This is Part Two of a two-part series blog. Part One sets out RFX’s Contributor Manifesto and provides a framework for community members to get involved and help RFX fulfil its mission of becoming the #1 derivatives protocol on zkSync Era. Part Two will provide an overview of RFX’s upcoming Liquidity Generation Event (LGE) and accompanying incentive programs.

Read Part One here: https://mirror.xyz/0x12Daf0085914D71fEA20Ccf66cb4704b67498383/DKzlUy0Hb8PCMNGKbtLHH-SrEyCjVQJBYn74lPCxCbI

Welcome back Anon.

The long-awaited moment is finally here. Season 1 of RFXs Interstellar Voyage commences on Oct 14, 2024.

As explained in Part One, RFX’s launch will take place in phases, and throughout Season 1 of the Interstellar Voyage users will have the opportunity to earn Particles by contributing to RFX. Some important notes about Particles:

-

Particles represent your share of the future RFX airdrop and can be earned primarily by completing missions, providing liquidity, trading on RFX, and referring users to RFX.

-

The Particles you accumulate every epoch (one month) will determine your Rank. Your Rank is determined relative to the Particles accumulated by other users, and so can change every epoch.

-

Phase 1 of the Interstellar Voyage kicks off on October 14, 2024, with a two-week-long Liquidity Generation Event (LGE).

-

Phase 2 of the Interstellar Voyage kicks off on October 28, 2024 with the launch of the trading exchange.

-

At launch, RFX will offer 22 perp markets and 2 spot markets (wstETH-wETH and USDC-deUSD), enabled through key integrations with Lido and Elixir Protocol, enhancing liquidity and capital efficiency. A full list of available markets will be published prior to Phase 2 of the Interstellar Voyage on Oct 28, 2024.

RFX LGE: An Overview of Markets and Incentives

On Oct 14, 2024 access to the RFX dApp will be made public and users will be able to deposit liquidity to available pools on RFX.

Overview of LGE Incentives:

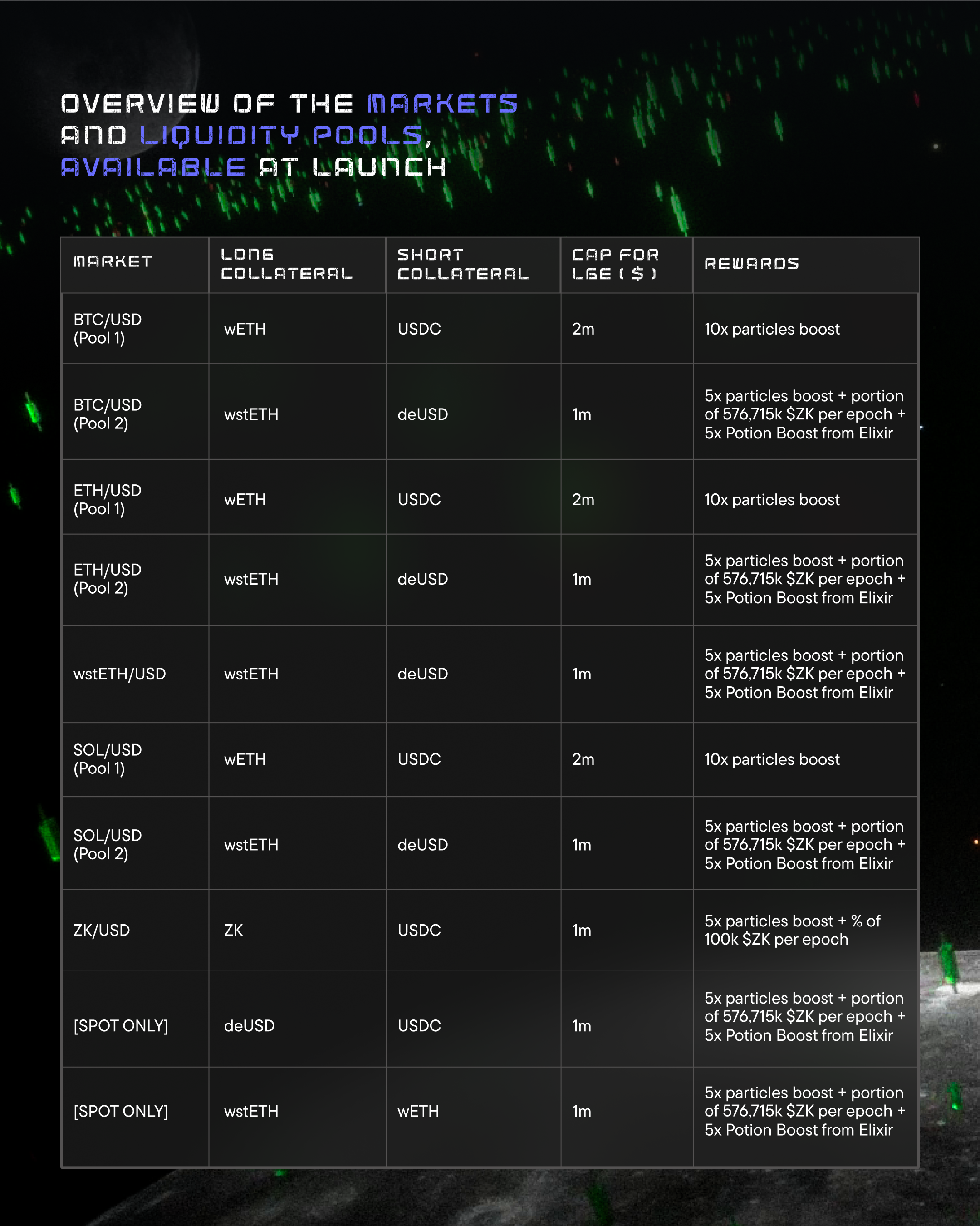

All wETH and USDC deposits during the LGE will be eligible to earn a 10x boost in Particles every epoch. One Epoch = One Month. Additionally, LPs are also eligible to earn $ZK Rewards previously awarded by Matter Labs, along with RFX and additional partner rewards if depositing wstETH or deUSD in eligible pools. These are as follows:

-

LPs depositing ZK or USDC into the ZK/USD market will be eligible to earn $100,000 $ZK per epoch for 3 epochs along with a 5x Particles boost**,** distributed pro rata at the end of every epoch.

-

LPs depositing wstETH or deUSD into BTC/USD, ETH/USD, SOL/USD stETH/USD perp markets and wstETH - ETH, USDC - deUSD during the LGE will earn: a portion of 576,715 $ZK per epoch for 5 epochs, distributed pro rata to LPs across eligible pools at the end of every epoch, a 5x Particles boost and a 5x Potions boost from Elixir Protocol.

- Note: ETH and USDC deposited into the spot pools will also be eligible to earn the $ZK Rewards in addition to Particles boosts

-

If liquidity is withdrawn during an epoch then LPs automatically forfeit all Particles boosts previously earned and any $ZK rewards earned for the current epoch. This will not affect any $ZK rewards already earned by LPs for past epochs.

The following table provides an overview of the markets and liquidity pools that will be available at launch, the underlying collateral for each pool, the deposit caps for each pool and the rewards available for LPs:

Overview of RFXs LP Architecture:

-

RFXs uses a multi-pool design with each trading pair sourcing liquidity from independent liquidity pools created for that market.

-

This is complemented by RFXs Shared Liquidity Vault which seeds liquidity to perp markets for alt coins, and algorithmically allocates liquidity across all markets.

-

During the LGE, LPs can deposit liquidity into pools for the following trading pairs:

-

BTC/USD: 2 Pools

-

ETH/USD: 2 Pools

-

SOL/USD: 2 Pools

-

ZK/USD: 1 Pool

-

stETH/USD: 1 Pool

-

LPs wanting optimised exposure to all markets on RFX should deposit USDC into RFXs Shared Liquidity Vault.

-

-

Every liquidity pool is dual-sided, i.e. uses 2 collateral tokens.

-

Markets on RFX are synthetic and primarily use wETH and USDC as collateral. An exception to this is the ZK/USD market which can be traded using ZK and USDC.

-

Additionally, 4 markets (ETH/USD, BTC/USD, SOL/USD, and stETH/USD) will also be enabled using wstETH and deUSD, with 2 separate pools available for these perp markets as detailed in the table above.

-

With spot swaps, a user can use any collateral to trade any Perp, incurring/adding/executing an extra swap in the process.

-

Deposits for each pool will be capped during LGE - so make sure you get in before caps are hit.

Note: Answers to frequently asked questions and technical information about RFX’s design and LP architecture will be published on Oct 11, 2024 ahead of the LGE.

RFX’s goal is to provide a deep and unified liquidity layer for DeFi primitives, accessible to market participants across zkSync’s Elastic Chain. The launch of the RFX v1 on zkSync Era marks the first milestone towards this ambitious goal, providing LPs with capital-efficient pools and competitive yields, and promising traders a superior, gas-less trading experience, with up to 50x leverage available on all markets.

Make sure you follow us on X, join our Discord, and Telegram as we prepare for take off.

评论 (0)