Mangrove introduces Kandel, our first venture into on-chain Automated Market Making, now operational on Blast. Following the integration of Mangrove with Blast, Kandel represents our next step towards enhancing on-chain trading dynamics.

Introduction to Kandel

Kandel operates as a fully on-chain automated market making strategy, designed for instantaneous order execution with zero latency.

Simply put:

-

Profit Optimization: Buy low and sell high, generating profits through the accumulated spread, i.e., the difference between Bids and Asks that are taken.

-

Automated Convenience: Provide efficient, automated trading strategies that maximize returns and improve liquidity management.

Kandel is now available on WETH/USDB, mwstETH-WPUNKS:20 and mwstETH-WPUNKS:40 markets.

Try it now: app.mangrove.exchange/strategies

How does Kandel make profit from the spread?

Kandel uses on-chain order flow to repost offers instantly and make a profit from the spread between offers, without any latency. It could be considered as a market-making bot equivalent that operates solely on the blockchain. It leverages the interaction between buyers and sellers that creates price movement, rather than the price itself.

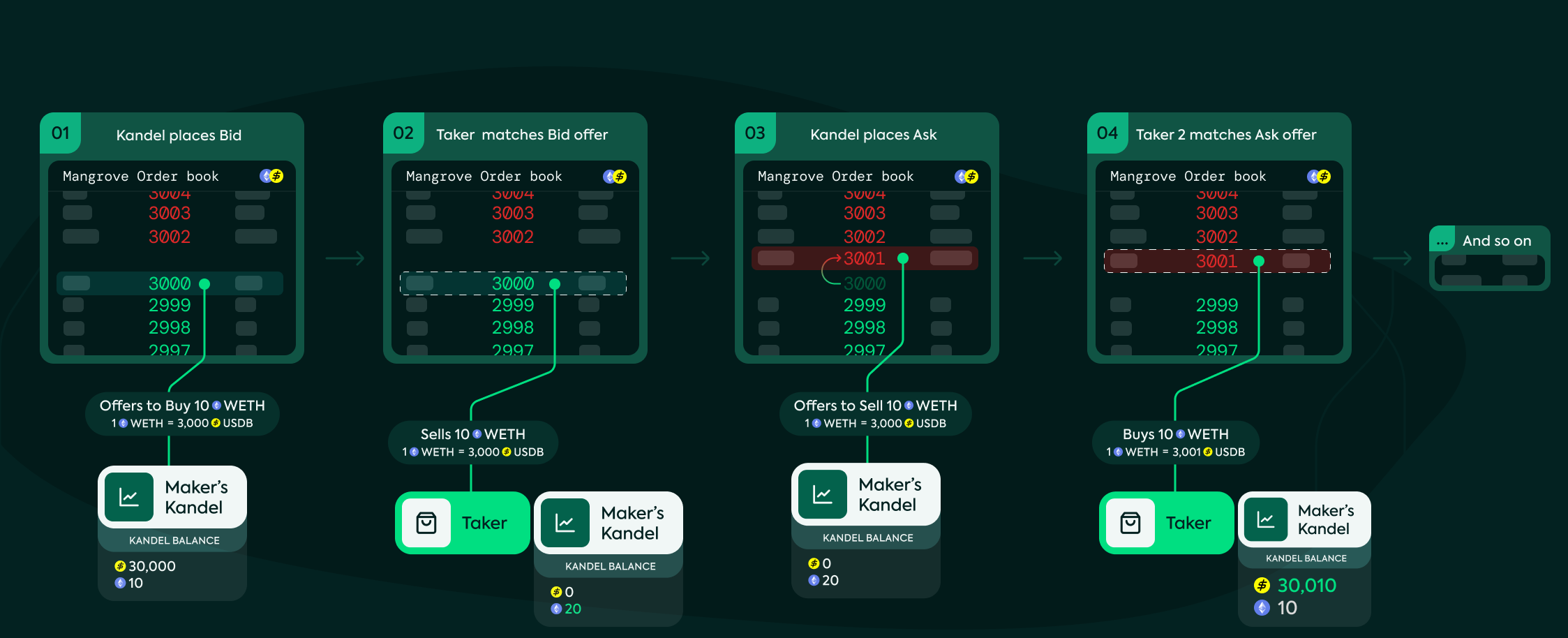

In the example below, you have set up your Kandel on Mangrove’s UI or through the SDK and you loaded your Kandel with 30,000 USDB and 10 WETH

Step 1: Kandel places the Bid & Ask

Kandel automatically posts an offer on the Mangrove Orderbook to buy 10 WETH at 3,000 USDB per WETH.Kandel’s Balance: 30,000 USDB and 10 WETH.

Step 2: Taker matches the Bid offer

When your offer is taken, your Kandel receives 10 WETH and send 3000 USDB to the seller.Kandel’s Balance: 0 USDB and 20 WETH.

Step 3: Kandel places an Ask

Kandel automatically posts an offer on the Mangrove Orderbook to sell 10 WETH at 3,001 USDB per ETH.Kandel’s Balance: 0 USDB and 20 WETH.

Step 4: A Taker 2 is matched with the previous Ask offer

When your offer is taken, your Kandel receives 30,010 USDB and sends 10 WETH to the buyer.Kandel’s Balance: 30,010 USDB and 10 WETH.

→ Profit: $10 USDB.

Following these steps, your Kandel will continue to automatically post offers based on your parameters. Should the market price move outside your specified price range, you'll need to adjust it accordingly.

For more information about Kandel, you can check our documentation here.

Cautionary Note

Users engaging with Mangrove and its Kandel strategies should be cognizant of the risks involved. These include the standard hazards of token trading, market volatility, and potential impermanent loss, as well as risks specific to smart contracts and blockchain technology.

Stay connected with the Mangrove community 👥

-

Website: mangrove.exchange

-

Kandel General Doc: docs.mangrove.exchange/general/kandel

-

Kandel Step-by-step doc: docs.mangrove.exchange/general/web-app/strategies

-

Kandel developer doc: docs.mangrove.exchange/developers/SDK/getting-started/deploy-kandel

-

Twitter: x.com/mangrovedao

-

Discord Community: discord.com/invite/rk9Qthz5YE

评论 (0)