what is notcoin premarket ? The token distribution model based on users' accumulated loyalty points is becoming increasingly popular. Consequently, platforms that facilitate trading these points are emerging in the market.

Let's take a closer look at one of these platforms — Whales Market, which combines trading of loyalty points with OTC deals and pre-sale tokens

What is Whales Market?

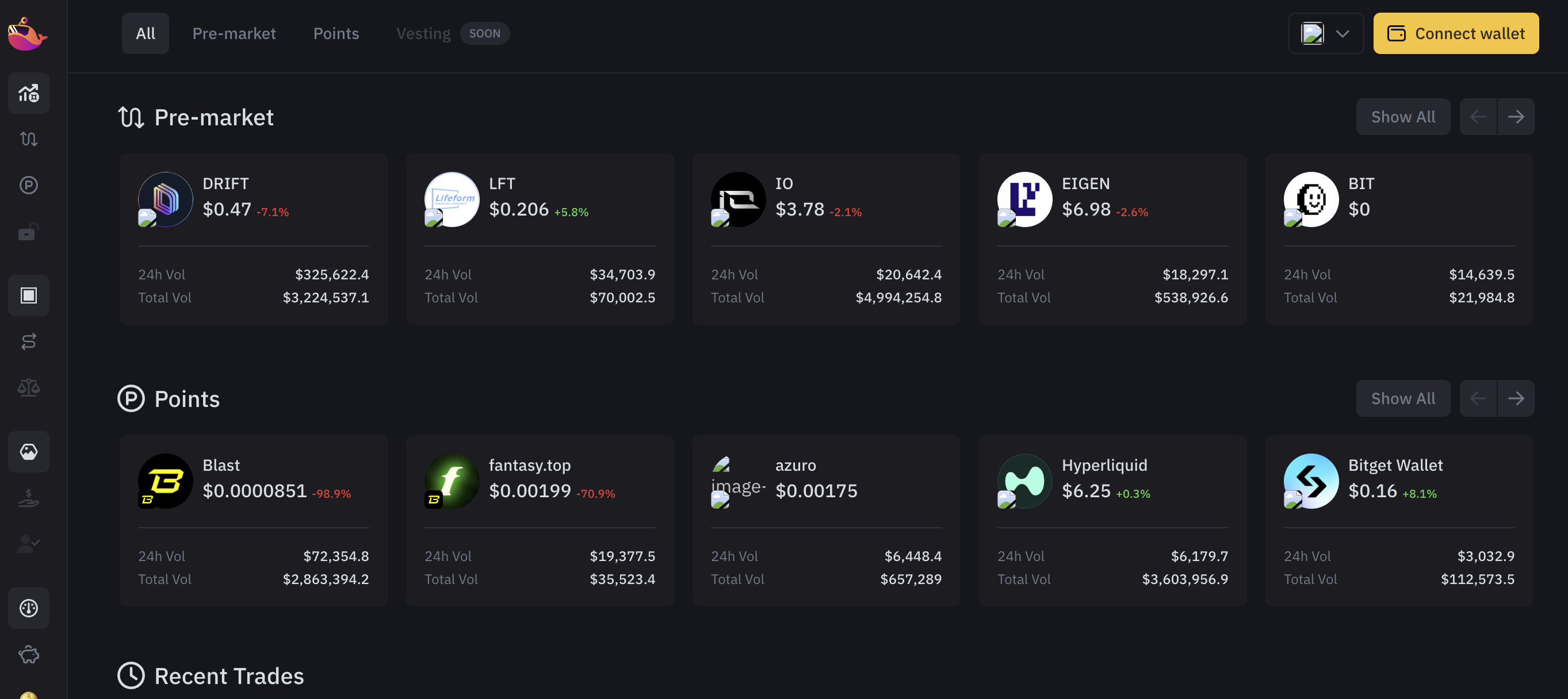

Whales Market is a platform for decentralized trading on the OTC market, also offering a marketplace for P2P transactions involving pre-sale tokens (before TGE) and loyalty points.

Points or loyalty points are essentially an external accounting system for tracking user activity in a specific decentralized application (dApp). Due to their ease of implementation and transparency, they have become a primary method for organizing airdrop campaigns.

Pre-sale token deals, known from traditional finance as Pre-Market Offerings (PMOs), involve offering securities to investors before the trading session starts on the exchange. In the crypto market, these deals were less accessible to retail users, but Whales Market has made them simpler and more accessible.

Who Created Whales Market?

The platform was created by the team behind the Telegram bot Loot Bot, which focuses on drop hunting. Although the project's team composition is not officially disclosed, Loot Bot announced the creation of the OTC platform in December 2023. xLOOT holders and LOOT stakers were allocated a portion of the total WHALES supply via a retro drop.

What Features are Available on Whales Market?

Whales Market offers users four main areas of interaction with the platform.

-

Pre-Market Trading (Pre Markets) This involves trading tokens that will become available after the TGE. Smart contracts protect the interests of buyers and sellers, addressing security issues.

-

Points Markets A secondary market for loyalty points. Users can sell accumulated points or buy additional ones. This is particularly relevant for projects that have not yet released their tokens.

-

OTC Markets The platform offers a user-friendly interface and fraud protection for OTC trading of tokens circulating in the crypto market. There is also a private offer option, allowing for anonymous transactions.

-

WLs Market Plans include launching a market for early access to NFT purchases through project whitelist status.

How Does Whales Market Work?

Whales Market operates on the principle of most DEXs but focuses on OTC markets and trading allocations for upcoming airdrops. The platform supports Solana, Ethereum, Arbitrum, Blast, Starknet, Base, and other networks.

Security is ensured through smart contracts that protect participants in the deals. Counterparties make collateral payments, preventing fraud and non-fulfillment of obligations.

Platform Fees and User Rewards

Whales Market charges transaction fees, which serve as the platform's revenue and provide financial incentives for users involved in staking the WHALES utility token.

WHALES Tokenomics

As of the time of writing, the daily trading volume on Whales Market in the Solana network exceeds $10 million. The price of the WHALES token increased by more than 2900% in January 2024. As of March 2024, the token's market capitalization is approximately $46 million, with a TVL in the Solana network of $3.5 million.

Whales Market stands out as a platform offering users convenient and secure tools for trading loyalty points, pre-sale tokens, and OTC deals.

评论 (0)