This is a summary and walkthrough for our ’Staking on Ethereum’ lesson and quest. Check out the full lesson to level up your knowledge and claim your badge!

Key Takeaways

Staking is essential to decentralization and transaction processing on Ethereum.

It’s simple: lock Ether on the network, earn rewards.

Running a

validator nodeis the fundamental form of staking on Ethereum, requiring 32 Ether.Using the rETH

token, Explorers can get involved in staking with any amount of Ether.

What is Staking?

Put simply, staking on Ethereum is an action that allows anyone to help secure the network. You lock a portion of Ether on the network, aiding network validators, and earning rewards.

Staking is an essential part of Ethereum’s consensus mechanism: the separation of legitimate transaction and blocks from the fraudulent ones, in a decentralized way. This sorting is integral for maintaining a fair economy across the network.

This might sound familiar — because it has the same goal as mining does on the Bitcoin network. Yet there’s a crucial difference between mining and staking: On Ethereum, staking can be accessed by anyone. You don’t need a powerful computer to process transactions, like you would for mining on Bitcoin.

So by simply buying Ether and locking it in a network smart contract, you can become a staker. In doing so, you’ll help keep Ethereum running smoothly, and earn rewards in return!

Start Staking with rETH

Now, the best way to get involved in securing Ethereum is to run a validator node. It grants the most rewards, and has the biggest impact on network decentralization. The problem is… it requires 32 ETH, some technical knowledge, and a dedicated computer with 24/7 power and internet access. That’s a tall order for most Explorers. Fortunately, innovators within the Ethereum community have created an easy entry point that anyone can use to get involved: staking pools and liquid staking tokens (LSTs).

Rocket Pool is a leader in this category, with an approach granting high positive network impact. By locking Ether in one of their staking pools, you’ll mint rETH. While minting rETH directly from the Rocket Pool smart contract has the largest impact on network decentralization, you can also buy it on a decentralized exchange. In holding this token, you’ll begin earning staking rewards, generating annual returns between 3% and 16%.

With rETH, staking rewards are added straight to the value of the token: If you hold 1 rETH today, you will still own 1 rETH in a year. It will just be worth more.

Prerequisites

- You’ll need some regular ETH on one of the following networks: Ethereum, Optimism, Base, Arbitrum or Polygon (POS).

Walkthrough

Option #1: Minting New rETH

Requires >0.01 ETH, and only works on Ethereum Mainnet.

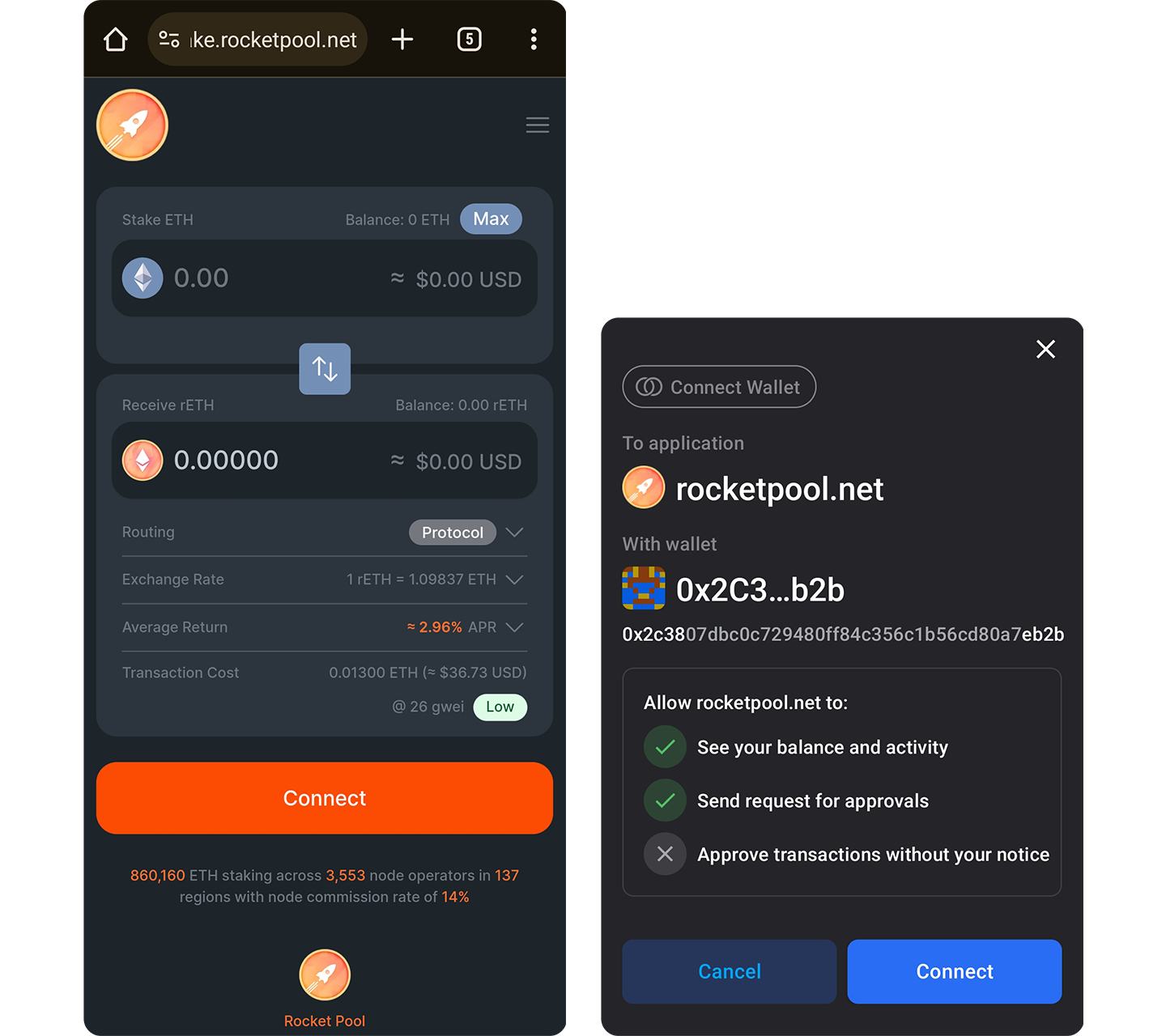

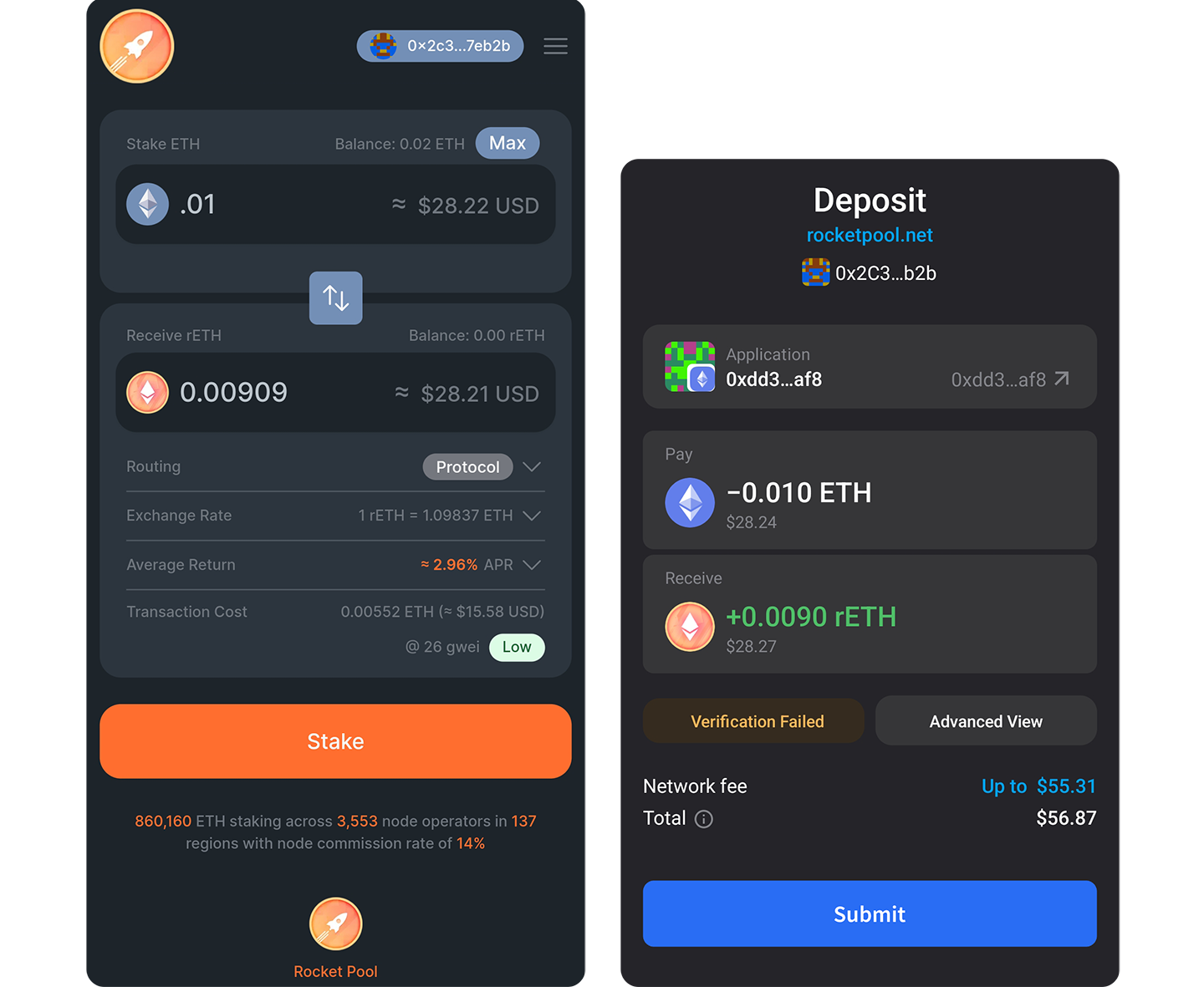

1. Head over to https://stake.rocketpool.net/ and connect your wallet.

2. Enter the amount you’d like to stake, hit ‘Stake’, and then in your wallet hit ‘Submit’.

Your rETH will land in your wallet once your transaction has been processed. It’s that easy.

Option #2: Buying rETH on a Decentralized Exchange

No minimum balance requirements, and works on all networks listed above.

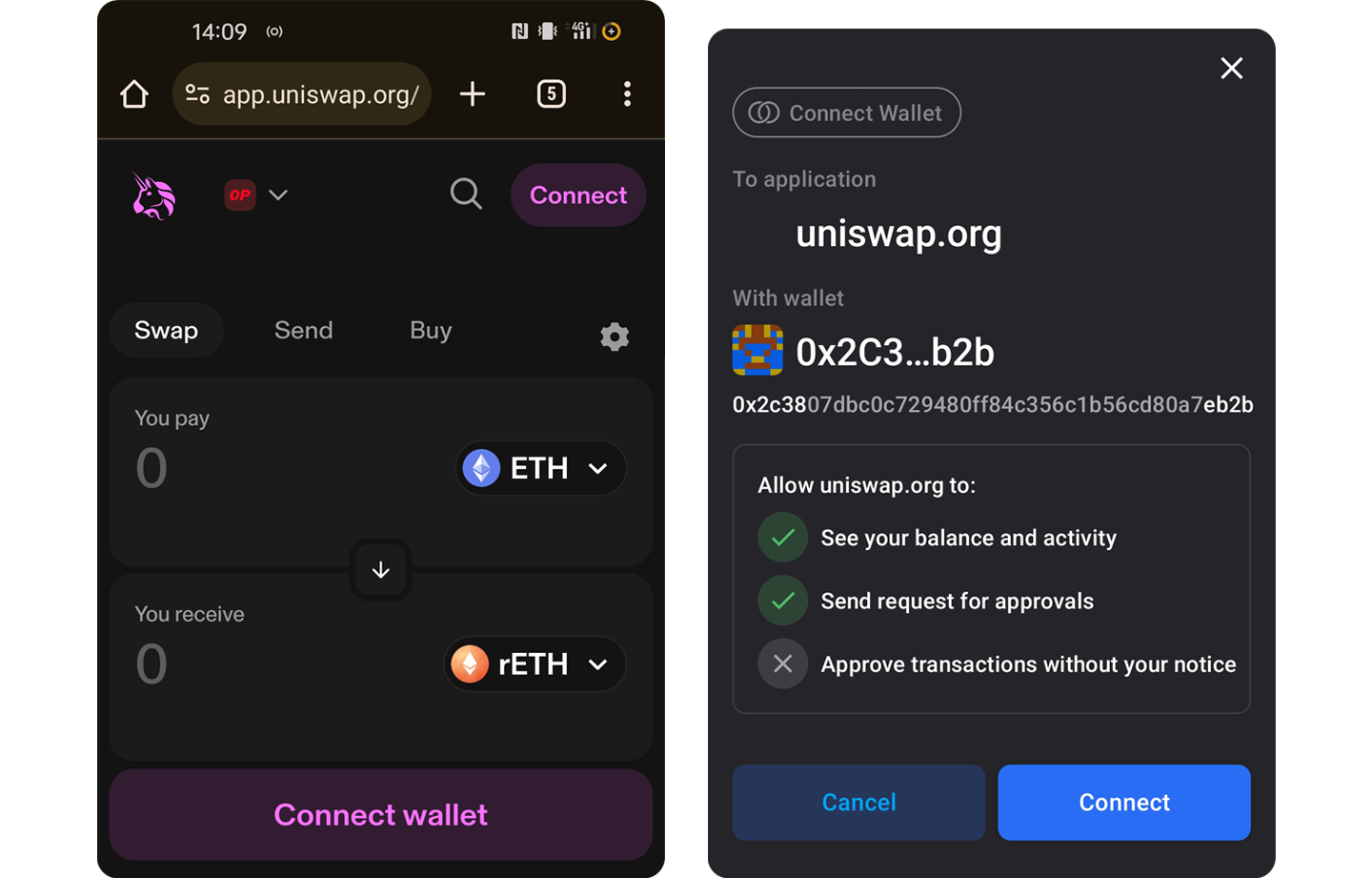

1. Jump to https://app.uniswap.org/swap and connect your wallet.

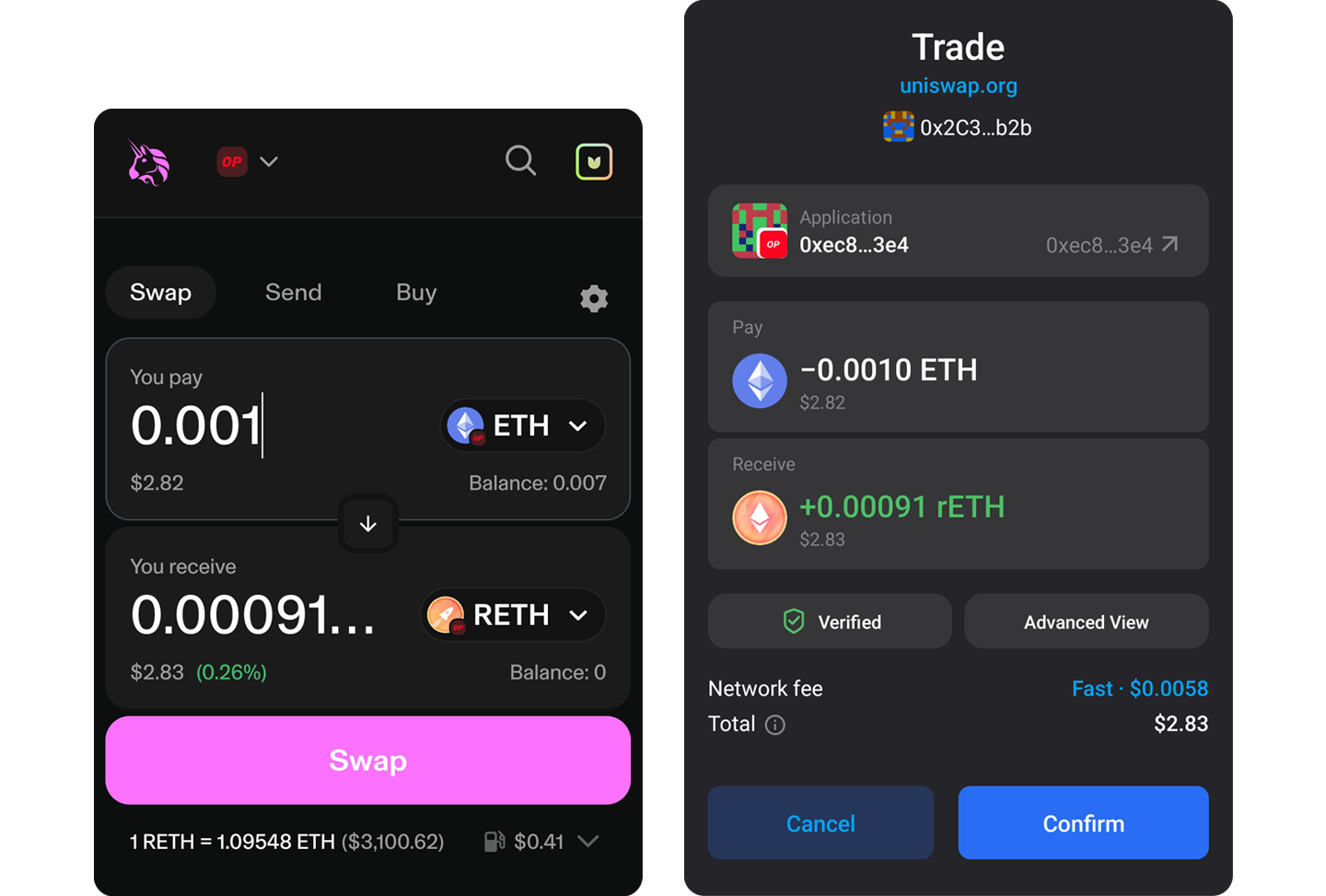

We’re swapping on the Optimism layer 2 network, because gas fees are a lot lower than on Ethereum mainnet. Learn how to bridge to Optimism, in our “How to Fund Your Wallet on L2” article.

2. Enter the amount you’d like to hold, hit ‘Swap’, and then in your wallet hit ‘Confirm’.

Your rETH will land in your wallet once your transaction has been processed. It’s that easy.

It’s time to become a guardian of Ethereum! We hope you’ve enjoyed this entry in the Explorer’s Handbook: ‘’Staking Ether”.

Don’t forget to collect this entry if you want to own a copy for easy reference on your travels, and to support future content at Bankless Academy.

Safe travels, Explorer!

FAQ

What are the risks of staking?

It depends on the method used, but the one shared risk is that the validator nodes you’re involved with could get slashed. In most staking pools and centralized exchange staking, these kinds of losses are diluted across the entire platform (everyone shares the loss, diminishing its impact) or even insured.

Other risks include:

-

Solo Staking: A bug in the validator node’s chosenvalidator clientsoftware. -

Staking Pools: A bug in the staking pool’s smart contracts, or the validator client software. -

Centralized Exchange Staking: Sudden bankruptcy of the exchange, and loss of any stake in it.

The potential impact of each risk is really difficult to predict, but it’s safe to say that staking Ether is more risky than simply holding it. Where there’s reward, there’s risk! Only invest what you’re willing to lose.

Does all staking benefit Ethereum?

Benefit comes in the form of decentralization — you want as many independent node operators as possible.

-

Solo Staking: Maximum decentralization, as this typically means just a few nodes under one person. -

Staking Pools: It depends on the platform. Some staking providers only allow specific people to act as validator nodes within their pools. That means many nodes under a few people — a centralizing force. Rocket Pool is one of the few providers that allow anyone to become the node operator of a staking pool. This makes their platform one of the best staking options for citizens of Ethereum. -

Centralized Exchange Staking: Much like the centralizing forces within staking pools, many nodes under one entity is bad for Ethereum.

Do staking rewards change?

Yes, rewards depend on two key factors:

-

Network Activity: Generally speaking, in times of low traffic rewards are lower, and in high traffic they’re higher.

-

Number of Validator Nodes: With more participants, rewards are further divided.

Rewards also change based on the staking method chosen. Check out our “Staking on Ethereum” lesson to learn more!

How do I run a validator node?

If you want to become a solo staker, you’ll need the full 32 ETH, as well as your validator hardware. Check out this great guide by CoinCashew.

You can get started with just 16 ETH by running a staking pool with Rocket Pool, where other participants will help you reach the 32 ETH required. Of course, you’ll still need your validator hardware. Check out the documentation over at Rocket Pool to get started!

Author

Tetranome is the Project Champion at Bankless Academy, focusing on user experience, interface, design, and content.

Patron

This article is funded by Rocket Pool.

This article does not contain financial or tax advice. Bankless Academy is strictly educational and is not investment advice or a solicitation to buy or sell any assets or make any financial decisions. Talk to your accountant. Do your own research.

Explore more lessons on Bankless Academy to level up your web3 knowledge.

评论 (0)