In crypto, volatility is the rule, not the exception. Yet within this turbulence, market behaviour often follows recognisable, repeatable structures. One such framework that continues to gain traction among serious traders is Elliott Wave Theory.

Understanding Elliott Wave Theory

The theory, developed by Ralph Nelson Elliott in the 1930s, is grounded in behavioral finance and posits that markets move in predictable wave patterns driven by crowd psychology.

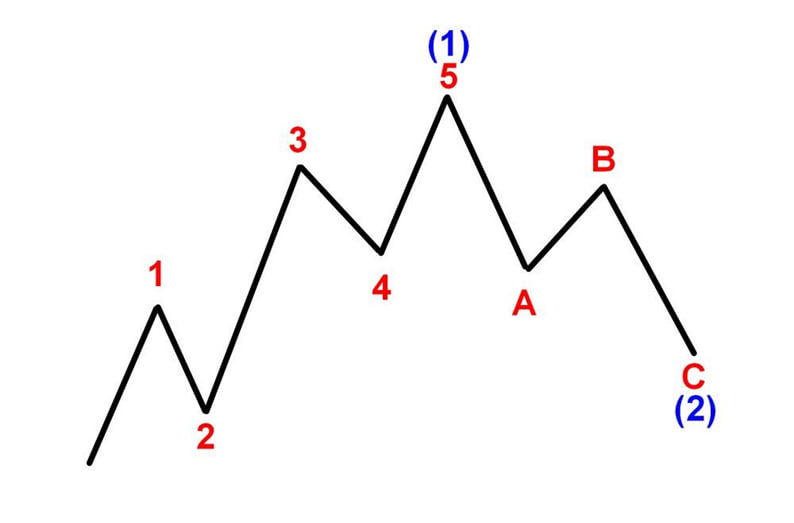

These patterns form a cycle:

-

Impulse Waves (1-2-3-4-5) move in the direction of the trend.

-

Corrective Waves (A-B-C) move against it.

Each complete cycle of eight waves signals either the continuation or reversal of a market trend.

Why Crypto Traders Use It

The cryptocurrency landscape is uniquely volatile, impacted by tweets, regulations, and retail sentiment. But this is where Elliott Waves shine. Because the theory is rooted in human emotion, it aligns well with a space dominated by irrational exuberance and sudden fear.

Traders use wave counts to:

-

Time entry and exit points

-

Forecast the depth of corrections

-

Identify trend exhaustion early

Key Rules and Wave Structure

To use Elliott Waves correctly, traders must respect its core principles:

-

Wave 2 never retraces more than 100% of Wave 1.

-

Wave 3 is never the shortest.

-

Wave 4 doesn’t overlap with Wave 1 territory.

The golden ratio (1.618) often appears in wavelengths, especially in Wave 3. Recognizing these relationships can significantly improve the accuracy of your analysis.

Application in Real Charts: Litecoin (LTC/USDT)

Let’s consider a classic pattern on Litecoin’s daily chart:

-

Waves 1–5 formed a clean bullish impulse.

-

Followed by A–B–C corrective structure.

This structure offers traders a potential buy-in at the end of Wave C, anticipating a new upward impulse.

Best Practices

To make Elliott Wave Theory effective:

-

Begin analysis on higher timeframes (4h/Daily).

-

Use other indicators like Fibonacci retracements, RSI, and trendlines.

-

Validate waves with volume and support/resistance zones.

Final Thoughts

Elliott Wave Theory is not plug-and-play. It demands patience, context awareness, and experience. Yet for crypto traders, its ability to interpret market psychology makes it a powerful addition to any technical analysis toolkit.

Whether refining your edge or building a framework from scratch, pairing wave analysis with robust trader platforms can deepen your market understanding and enhance decision-making.

评论 (0)