If you were to go around and ask what the defining narrative for the next phase of crypto adoption would be, it’s almost certain you would hear about RWAs. Tokenising real world assets promises to bring trillions worth of value to blockchains and revolutionise the backend for our legacy financial systems. But what exactly are RWAs? In simple terms, they are digital tokens that represent ownership of tangible assets or regulated securities that exist in the traditional financial world – everything from Treasury bonds to real estate to private credit.

However, are we ready to accommodate this incoming wave of value? Traditional permissionless blockchains such as Ethereum were not purpose built for handling regulated securities or physical assets hence leading to pain points that will cause suboptimal UX and hinder institutional adoption. Compliance requirements like KYC (know your customer) and AML (anti money laundering) are difficult to enforce on the base layer and institutions will demand token transfers to be gated and monitored in line with regulation.

These challenges have highlighted the need for an RWA focused blockchain that would combine the openness of public chains with the features necessary to accommodate RWAs and institutions. This sort of approach can offer regulatory guardrails, specialised performance optimisation and integrated services such as verification which are so craved by institutional capital.

It’s amusing to think about how horrified early crypto-pilled financial freedom maximalists would be reading what I have outlined above, however the community has made a deal with the quote-unquote devil to bring institutional capital onchain and expand the stagnating pie of crypto market cap.

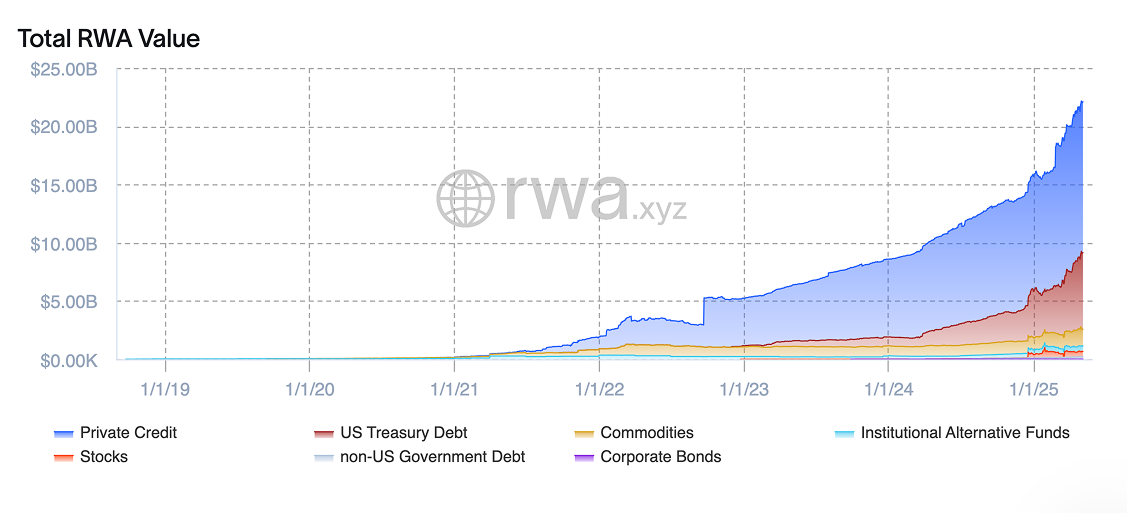

RWAs adoption has emerged steadily through 2023/24 even as other sectors came and went now reaching at the time of writing a sizeable $22 billion (excluding stablecoins), driven primarily by private credit and tokenized treasuries. Private credit dominates RWA markets with a nearly 55% share, with the majority however being in an illiquid state. Next is treasuries with just under 30% and followed by commodities like gold at just over 6%. However, this is still just a speck when compared to the $477T asset universe of global finance (according to a report by BCG). This shows why many are so excited about the potential for growth in this vertical.

The Current State of the RWA Market

RWAs adoption has emerged steadily through 2023/24 even as other sectors came and went now reaching at the time of writing a sizeable $22 billion (excluding stablecoins), driven primarily by private credit and tokenized treasuries. Private credit dominates RWA markets with a nearly 55% share, with the majority however being in an illiquid state. Next is treasuries with just under 30% and followed by commodities like gold at just over 6%. However, this is still just a speck when compared to the $477T asset universe of global finance (according to a report by BCG). This shows why many are so excited about the potential for growth in this vertical.

“I believe the next generation for markets, the next generation for securities, will be tokenization of securities.” - Larry Fink, CEO of Blackrock

Others are also not shying away from grand predictions with BCG and ADDX estimating asset tokenization could reach $16T – to be taken with a grain of salt (I’m still waiting for their Voluntary Carbon Market predictions to get back on track). Others are also making bold predictions with Standard Chartered predicting a tokenization market of $30.1 trillion by 2034 dominated by trade finance. Such eye watering (or mouthwatering for crypto natives) figures show the immense potential for stocks, bonds, funds and real estate among others that are predicted to be placed on blockchain rails for increased efficiency and accessibility.

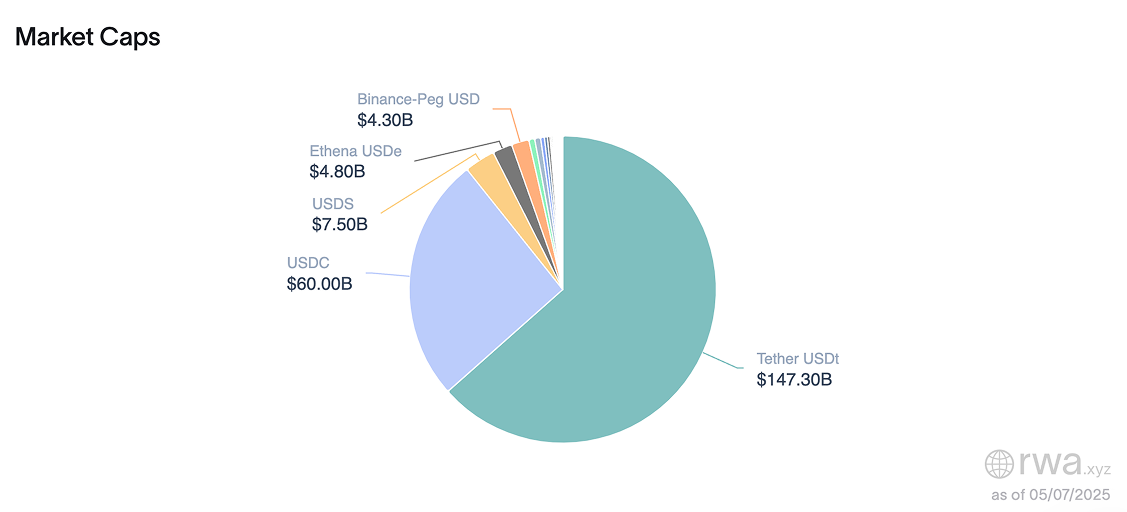

Even with the current and predicted growth there is one asset class that overshadows all other RWAs – fiat backed stablecoins which currently exist in a sort of duopoly with USDT ($147B) and USDC ($59B) dominating in a total stablecoin market of $231B. These tokens which are effectively tokenized dollars backed by US treasuries are the first RWA product to have found undeniable product market fit. Excluding stablecoins however RWA tokenization is still in its nascent stages with fragmented liquidity and limited participation. Just check the total holders’ statistics on most institutional tokenized products on RWA.xyz you will struggle to find holder numbers over three figures.

“Institutional capital is yet to enter the RWA market” in a meaningful way.” - Chris Yin, CEO of Plume Network

He estimates that onchain market cap for usable RWA products is somewhere closer to $10B with most of the institutional activity being purely extractive (taking money out of the system through their product offerings) rather than productive.

Still momentum is building, the Ondo Summit in February brought together financial powerhouses like Blackrock, Fidelity investments, BNY Mellon, Franklin Templeton, Goldman Sachs, Swift, Apollo, Fidelity, Broadridge, Wellington Management, WisdomTree, Mastercard, S&P Global and the DTCC. Even Don Jr made an appearance clearly showing the backing of the current US presidential administration. Having watched all 5 hours I was honestly quite impressed with the understanding and excitement that the TradFi speakers showed for crypto markets. A moment that really stuck with me was when Cynthia Lo Bessette from Fidelity Investments talked about the customisation for customer experiences that programmable money will bring – this is not just about making incremental back-office improvements, but an opportunity to rethink how we provide financial services.

All these developments converge on one idea: crypto platforms are in desperate need of the stability and steady cashflows that RWAs provide, and institutions are intrigued by the potential of blockchains to provide a new market for their products, enable improved efficiency, and offer 24/7 liquidity. Compliance however remains the sizeable elephant in the room. There has been significant progress made in what now are the emerging primary destinations for crypto operations: UAE, Singapore and now the US with its upcoming STABLE and GENIUS Acts. The expansion and survival of RWA markets depends on building the necessary infrastructure to allow seamless compliance and curate user experiences that take into account the aforementioned particularities of RWA tokens. To that extent, three competitors have emerged to try and enable the growth of RWA markets each building a chain specialised for the deployment and use of RWA tokens. In this article I will outline the advantages of each approach and who I believe will win the battle for institutional capital.

Plume Network

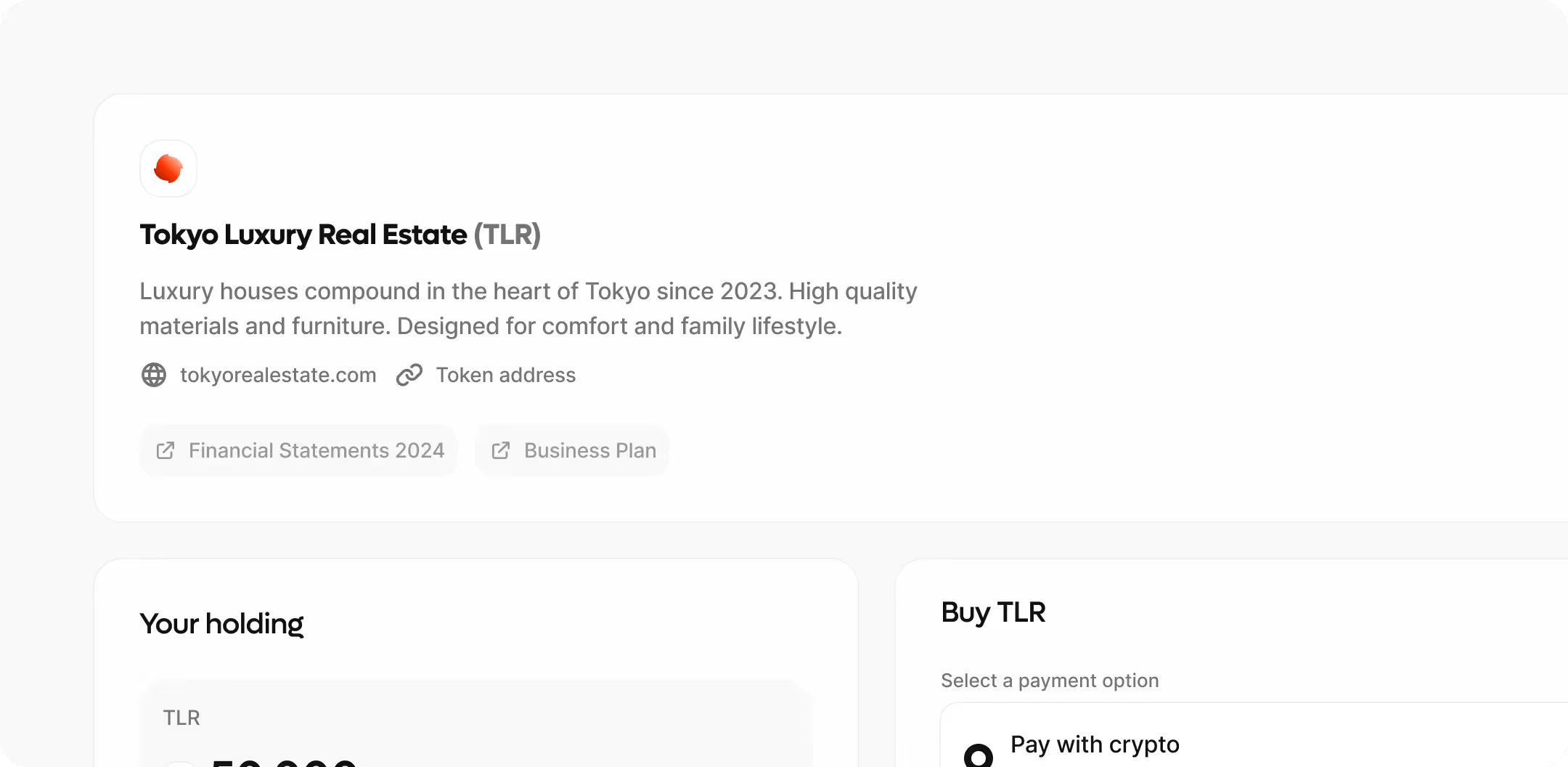

Plume Network positions itself the community first RWA chain and essentially a “Robinhood 2.0” for tokenised assets. They have taken the route of building an EVM compatible Layer 1 for bringing RWAs into DeFi a concept they have coined under the name RWAfi. As implied by the “Robinhood 2.0” slogan they are choosing to primarily cater to the retail market as it is their philosophy that it will be crypto-native retail that initially drive RWA adoption. Plume's CEO has argued that the industry "should rely more on the native community" at this stage, since large institutional capital moves slowly and will only start participating when they see significant scale and profit. Plume is building an ecosystem that makes interacting with tokenised assets easily accessible, liquid and most importantly user friendly while still having the compliance tools needed for institutional use.

In its upcoming mainnet launch Plume plans to offer a sleek experience for discovering and investing in RWAs, this includes the Plume Passport that has built in compliance and custodial logic. Additionally it would support gasless and batched transactions that are paid for by a sponsor (a project aiming to create a gasless experience for their users) reducing friction for onboarding and usage. By integrating identity verification and permission controls on the wallet level, Plume can tailor RWAfi experiences based on the qualifications of the investor in question – for example if you were to connect your wallet to an RWAfi app you would only see the products you are allowed to interact with. Additionally, the ability to build extensions to wallet infrastructure provides immense customisation capabilities for creating novel retail UX. Furthermore, Plume’s Skylink allows for yield streaming across chains integrating RWA assets yield across the crypto ecosystem. This approach is how Plume intends to drive demand for RWAs onchain.

This mission of fixing the retail UX however does not mean that Plume is ignoring institutional demands, they are ensuring that once there is fertile ground for the institutions to step in the infrastructure will be there to meet their needs. To that end, they have embraced the ERC-3643 standard for permissioned tokens that has been used by the likes of Citi Bank and ABN AMRO to tokenise regulated assets. Plume has also integrated Fireblocks a leading institutional custody and settlement platform so that banks, asset managers and funds using Fireblocks can directly access RWA yield opportunities in the Plume ecosystem. Plume’s flagship institutional product is Arc, which allow institutions to easily tokenise, manage and receive legal guidance for their products and assets on the Plume chain. Additionally, Plume has its own decentralised oracle solution – Nexus to provide RWA data feeds.

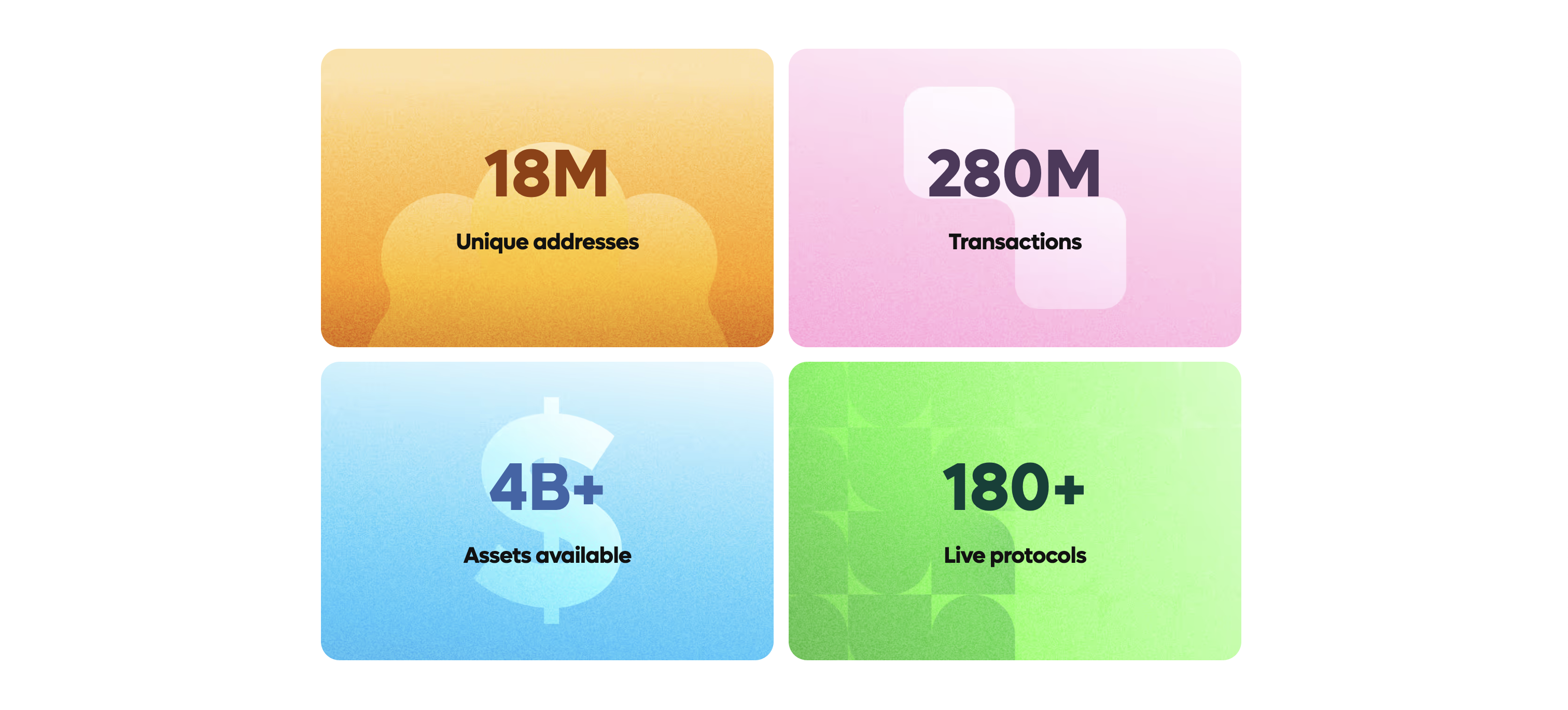

Plume has had significant ecosystem traction even prior to their mainnet launch, as of writing this report they have 191 apps and protocols building on the chain. Notable examples include Mercado Bitcoin who have chosen Plume as their primary partner to tokenise assets and distribute them to their millions of Brazilian users. Through Nest a Plume ecosystem exclusive project users will be able to access institutional yield from the likes of Blackstone, Blackrock, Hamilton Lane, UBS, Superstate. Other big names in the RWA space like Superstate, Centrifuge and Ondo have also joined onboard. Plume has also recently announced an investment from Apollo signalling that they will likely become a primary hub for Apollo’s onchain private credit products. Plume is actively forging connections on the supply side and on the demand side to solidify its position as the buy side platform aggregating RWA demand. With a sizeable war chest with contributions from the likes of Galaxy Digital, Brevan Howard Digital and Huan Ventures they are in a prime position to make RWAs mainstream for the crypto community first and then eventually everyone.

Ondo Chain

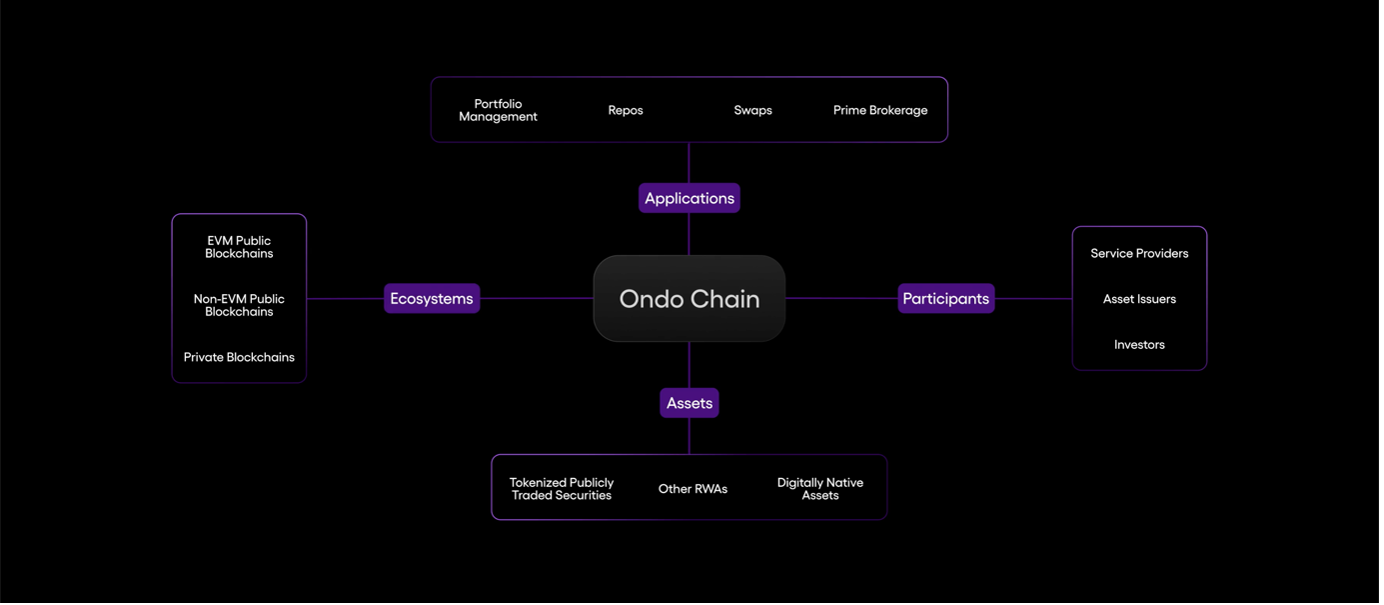

Ondo started out as a DeFi company which provided access to DeFi yields to TradFi institutions, then however after adverse market conditions they pivoted to the inverse, providing access to RWAs to crypto markets. Now in order to enact their vision of “Wall Street 2.0” they are building out the Ondo Chain. Their vision is to completely build out traditional financial markets onchain, with an explicit focus on institutional grade products and compliance from day one. Ondo’s CEO Nathan Allman has predicted that tokenised assets would reach up to $100B in 2025 as TradFi begins to embrace DeFi and he intends Ondo to be the bridge. The Ondo chain is a L1 proof of stake permissioned blockchain that combines the security of private networks with the openness of a public permissionless chain. In essence it’s a walled garden where approved entities validate transactions, but anyone can issue or trade assets within their compliance framework.

Ondo’s strategy is very much institutions first, while still accommodating retail. Along with Ondo chain they unveiled Ondo Global Markets (OGM) which will tokenise publicly traded securities such as equities, bonds and ETFs. OGM however will provide 24/7 trading, instant settlement, near-instant redemption/minting, and even margin trading for tokenized securities. This would greatly enhance the traditional trading experience for settlement, trading hours and DeFi composability. Participants would access these yield bearing tokens onchain with automated compliance thanks to partnerships that Ondo has secured to back the assets with a robust legal structure. This setup provides a transformative UX for both retail and institutional trading and asset management.

One of Ondo’s key innovations has been its approach to network economics where validators can stake and even pay gas fees with RWAs. This is a huge incentive to pull institutions onchain as instead of holding volatile assets such as ETH or the ONDO token they can instead run a validator node with treasuries or private credit – assets that are already on their balance sheet. This seems like a win win scenario for institutional adoption allowing them to access the efficiencies of DLT (distributed ledger technology) without having to hold what they deem to be risky assets. Additionally, as Ondo's validator set is permissioned it removes the risk of MEV (Maximal Extractable Value, where validators can extract additional profit by manipulating transaction order), ensuring the kind of predictability that large financial players expect from their transaction rails. Transactions can be processed with lower latency providing an almost high-frequency trading feel when moving money on-chain.

Ondo has also been busy in terms of building out its ecosystem and compliance strategy. The chains design phase had input from the trillion-dollar asset manager Franklin Templeton which had previous experience issuing tokenised mutual shares. They have also engaged with the new CFTC chair Caroline Pham and legal advisors to create a framework that TradFi can confidently operate in. Furthermore, the aforementioned Ondo summit brought together leading wall street firms to discuss the inevitable move onchain. Ondo’s existing tokenised products namely the yieldcoin USDY and the OUSG tokenised treasury (with over $1.1B total TVL) give it a strong advantage over the competition. By launching its own chain Ondo can scale these already industry leading offerings and list many more assets. Ondo has chosen to play more of a sell side role in the RWA ecosystem being the chain of choice for institutional asset issuers.

Converge

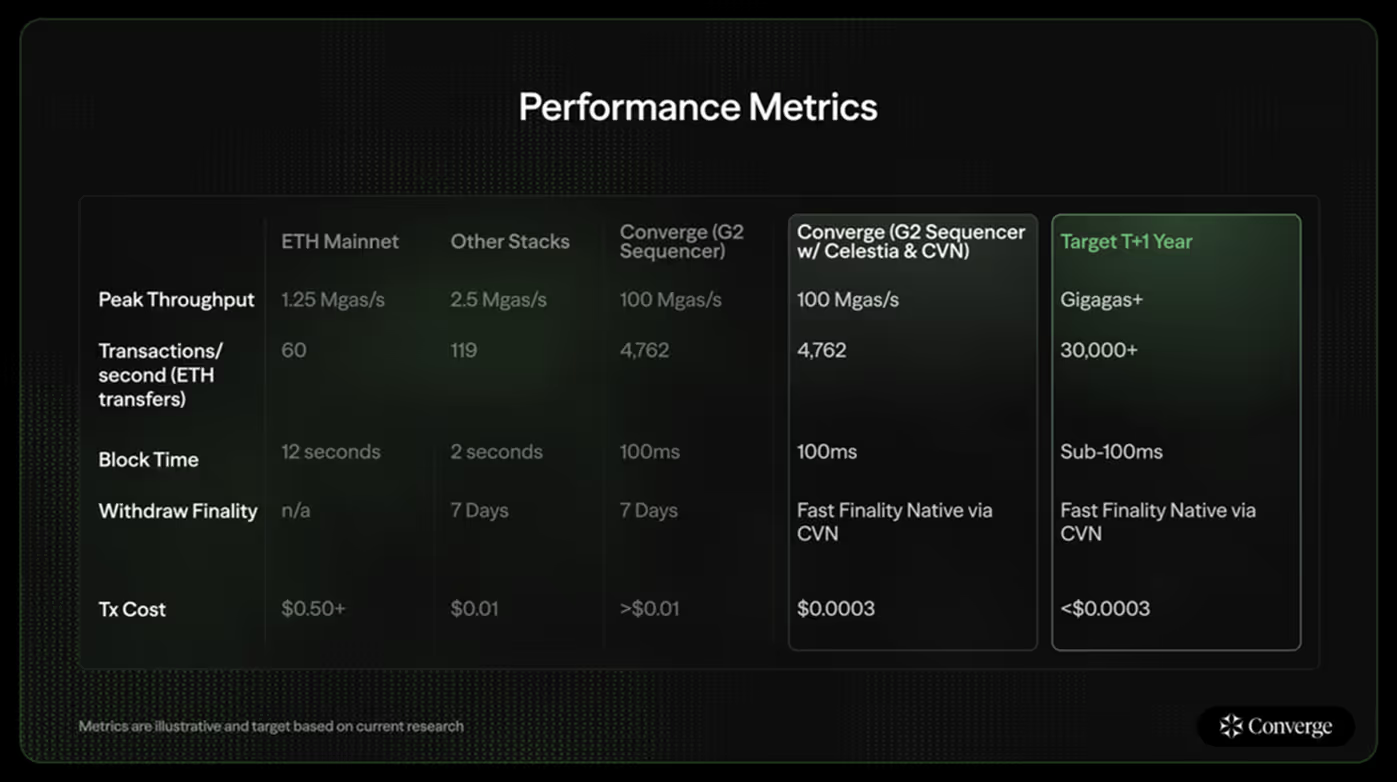

Converge is the newest of the contenders and has emerged as the result of a partnership between one of the most successful DeFi projects in recent memory – Ethena – and the leading institutional asset tokenisation platform, Securitize. They are building an Ethereum L2 that’s using the Arbitrum technology stack and Celestia's data availability layer, effectively building an Arbitrum Orbit chain that is fully focused on RWAs. This gives Converge the security of Ethereum while also having Celestia for scalability (offloading data to a specialized network) which enables high throughput and ultra-fast finality. Converge is designed for speed and usability at scale, they plan to launch with 100-millisecond block times and are aiming to reduce that further to 50ms. That’s nearly web2 levels of transaction speed which would be suitable for high frequency trading of RWAs. Converge has also taken the route of allowing gas to be paid in a stable asset, namely Ethena’s USDe and USDtb stablecoins. This ensures predictable costs and no exposure to crypto volatility for users and institutions on the Converge network. The security model will involve the staking of the sENA token aligning the interests of the chain the Ethena protocol.

From an adoption standpoint Converge will begin with a sizeable war chest of assets. At launch about $7B worth of assets are expected to migrate onto Converge. This is made up of $5B in reserve backing Ethena’s USDe (synthetic stablecoin) and $2B worth of Securitize’s tokenised assets. Securitize brings institutional assets from leading issuers such as Apollo, Blackrock, Hamilton Lane, KKR and VanEck. This is in addition to commitments from leading DeFi protocols such as Pendle, Aave, Morpho and Maple to build on Converge.

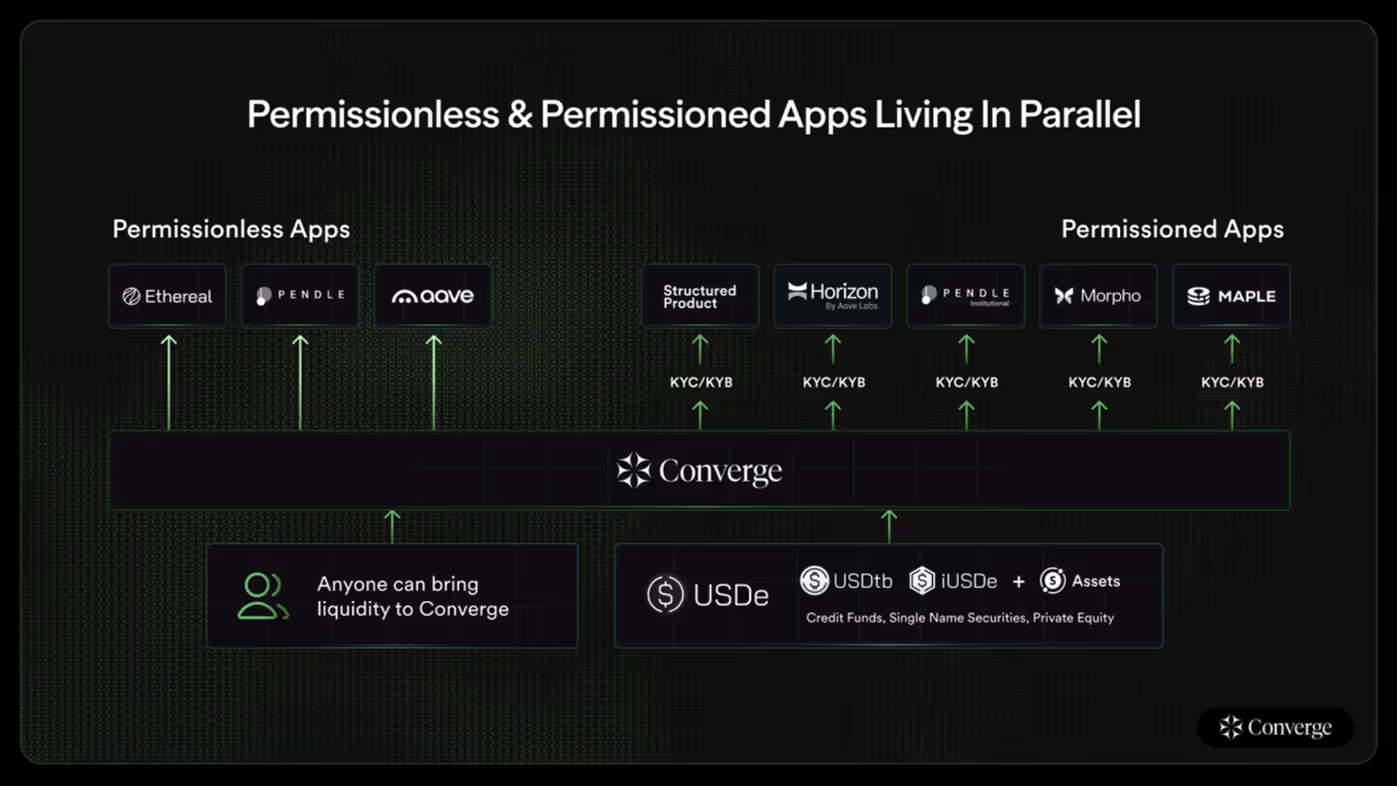

To this extent Converge takes a duel pronged approach giving access to both permissioned and permissionless finance. Permissionless DeFi apps can easily deploy providing functionality beyond RWAs however at the same time permissioned products – like a private credit token only open to KYC-verified investors – can operate on Converge with Securitize's compliance infrastructure ensuring only eligible wallets interact with those assets. This could allow interesting intersections between the two – for example a permissionless yield farm could include tokenized bonds in its strategy (with only whitelisted addresses able to provide those bond tokens). Securitize's role here is integral as their position as a regulated transfer agent and broker-dealer allows them to handle onboarding of investors and issuance of tokens that comply with securities laws. This gives Converge a strong foundation for institutional adoption.

Finally being tied to the Arbitrum ecosystem could serve a significant tailwind in the race to attract liquidity. Offchain Labs (Arbitrum's developer) has already announced Converge as part of its orbit, and improvements like Arbitrum's new Timeboost transaction ordering (which debuted the same time as Converge) show a supportive environment for specialised chains. It is likely Converge will integrate with Arbitrum One or Nova allowing frictionless movement of assets. This interoperability in addition to the sheer scale of assets coming to Converge even with their late entry make them a very strong contender. Converge’s strategy is to integrate the best of both worlds of TradFi and DeFi. They leverage the compliance of Securitizes tokenisation platform and the speed of a cutting-edge L2 blockchain with the mix of permissioned and permissionless apps to allow the creation of many interesting hybrid use cases.

Who wins the battle for institutional capital

With three worthy contenders vying for liquidity in the emerging RWA markets who will come out on top. As we grapple with this question it is important to note that in reality RWAs encompass a vast universe of asset classes, use cases and regulatory regimes. It is unlikely that a single chain will monopolise liquidity and onchain activity. Instead, it is likely that these chains will each capture separate niches and possibly even complement each other.

We can already see evidence of this very thing occurring with the clear symbiotic relationship between Ondo and Plume. Ondo is building out the supply side working with Wall Street giants to tokenise blue chip assets and ensure they are compliant and collateralised. Plume on the other hand is focusing its efforts on cultivating an active community of retail and crypto native investors to build out the demand side of the equation. Ondo has already committed to building products on Plume – this partnership could be very powerful with Ondo bringing, let’s say an ETF or bond to market and Plume immediately driving adoption with a strong retail base and the ability to coordinate cross chain yield streams. If this partnership holds it has the opportunity exponentially increase the value of both chains due to the specialisation of each project.

In the long term however, Ondo appears to have strongest advantage, being heavily embedded into Wall Street, having access to the current pro crypto administration and strong institutional support. Finally, the advantages the Ondo Chain brings, those being: providing 24/7 trading, instant settlement, near-instant redemption/minting, and margin trading for tokenized securities in addition to leading institutions in their validator set and being able to pay gas and stake using RWAs could make them rival traditional venues for institutional investment, trading and settlement. This would long term position them as a truly transformational onchain project.

However, I would not underestimate the potential of Converge to be a dark horse in this race. They are the only chain that has a product with real institutional interest – fixed rate USDe through Pendle. Additionally, with $7B when compared to the $4B coming onchain through Plume’s Arc they have an immense TVL to bootstrap adoption. Furthermore, support of Securitise and their already established institutional partnerships will definitely challenge Ondo’s status as the venue of choice for institutional issuance.

Technology will also play a role in bringing demand to Converge due their strategic choice to build atop Arbitrum Orbit and the quite frankly exceptionally fast block times. Finally, their dual pronged approach to DeFi TradFi composability could result in novel use cases that separate them from the pack.

Converges entry shows that the race for RWA dominance is accelerating at a remarkable pace. While I made my bets above, the real winner as you can probably tell is the RWA industry itself with clear retail demand and institutional interest we are entering a new age of finance where the lines between DeFi and TradFi are forever blurred.

评论 (0)