There was news and noise of BlackRock filing the USD Institutional Digital Liquidity Fund with the SEC. There are few areas of focus, I will hone in on one. Alan Howard.

Standing at 5’5”, he has a masters in chemical engineering and a big donor of the Conservative Party. He co-founded Brevan Howard, the Brevan part of the firm name was formed from parts of the founders’ last names. He has proven to be good at making money from following data, such as making profit out of 2008 and predicting Brexit, he went for Cypriot citizenship after the Brexit outcome a passport that costs at least 2 million Euros.

From 2002 to 2013, Brevan Howard fund reached $40bn AUM however, by 2018 the fund dwindled to $6.3bn due to the economic environment and low returns. Alan’s style suited volatility, it appears he saw his opportunity in digital assets.

One River Asset Management founded in 2013 not by Alan Howard but in 2020 he did back the fund in their its $600mm purchase of BTC and ETH. This raised $1bn from institutional investors, reportedly the largest raise for a crypto fund. BH acquired 25% of One River and in 2022, BH launched their BH Digital Multi-Strategy Fund. One River would partner with Coinbase and then be acquired by Coinbase in 2023 and this is the basis of Coinbase’s investment advisory service for institutional clients.

In 2019, Howard was a part of a $182mm fund raise for Bakkt and there were intentions to get a futures and ETF approval. With recent news taken into account I say watch this space.

2021, Makor Group has raised $17 million to fuel the growth of Enigma Securities, its crypto brokerage, and its strategic partners are Algorand and Alan Howard. Howard invested in Copper, Bullish Global, Bottlepay and Ledn. Howard and Nomura’s Laser Digital founded Webn group for venture incubation, here is their public PF - www.wng.co/portfolio/. Nomura is Japan’s largest investment bank.

In 2022, BH invested in a Series A round for Horizon Gaming, this includes lots of big names – LINK – plus they have invested in Injective. The same year Howard invested in Polygon, Mina, Atmos Labs, Nested, Spark Cognition and more (www.crunchbase.com/person/alan-howard-2). 2023 saw BH open its Middle East HQ in Abu Dhabi.

He has established Elwood Technologies which helps banks and fintech firms to access crypto liquidity through an API, this raised $70mm Series A in 2022. Elwood provides a tech platform akin to the Bloomberg terminal or BlackRock’s Aladdin portfolio management system. In Jan 2024, Elwood gained FCA authorisations as a SaaS for institutional-grade access to digital asset exchanges and liquidity.

Keeping to 2024, aforementioned Enigma partnered with Circle-backed OpenTrade to bring US Treasury bill-backed yield products on-chain, the loans will be secured in USDC.

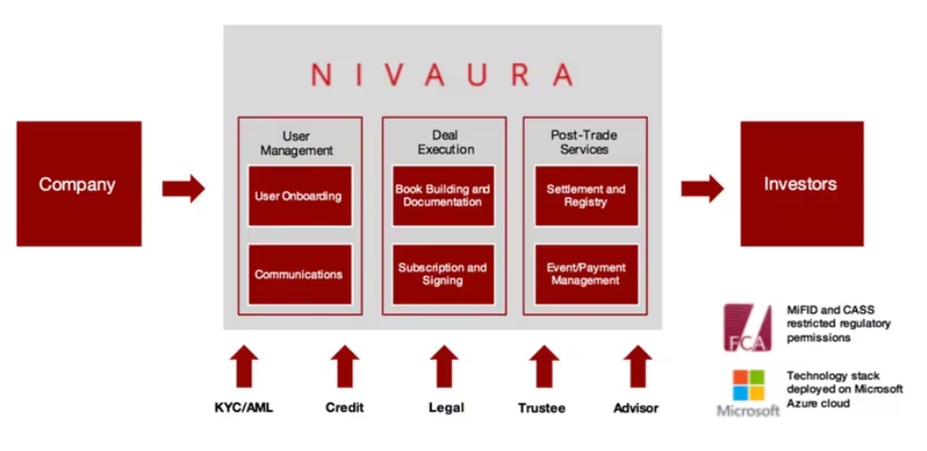

Nivuara was founded by Avtar Sehra in 2015 and this had partnerships with Accenture, JPM, UBS, Digital Switzerland, and helped the FCA back in 2017. 2024, Libre was founded by Sehra and has foundational backing from Webn.

Libre will be launched on a permissioned sidechain of Polygon and it is a B2B protocol that helps automating the legal, regulatory and policy aspects of RWA and tokens for their wealthy clients. Libre will eventually leverage other chains in the future.

Securitize is a regulatory-compliant asset tokenization firm that enables the issuing and trading of digital asset securities. It was founded in 2016, in 2019 it raised $14mm from Fenbushi, Santander, MUFG, Sony, Nomura and more, this round later reached $30mm. Series B scooped up $48mm.

In 2022, Securitize launched KKR’s Health Care Strategic Growth Fund II (“HCSG II”) on Avalanche, closing the fund at $4bn. 2023, Securitize again utilised AVAX to launch a fund that represented equity in Spanish real estate investment trust Mancipi Partners, this was under test conditions.

2024, BlackRock launches its first tokenized fund, BUIDL, on the Ethereum network, exclusively available on Securitize. The new fund will only be available to institutional investors with the minimum investment accepted set by the Wall Street mammoth at $100K.

Alan Howard is one of the worlds wealthiest men who is seeking to regenerate his returns since they fell flat in the 2010s and he is seeing these returns in digital assets. He is well connected to regulators and institutional investors meaning his investments and movements are worth keeping an eye on as they are likely to succeed.

His Investments:

Wormhole

Membrane Labs

https://www.shrapnel.com/shrap-token

www.polysign.io/ - David Schwartz is advisor and Arthur Britto is president.

评论 (0)