Decentralized prediction markets have long been touted as a groundbreaking application of Web3. They offer transparency, efficiency, and verifiable ways to wager on real-world events, from sporting matches to election outcomes.

Vitalik has been discussing prediction markets for years; let's examine their current state.

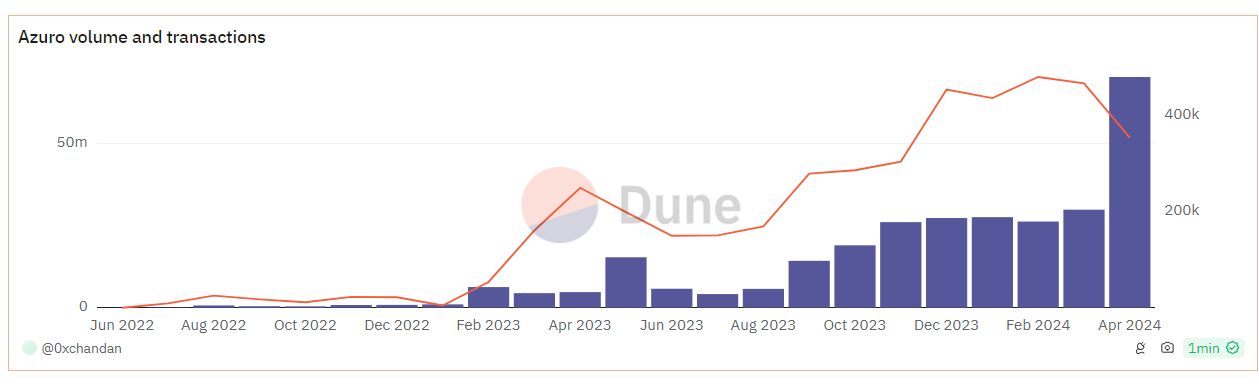

Azuro's monthly volume for April reached $70 million, a threefold increase from last April's volume. Transactions on Azuro have doubled over the same period. Additionally, 70% of this volume originated from Polygon, with the remainder on Gnosis.

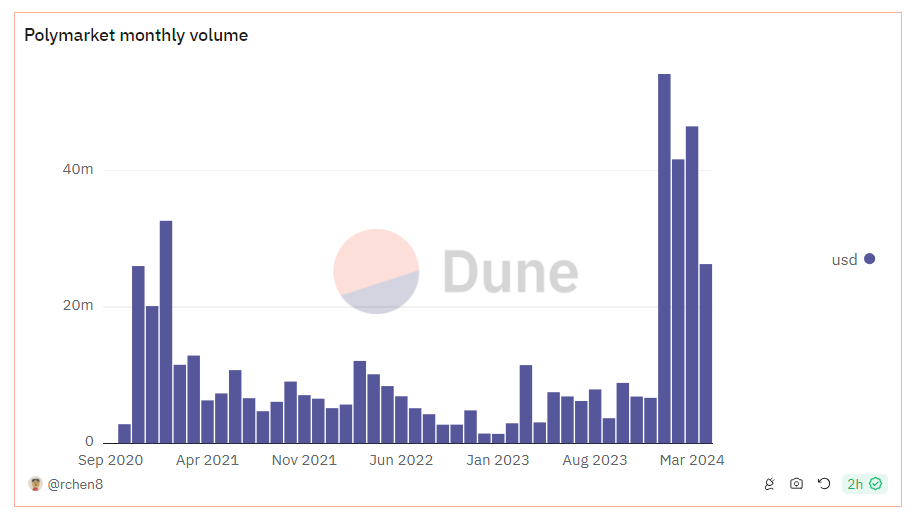

Polymarket's monthly volume for April reached $26 million, which is an eightfold increase from last April's volume. Currently, Polymarket is exclusively available on Polygon.

Azuro and Polymarket are the largest prediction markets, followed by EtherFlip, WINR Protocol, and others.

None of the protocols mentioned above currently have a token, so there is no direct way to invest in them.

Azuro appears to be the clear leader in terms of metrics. Unlike other prediction markets, it is not merely a casino but a comprehensive infrastructure and liquidity layer for gaming and gambling protocols to build upon.

Currently, 70% of the market volume is on Polygon, but as Base is growing rapidly, we can expect prediction markets to launch on Base and potentially erode Polygon's market share in the prediction market space.

Polymarket is also performing well, receiving considerable free marketing from its Biden and Trump pool.

The global online sports betting market size had a value of approximately USD 54.56 billion in 2023 and is projected to reach around USD 142.56 billion by 2032

The global horse betting market was valued at $44.3 billion in 2022 and is projected to reach $91.2 billion by 2032.

With Web3, you can establish prediction markets for any type of event, such as the outbreak of war between two countries, a bank defaulting, or predicting what happens next in a series.

Gradually, Web3 prediction markets are likely to capture Web2 market share because they offer greater transparency, enhanced liquidity, and the flexibility to set up markets for any type of betting.

Thanks Alan from RailGUN for sharing his thoughts,

Well, if you're going to build a private L1/L2, it's a much bigger task. Building in a privacy option into a currently thriving ecosystem is a fundamentally task...Garnering the attention of liquidity, builders etc is a big ask.

Builders for example aren't going to just up and retool for nothing; so if you're telling them leave the EVM world or add this new "privacy" chain to their deployment stack. You have to have a very big reason to do so.

WIIFM - what's in it for ME?!

Why would I deploy there?

This is especially true of really big applications that many DeFi natives use on a DAILY basis. Every new deployment comes with big considerations and that's just when you're considering EVM <-> EVM where solidity is solidity. So we gotta respect that mission is MUCH MUCH larger if that's what privacy layer1s are going for.

In other words, I think a RAILGUN "go to market strategy" is simpler and doesn't have the ancillary requirements of spinning up a New Haven for privacy. The DeFi ecosystem that's addressable by privacy is vibrant and rich already. RAILGUN can be deployed on *insert favorite Ethereum/Bitcoin L1/L2/Rollup* instead and BRING the solution to the market where it's already needed.

In my opinion, privacy alone isn't a large enough value proposition to lure liquidity away, so it's a much lighter, more impactful lift to bring the privacy to the existing liquidity.

People don't do what RAILGUN contributors do because it's hard but it's a far deeper value proposition for the current state of the ecosystem.

There's several billions of dollars’ worth of TVL in protocols to address in the Top 10 chains according to DeFi Llama. There's about 3600ish protocols (I really question this metric's analytical merit but okay) and there's something like 128billion+ dollars in stables across these chains.

To say these people will uproot their financial lives to go to a new ecosystem outside of self-serving liquidity harvesting (airdrop/grant hunting etc.) is a very big assumption.

The easier to appreciate value proposition is to bring privacy to these ecosystems that exist already. Admittedly it's harder to build within the confines of already set rules (unlike just making them up for your new chain) but it's a much easier to understand mission.

评论 (0)