Report Review

-

Sources Reviewed:* Glassnode > Bitwise > Kaiko*

-

General Observations:* Many reports offered a straightforward recap with extensive lists of data and charts but lacked in-depth insights.*

-

Glassnode's Focus:* Emphasized on-chain data, comparing previous and current cycles, notably in collaboration with CME, enhancing coverage of exchange dynamics, particularly around CME’s advancements.*

-

Bitwise Analysis:* Provided a diverse range of charts and analysis, characteristic of an asset management perspective, focusing on Bitcoin and comparing its performance with other asset classes and various Bitcoin-specific indicators.*

-

Kaiko's Report:* Somewhat disappointing with no standout content, feeling akin to a weekly report in terms of depth and insights.*

Consolidated Summary

Key Events:

-

Regulatory Actions:* Multiple Wells notices issued by the SEC, targeting entities like Uniswap and Robinhood.*

-

Bitcoin Halving:* The mining reward was reduced to 3.125 BTC per block.*

-

Spot ETF Approvals:* New spot ETFs for ETH were approved, along with launches in Hong Kong.*

-

Mt. Gox Repayments:* Plans were announced to commence creditor repayments.*

Market Trends:

-

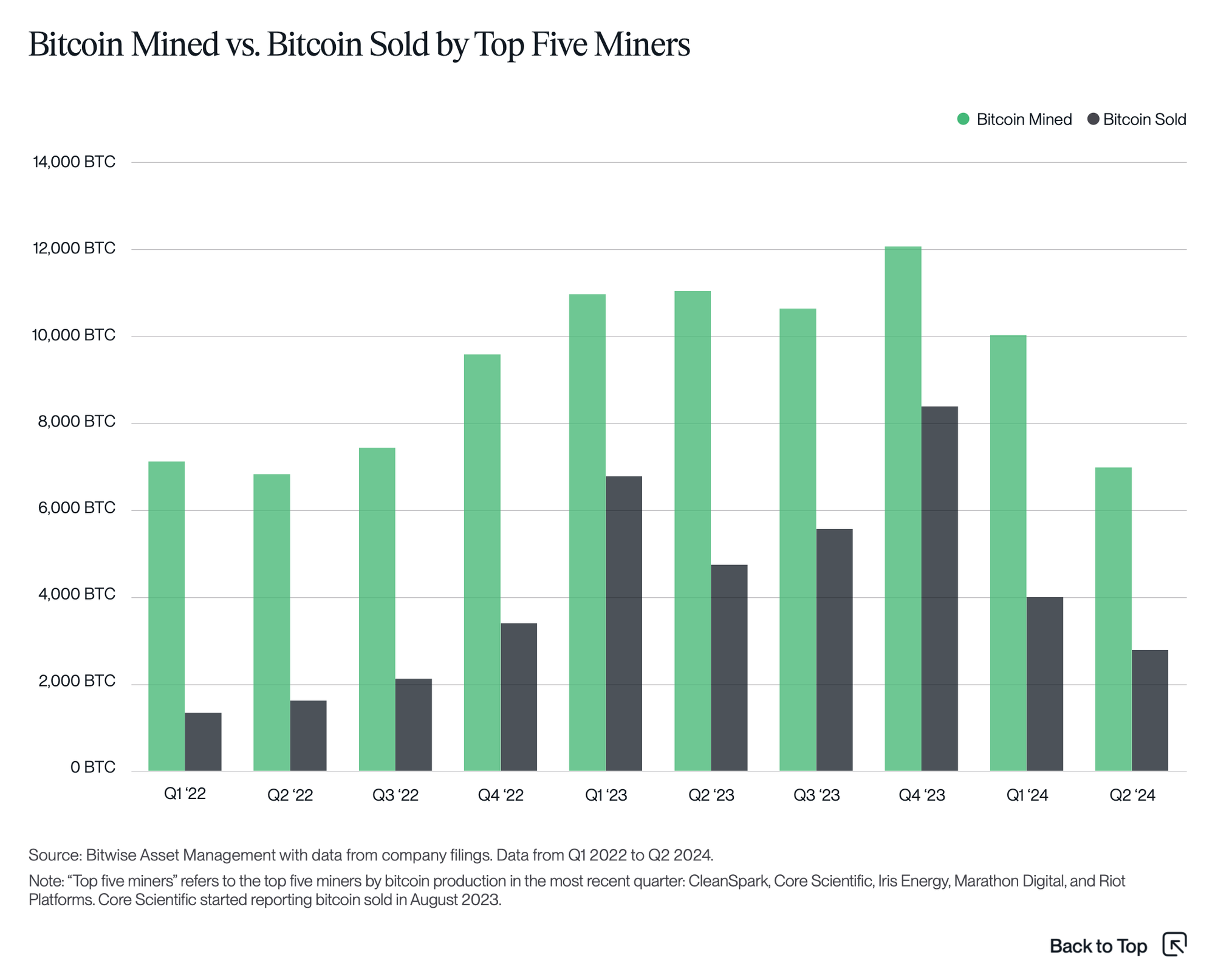

Post-Halving Impact on Bitcoin:* BTC prices fell, with increased selling pressure from miners.*

-

Stablecoins:* Launch of new yield-bearing stablecoins, including USDL by Paxos.*

-

Regulatory and Compliance:* MiCA regulations were implemented in the EU, impacting stablecoin operations and promoting growth in EUR-denominated stablecoins.*

-

Institutional Dynamics:* BlackRock overtook Grayscale in terms of assets managed under its Bitcoin ETF.*

Institutional Analysis:

-

Trading Patterns:* Shift in BTC trading volumes to align with U.S. market hours, influenced by U.S.-based ETFs.*

-

Derivatives Market:* Lacked direction, with a focus on basis trade strategies among hedge funds.*

-

Innovation in Financial Products:* Growth in tokenized funds, with traditional financial institutions like BlackRock expanding their footprint in the digital asset space.*

Market Dynamics:

-

Growth in Bitcoin and Ethereum:* Both saw significant capital inflows, with stablecoins also gaining traction.*

-

Derivatives Markets:* Increased activity, especially with futures on the CME indicating strong institutional involvement.*

-

Volatility Trends:* Reduced volatility in BTC and ETH, suggesting maturing markets.*

Technological Advances:

-

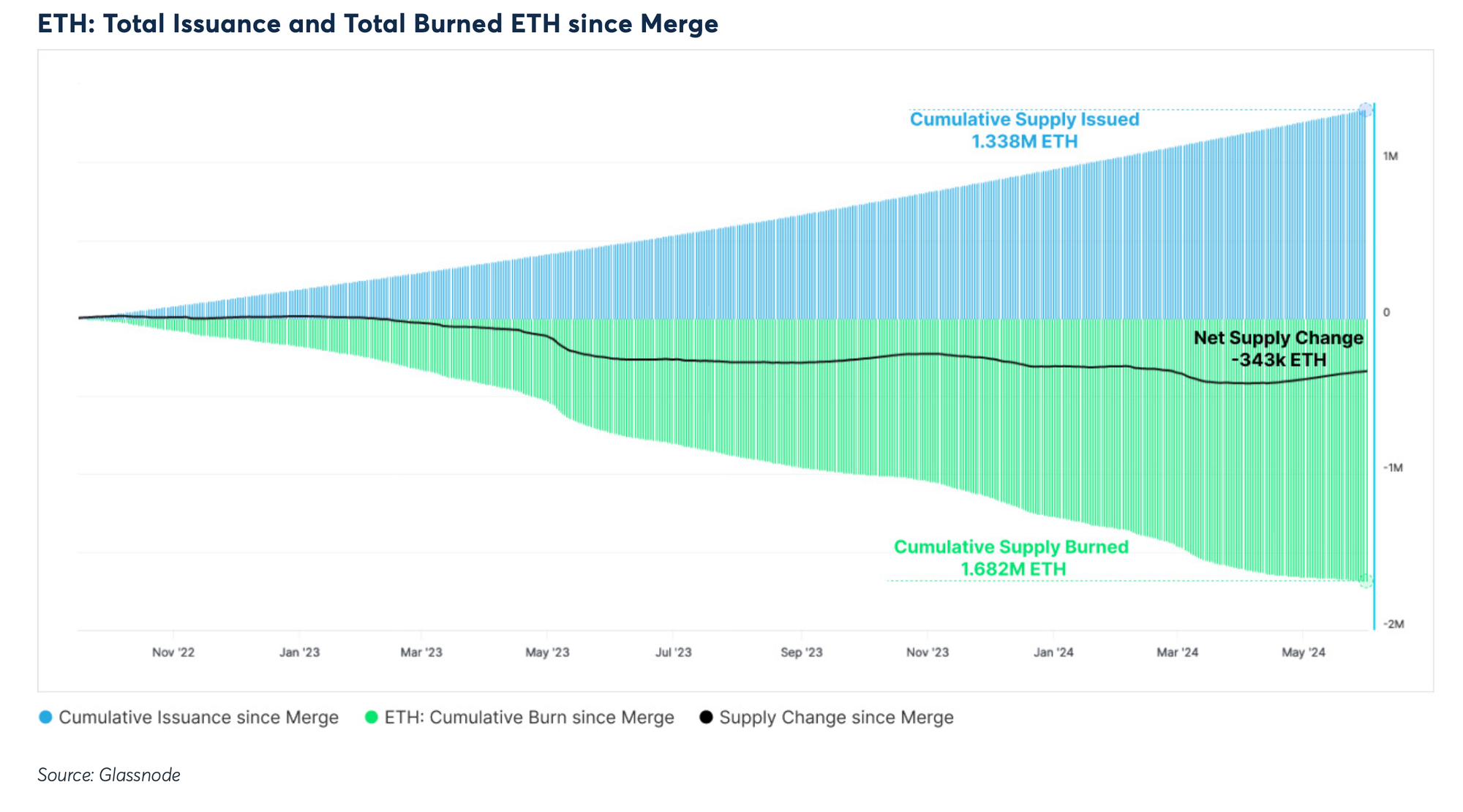

Proof-of-Stake Migration for Ethereum:* Significantly reduced daily issuance, potentially leading to deflationary pressures due to ETH's burning mechanism.*

-

Regulatory Developments:* The approval of U.S. Spot Bitcoin ETFs enhanced market access and possibly increased demand.*

Investment Insights:

- Institutional Adoption:* Continued growth in institutional investments in crypto, facilitated by clearer regulatory frameworks and advanced financial products such as ETFs and derivatives.*

Key Charts with Commentary

Bitwise Analysis

-

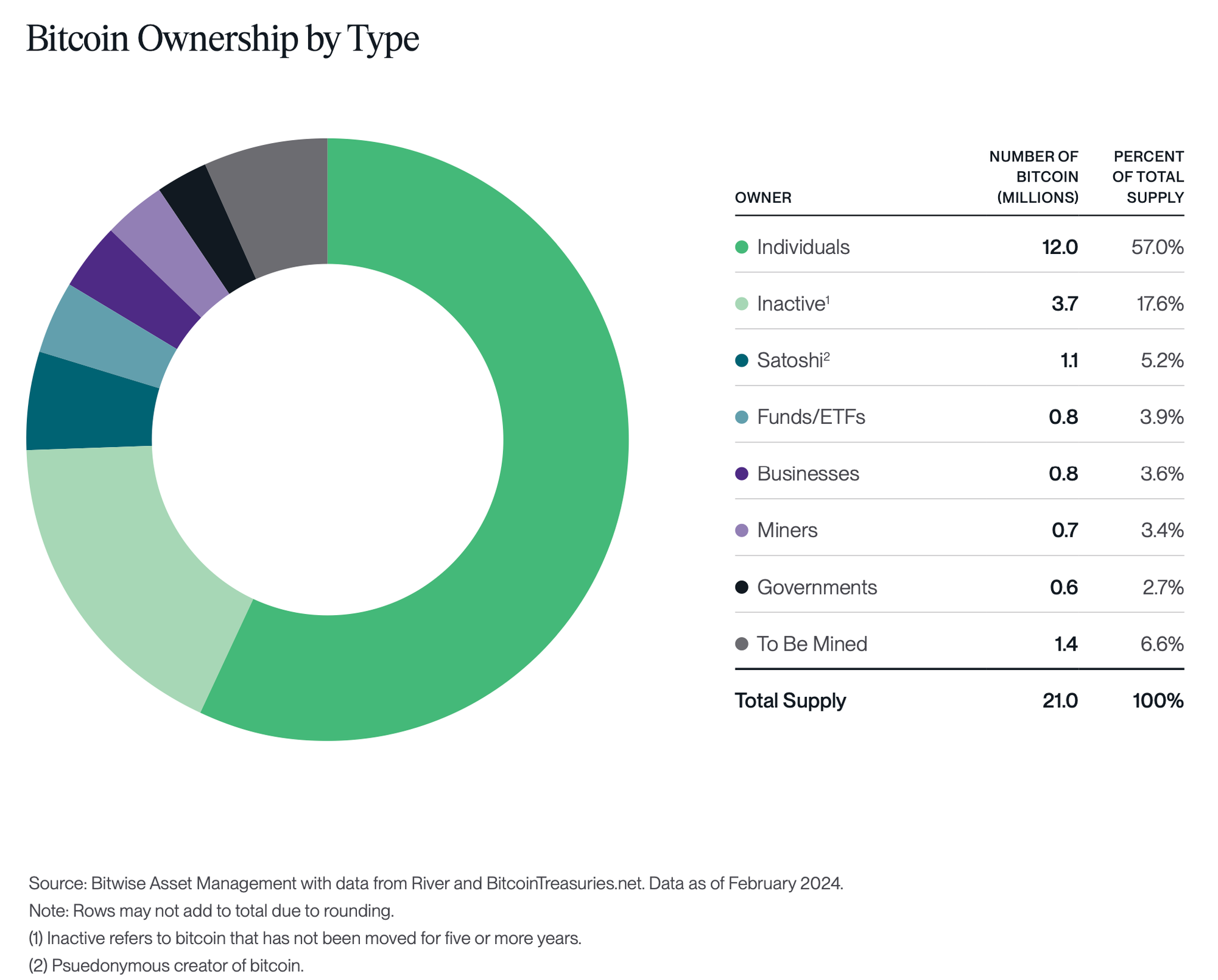

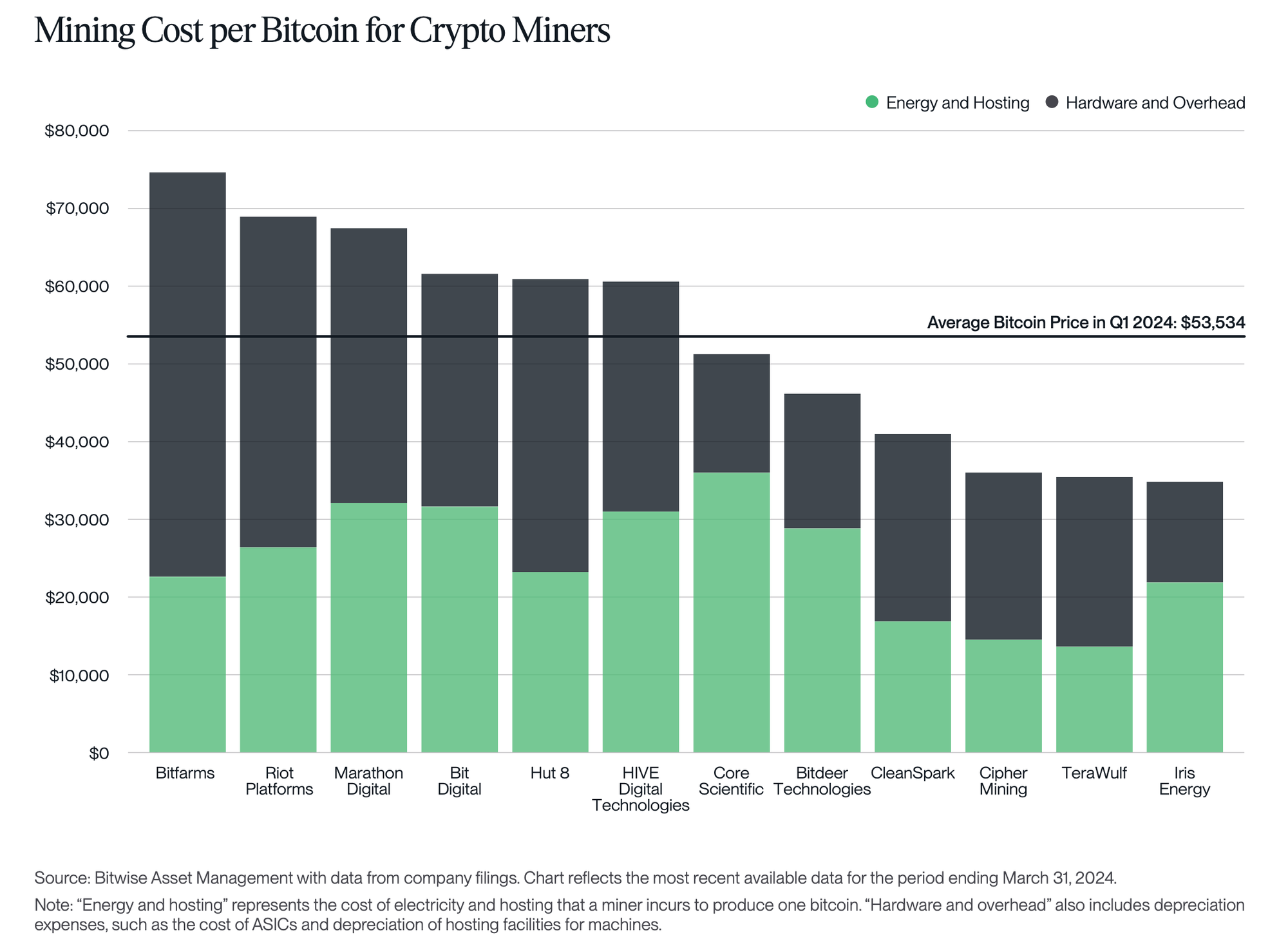

Mining's Diminished Role:* Miners are no longer the primary Bitcoin holders. Numerous mining indicators (mining difficulty, hash ribbons, etc.) are becoming less significant. Market sensitivity was more attuned to U.S. macroeconomic factors and U.S. BTC Spot ETFs during this halving cycle.*

-

Ongoing Focus on Funds/ETFs:* The increasing proportion of Funds/ETFs suggests that Bitcoin is becoming more of a financial investment asset (digital gold), with rising correlations with other asset classes.*

Glassnode X CME

BTC vs. ETH

-

Limited PoS burned effect: 343,000 ETH was burned after the Ethereum merge, but the impact on the price seems to be very limited as it only represents 2.8% of the total circulating supply.

-

Underperformance Factors:* Early U.S. Spot ETF approvals for Bitcoin in January 2024 created significant buy-side pressure. Ethereum competes in an increasingly crowded Proof-of-Stake landscape affecting its liquidity, capital, user experience, and scalability. The introduction of U.S. Spot ETFs for Ethereum may reverse this downtrend.*

Cyclical Overview

-

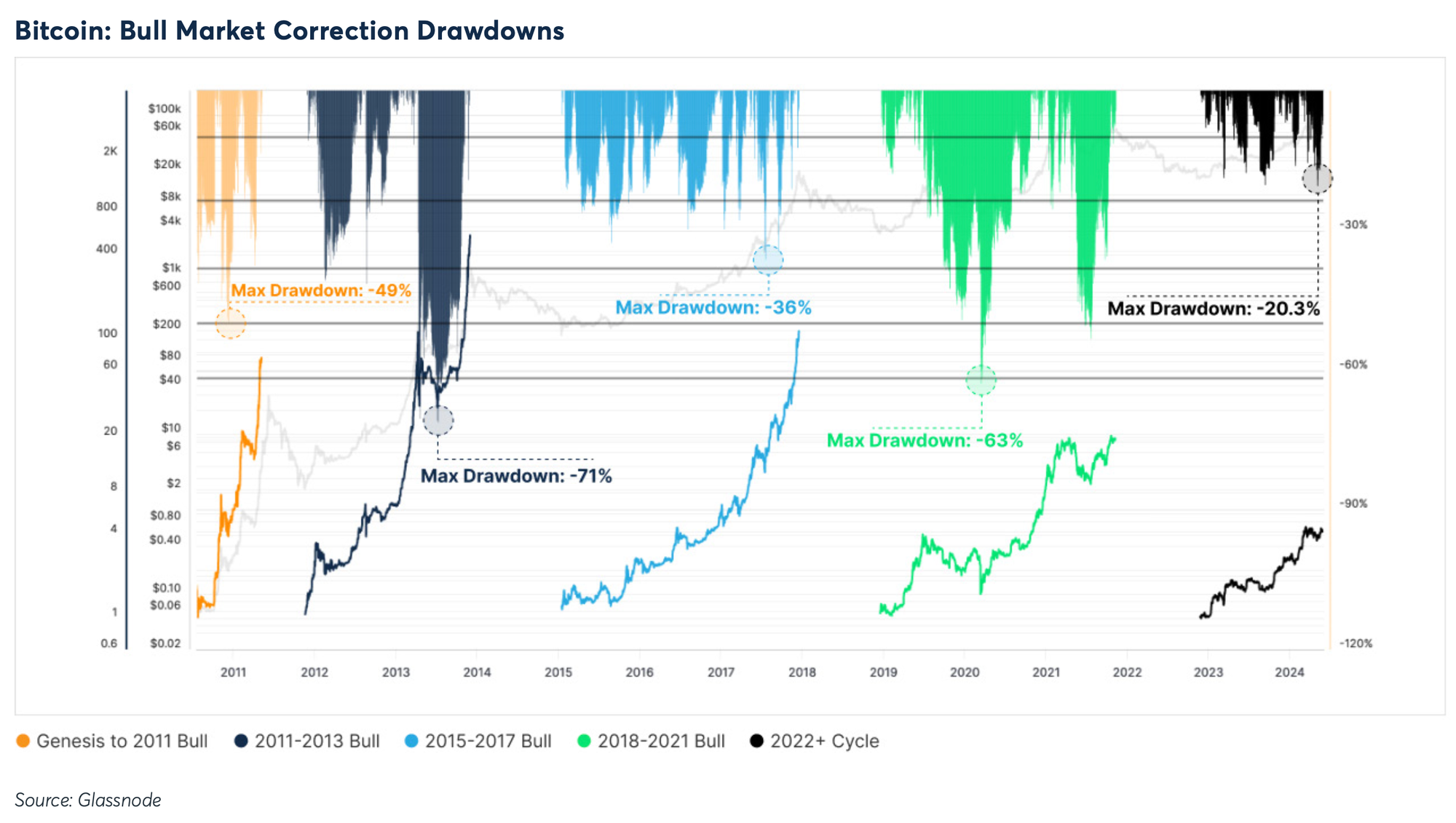

Mid-Cycle Positioning:* Comparisons with previous bullish periods suggest the current cycle is midway, with potential for continued growth, estimating a 2x to 10x increase in value over the next year.*

-

Paving the road: Compared to previous cycles, downside volatility appears to have decreased significantly. As more institutional investors come in, volatility is expected to gradually decrease. MDD will also show better than previous cycles

Backward Looking - Catch the Bottom

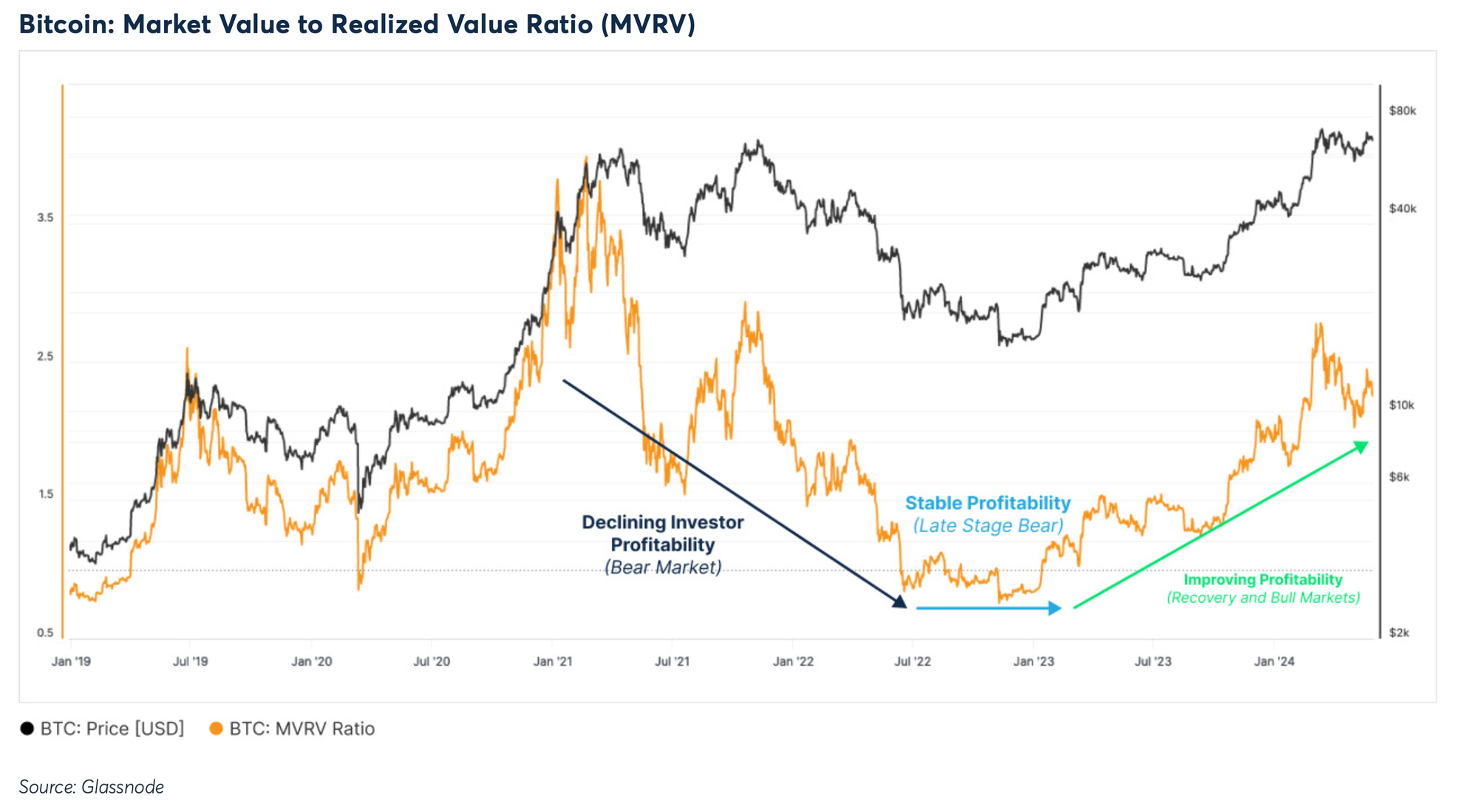

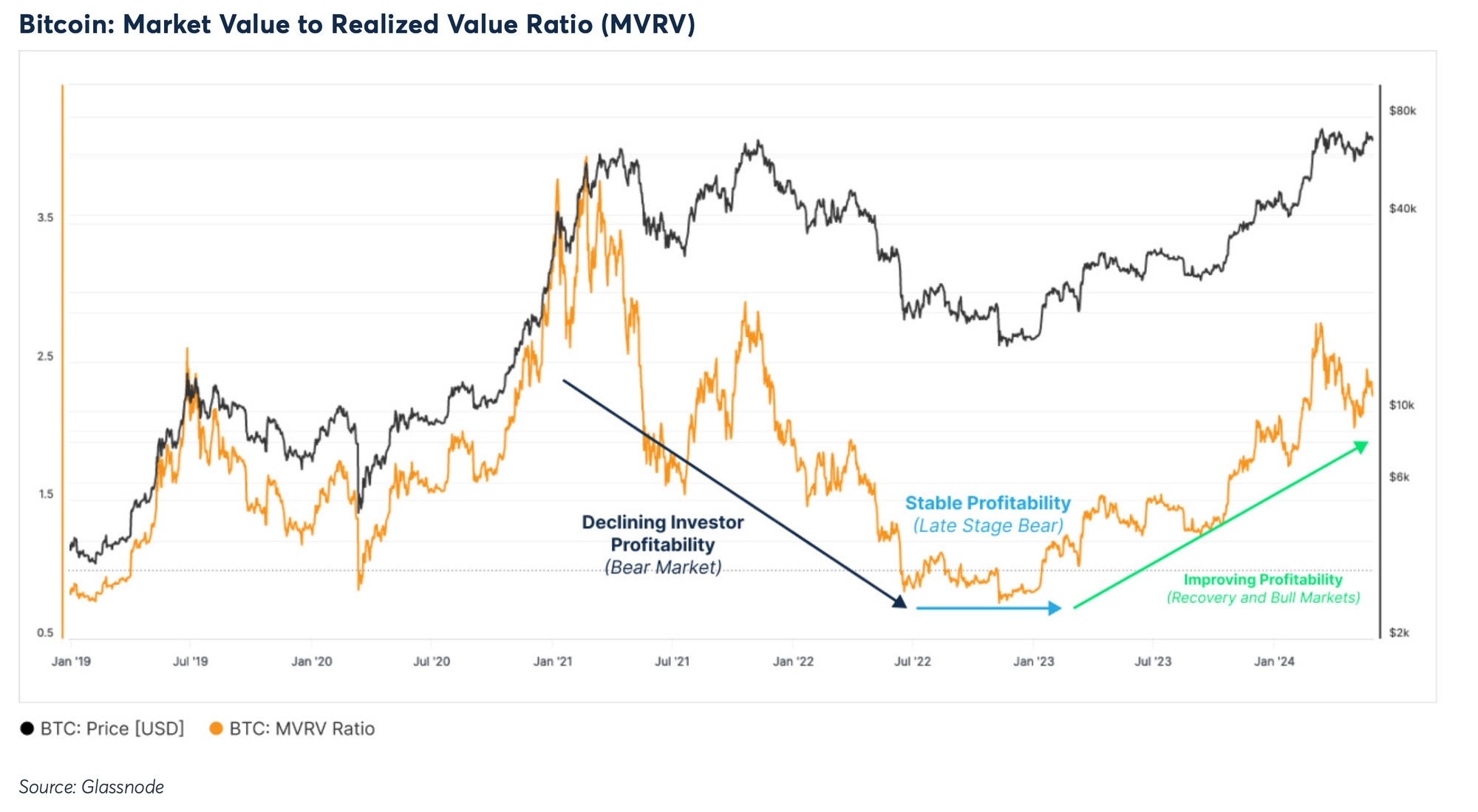

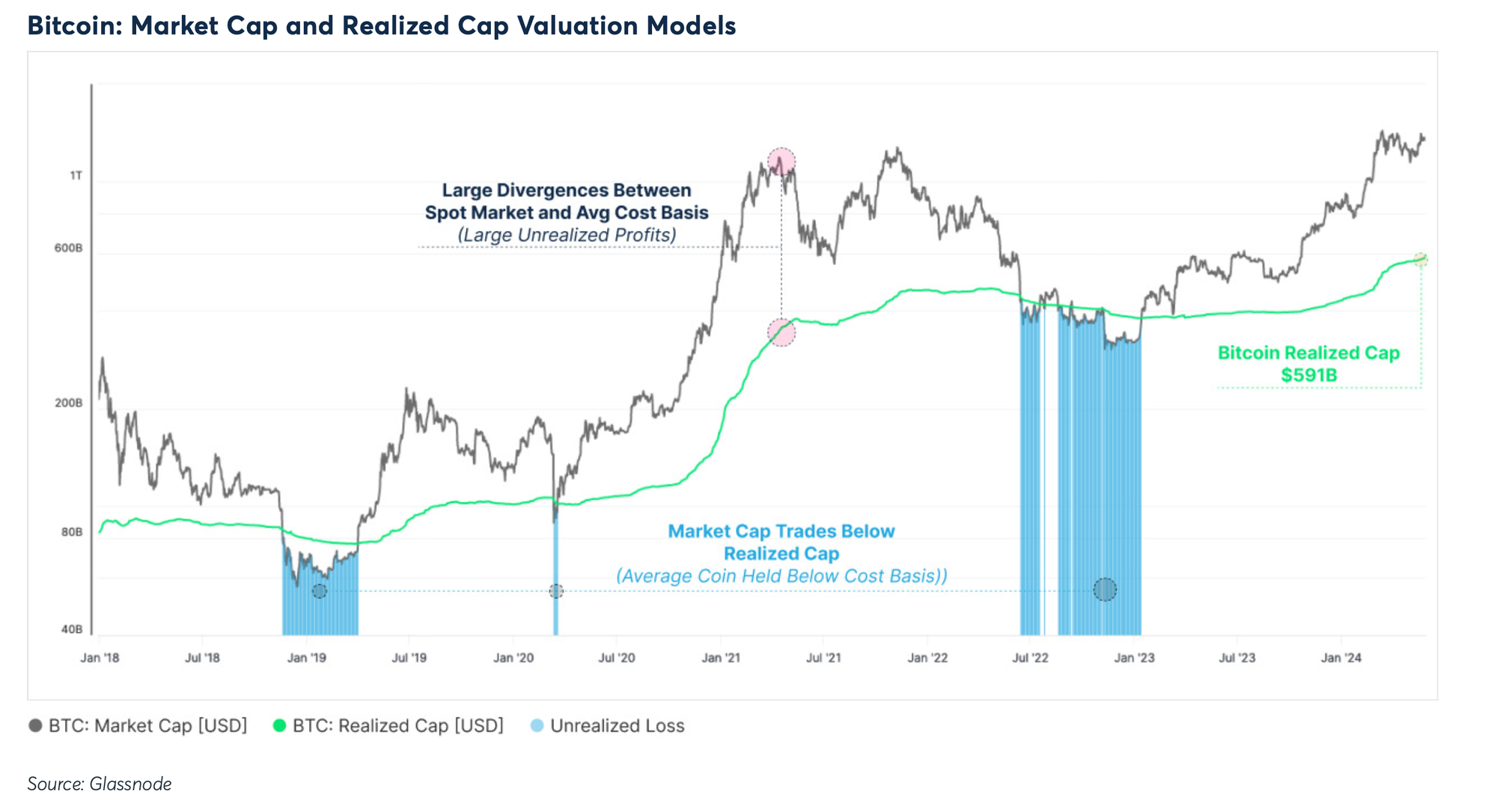

- Using MVRV and Realized Cap:* These indicators are valuable for identifying price bottoms over extended periods. Especially, when MVRV < 1 and Realized Cap break-out in long-term view.*

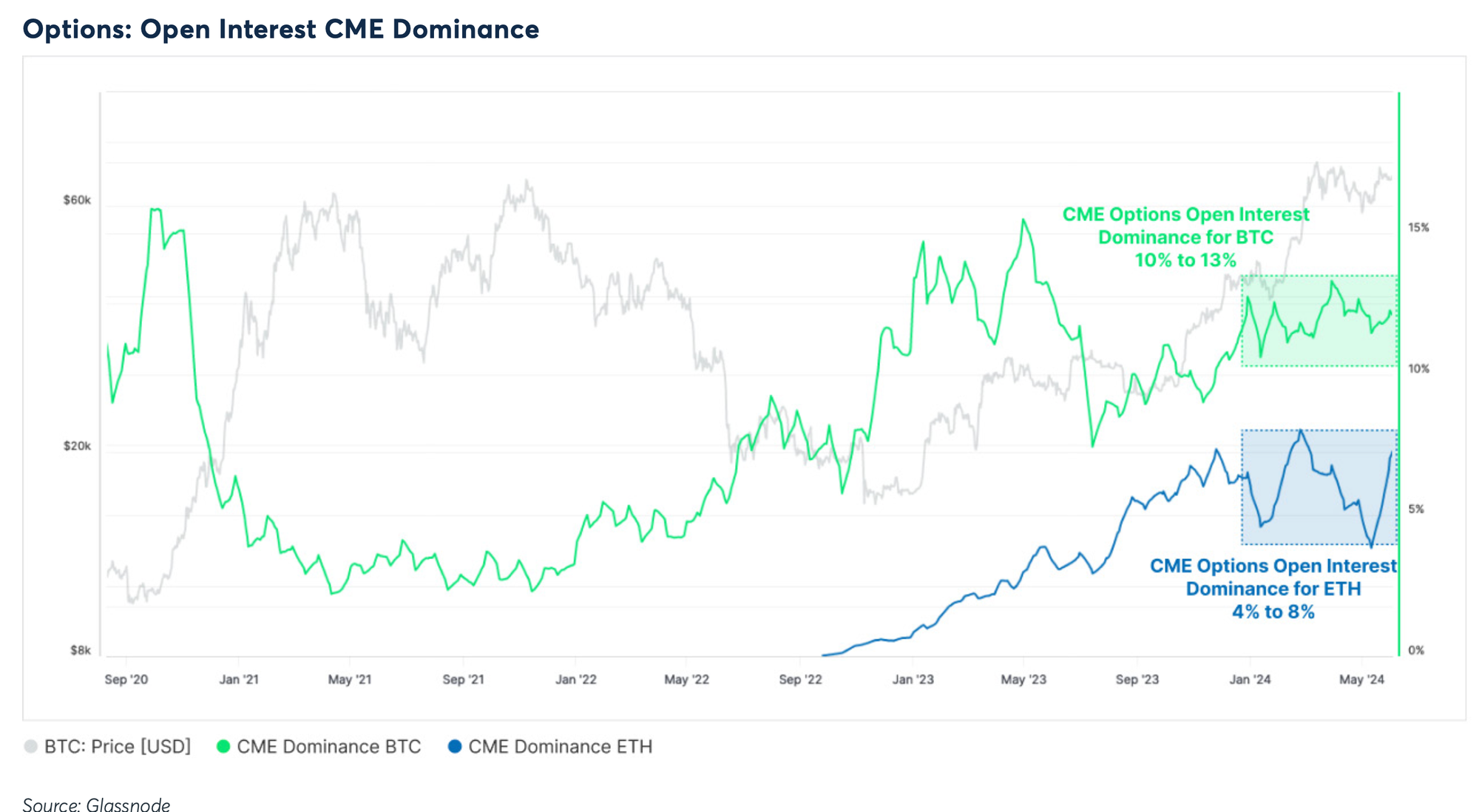

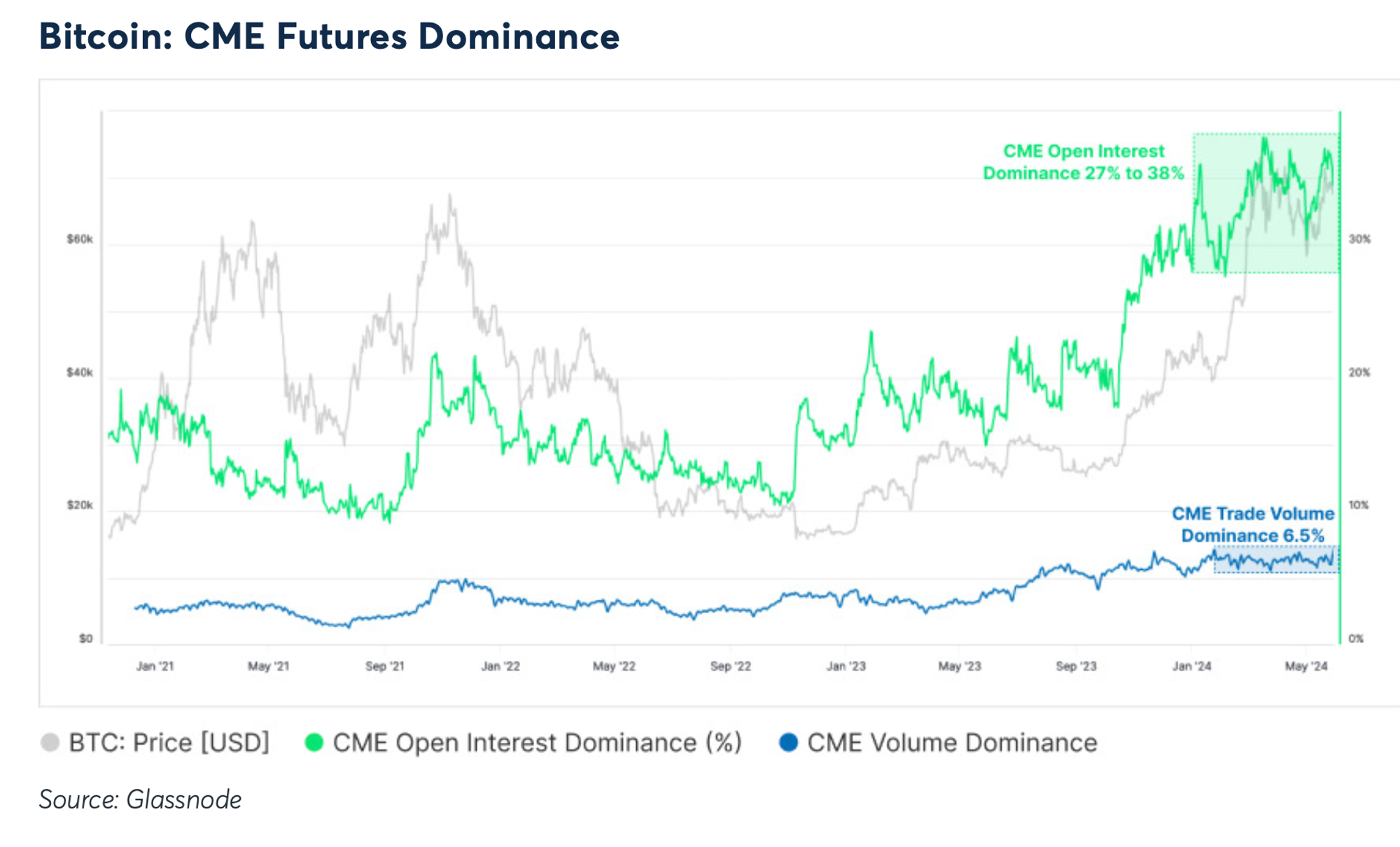

CME Futures and Options Surge

- Rise of CME in 2024:* Institutional demand for CME Derivatives increased significantly following the listing of Bitcoin spot ETFs, with a disproportionate volume share compared to open interest, suggesting that high-frequency or speculative trading is still prevalent in offshore exchanges.*

Kaiko

-

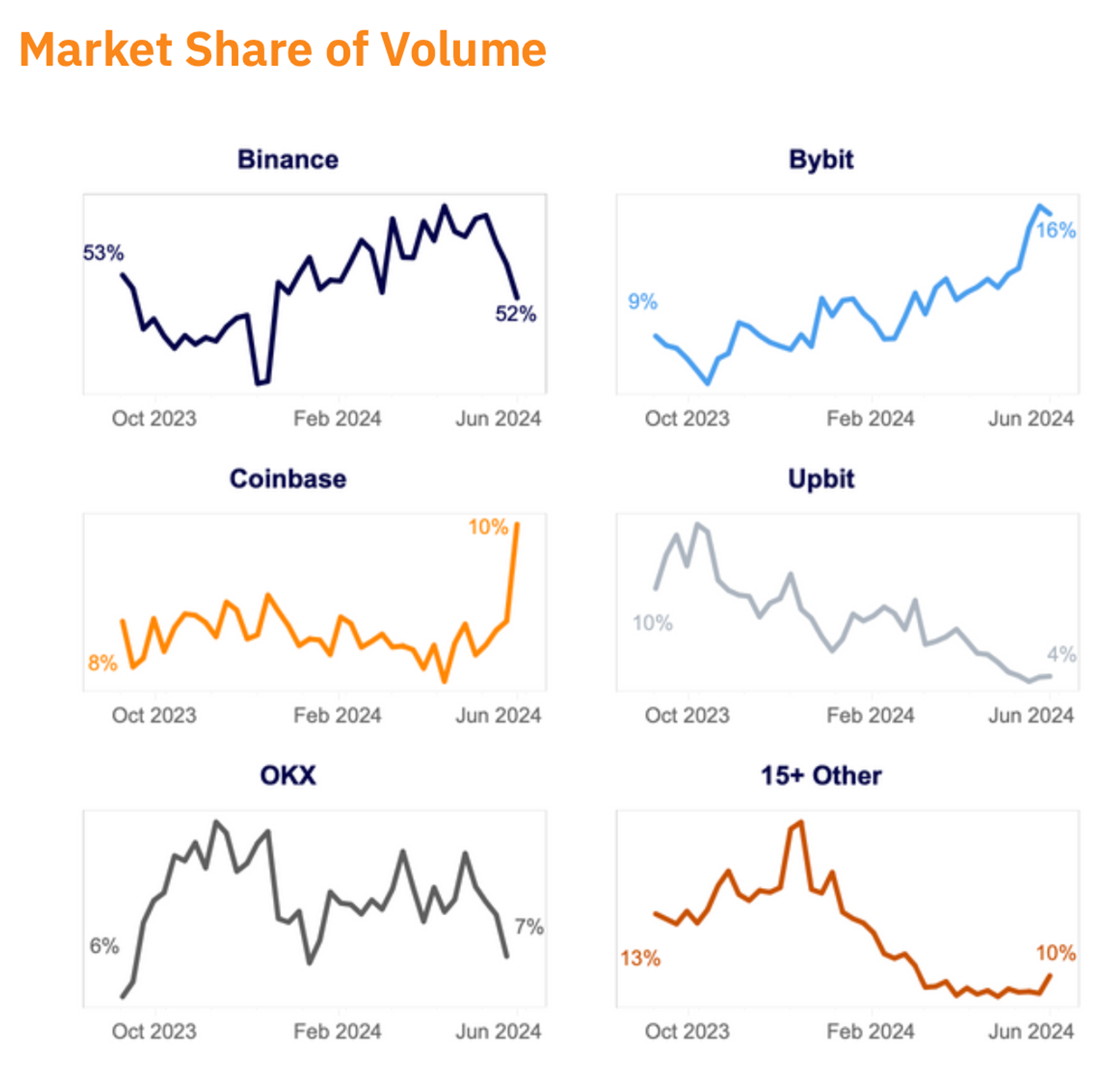

Exchange war: Bybit is growing its market share significantly in 2024. Coinbase also seems to have become the exchange of choice for many institutional exchanges, driven by the BTC Spot ETF. Binance's dominant share is declining.

-

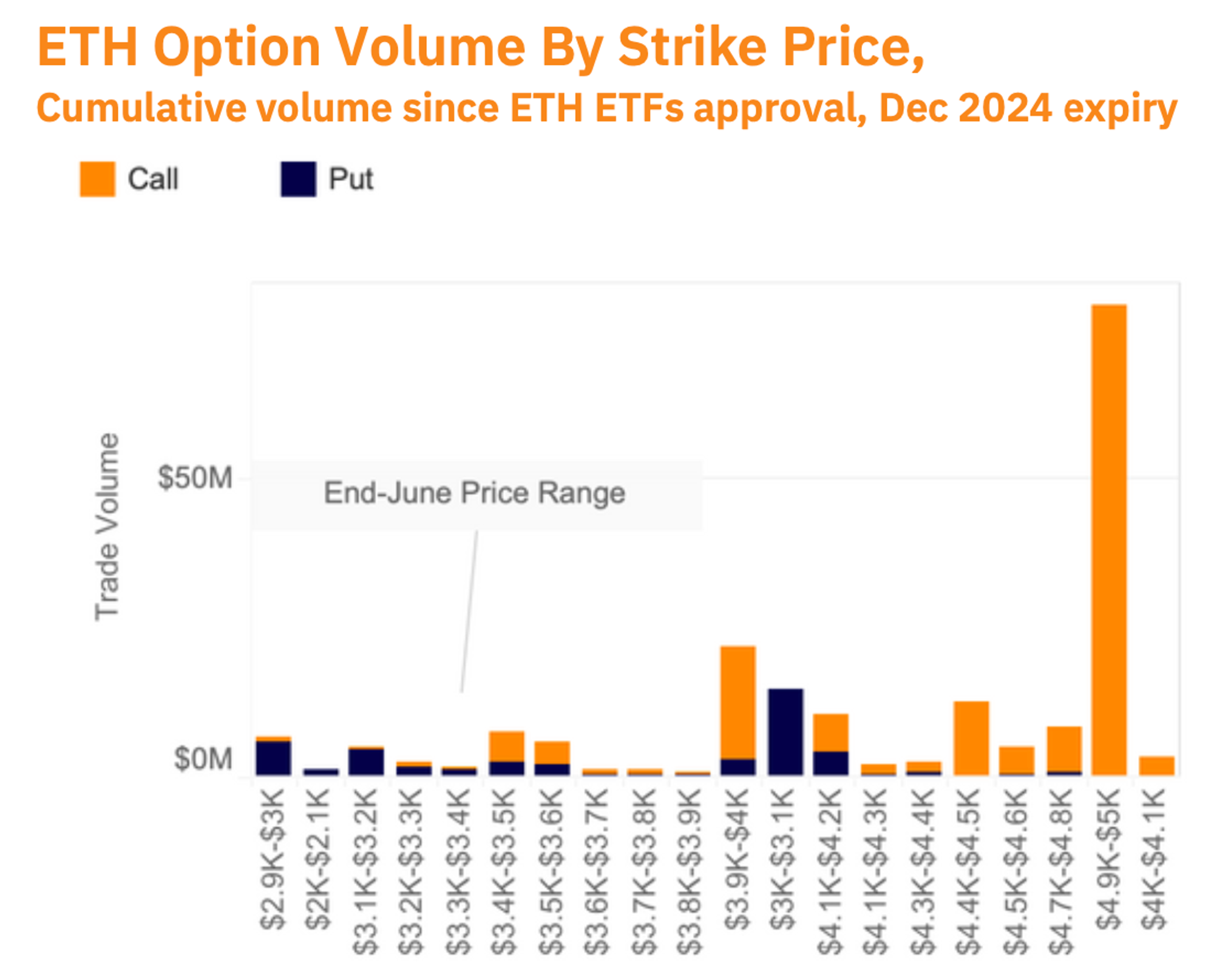

Hopeful ETH options market: most seem to be expecting ETH to hit $5,000 by the end of the year. The only remaining catalyst for ETH is the spot ETF, with many expecting the BTC spot ETF to work for ETH. If and when the spot ETF materialises, ETH will be able to ride the uptrend on the anticipation.

Report source

https://get.glassnode.com/cryptocurrency-trends-2024-h1-report

https://bitwiseinvestments.com/crypto-market-insights/crypto-market-review-q2-2024

评论 (0)