I thought they were Liberty Caps…

…. and now I am in Valhalla

6/12/2022

An early report on potentially ground-breaking tech.

“Mate I ain’t reading that…

“… that’s like lots of words, mate.”

Go on. Do it. Well, at least let me calm the ire. I meander through the idea of projects, present a history of Sedicii leading to Masanto’s vision and De Vega’s labour, I tell of the wider team and give some comparisons on market caps of companies and projects in a similar field as Nillion.

All I have to go by is the internet and my nose.

I sometimes do chapter headings for the practical, time-concerned minded, this time I didn’t. Use CTRL+F and type in a key word if you fancy skipping around.

This is a succinct market-press explanation of Nillion:

Nillion is a web3 internet infrastructure start-up that is based on a new mathematical algorithm that changes the way data can be stored and processed online. The team sometimes refers to it as creating an ‘InterPlanetary Security System’ or ‘IPSS’ – a security variant of the popular web3 InterPlanetary File System (IPFS) protocol.

Unlike regular data storage, data stored on Nillion gets split up, fragmented and distributed across a decentralized network. Each fragment is individually unrecognizable (a security standard called ‘Information Theoretic Secure’) but can still be used for computations as though it was in original form. Distinctively, Nillion’s technology requires no inter-node communication, allowing computations to be performed at commercially viable speeds.

Nillion will act as a public utility providing fast (near client-server speed), secure (post-quantum), private (Information-Theoretic Secure), chain-agnostic (universally available base layer infrastructure), and leaderless (fully decentralized) processing, with the objective of both supercharging existing blockchains and offering native network services with properties unique to a new cryptographic primitive (NMC).

Nillion empowers people to store and share information and have control over how that information is used. It is the progeny of One-Time-Pads, ZKP, SMPC, Blockchain and an amalgamation of corporate talent from Sedicii, HBAR and more.

Here we go…

Humans need a story, vision or narrative to drive them forward, it helps a lot more if there is a good incentive to it, one that really hooks the imagination.

In the Neolithic period, hunters and gathers were gathering and hunting in Anatolia and some fella offered an idea. “Gentlemen, lets build a temple.” No one knew what a temple really was but he explained it to them, enough for it be consider but not enough to halt the hunting and the gathering. He knew he had to offer the goods, he upped it, “Lads, there will be beer.”

And that is how Göbekli Tepe was started and constructed by a vision and a love for alcohol.

This echoes throughout the ages and it is how the cogs revolve in the human cycles, visions and projects to take from the imagination that runs across the cortex and turn it into the material. There was an age in history called the Age of Projects or the Projector Age – roughly 1680 – 1720. An industry that took quite the knock in the South Sea collapse. In the midst of all the hustling was the beginning of the Bank of England.

The Spanish took a lot of gold and silver from the New World and there were casualties meaning ships sunk with large hoards of wealth. The Nuestra Señora de la Concepción was one such ship, it sunk with 34 metric tonnes of the special metals. A man named William Phip had the occupation as a Projector, he would approach those with money and say, “Listen, lads, I have an idea…”

These ideas need to benefit all involved. He had an idea to find this Spanish galley and share the booty he simply needed funds. Once he had them, he went off around the Caribbean and combed the Bahamas but there was no luck. Bugger, he thought, another project foiled but at least he made some friends along the way – the real treasure.

They were heading home but just before they left some of his men decided to get some mementos of their adventure. In a coral reef, where some of the sailors swam, was a cannonball. The detective nose kicked in and not too far away lo and behold the Nuestra Señora and its full belly was discovered.

Such is luck.

Phips succeeded and his investors profited hugely from it. William Paterson was one such investor and he had a projection of his own.

Wars. Wars are a costly affair. Once you start one, you never know how, when nor where it will end up. A neighbour moved my garden gnome once, so I poured salt on his garden. Rumour has it he has intercourse-d my mother, this is all verbal noise but my mother is awfully forgiving of my neighbours’ transgressions. I am now looking to move house for I am the bigger man.

Where was I? War. France and England have had plenty of them. If we aren’t at war with one another, we are either plotting a new one or by dreadful circumstance we are allies. Paterson started the Sun Tavern, a society that was to place discussion of investment ideas at the forefront between those involved. Paterson saw two opportunities.

The Phips project meant there were suddenly a lot of bullions in England, too many for goldsmiths to cope with. England and France competing for trade routes and supremacy meant Patterson et al had great incentive to aid the English State so not to end up speaking French as well as gain huge profits.

In 1694, The Bank of England – also simply known as The Bank – was set up as a private corporation that would help store the bullion and finance the government debt. Then the English went on to accidently conquer many parts of the world.

The great project at the moment is the Metaverse, CBDCs and Digital Identity (DID). The UK government in 2022 established an interim body named “Office for Digital Identities and Attributes” to help aid establishing standards for DID. This is said on the official UK government website:

“Digital identity solutions can be accessed in a number of ways such as via a phone app or website and can be used in-person or online to verify a person’s identity. It will be for people and businesses to decide what digital identity technology works for them to prove their identity, should they choose to create a digital identity at all.

“For example, if a person wants to prove they are over 18 to buy age-restricted products, they could create a digital identity with a trusted organisation by sharing personal information such as their name and date of birth. This digital identity could then be used to prove to a retailer they are over-18, without the need to reveal the personal information used to create the digital identity, boosting users’ privacy, unlike physical documents which may disclose date of birth, name and address.”

This technique is Zero-Knowledge Proofs (ZKP) and has had Buterin’s public approval this year. It has been around for a little while, Redcom Laboratories have large contracts with the US Government and Military for telecom-based products. They have launched a division called ZKX Solutions, the Redcom Executive Vice President, Mike Sweeney, is leading ZKX, a division which is applying ZK to Multi-Factor Authentication tech for the US Military.

This solution can be applied to many sectors and in 2015, CEO of Sedicii, Rob Leslie, spoke in China at the World Economic Forum’s (WEF) event ‘Decoding Our Digital Identity”. His company has experienced quite an impressive rise since its founding in 2013. Sedicii utilises Zero-Knowledge Proof (ZKP) based tech aim at banks to help protect customers identification data whilst able to authenticate it without having to store it on servers. ZKP allows for the verification of personal ID without either party to the verification process having to share the raw data, making it easier to not violating regulations or laws and still collaborate with one another. This can speed up processes between banks significantly.

The seed round saw funding come in from CIA’s In-Q-Tel, the Irish Government and Zone2Boost – this is a partnership of Global Payments, Caixa Bank, Ingenico Group, Visa, IESE, lastly, Plug and Play. Miguel De Vega was the CTO, the man has coated himself in so many patents in order to keep warmth in any fuel/energy crisis. He has 27 in total thus far, with an employment history at Siemens and Nokia working on problems involving mathematics and intersections with technology. He is a figure who helped modelled the backend of the internet, so Masanto says, his inventions govern how data flows through the internet, he is a cryptography advisor to the Royal United Service Institute – UK’s leading defence and security think tank.

To date, as far as I am aware, Sedicii have these products: KYCexpert, which is API integration of digital biometric onboarding, Kagii, the patented ZKP authentication solution, Prexa, AML solution. There is the Kriptan Identity Network, this is comprised of organisations who have data that can verify who you are and organisations that need to verify information about you to check its validity. It is the engine to perform and provide checks of digital identity. On top of that, a public infrastructure for governments and councils to build upon. There is a foundation established in Switzerland (https://kriptan.org/)

In 2014, only a year after establishment, Sedicii was one of six winner of IPACSO’s innovation award. IPACSO is EU backed and focusses on cybersecurity. The preceding year, Sedicii was one of 5 finalists at SWIFT Innotribe, one of the other finalists, you may recognise, were Revolut. 2015, Sedicii was recognised by the WEF as a Technology Pioneer in the Information Technology category – TransferWise and Ripple Labs are immediately recognisable names in that category of the same year.

Rob Leslie spoke at Interpol World Congress 2017 hosted in Singapore. A figure that came out from Interpol was cybercrime cost the global economy US$450 billion and estimated it would cost $3tn by 2020. After a lazy Google search, the figure was just over $1tn when taking into account the losses and the money spent on cybercrime prevention. In 2021, there are some reports that the cost was $6tn.

This event was supported by Singapore’s Ministry of Home Affairs (MHA), Singapore Exhibition & Convention Bureau (SECB), and the World Economic Forum (WEF). It had three days, each day was dedicated to a topic, those being Cyber Crime, Safe Cities, Identity Management. This was a great opportunity of exposure and networking for Leslie and his company.

The rise continued into 2018, Sedicii were awarded the “BBVA Open Talent Fintech For Future Award” and “BBVA Regtech Award”.

Sedicii’s Clare Nelson was a reviewer of Blockchain Bundesverband paper on blockchain identity “Self-Sovereign Identity”. Other reviewers were Fabian Vogelsteller Ethereum, DIF, Peter Czaban Web3 Foundation, Rouven Heck ConsenSys. Notably Joachim Lohkamp was a reviewer, he is a part of the DIF (Digital Identity Foundation). DIF work with Accenture, WEF, W3C, FIDO Alliance and Trust Over IP Foundation. This is further evidence of Sedicii’s involvement with influential circles on Digital Identification. (https://jolocom.io/wp-content/uploads/2018/10/Self-sovereign-Identity-_-Blockchain-Bundesverband-2018.pdf)

This was the year of the “Known Traveller Digital Identity” (KDTI) prototype, a project where the Government of Canada collaborate with WEF and partners to trial DLT with biometrics and how passengers can utilise their mobile phones providing data through these cryptographic methods. It should not be much of a surprise WEF and Canada worked with one another as Klaus Schwab boasted that more than half of Trudeau’s cabinet were WEF Young Global Leaders. Consultancy agency Accenture, who work closely with BIS, were involved, along with Google, Interpol, UK’s NCA, Visa amongst other organisations as well as Rob Leslie’s Sedicii.

In 2020, Sedicii produced and pitched “Prexa”, a solution to help anti-money laundering, it helps detect fraud and criminal activity without disclosing personal information before a transaction is executed. They presented it in Abu Dhabi, FCA’s Digital Sandbox, Global Fintech Hackcelerator in South Africa and so on, you get the idea, they went around the world. For this, in November 2020, the Bank for International Settlements Innovation Hub (BISIH) centre in Hong Kong and the Hong Kong Monetary Authority (HKMA) at Hong Kong Fintech Week announced Sedicii runners-up for the “Best Governance, Regulation and Compliance Solution” category, they came second to Standard Chartered.

With previous work done with the Canadian government on air passenger traffic, it primed Sedicii to be selected by the Cabinet Office and HM Passport Office for a pilot project for passport data verification to prevent financial crime. Sedicii announced their Document Checking Service (DCS) and announced at the SIBOS conference they will be working with the UK government on a service to check validity of UK passports.

The good news for Sedicii carried into 2021, Caixa chose Sedicii to be a company partner – Caixa is a part of Zone2Boost, who, if you remember, were a part of the seed funding. A tier one bank provides a fantastic opportunity for awareness and growth of Sedicii. The firm won another award, it was the winner of Geneva based Tech Tour’s Deep Tech.

Sedicii has had a remarkable rise. A talented team that has a wealth of experience with other impactful companies, David Cunningham was CCO at Sedicii from June 2020 to July 2021, currently he is at Citi Group as the Director of Strategic Partnership for Digital Assets. It only serves as speculation but I do wonder if old connections between Leslie, Mig and Cunningham will crossover into strategic collaboration between Citi and Nillion. I have little doubt Cunningham does not know of Nillion and appreciate its potential impact.

Sedicii has provide the market with a product it has been crying out for plus it is aided by advisors such as Andy Honess, a software seed investor, his investment company is called JumpXL. One notable experience is taking Qlik Tech from start-up to having global banks and NHS as customers. He is a mentor and investor for FinTech Innovation Lab London. FTILL is the London chapter of Accenture’s FinTech accelerator, some of their partners include Deutsche Bank, Citi, Black Rock, DTCC, HMRC and a few more big financial players.

David Murray of Argento Partners used to advise Sedicii between 2014 – 2016, he went on to co-found and advise SignD (https://signd.id/). Through an API, SignD help KYC and B2B services.

Another advisor is Michael King, who has 12 years at Standard Chartered, 21 years’ experience with SWIFT, over 4 years of that he helped HSBC with cost efficiency, business development and “identify industry trends and help HSBC define a strategic response, especially linked to payments, regulation and KYC”.

Speaking of HSBC, Steve Suarez is the Global Head of Innovation, Global Functions at HSBC and is an advisor to Tech Passport, who have Morgan Stanley as a customer and have made a partnership with Sedicii. The founding CEO of Tech Passport, Layla White, experience with Lloyds, FCA, UK Ministry of Justice, Women of Fintech, Deutsche Bank, and HSBC. Tech Passport is a part of the CITI Ventures Accelerator Alumni 2022, the same Citi that Cunningham is a part of. On its website it showcases Citi as a partner, along with Women of Fintech amongst other Fintech based organisations.

Tech Passport also has the badge on its chest of having Oscar Brennan as a non-executive director. He is the Head of Fintechs and Business Development Manager at IBM Financial Services Cloud as well as procuring the position of EMEA Financial Services Leader and Head of Fintechs at DXC Technology in July 2022.

And then there is me, in a spite war with my mother-shagging neighbour.

Tech Passport are reaching into crypto with a partnership with SingularityDAO, this sees a collaboration between TP’s simplified bank onboarding with decentralised AI and defi.

Another partnership is with Virtusa. One advisor, Yugandhar Alaparthi, comes from Capgemini, which generates billions in revenue. CEO Santosh Thomas has a long history at Cognizant. They provide a combination of digital strategy, digital engineering, business implementation, and IT platform modernization services to clients in the Banking, Financial Services, Insurance, Healthcare, Telecommunications, Media, Entertainment, Travel, Manufacturing, and Technology industries. Their other partners include Salesforce, SAP, Oracle, Google, Microsoft, Adobe and AWS among others.

As highlighted, Sedicii provides much of the soil from which the bud of Nillion sprouts. An Irish based company that in a short amount of time has won numerous awards and is a part of projects ran by powerful institutions, whilst also bagging companies such as AirBNB and UBER as customers. Future Today Institute highlights companies that are in the security data sector, this is their public list:

“Akamai Technologies, Amazon, Anonymous, Apple, Carbon Black, Check Point Software, CIA, CrowdStrike, DARPA, Def Con, Duo Security, Ethereum, FBI, FireEye, Fortinet, Fujifilm Holdings, GitHub, Google, HackerOne, Huawei, iARPA, IBM Intel, In-Q-Tel, JPMorgan Chase, Kaspersky, Krebs on Security, McAfee, Microsoft, Oracle, Palo Alto Networks, Princeton University, Qualcomm, SAP, Sedicii, Sony, Splunk, Symantec, Technion Israel Institute of Technology, Tor, U.S. Computer Emergency Readiness Team, U.S. Cyber Command, U.S. Department of Defense, U.S. Department of Energy, U.S. Department of Justice, U.S. National Security Agency, Uber, Webroot, WikiLeaks, ZTE, municipalities, counties and civil agencies everywhere and the governments of Russia, China, Singapore, North Korea, Ukraine, Israel, United States, Iran and the U.K.”

The Nillion story can be viewed as the confluence and convergence of 3 minds. First, Rob Leslie when he started Sedicii noted the drivers were “[t]he first is blockchain technology and the need to build privacy and confidentiality into it. The second is GDPR and the need for organisations to ensure compliance”. Second, Miguel De Vega is the maths and computational mind that is bringing together the best methods from various solutions into a new model, NMC. Third, Andrew Masanto, the unicorn builder, is pulling in his clout and network to take Nillion from zero to one.

The business was there, the tech was developing but timing was an issue for Masanto. He met De Vega through a friend. Andrew’s friend was adamant he should meet Miguel for old Migs was a genius. The year was 2017 when Masanto met Miguel at NYU, and De Vega informed Andrew that he had come up with an evolution of ZKP but at the time Masanto could only see a faster version of ZCash, which was not enough. Two years on, 2019 for those that cannot count, De Vega’s idea was now more identity focussed, Masanto thought that is a decent idea but identity cannot be the frontal motive, the companies that Masanto knew that were centralised around identity were successful as they solved problems relating to fraud prevention or passports, they were not leading with the ID narrative but more the security it provided and problems it solved. In 2021, they honed De Vega’s invention.

The tech was for B2B but it has moved into the crypto-sphere due to the “ambition”. There are lofty goals in the space and there is a lot to gain, The global DeFi market, depending on your source, is predicted to reach $508bn by 2028, rising from $74bn in 2021.

Masanto has appeared at the University of Cambridges to talk. The JEC - Johnian Entrepreneurs’ Club - collaborated with CUTEC - Cambridge University Technology and Enterprise Club - to host Masanto and De Vega to speak about an unhackable decentralised network. It is said when they talked at Cambridge University, two of the interviewers and two of the listeners from the computer science faculty joined the team. (https://johnian.joh.cam.ac.uk/wp-content/uploads/2022/10/The-Eagle-2022_Inside-Pages_01-09-2022-Web.pdf , https://www.linkedin.com/posts/cutec_cutec-cutec-cutec-activity-6969706911285813248-TkME/?originalSubdomain=uk , https://cutec.substack.com/p/nillion-introduction-to-an-unhackable )

Masanto is a great wedge for Nillion and a marketing man. Leslie has proven success with companies in the traditional economy, the tech can cross over into the crypto-sphere but who better to help spear head the crypto-based project than a man who has two unicorn projects? Perhaps a man with three but I cannot name one off the top of my head.

He founded Hadera Hashgraph and Reserve Protocol, both have gone on to have great success but there were faults, which lessons have been learnt. HBAR has gone on to be the basis for CBDCs for countries such as Ghana and Nigeria, and Hadera Consensus Service is integrated with Hyperledger Fabric. Banks use Hyperledger are inadvertently using Hadera Consensus Service. Yet, when he started the project, no one believed in it. He had to get his first $500k from his brother Christopher. He went on to have, let’s say, creative differences with the eventual President and was ousted by that person.

At Reserve, he said his fault was not building the eco-system early on the protocol. His experience is he can build a protocol from 0 to $100mm but then it garners its own momentum and does not need its founder. A realisation of a trend in life, companies at the start need a contrarian, creative visionary to get through the more chaotic period, as it progresses it has a proclivity for a conservative, stable leader for order.

With his experience, Masanto has some guidelines for establishing a billion dollar project. One of the ideas is “Disruptive tech or novel idea.”

With both of these projects is they offer an alternative. HBAR offers an alternative consensus mechanism and Reserve is an alternative to Central Bank fiat.

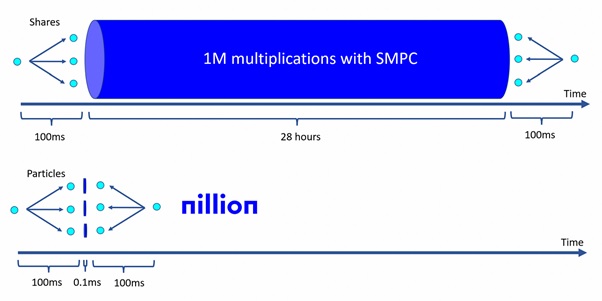

Nillion – the pitch goes - is building the first non-blockchain Secure Multi-Party Computation (SMPC) network. Its new cryptographic primitive opens up entire new use cases for both web3/blockchain and the real-world. Nillion will enhance many of the most well-known public blockchains and open up whole new industries to decentralized disruption.

Nillion is offering a step forward in processing data and a catalyst for a new generation in crypto-computation. After jabbering at you about the history of Sedicii and my gnome-bothering neighbour, let me tell you what Nillion is providing. The fruits of De Vega’s labour.

NMC.

Nil Message Compute.

There is an old joke, it goes like this:The patient walks in grasping his arm in pain, “Doctor, doctor, my arm hurts when raise it.” The Doctor replies, “Don’t raise it then.”

Blockchain is great at being a pedantic, correct, orderly scribe but it is public. SMPC tech is great at not centralising data, it requires multiple nodes to come together to authenticate the data but it takes time.

So, why not, simply, do the bit that works and cut the bit that doesn’t? Why has no one thought of that, ey?

Always easier said than done. Take the trustless privacy that SMPCs provide without the messaging and the figure a way to run a network without an immutable ledger.

The particles are held in an ITS (Information-Theoretic Secure) manner (i.e. post-encryption and post-quantum), it has the security of being held in a decentralised, unrecognisable/transformed, fragmented away.

The underlying data can still be processed/computed on by nodes at commercially viable speeds, without the need for data reconstruction or inter-node messaging.

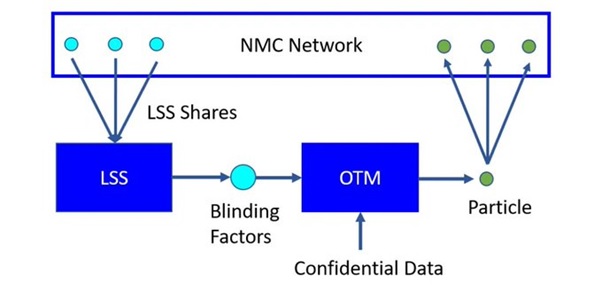

Data is input by the user. This data is masked to shield the data from anyone else other than the data provider. It is masked during the input, known as the blinding factor, and the output of the masking is called a particle. Copies of the particle is stored around the network. The particle shields the input and the nodes process the particle without knowing anything about the data and its provider. This is OTM, meaning “one-time-mask”.

Here is a cheap analogy. I input my name, Psilocybe. The blinding factor calls this Csilepyob, and the particle is created into Byeliscop.

A share of the input data is shared amongst nodes, this method is Linear Secret Sharing. When called upon the nodes assemble the shares. The shares are blinding factors and not the secret themselves.

To hack this data, many nodes would have to collude to in order to collect many blind factors (T+1) to make a particle recognisable but to the hacker they need to get the particle that is related to your sensitive data, a particle does not reveal the underlying data and there is no digital footprint of that on the nodes. Contrast that with encryption, powerful computers are only one hack away from the data as they can solve mathematical problems.

ITS offers protection of the storage, transfer and processing of data. With the data being split up rather than stored in a completed manner, it is GDPR complaint.

The fear with any computational tech currently is the quantum computers. Nillion by its design makes it quantum-proof. One-Time-Masking helps computation and multiplications and help with correctness, this is using blinding factors. Utilising Shamir Secret Sharing, this hides the blinding factors that mask the secret.

The network aims to reward good actors, who are judged by two scores, Node Health Score (NHS) and DAO Support Score (DSS). NHS reflects the on-chain contribution to the network of a node. DSS is used to rate full nodes. Then there is the rating of the organisation or individual running the node. Anyone who meets the criteria set by the nilDAO is then eligible for a light node or full node.

It gets its consensus on value, on just the amount of data that is needed not all of the data on the whole of the network. The consensus is locally stored on the result node and the nodes need not exchange messages between them, making the network near instant.

Nillion’s programming language is Nada and the aim is to make Nillion compatible with many others, with the obvious Solidity being a priority, for Nillion aims to complement existing Layer-1s by offering storage, transfer and compute capability taking overall blockchain utility to the next level.

I have two warnings. Firstly, I am not a tech geek, I get the gist of this high-end tech but by no means am I fluent. I spend more time plotting the demise of my neighbour than read about the tech. I am thinking of putting the plant pots on the roof of his car and cut his breaks… hmmm, I can be more imaginative than that. I could tar-and-feather him.

Here is the whitepaper - https://nillion.docsend.com/view/zbij887cca9pznf8 –

Here is the One-Pager Summary –

https://nillion.docsend.com/view/8nyuynnijsc2959c

On this link you can watch/listen to an unlisted video of Miguel in the technical overview - https://www.youtube.com/watch?v=dHxLwGZmzHw

Here a good substack article by Darshan Gandhi (Future X), that covers the tech side of Nillion well, like the chocolate side of the digestive biscuit - https://darshang.substack.com/p/drop-42-nillion

https://twitter.com/DarshanG_/status/1591099742691667968

Added to that these two videos provide some insight to the core understanding of tech underlying NMC.

Computer Scientist Explains One Concept in 5 Levels of Difficulty: https://www.youtube.com/watch?v=fOGdb1CTu5c

What is Secure Multiparty Computation: https://inpher.io/technology/what-is-secure-multiparty-computation/

These will help give you context on the underlying technology.

Secondly, this project is still very early and in construction. There is the intention of providing a prototype by the end of 2022 but I would not hold my breath on it hitting that deadline, not because I do not have faith in the talent of the team but this is a complicated situation and the company are pulling in mathematicians and programmers as fast as they can.

Talking with David Malka in March 2022, Masanto said it may be a year to a year and a half to be in a place to for the protocol to be ready for people to build upon it. It depends on the number of engineers they can get in.

Then the next year to a year and a half is for the more advanced functions such as cross-chain functionality, complex decentralised computations.

It is hard to provide a roadmap at this stage but there is an idea of implementation.

There is the need to develop a secure, public network for the storage and use of private information, the marketing term Nillion are using for now is the “Fort Knox of the Metaverse”.

The development of a Meta Layer will enable the Nillion Network to enhance and connect different blockchains, thus providing interoperability and cross-chain computation solutions.

And the further vision of Nillion is to have a secure processing layer for DID, biometrics and medical data.

The key is to win the small battles and challenges to begin with then compound that to a larger success. As with projects, not every use case and eventuality can be predicted, that is some of the joy of creation, there will be unexpected uses.

For example, web3 has a lot of untapped potential but if we simply take the social media side of it, if that is conquered it will bring a lot of finance and data to the crypto-sphere. Masanto says he does not know how Web 3 social network will express itself but I side with former choir-boy, director/producer, crypto-nerd Robin Schmidt’s ideas on the topic. Web 2 wins as Web 3 social network is still being greedy. Web 3 assumes the solution to the advert-based Web 2 economy is tokenisation. Token is an answer to liquidity swapping. Tokens are subject to volatile market conditions; a content creator will then see adverse effects to their margins due to the trading conditions of crypto. For example, football tokens have proven to be cruel money grab by clubs that are awash with money and short change their fans.

This is not ideal for the creator economy, Youtube, as an example, is better for them. The creator and the apps need to share the wealth somehow, provide incentive for the consumer otherwise Web 2 advert-based model beats the fluctuant markets of crypto.

Nillion will disrupt passports, medicine, agriculture, viticulture, shipping, payments, governance, biometrics, IOT, Docusign, high level security storage, official documentation verification, Metaverse AR/VR verification, voting, decentralised computation, to name a few.

One of Masanto’s points in building a unicorn is having a strong team. If the team have experience with one another then that helps speed up the process. The vision and tech behind Nillion is quickly convincing people thus it is drawing in talent to the Executive Team and the engineers. They have been talking at top universities as well to find talent.

The entire founding team has been bootstrapping the project. They could do it themselves for years without seed funding. There are 40 people on the team. At least half of them and the core founding team are working for tokens, they are not demanding any fiat or cash.

The opening seed round oversubscribed within 72 hours. From that raise alone they have runway for two and a half years. To help foster an ecosystem Nillion has a Founding Entrepreneurs Program (FEP); when Luna began it had projects on it to demonstrate its utility, the Iphone was released with apps, without projects upon a network in crypto it can turn the project into a ghost town. This FEP will most likely comprise of people they are connected. If we look into the team and some of the external links to that it can provide some clues.

Masanto, CEO Alex Page and CMO Andrew Yeoh set up the skincare business RDF together in 2014. RDF stands for Royal Dermatological Formulations. That company did not age well.

In 2013, Yeoh and Page co-founded Sports Food Nutrition (2013 – 2016) and Weekday Warriors (2016 – 2020). Again, Page and Yeoh became General Partners at Hadera Hashgraph 2020, this was 3 years after Masanto left Hadera. Yeoh was an Investment Banking Analyst at UBS from 2010 to 2011 then an IBA at Rothschild & Co from 2011 to 2013.

On the RDF website, it credits Alex Page as “a former Finance Consultant and has strong mathematics and negotiation skills. He has an acute business sense and has been tasked with growing the RDF LLC supply chain. Alex aims to create long-standing relationships with suppliers, which will form the backbone of RDF LLC inventory supply.”

Here is a quick list of Alex Page’s experience:

Brokerage and Sales at Morgan Stanley. 2006 – 2007.

Business Development at Fisher & Company 2007.

Special Situations Group at Goldman Sachs 2008 – 2010.

Restructuring Group at FTI Consulting 2010 – 2011.

Restructuring Group at GLC Advisors & Co 2011 – 2012.

Co-founder Sports Food Nutrition 2012 – 2016

Co-founder Weekend Warriors 2016 – 2020 (another nutritional brand)

Founder & Principal at Flag First Capital 2017 - ongoing. This was an early investor to Hedera.

Investor and General Partner at Hadera July 2020 - ongoing.

In 2020, Page, Yeoh and Masanto were whipping themselves and each other over the failure of RDF [Editors Note: this is complete fabrication from fantasy, what Psilocybe has just said was with no evidence of this] and they could not help but notice the resurgence of crypto, its infrastructure was materialising. Masanto ran diligence on De Vega’s work, he had Elizabeth Quaglia (https://pure.royalholloway.ac.uk/en/persons/elizabeth-quaglia) work on it and she was excited by it, Andre Lapitz built a prototype out of it in Python and got excited about it. He became a co-author of the technical whitepaper.

Quaglia has history with IBM, Qualcomm, and was a Huawei researcher before joining Royal Holloway, University of London, as a senior lecturer, it is one of the world’s leading cryptography institutions. She is Head of Cryptography at Nillion.

Grant Gittlin is now Head of Ecosystem, he has a business consulting background with Media Link. Jonathan Ende is Head of Government Partnerships. He was CEO of Seemless Docs for 8 years before they were acquired by Kofile Tech, where he was CSO for a year. At Seemless he was helping governments utilise the product and Kofile’s purpose is to help local governments with digital documents.

Conrad Whelan was founding Engineer at Uber – which was a customer of Sedicii - back in 2010 and from his success he went into an early retirement. After reading the Nillion whitepaper in his own words, Whelan said, ““At its core, Nillion is a mathematical solution to a long-standing problem – how to efficiently, scalably, securely and verifiably run decentralised computations on decentralised computers in the presence of bad actors.

“The implications of the Nillion innovation are big and the idea behind it was so powerful it literally ripped me out of retirement.”

It literally ripped him out of retirement. Literally.

We cannot all be perfect.

He is credited as the Founding CTO of Nillion. He also started Spirit River Atlas (https://www.spiritriveratlas.com/) in the Netherlands, it is an early seed investment fund based in Amsterdam, whose only notable investment I can currently find is ACE (African Clean Energy). He started this fund with Roel Nuyts, who has a background in quantum computing (MIT XPro), AI (Stanford), business strategy (MIT Sloan), theoretical and mathematical physics degree (Antwerp). He is a tech advisor for RecoverX, a company founded by Carl Bate, who has experience with AXA, Atos and Adlittle, “RecoverX’s goal is to transform medical decision making from overwhelmed human-based practice to human evidence based augmented intelligence.” This puts Nuyts, and by degree of separation, Whelan et Nillion, in contact with RecoverX’s other board members such as Chief Scientific Advisor Bob Rogers, a leader in AI; CPO David Epstein, who has experience in the healthcare industry, Chief technical analyst/strategist for 400-person, $100M department and developed strategies linking Research to industry sales/consulting divisions as well as other directing roles at IBM; CMO Jennifer Lee, Merrill Lynch internship, healthcare background “Pulmonologist / lung specialist with the World Trade Center Environmental Health Center”; Partner Lisa Chai of ROBO Global Ventures and so on. Here is their team list - https://www.recoverx.com/#team

Roel Nutys is the Interim Head of Product at Nillion, I wonder who he could inform about the potential of NMC.

Robert Leon Kurita-Goudlock is credited as a part of the founding team with no specified role. On his Linked In he has recommendations from the VP at Morgan Stanley, Chad Sheridan. He has done impressive work with Uniqlo, he was the first American manager in Japan within the entire corporation. He has gone on to work in Tokyo, New York and London for Uniqlo from a store manager all the way to Head of Digital Operations and Retail Marketing.

In 2022, he has founded Well-Inn, which is working on tokenising real-estate. Furthermore, he is a strategic advisor for HUM2N, “HUM2N is a next generation, physician led, data driven health optimisation clinic on the cutting edge of longevity, nutrition, aesthetics and more. We are pioneering a new era of healthcare & helping people to live longer, healthier lives”. Which translates to selling expensive supplements - https://hum2n.com/collections/all-products . It does offer therapies too.

Claire Kelly is the Director of Engineering since January 2022. She has been a lecturer and a business systems analyst in life insurance companies. She worked for Zinnia, which used to be called SE2 LLC. Her last role at Zinnia – a company based in Waterford, Ireland, the same place as Sedicii – was Tech Product Management Lead. In her words, “Senior Product Management Lead for SE2s pricing and trading product suite performing fund management and trading for 8 clients representing 29 insurance carriers. Our function incorporated daily pricing and trading for 104 fund companies, 1,802 funds serviced and $47Billion in variable assets to 100% accuracy. This role was responsible for managing the product development roadmap and day to day workload of the cross functional team of over 80 architects, engineers, product managers and QA testers, sales, marketing.”

Nathan Murphy is the founding Head of Community & Growth. He is the founding COO at Anona – it stands for Art NON-Artist – of which Masanto is a founder of. He has a background with Zurich.

Jack Nicoll is a founder and Partnerships Manager. He worked as a management consultant for Accenture, who are a key player in the driving of Web 3. He is the CEO and founder of Cel, a beauty products company, the other founder was Christoper Masanto – Mr Andrew’s brother, the one who provided the first investment into HBAR.

Lindsay Danas Cohen has been brought in for her lawyer skills. Formerly of Coinbase and Bloomberg, this demonstrates some of Nillion’s initiative to engage regulators, https://www.sec.gov/files/wsba-submission-custody-rule-and-digital-assets.pdf WSBA to SEC on the 14/11/2022, Cohen is referenced as a representative of Nillion.

Lukas Bruell is Crypto Lead at Nillion since Dec 2021. He is an odd one, he has had Short stints at LonVin, Deloitte, Warwick Finance Lab, Oliver Wyman, Warwick Finance Societies, Saxenhammer & Co, McKinsey, Latham & Watkins. Then begins to find some longevity with Life Will Limited (2018 – 2021), became a Founding Partner for The Merger Sight Group (2018 – 2022) and a Co-Founder at Eczodex, ongoing from 2021.

“Eczodex is launching the first asset-backed token that accepts real-world assets and crypto as collateral.”

A smart contract developer from Eczodex, Rehan Sheikh, had an internship with Nillion at the beginning of 2022 but that has come to an end and seemingly no full time employment. He has been at the Cambridge Blockchain Society (CBS) since 2021, I presume he may have been one of the converts from Nillion’s talk there.

On a slightly related link, the President of the CBS is Taranveer Sabharwal, who is also a part of TPS Capital, who invest in disruptive tech. He is an associate of Eczodex, and he is a software intern at CMR Surgical which delivers an evidence based approach to surgical robotics. It may seem frivolous information but with people like this close to the project there is a network effect of spreading the word of Nillion. Places such as Cambridge, Oxford et al, have an increasing growth in fintech/crypto societies, for example, Cambridge Centre for Alternative Finance, Cambridge Judge Business School (CJBS), through such societies a new generation of development is nurtured – having said that, look what degrees did to art.

There is an elusive Swiss Martin Hämmig who is a part of the board registered in the famous neutral mountain [that hoards Nazi gold].

https://www.linkedin.com/in/martinhaemmig/ He is an angel investor of Sedicii and from 2005 – 2011 he was an academic advisor for VC community at WEF. He is an angel investor of Lead Invent Pharma Inc. They LeadInvent Pharma have created a unique gel (GBGel) that could be directly applied onto the tumour resected cavity. GBGel is engineered to kill cancer cells upon getting excited with a low power laser.

He is an Innovation Advisor at GLORAD, “GLORAD is a platform for research on global R&D and innovation dedicated to the pursuit of new concepts, tools and understanding of the management of global R&D and innovation involving the international flow of ideas, technologies, and innovations.” The website is terrible - http://www.glorad.org/partners.html

Jamie Adamson is the Talent Acquisition Manager as of February 2022. Starting as a Recruitment Consultant at Gravitas 2016 – 2017, he has been a talent manager for Stint, Adzuna, Drest, Sport Whispers, Talent Heroes, then Renalytix before Nillion

A Sedicii Software Engineer has come in named Pablo Hernandez Lopez. He has previously worked with Open Canarias and Gran Telescopio Canarias.

Andreas Abros has been brought in as a senior software engineer summer 2022. Authentication, web developing background. At Fidelity, where he was Lead Software Engineer between 2014 and 2017, he was “[d]esigning and building scalable distributed data processing and data analytics platform and backend applications that manage surveillance and internal data gathering used to identify and resolve fraud. Developed solutions allows to handle over 100 million events per month and performs data processing near realtime.”

He has been a developer and consultant at Cloudbid (2009 – 2012), founded Bitclone, has been Principle Software Engineer and Consultant at Mega Data from 2014 to 2020.

Ken Grimes has had a career of fixing mismanaged IT systems. He co-founded Road Bird, a fleet and driver management company, in November 2021. Before RB he was at another gig economy company, Hyre Car, where he held senior positions and ended up as CTO.

With a security analyst and software engineering background, Matias Fontanini has secured a senior software engineer position since July 2022. He worked at Thousand Eyes (a part of Cisco) from March 2014 to August 2021 and then Polysign. Polysign is an early stage fintech company established by Arthur Britto and David Schwartz. Our mission is to drive global use of digital assets by building mission-critical infrastructure that enables institutions to secure and transact in digital assets across the capital markets and payments sectors.

Federico Gimenez has come in as a senior blockchain engineer with the same position at Polygon Hermez in 2022. He was Red Hat Principal Software Engineer from Nov 2020 reaching to Jan 2022 added to that he was Infrastructure Lead at Web 3 Foundation (March 2019 – October 2020) and Blockchain Infrastructure Engineer Consensys (Oct 2018 – Mar 2019). This is great experience, which dear reader by now you can appreciate each piece of the team seems to have in abundance.

Pedro Perez Orlanda takes the helm as Director of Finance, with an impressive resume. He was Head of Accounting at Birds (2019 – 2021) during their fastest period of growth. He was R2R Manager of International Finance & Accounting at the influential Accenture. He has Compliance Management experience with EY and the Lead Finance & Accounting at Philip Morris International.

Mike McDermott was the former lead of innovation partnerships at Nike for Web 3 and now is the Head of Ecosystem at Nillion. Slava Rubin has been brought in and he has piqued my interest. He is the current CEO and founder of Indiegogo, which is a crowdfunding site for tech. Here is his podcast if you are interested: https://podcasts.apple.com/us/podcast/smart-humans-with-slava-rubin/id1612146807

He said this of Nillion: “When I was a kid, my dad passed away from Multiple Myeloma. So the ultimate use case for me is that Nillion ends up accelerating medical research on cancer and other diseases. With Nillion, researchers could access millions of data points on people’s health without privacy ever being breached.”

Here is a brief list of his experience:

Investment Analyst @ West Capital Management | 1997 – 1999

Internet Business Solutions Group @ Cisco Systems | 1999

Manager @ Diamond Consultants | 2000 – 2007

Consultant @ Goldman Sachs | 2004 – 2007

Founder/CEO @ Indiegogo | 2006 – Present

Founder & Managing Partner @ humbition | 2016 – Present

Founder @ Vincent Alternative Investments | 2019 – Present

humbition is an early stage operators fund investing in seed and A round ventures, which he co-founded with Cyrus Massoumi (https://www.linkedin.com/in/cyrus-massoumi-58330b/details/experience/). Vimeo’s President Mark Kornlift is an advisor for humbition. Another founder of humbition is Frederik Roikjer, who did work for Morgan Stanley before and as of 2022 he is the CFO of Basic Block, a company that helps truck drivers pay days.

Eric Schell is a co-founder of Indiegogo and has gone on to be the Product and Data Lead at Vincent since 2021. Vincent provides access to private investment markets and looks towards alternative investments. Slava’s humbition has invested in Vincent, so too has Digital Currency Group, whose subsidiaries include Greyscale, Genesis, Coindesk, Foundry. They have an eclectic crypto portfolio - https://dcg.co/portfolio/ - including Reserve and Hedera… and… FTX….

….

Where were we? Vincent. Three names from the company stood out to me. Eric Cantor, Evan and Adam Cohen.

Evan Cohen has an editing background with the UN Food Programme in 2011 and has gone on to be a founding COO of Vincent - https://www.linkedin.com/in/ecohen16/. In between he worked at Indiegogo, at one point he was Head of Blockchain and Investing. He was also the Senior Director of Sales for Hardware and what can be seen as a natural progression of his experience he is a venture partner at HCVC, a venture firm for Hardware Companies, and was a co-founder of Ludus Group, a blockchain consultancy company and they seemingly offer an easy-investment fund for consumers, I am unsure of how success this venture is.

But who am I to judge? Last night, I deflated my neighbours tires after gaining courage in a sugar rush from eating three penguin bars. Whereas the experience of Ludus and Indiegogo plus his professional connections he is involved with Vincent.

At Vincent is Adam Ross Cohen. A man who viewed my Linked In, it has nothing on it, I like to imagine he was bemused at the sight of my barren page as to why I was looking him up then prying open the blinds to his windows to check for any suspicious activity. Hey Adam.

Adam has tech talent, he was worked at Samsung as a Senior Secret Software Engineer. He co-founded Tower Health - https://towerhealth.org/. Lululemon sells apparel and also have a product called Studio Mirror that one can do squats and the like in front of as they gaze upon a lesson led by some chiselled so-and-so. Mr Adam was the Director of Engineering for Mirror. It is available for $795.

The CEO of Vincent is Eric Cantor. After winning the English top division with Leeds United, he moved to Manchester United and won the Premier League. Quite impressive. I am going to do a copy and paste job here as it is an extensive history Mr Cantor has:

Executive VP & Co-Founder @ Internet Interstate | 1995 – 1998

“Internet Interstate was an Internet Service Provider (ISP) in the Washington DC metropolitan area which Eric co-founded and built up to a $3M run rate and a team of 28 prior to acquisition by Verio. Eric managed complex domestic and international customer relationships, planned and executed two acquisitions and integrations of local competitors, and led engineering, operations and financial functions to grow and manage the business. He also represented the company in acquisition and due diligence process leading up to a $7M transaction, and ensured a smooth transition to the new integrated structure.”

VP of Marketing and Product Management @ Verio | 1998 – 2000

“Verio acquired 55 leading local Internet service providers and hosting companies in the US to form one of the largetst publicly-held ISPs and backbones, including Internet Interstate which Eric founded. It was subsequently sold to NTT of Japan.”

VP of Business Developments @ Buydomains.com | 2001 -2003

“BuyDomains.com was a domain name marketplace which reached $8 million in sales before its acquisition by a venture fund consortium in Massachusetts in an $80 million transaction.”

Technology Business Manager @ Acumen Fund | 2005 – 2007

Founding Director & App Lead @ App Lab Uganda (Grameen Foundation) | 2007 – 2010

“Eric established a Google-funded mobile product lab and built its 35-member team. He led product prototyping and development for 14 concepts, leading more than 100 contributors across Google, MTN, AppLab and local NGOs. Designed, tested and built “Google SMS Health”, which launched nationally & won Social & Economic Development Product of the Year at 2010 GSM World Summit.

“AppLab tests, develops and scales mobile phone services that empower low-income customers to improve their lives.”

Venture Partner @ Blue Ridge Foundation New York | 2013 -2014

Founding Board Member @ Venture for America | 2011 – 2016

VP Product Dev @ Wage Goal | 2014 – 2017

“Under his leadership, the product team researched, prototyped and tested various iterations of the product with hundreds of users prior to launching via B2B channel. WageGoal has been recognized as leading Fintech venture by participation in JPMC/CFSI Financial Solution Labs’ first cohort and in other forums.”

Mentor, IoT Program @ Tech Stars | 2017 – 2017

Adjunct Professor @ Columbia University | 2013 – 2019

“Eric teaches "Technology Solutions for International Development and Social Change" in Columbia's International Affairs Masters Program, and serves as faculty supervisor to a ICT-related student projects. His course enables students to identify and explore a problem area they wish to solve investigating its contours and the reality of those it affects. Next, they form teams to review potential technology solutions, design Minimum Viable Products and in the "final exam" pitch those concepts to professional Venture Capitalists for feedback. Several course teams are still operating the businesses created in the course, and creating global impact.”

Entrepreneur in Residence @ ConsenSys | 2018 – 2019

Managing Director @ Mobile Global | 2011 – Present

“Mobile Global is a boutique strategy firm focused on web and mobile business-building and advice.”

https://tinyurl.com/ky9rdxx3 From this post we can see Eric with Kingsley Advani, Mr Advani typed:

“Excited to partner with Eric Cantor CEO of Vincent Alternative Investments to democratize access to alternative investments.Vincent Alternative Investments aggregate $6bn in alts across 150 investment platforms🚀🚀🚀

“Allocations Luis Brecci Olia Golinder Rachael Bickford Carlos Eduardo Biazotto Chesley McLeary Slava Rubin Evan Cohen”

This Kingsley is a serial angel investor and has invested in pretty much everything. You are going to tell us all those investments, aren’t you Psilocybe?Not all of them, here is a list: Uber 2014 entered and exited

Monzo 2016 ongoing

Zilliqa 2017 ongoing

Momentus Space 2018 ongoing

Securitisze 2018 ongoing

64x Bio 2018 ongoing

Bakkt 2018 ongoing

Vise 2018 ongoing

Algo Capital 2018 ongoing

NABIS 2019 ongoing

OncoSenX 2019 ongoing

Oisin Biotechnologies 2019 ongoing

Loonify Space 2019 ongoing

eToro 2019 ongoing

Algorand 2018 ongoing

Robinhood 2018 ongoing

Coinbase 2018 ongoing

ABRA 2019 ongoing

Orbit Fab 2019 ongoing

Juvenescence 2019 ongoing

Bolt 2019 ongoing

Relativity Space 2019 ongoing

Luminous Computing 2020 ongoing

SpaceX 2020 ongoing

Space Fund 2020 ongoing

Volumetric 2020 ongoing

Swarm Technologies 2020 ongoing

Ashvattha Therapeutics 2020 ongoing (https://www.linkedin.com/in/kadvani/details/experience/)

He likes to hodl.

This is his capital firm Allocation’s website - https://www.allocations.com/This is Allocation Angel’s website - https://www.allocations.capital/

And if I was to stretch a little further with the network effect, there are investors such as Victoria Lipatova who shares investments such as SpaceX, Volumetric, Oisin, Relativity Space, and Algorand with Kingsley, she also invests in Arweave (https://www.linkedin.com/in/yomaaan/details/experience/).

Then there is a person like Ben Kong has many shared investments with Kingsley, hardly a surprise as he is a seed investor of Allocation - https://www.linkedin.com/in/benjamin-kong-92037ab/details/experience/ . If you are too lazy to look allow me to mention a few angel investments: Solana, Arweave, Algorand, Coinbase, Oisin, Ashvattha Therapeutics, Orbit Fab. Then there are more investments that steal the eyes attention.

Now where Leslie and Masanto have pulled in people from their connections, is it a stretch to speculate Slava is going to utilise his connections for Nillion’s benefit? And is it a stretch when having an understanding of Nillion’s impact that it will interest a large array of investors?

There is a lot of skill and influence seemingly at Nillion’s doorstep.

As far as I am aware the investors in Nillion thus far are Distribute Global, SALT, OP Crypto, Chapter One, AU21, Big Brain Holdings, Jade Protocol, vVv, Coin List Seed, House of Obsidian. Brady Anthony-Brumfield is another person who invests in Nillion, he too is in Ashvattha, he invests in photorealistic AI avatars for remote work, a zk roll-up for Ethereum named Uqbar Network, AI, Gravitics Inc, and is a partner at Cluster Capital - https://www.linkedin.com/in/bradyab/details/experience/.There are more but I cannot find who they are.

Nillion were at Coin Agenda and I am unsure who they seduced at this event. CoinAgenda is a series of three conference, one in Puerto Rico, Las Vegas and usually hosted somewhere in Europe, such as Greece in October 2023. It provides a meeting event for professional investors, traders, family offices and digital currency funds with top entrepreneurs in the blockchain and cryptocurrency. Following the presentations, judges selected the top Best in Show based on their professional analysis.

“The winners from CoinAgenda Caribbean BitAngels Pitch Day in Puerto Rico [2021] are:

#1: Codex- Defi for everyone. All the functionality of Paypal, Robinhood and

Transferwise in a fully DeFi app. Running on crypto's most liquid blockchain.

#2: Rair Tech- A blockchain-based digital rights management platform that uses

NFTs to gate access to streaming content.

#3: Nillion- Store and compute your private data nowhere via an unhackable*

decentralized network.”

With In-Q-Tel invested in Sedicii, I do not feel risky is hazarding a guess that they are involved or going to be involved at some point one way or another.

Sedicii has won over 20 awards from well-known organizations like BT, Citi, EIT Digital, and BBVA, become a WEF tech pioneer. The World Economic Forum expects the market of globalized tokenization on the blockchain to reach $24 trillion by 2027. If you have significant wealth and connections, you want to entrust people you already do business with to build up the platforms to eat this juicy, succulent pie. Rob Leslie,

The tokenomics have not been released, I know the team are working for tokens, I do not know how many there will be, it will be released as an ERC-20 token and the function of the token is quite standard. A user will have to pay in the Nil token to store, transfer and compute their data. Tokens are sent to a smart contract and will be paid to the nodes of the network that process the data.

Staking is similar to POS blockchains. Stake Nil to provide storage, transfer and computation services. There will be a DAO and token holders can participate in governance.

From their Discord, Jackattach said, “At a high-level, the token incentive mining program onboards users, and then the token itself has utility to pay for services and support good behavior for nodes. There’s also a few other interesting tokenomics aspect, but we are keeping that under wraps until fully ready. It’s a pretty innovative token design.”

I am curious as to what “pretty innovative” actually translates to.

Regardless, lots of investment is coming into the space. Defi is the future for finance.

Comparative companies and projects with their market cap in $’s.

ARPA - $35,097,153 THORChain - $450,805,821 Fireblocks – had a raise in Jan 2022 that raised its valuation to $8bn Keep - $76,594,056 Gnosis - $233,465,186 Synapse - $92,148,676 Filecoin - $1,493,576,169 Arweave - $314,848,518 Qredo - $25,027,716 Monero - $2,620,875,351 ZCash - $730,073,571 Secret - $131,687,200 Mina - $431,574,125

https://nillion.docsend.com/view/qpmnn7g39iyy4uz9 go to p32 to read Nillion compared to the above protocols.

Panther Protocol - $5,036,886 Polygon - £6,646,549,195 Pac Star – in 2019, the company won a contract worth $49mm with the US Marines, then in 2020, company was acquired by Curtiss-Wight $400mm,Redcom Laboratories (ZKX Solutions division) -Zultys Inc – integrated Jenne, launched MXvirtual.Tadiran - $966mm market cap

Compunetix – has revenues of $54mm + yearly.Paychex - $44.4bn mc Microsoft [Onedrive] - $1.865 Trillion DuskNet - $39,025,434 Hyperledger Aries - Hyperledger Aries is a shared, reusable, interoperable tool kit for developing critical digital credentials solutions. IDC reports that worldwide spending on blockchain solutions may reach $4.1 billion this year. Look at this site, everything runs on Hyperledger. https://www.forbes.com/sites/michaeldelcastillo/2022/02/08/forbes-blockchain-50-2022/?sh=437a41fe31c6 Iden3 - iden3 is a next-generation private access control based on self-sovereign identity, designed for decentralised and trust-minimised environments. Loopring - $336,614,812 dydx - $113,819,246 Sorare – in September 2021, valued at $4.2b. ZKSync – Has raised $458mm so far. Stark Ware - $8bn QEDIT – has raised $12.5mm. Its value is believed to be around $50mm Blockstream - $3.2bn PolySwarm - $11,583,227 Authoreon – $1.5mm raised.Humaniq – raised $5.2mm Manta - $35mm raisedXage Security - $61.2mm raised Immuta – value $1bn, rounds raised $267mm so far Fortress Identity - Aware, Inc., a leading global provider of biometrics software products, solutions and services, today announced it has acquired Fortress Identity, a pioneering provider of digital ID verification and biometric authentication. Cannot find the acquisition worth. Aware’s mc = $42mm. Fire Eye - $4.13bn Fortinet - $40.20bn Oasis Labs – valuation of $500mm Valid Network – Not too sure about this one, I think it is $10mm raised so far. Coin Fabrik – under $500mm raised Qu Secure - https://www.qusecure.com/Zscaler - $16.2bn Cipher Trace – $45.1mm raised after 5 rounds. https://ciphertrace.com/Miraki - https://meraki.cisco.com/Altoros Labs - https://www.altoros.com/EPAM Systems - $20.14bn Sovrin - https://sovrin.org/ NuID - $4.2mm raised in Round A Ocean - · $852,078,280,788Trust Stamp - $18mm Icomply - $2.7mm EY Nightfall - Nightfall is a hybrid of two popular types of rollups: privacy-preserving zero-knowledge proofs, which only publicly disclose the time and date of a transaction, and optimistic rollups, which assume the transactions are accurate but allow validators to contest them. EY are putting in $100mm into blockchain fund.

Okay, I think that is enough. If we go any further down these rabbit holes we will never return. To round it up then:

$15tn is coming into blockchain/DLT/alt consensus in the next 10 years. Decentralised ID could be worth $77.8bn by 2031. Nillion’s tech that is GDPR compliant. A team that is elite and world class with connections to elite investors and companies is making a protocol for DID, data storage, privacy and enhancing blockchain performance.

The risk is the product does not come to fruition but they have run prototypes and tests that have excited people enough to rush to work for the project. It could go like the Royal Dermatological Formulations or it could blow the world of crypto wide open or anything in between.

This is still really early, Nillion is still getting funding and developing. You may be already involved or able to invest, if not, I would highly recommend to get this on a shortlist and look out for it.

I’ve realised that I have the energy of a girl who thinks her boyfriend is cheating on her but applied to Linked In.

I am tired of beating around the bush. Yeah, sure, invest in Nillion when you can but now I have you attention please do invest in my Go Fund Me. I am in need of investment to get revenge on my neighbour, I want my gnome back.

We will share the spoils. I know he buys Logan Paul NFTs, to be honest with you, you can have them but he may have gold under the floor boards. With that we could start a bank.

评论 (0)