

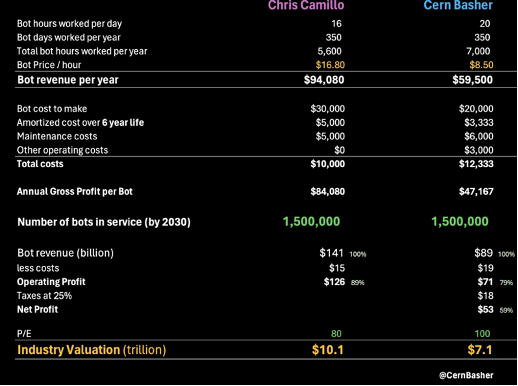

“Anticipating a lease condition of at least 16 hours a day for 350 days a year at $16.80/hr, this cost model will be highly discounted to an employer’s “all-in” cost of human employment burdened by taxes and insurance. Expect discounts for >16hrs/day to maximize use, flipping the script on human overtime.

Projected to start scaled production in 2027, by 2030 Tesla could have 1.5M humanoids in service. At a $30k production cost per bot, amortized over a 6-year service life, with Tesla absorbing an additional $5k for yearly maintenance, each bot could generate $94k in recurring annual gross revenue, translating to $84k in annual operating income. This would result in $141B in revenue and $126B in operating income by the end of 2030.

Tesla's Optimus division has the potential to hit a $10 trillion valuation based on an operating P/E ratio of 80, plausible for rapidly expanding markets. My projection assumes 1.5 million Optimus robots will fill critical labour shortages in specialized sectors.” – Chris Camillo (Dumb Money)

“It's not just a robot - Tesla is building a deflation machine - one that will lower the cost of living for humanity.

“The world could feasibly see between 5 to 10 billion humanoid bots. The implications are monumental.

In summary, we are on the cusp of witnessing the birth of perhaps the most significant new product in history. The potential value creation and global impact of humanoid robots are beyond staggering.” – Cern Basher

The above are taken from Chris Camillo & Cern Basher (there are projections of the industry from ARK Invest too, in addition to other industry material one can easily find online). Chris Camillo is perhaps amongst the most well-informed investors on the Humanoid space.

As with FSD 12, Elon has been talking about fully autonomous driving for years now, and there are great models from ARKK invest’s Tasha Keeney on robotaxis etc:. I guess, the market is not even close to appreciating the Humanoids business and hence I wanted to stamp this as a core part of my Tesla investment thesis.

I do foresee a “this time is different” scenario with autonomous driving because of the change in FSD 12 as highlighted earlier. However, to reiterate the Optimus optionality (and FSD) is not even close to being priced in.

Tesla today is valued at the same market cap that it was when it was losing cash & trying to get its production lines and factories up and running a few years ago. Today, Tesla generates a meaningful amount of free-cash after investing heavily in R&D and all of these demanding projects, such as Optimus. Tesla also sits on about $30b in surplus cash without any debt.

So, to see the Company trade at the same price with all of the above changing & the potential of Optimus (and FSD) makes for a compelling asymmetric r/r opportunity.

It is beyond the scope of this informal note to explain how humanoids could meaningfully impact global economics, demographics and GDP trends in the future. This can be read-up on if one is really interested in the space. It is part of my investment view on the space and Tesla.

As of today, we have an opportunity to play this significant shift through a publicly listed company that everyone has access to.

Sources : Chris Camillo, Dumb Money, ARK Invest’s Tasha Keeney, Tesla con-calls, Tesla presentations, Tesla events, Cern Basher, Investinganswers, Sandy Munroe, Joe Justice (for Teslaone specifically), Prof. Ashwath Damodaran (substack note on Tesla’s valuation currently) and other public sources across digital media. I had been a follower of Dumb Money’s initial youtube channel since early college, years later, their/Chris’s Humanoid research & podcasts have helped me navigate this space.

Risks : There are risks on the execution side as these are cutting edge technology & manufacturing challenges. In addition to those, one meaningful risk to be noted is that of Elon Musk. His presence is very important to the success of the company. Elon Musk also has to be incentivised to ensure that majority of the technology advancements continue under the Tesla umbrella. (note : the recent lawsuit voiding his compensation package, Elon has said during concalls that it is control that he desires and not the additional economics. It was mentioned by him that 25% was the number that he was looking at. As this would give him enough control so as to not be pushed and not too much control so as to void minority & other shareholders in case he goes “bonkers”)

This entire note is not financial advice, it is high-risk and one can lose money. The author of this article and all of the sources cited are not responsible for the repercussions of your actions and investment decisions. Please do your own due diligence.

评论 (0)