had a free time this morning so wrote a about scalping the market. enjoy.

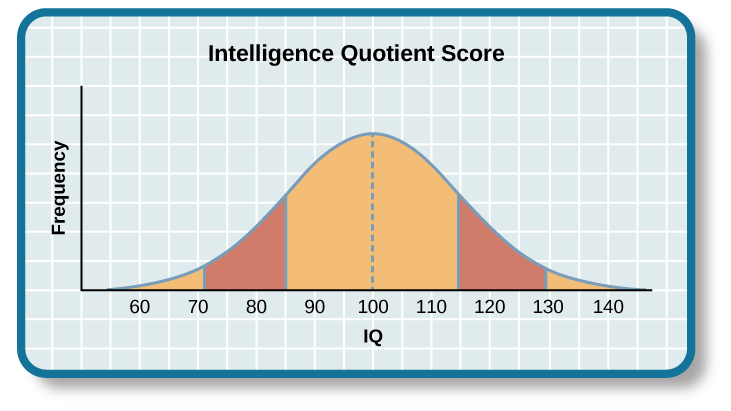

life is short. remember to change bias when new information hits the market. yes I know its amazing how physically exhausting it can be to do nothing or that the guy who sits next trump has reminded us to act upon your iq, rule is simple as this:

-

low iq players will always outperform mid iq participants, this totally relates to the natural tendency of mid players to OVERTHINK. so if you are in this dead zone pls gtfo.

-

what do low and high iq players have in common? they both can stomach the volatility of high betas, as simple as this, some of the best guys that i know doing the research work-load in crypto, will simply lack the will to size up and stomach volatility, this trait is not acquired, you are born with it or not.

conviction > capital

the primary distinction between left and right side of the bell curve resides mainly in positioning and time effort, pareto rule, 80% of our outcomes come from 20% of our actions, this principle can be seen in the majority of fields.

do not try to find a bunch of early plays, focus on high conviction plays and let it roll. focus on plays that are beginning to gain traction and hop onto right before they reach escape velocity, do not be irrational, if market conditions are indicative of a bubble formation, add fuel to the fire.

what does this mean? high iq feel comfortable missing the initial gradual phase of price appreciation which tend to go on over months, rather they focus on capitalizing on the final exponential price discovery phase. DONT DILLUTE YOUR ATTENTION on multiples plays.

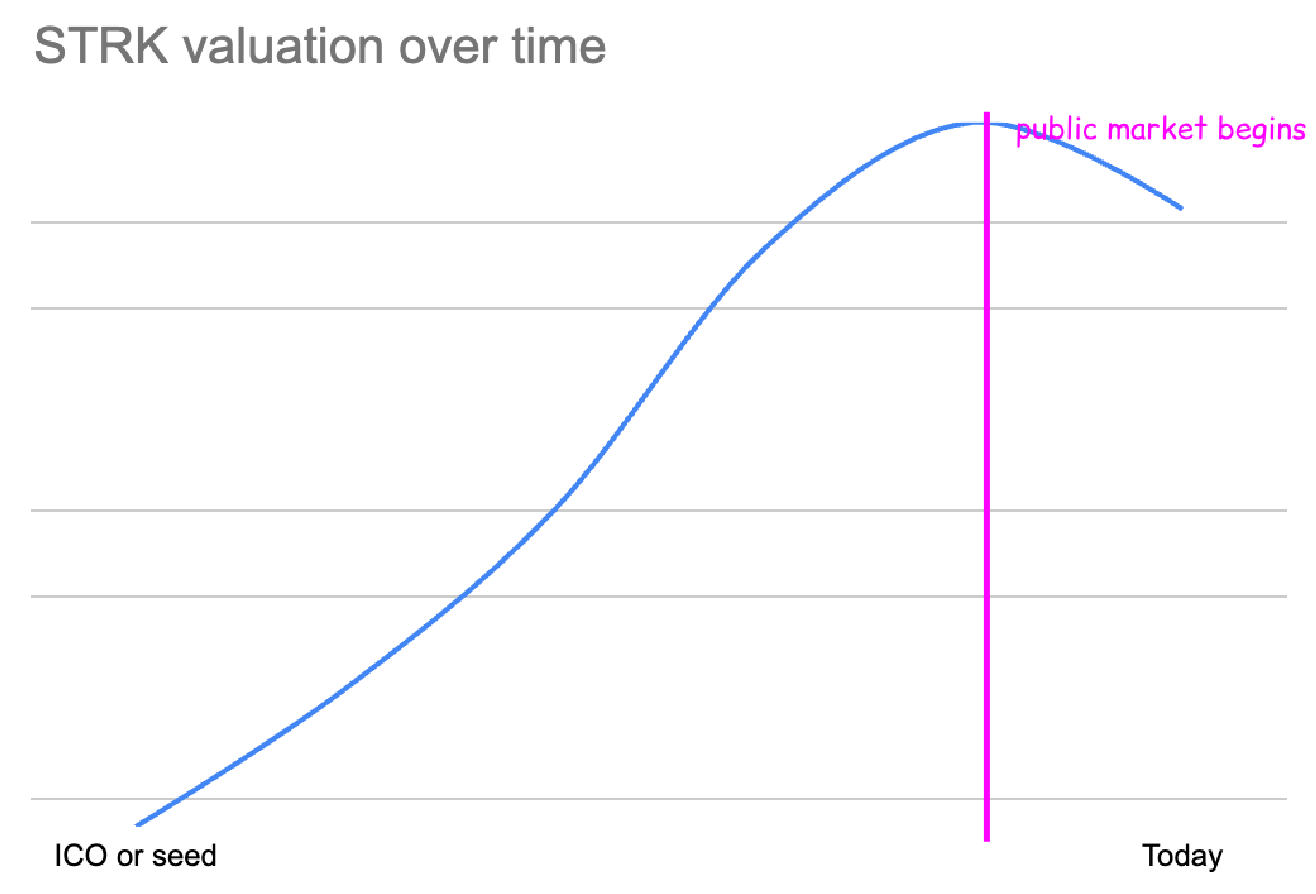

most of the gains for new tokens are now being captured privately

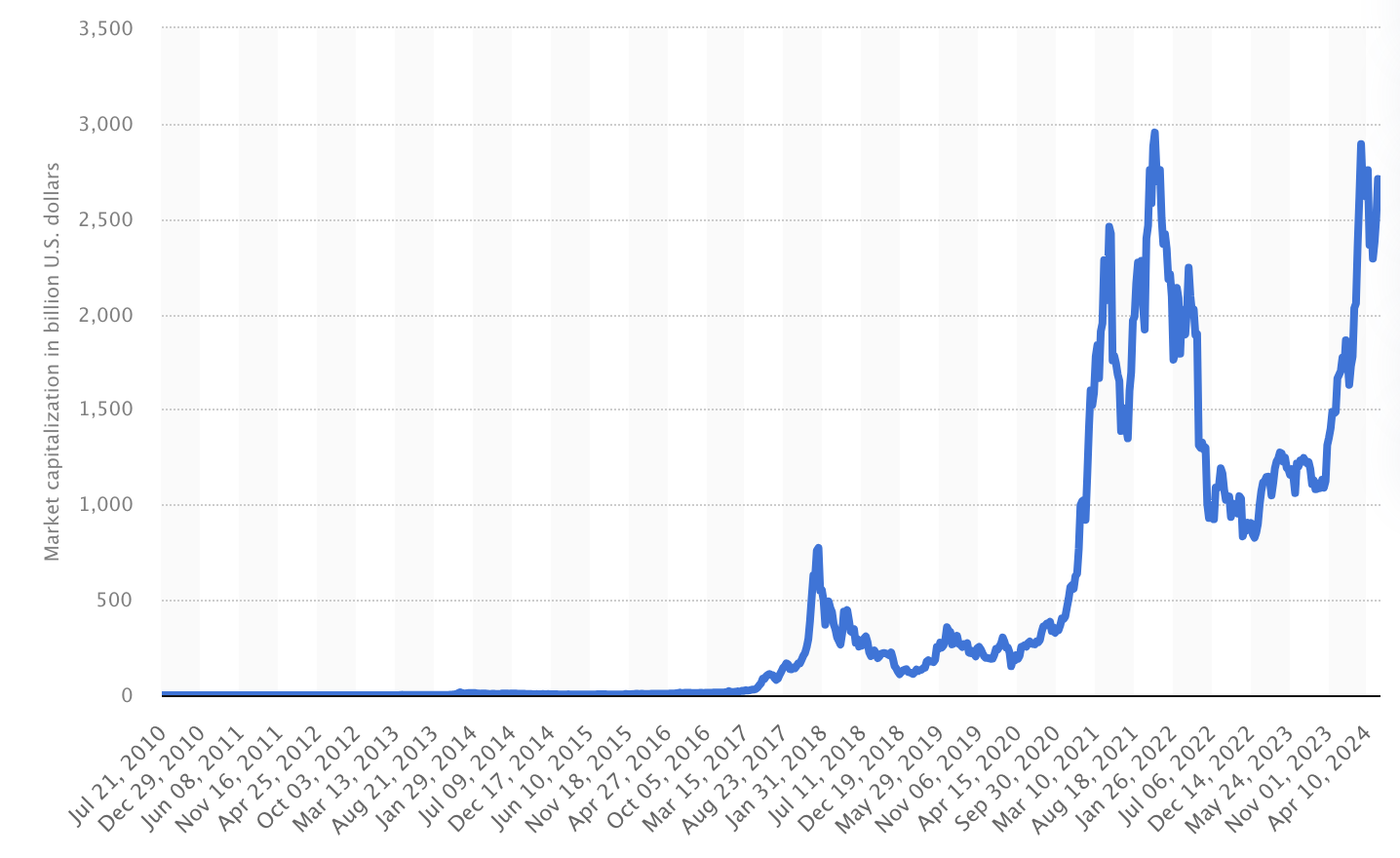

this is not new, if you want to dig deeper just go and read cobie substack, technology markets are rapidly evolving. this is evident in disruptive technologies like ai, which have received more investment in the past five years than in all previous years combine, crypto does not deviate from this we have seen a 22x inflows into the industry in the last five years, with a current 2.7t market cap.

the side effects of this order magnitude shift are mainly predatory and abusive behaviors from vcs, in the modern era majority of assets face and off-makrket price-discovery, captured privately before the tge, yes private markets are taking the whole upside.

market participants should expect that new launch valuations remain high while the market is in demand. it is no longer possible to be “early” in the privatised-gains meta — instead, investors should focus on finding value in the market that others have forgotten or has become mispriced and out of favour.

token buyers should aim to become more sophisticated at evaluating the valuation and supply/demand dynamics of new tokens, identifying which high fdvs are based in supply/demand realities, and which have extremely dislocated phantom markets.

opting out of participating in these markets is voting with capital.

good founders want to build successful projects and they know that market dynamics will interact with their project’s perception. memecoin over-performance and new token launch under-performance have caused readjustments in fundraising and launch plans for future founders.

评论 (0)