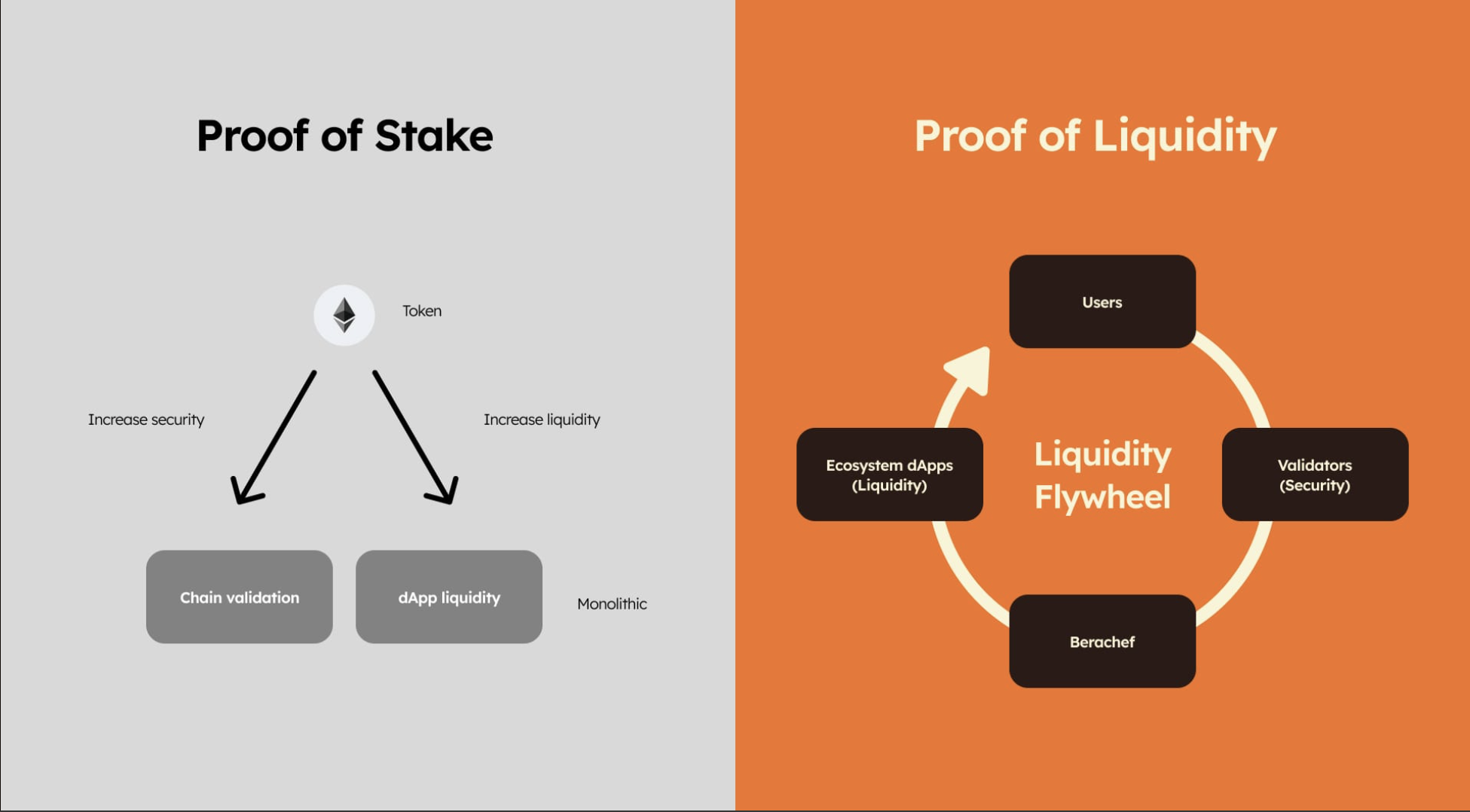

Proof-of-Liquidity (PoL) could be the first consensus mechanism truly built around long-term alignment. Unlike traditional PoS where rewards are tied to inflationary emissions, Berachain uses BGT—a non-transferable, non-tradable governance token—as the sole reward mechanism. BGT is only earned by providing liquidity, decoupling protocol incentives from market speculation.

This creates a self-sustaining reward engine and reframes block validation economics around productive activity. But the deeper question remains: can validators and BGT stakers remain properly aligned over the long term? After all, the value of blockspace is ultimately driven by demand to use it.

🍏 Ecosystems Win: From Apple to Berachain

Apple didn’t win because it made the fastest or cheapest devices. It won because it built an ecosystem—one that users didn’t want to leave. Berachain takes the same approach. By embedding incentives at the protocol level through PoL, it creates a self-reinforcing ecosystem where protocols and users co-exist, collaborate, and grow together.

In finance—whether TradFi or DeFi—liquidity is user experience. DEXs need it for trading pairs. Lending protocols need it to generate yield. TradFi markets need it to function. Berachain’s design turns liquidity into a first-class primitive at the protocol level. This unlocks a unique flywheel where deeper liquidity improves UX, which draws more users, which then generates more liquidity—all within a single, enshrined ecosystem.

The result: a blockchain where users don’t need to leave the ecosystem to swap, lend, borrow, or stake. Everything they need is built in—and all aligned by design.

🔍 PoL in Practice: Liquidity Dynamics and Open Questions

Once mainnet is live, a rush of users will begin to interact with Berachain. But that also brings critical questions:Where will liquidity flow? Which tokens will dominate early interest? Will cross-protocol alliances emerge to incentivize deeper liquidity pools and accelerate BGT generation?

These are the dynamics that will determine whether PoL can scale. Many chains have tried to be "community-first" but failed to deliver beyond short-term incentives. Berachain’s approach differs: it nurtures a collaborative, composable ecosystem where protocols work in sync—not in conflict. Dozens of new projects are building atop Berachain’s primitives—Gummi, Infrared, Kodiak, Shogun, IVX, and more—and how they interact with PoL could define the next generation of DeFi.

🌌 The Unknown Ahead: Why It’s Worth Paying Attention

What will Berachain look like at launch? Three months after? Three years? No one knows. There are no historical benchmarks for PoL. It’s a novel, untested concept—one that doesn’t fit neatly into legacy financial models or traditional crypto playbooks.

For traditional analysts, that uncertainty is a risk. But for crypto natives, it’s an opportunity. Berachain is fresh. It’s different. It’s composable, community-driven, and ecosystem-aligned—qualities that haven’t been integrated at the protocol level before launch.

If you're someone who believes the future of crypto depends on aligned incentives, sustainable growth, and superior user experience—not just faster L1s or cheaper gas—then Berachain is worth watching closely. PoL may not just be a new consensus mechanism. It may be the start of a new design paradigm.

Conclusion

Berachain’s success isn’t guaranteed—but it is original. PoL may redefine what it means to align incentives on-chain. And with an ecosystem built around loyalty, synergy, and sustainable growth, Berachain may very well become the model others try to replicate.

We’re witnessing something rare: not just a chain launch, but a consensus revolution. The question now is—will the rest of crypto catch on in time?

评论 (0)