Discreet Log Contracts (DLC) are an advanced smart contract technology on Bitcoin Layer 1 that enables Bitcoin to interact with off-chain data securely and efficiently. This innovative approach allows for creating financial contracts that depend on external events, which is crucial for implementing complex DeFi functionalities directly on the Bitcoin blockchain.

DLCs enable Bitcoin to utilize off-chain data by using adaptor signatures. These signatures ensure that the contract outcomes are verifiable and enforceable only when specific conditions provided by an oracle are met. In Shell Finance, this powerful technology forms the backbone of the lending protocol’s liquidation module.

What is DLC?

DLC is a cryptographic technique that uses adaptor signatures to create programmable financial contracts on Bitcoin. Its core functionality allows Bitcoin to securely utilize off-chain data provided by oracles, trusted entities that supply external information such as market prices, weather data, or sports scores. This integration allows Bitcoin to perform complex operations that typically require a more flexible execution environment like Ethereum's.

DLC in Shell Finance

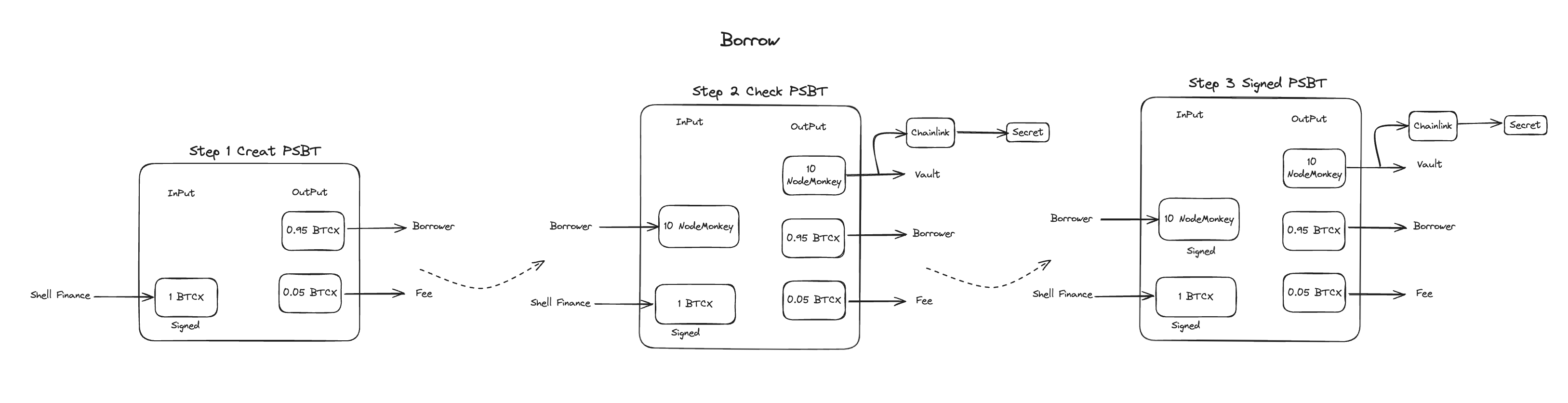

In Shell Finance, DLC is implemented as the core technology for the lending protocol’s liquidation mechanism. This application ensures that collateralized loans are managed transparently and securely, leveraging off-chain data to determine the state of each lending position. Here’s how DLC is used in practice:

- Loan Initiation: When a user initiates a loan by collateralizing Bitcoin inscription assets (such as Ordinals, Runes, Atomicals, and BRC-20), Shell Finance calculates the loan amount based on the collateral value and the current market price provided by an oracle. A DLC contract is then set up, initializing a secret value used for future liquidation scenarios.

-

Loan Adjustment: Users can adjust their collateral or debt amounts throughout the loan's lifecycle. Each adjustment recalculates the collateral ratio using real-time data from Oracle, ensuring the loan remains properly collateralized. The DLC is updated accordingly to reflect any changes.

-

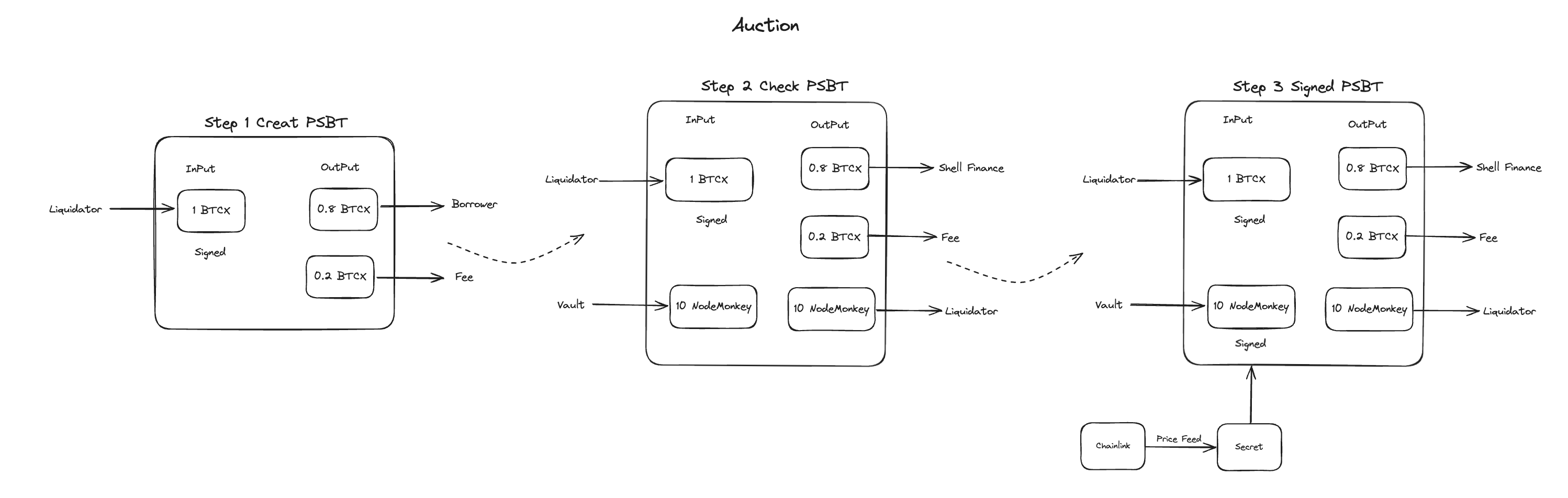

Liquidation: The most critical application of DLC in Shell Finance is during liquidation. If the collateral value drops below the required minimum collateralization ratio (MCR), the DLC allows for the automatic liquidation of the position. Here’s how it works:

-

The oracle provides a price update indicating that the collateral value has fallen below the liquidation threshold.

-

This triggers the disclosure of the secret value within the DLC, enabling the protocol to execute the liquidation.

-

The assets are then auctioned off in a Dutch auction style, with the proceeds used to repay the debt and any excess added to Shell Finance’s insurance fund.

-

Practical Operation

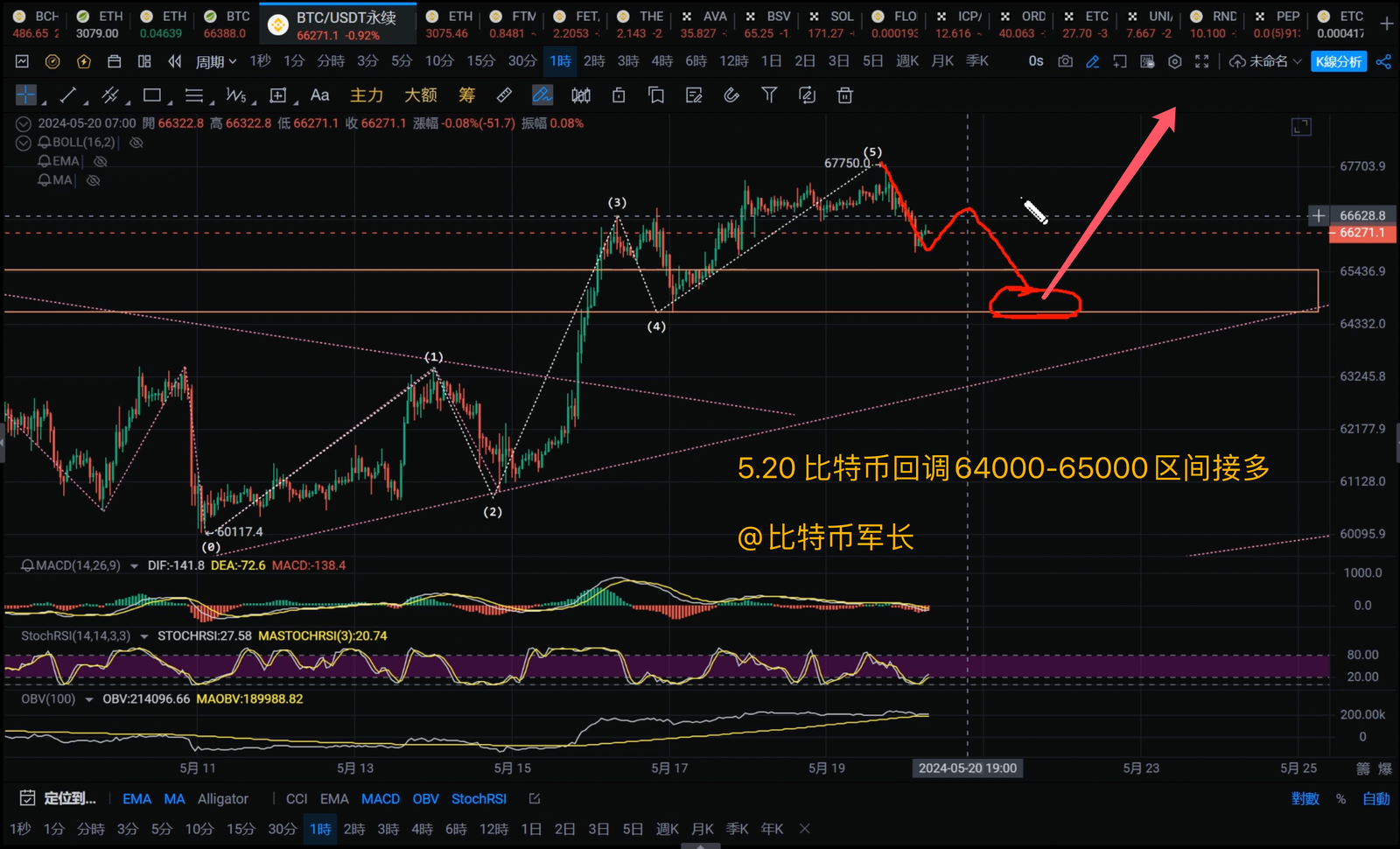

Consider a user who has collateralized $ORDI to borrow $BTCX in a practical scenario. The following steps outline the DLC-driven liquidation process:

-

Monitoring: The oracle continuously monitors the market price of $ORDI.

-

Triggering Liquidation: If the price drops below 225,000 SATS/ORDI, the oracle signals the protocol.

-

Executing Liquidation: The secret value is revealed, and the DLC signatures are completed to liquidate the position.

-

Auction: The collateral is auctioned, and the proceeds are used to cover the debt and any liquidation penalties.

By integrating DLC with Oracle technology, Shell Finance ensures a trustless and automated liquidation process, enhancing security and efficiency in its lending operations. This innovative use of Bitcoin Layer 1 capabilities sets a new standard for DeFi protocols, bringing sophisticated financial services directly onto the Bitcoin network.

评论 (0)