RENZO / ZEROLEND MUTIPLIER TRICK

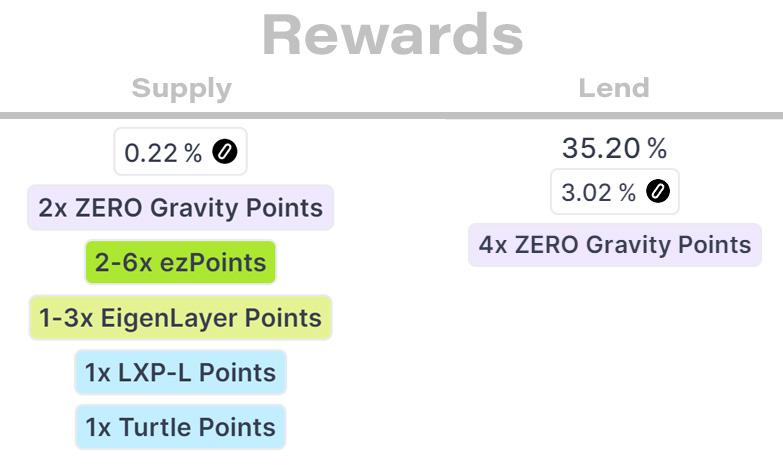

To achieve maximum points allocation, stake ETH on Renzo and get exETH in return. Leverage your ezETH holdings within the ZeroLend system by adding liquidity, using it as collateral to borrow, and restaking borrowed assets is suggested. This process can increase your points from 2x to 6x, potentially up to 12x depending on the loan-to-value ratio. It’s important to maintain your health factor above 1 to avoid risks. Additionally, borrowing and supplying the same asset does indeed grant points for both actions. 👍

A little tricky, but a great multiplier hack and a no-brainer, especially if you are farming ZeroLend, EigenLayer and Linea. See the image below for the full list of rewards.

You also get Turtle Points. If you are not already collecting them, you may as well sign up, it costs nothing, otherwise the points you are farming are just going to waste. You can sign-up for Turtle Club here and if asked for a code you can use BONUSXP

Follow these setps:

1. Supply ETH (on Linea) on Renzo and get ezETH in return.

2. Then supply that ezETH on ZeroLend.

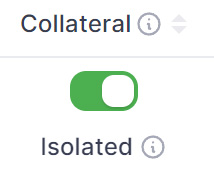

3. Toggle the isolation tab to allow borrowing against your supplied asset.

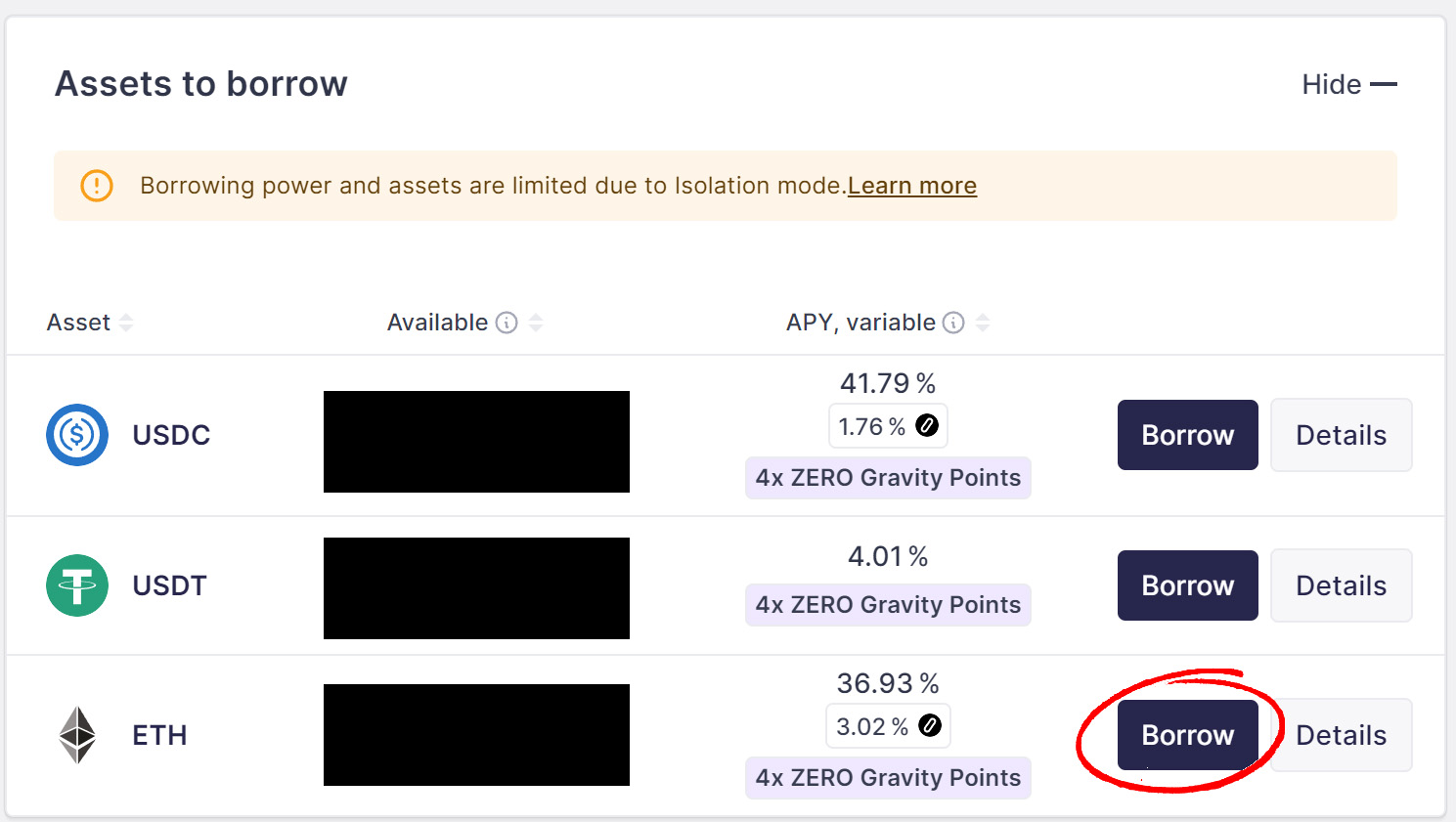

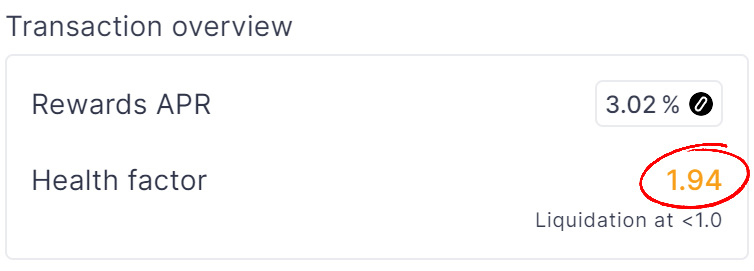

4. Borrow ETH against the ezETH you supplied. (The APY is high, so this is not a long term action - be mindful of this and manage accordingly - decide how much you want to spend on the multiplier)

5. Take that borrowed ETH and supply it on Renzo for more ezETH and repeat steps above.

You can repeat this as many times as you wish or until you are no longer able to borrow against your ezETH.

It is important to note that you need to keep your health factor above 1 to avoid liquidation risks.

If you do not want to deal with the borrower’s high interest rate then you do not need to borrow and you still get the supply rewards, however you will not be able to max your multiplier.

Links

https://app.renzoprotocol.com/?ref=0xec17c56b3606ca9517bc8b640f93acd48ad06217

https://airdrop.zerolend.xyz/#/?invite=gqTl27C8HTsj

https://turtle.club/points/?ref=BONUSXP

DISCLAIMER: Please be aware that there is inherent risk associated with endeavors like this. Factors such as exploit vulnerabilities, rugpulls, contract risks, and liquidation events are always present. While we provide information, it is crucial to understand that any actions you take based on this information are entirely your own decision. We assume no responsibility if outcomes do not align with your expectations. Proceed with caution and conduct thorough research. Additionally, keep in mind that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

AFFILIATES: This article may contain our affiliate links, and we would greatly appreciate it if you use them to show support for the time and effort we’ve put into gathering information and creating these articles. Your support means a lot to us! 😊🙌

评论 (0)