A year ago, I had the honor of being invited to a longevity dinner by my favorite DeSci organization, VitaDAO. While I love the people working in this space, my own personal life philosophy (life maxing) always seemed to be at odds with theirs (time maxing). Alas, I hopped on the train and met them in the park to learn more about their Sisyphean cult.

I asked each of these wonderful people about what specifically motivated them to work on longevity. Many, self aware, simply said that they were scared of death. One man, with his mother there in attendance, shared that he dedicated his life to longevity so that he might be able to spend more time with her.

I’m not crying, you’re crying 😢

Inevitably, I ended up asking a good friend of mine and crypto OG, Tom Howard, this very question. What he said changed how I thought about life.

Tom said to me:

Well Jake, life is just a series of games and there are finite games and infinite games. Finite games are like graduating from college, or winning a contest, or getting a job. If you build your life around finite games, you will always feel unsatisfied. But, infinite games, infinite games are like climbing or running, you can always get better. Making money is an infinite game and so is living longer. If you build your life around infinite games, you will find happiness in the pursuit.

This is great advice and I hold it dear to my heart, but what does it have to do with crypto?

Core to Tom’s philosophy (adopted from James Carse’s book) is the ability to look at all things in life as games. There are good games and there are terrible games, but it’s all games.

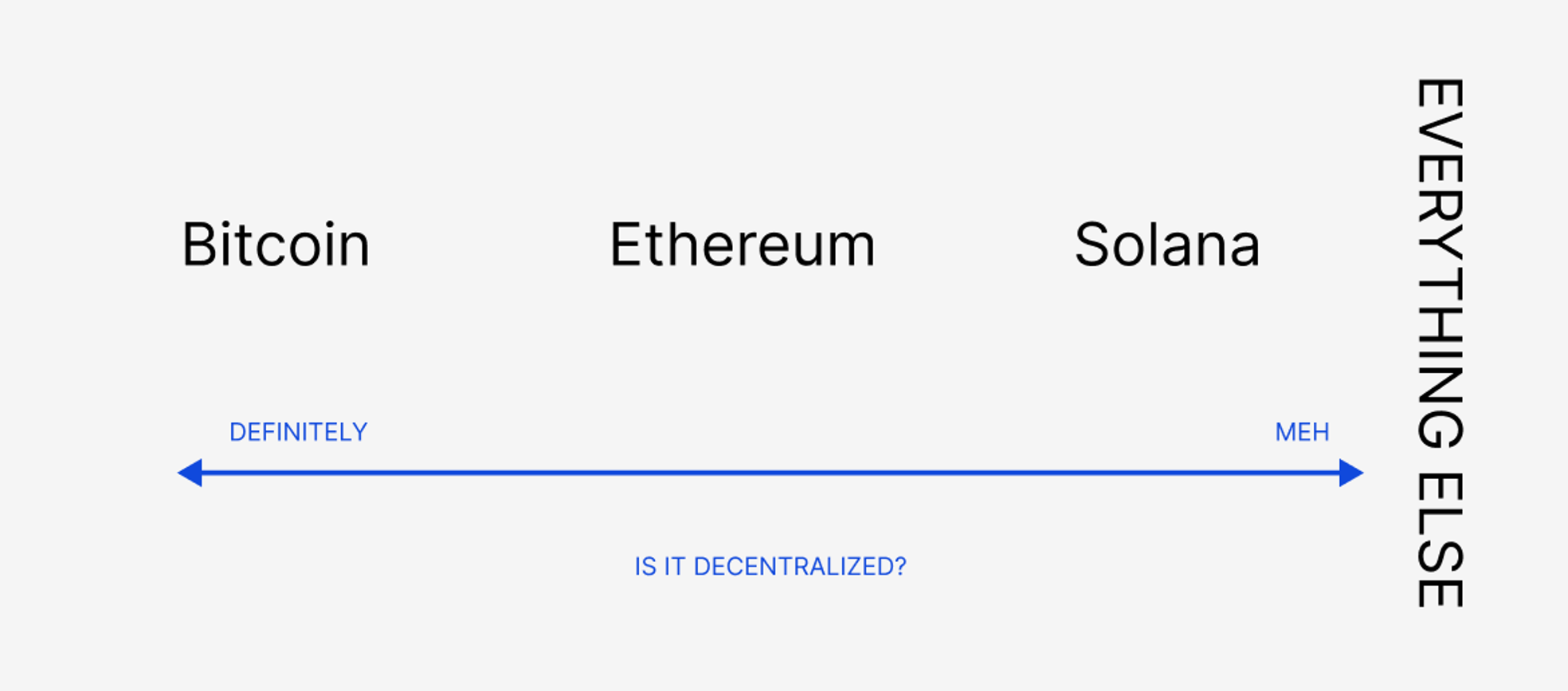

The major difference between this cycle and last cycle is that the “decentralized LARP” is over.

The results are in and, for once, it seems like we all agree on this simple framework:

As we shift into the bull market, we will likely be inundated with technical narratives from multiple L1 challengers, as well as several new roll-ups. In this meta, the tech will increasingly become commoditized. So how does one spot “the next Solana”?

This is quite literally a billion dollar question… and I have some thoughts.

Everything is a game, and when we look at games, there’s really only two things that matters:

-

Customer acquisition cost (CAC)

-

Lifetime value (LTV)

Most investors missed mobile gaming because they want to invest in something sexy. Admit it, Candy Crush just isn’t that sexy of a game. If you got pitched Candy Crush on the backdrop of Halo 3 and Call of Duty Black Ops 2, you, like most people would probably pass. But good businesses are not always sexy. Sometimes they are just simple and boring, and the unit economics are what makes them work. The freemium model, which is now the industry standard, was invented to maximize the CAC:LTV ratio.

In the context of alt-L1s and roll-ups, LTV is quite simple really. LTV is just some average function of:

-

Gas fees (spend)

-

TVL / AUM (liquidity)

-

Social capital (feeding network effects)

These are the three ways in which a player (an address) interacting with a game (chain) is valuable to the health of a network, a dapp, or an ecosystem.

Measuring CAC is slightly more complex when mapped to roll-ups and L1s. Traditionally, in gaming, CAC is just the advertising budget. For many ‘decentralized’ applications, they have a marketing budget, but they also have other expenses. I argue that the most notable expense - the airdrop - is one of the most overrated user-acquisition (UA) strategies.

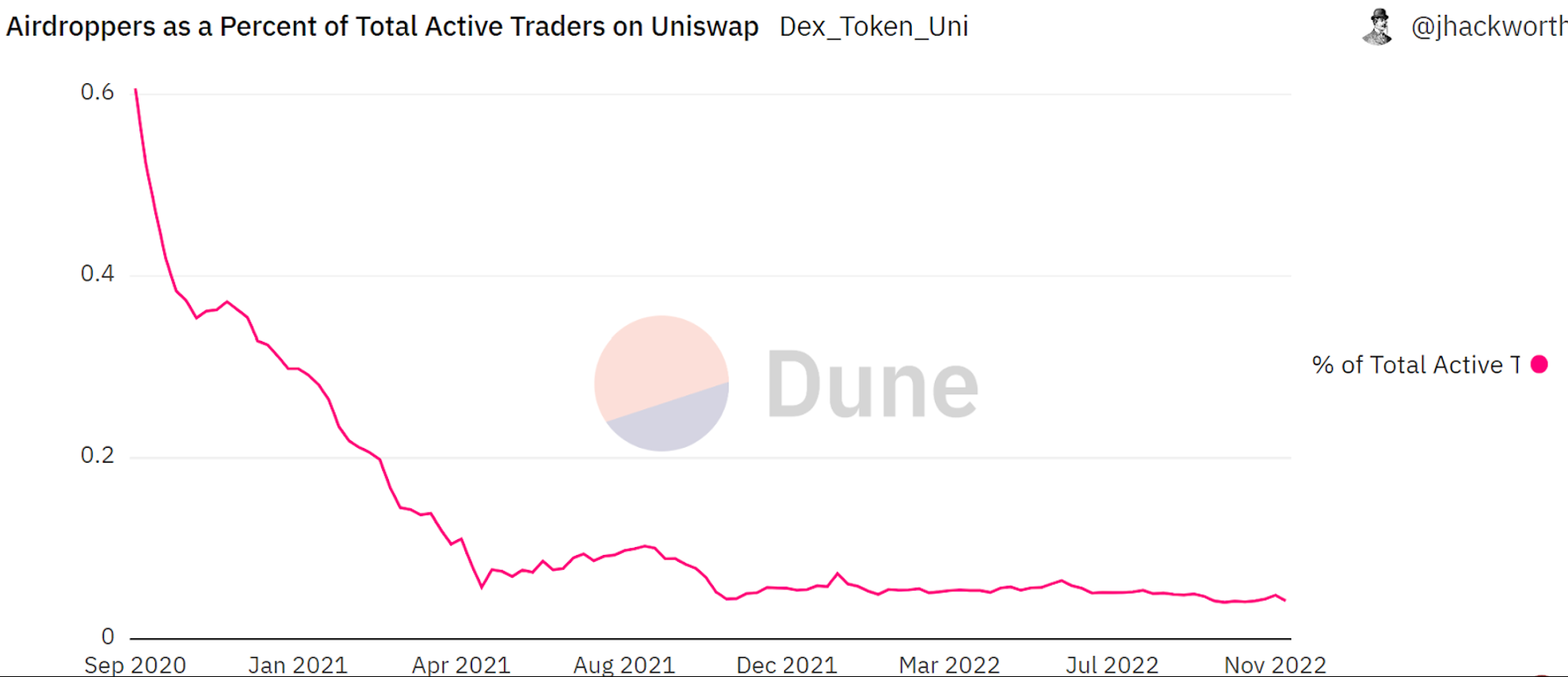

If you don’t believe me you can check out this incredible analysis by jhackworth on Dune, looking into the success of the Uniswap airdrop, among others. Some major highlights:

-

The average airdrop was between $1-$12,000 per person

-

Only 1% of airdroppers increased their UNI position, the rest sold

“The number of airdroppers actively trading declined in the weeks and months following the drop, falling from over 62k weekly traders in mid September 2020 to around 10k a year later. This continued through 2022, and by September was down to only 4k!”

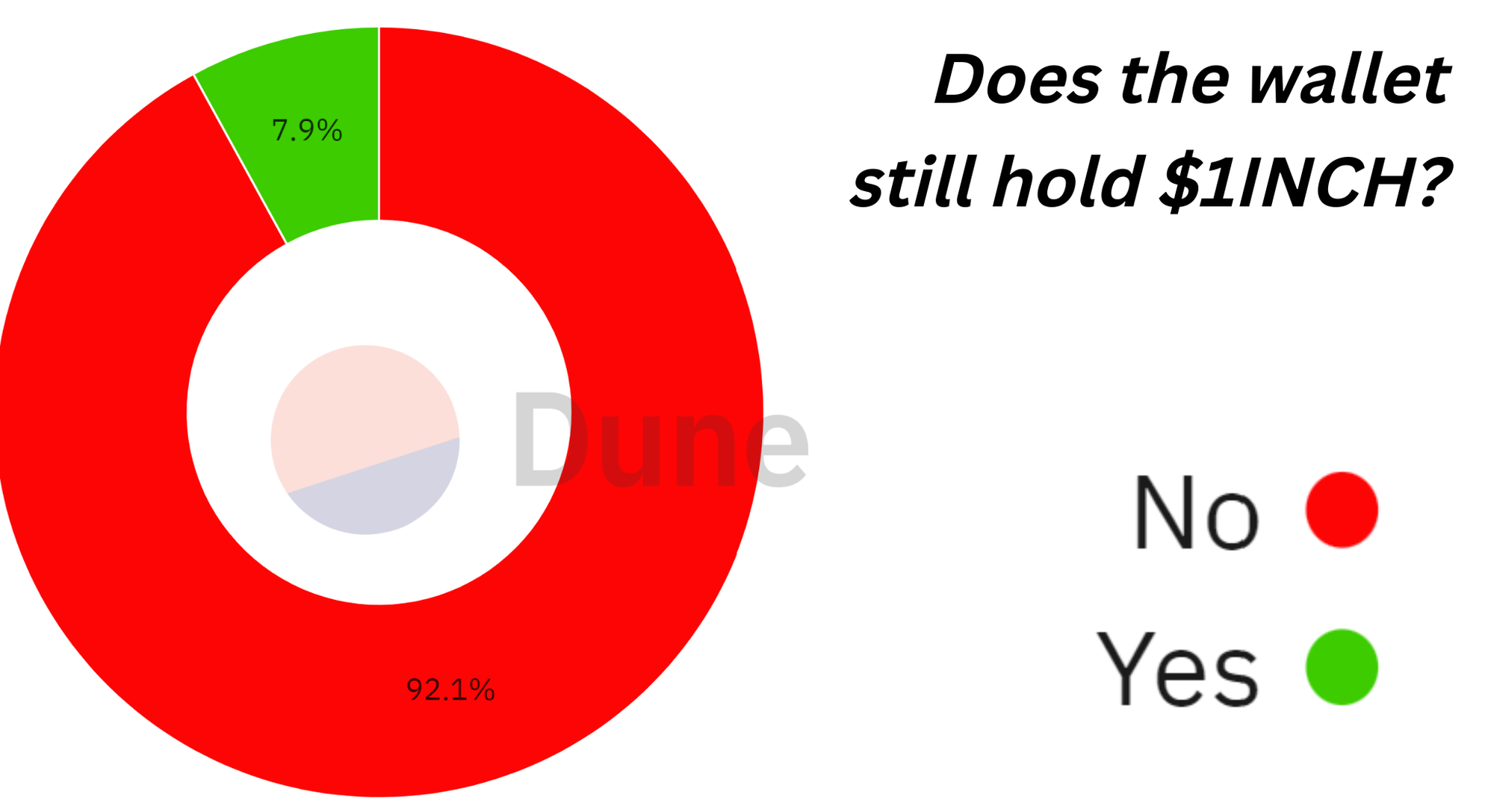

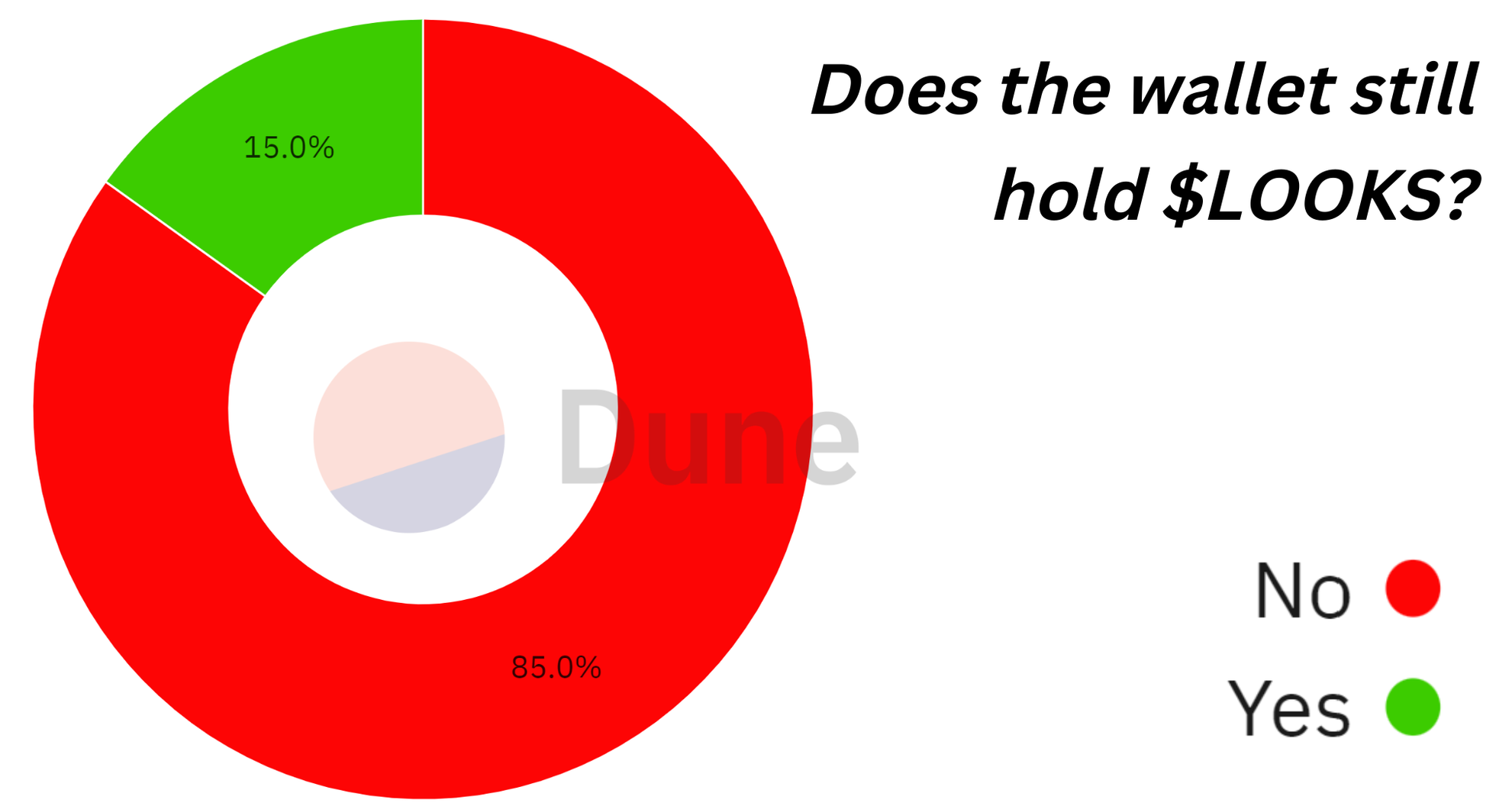

Similar patterns can be observed in other notable airdrops:

The points meta is a step in the right direction. The point systems trains behavior and allows the team doing the airdrop to fine-tune their desired CAC over time. But it still leaves a lot to be desired - a friend I was chatting with at ETH Denver simply said “points lack soul”. They are transactional, not emotional.

The lesson here is simple: applications and L1s that are in heavily competitive areas (SVM, RAAS, Alt-L1s, Optimistic L2s) will likely find that the war is won one user at a time and that optimizing for a lower CAC will have compounding effects.

For this reason, I’m extremely bullish on L1s/L2s with existing distribution networks like Base and Coinbase. I’m also extremely bullish on teams that invest heavily into community building and productization, like Monad with their Nad army (and even Pendle with their Pendies).

Conversely, I’m cautiously bearish on networks that are overly relying on their airdrop and points mechanics. I won’t name any names here, but I’m certain an astute reader will have some in mind. These are likely to overpromise and under deliver in the long run.

Airdrops are finite games. Communities are infinite games.

评论 (0)