Make ICO Great Again

In a time when only professional investors had access to early startup funding rounds, ICOs emerged as an innovative means of crowdfunding, allowing projects to raise funds publicly from retail investors worldwide.

However, due to increasing regulations from financial bodies like the SEC, ICOs quickly faded from the market. As a result, the crypto funding landscape reverted to an exclusive domain, accessible only to top-tier venture capitalists.

In this environment, a new project named Legion has emerged, aiming to capture the strengths of ICOs while addressing their significant drawbacks, all with the goal of making ICOs great again.

This article explores the background of Legion and examines how it could revolutionize the token sale landscape.

1. History of Token Sales

1.1 ICO

Initial Coin Offerings (ICOs) were the earliest popular form of crowdfunding in the crypto space. In the early days of crypto, when regulations were nearly nonexistent, startups leveraged ICOs to raise funds globally, operating in a regulatory grey area. With just an idea or a whitepaper, founding teams could pitch to the public and receive crypto investments, offering project tokens in return.

The first ICO was launched by JR Willett's Mastercoin project, which raised $500,000 in July 2013. Ethereum's 2014 ICO raised 31,000 BTC (worth $18.3M at the time). In 2017, projects like Tezos ($232M), EOS ($4B), Brave ($35M), Kik ($100M), and Filecoin ($257M) successfully raised funds through ICOs. With the ERC-20 standard making token issuance easy, ICOs quickly became a hot topic. In 2017, 875 projects raised $6.2B through ICOs, while 2018 saw 1,253 projects raise $7.8B.

However, due to the regulatory grey area, scams and fraud were rampant, with projects sometimes abandoning development or dumping foundation-held tokens. Recognizing the issues, financial authorities like the SEC began enforcing regulations. The SEC fined EOS $24M for its unregistered ICO and ordered Telegram to pay an $18.5M fine and return $1.2B to investors for its unregistered offering of TON.

Regulations were tightened worldwide, citing securities laws and investor protection, and with the added impact of the 2018 crypto market crash, ICO funding largely disappeared.

1.2 DeFi Farming

Although not a direct token sale method, DeFi protocols like Compound and Uniswap popularized liquidity mining after 2019. Through liquidity mining, users could earn tokens simply by lending or providing liquidity in protocols. This approach, unlike ICOs, didn't involve direct token sales to investors, allowing it to operate with fewer regulatory hurdles.

1.3 IDO/IEO

After the bear market of 2018, the crypto space started to recover in 2019-2020, leading to the development of new fundraising methods like Initial Dex Offerings (IDOs) and Initial Exchange Offerings (IEOs). Although not entirely free from regulatory risks, these methods avoided some regulatory challenges faced by ICOs.

In IDOs, funds were raised through DEXs and smart contracts, rather than directly by the projects themselves. This reduced intermediary risks and made IDOs less susceptible to regulations. Many projects raised funds via decentralized platforms like Pancake Swap, Raydium, and Daomaker.

In IEOs, CEXs raised funds on behalf of projects. With access to large user bases and established regulatory compliance, CEXs offered a safer route for public offerings. Projects like Polygon and Elrond (now MultiversX) held public offerings through exchanges like Binance and FTX.

1.4 NFT and Node Sales

While IDOs and IEOs faced fewer regulatory issues than ICOs, uncertainties remained, making public token offerings burdensome for many crypto startups. To avoid direct token sales, some projects began issuing NFTs and later airdropping tokens to NFT holders. Another method involved selling the right to operate nodes and allowing node holders to mine tokens, offering an alternative way to engage the public.

2. Token Sales Today

Securing funding is crucial when a startup is just getting started. So, what challenges are crypto startups and investors facing in the current fundraising landscape?

2.1 Regulatory Uncertainty

ICOs have faced regulatory action from the SEC and other financial authorities worldwide. Even alternatives like IDOs, IEOs, and NFT/node sales come with considerable regulatory uncertainty. In the U.S., where regulations are particularly strict, most crypto projects now exclude U.S. citizens from participating, even in airdrops, to avoid compliance issues.

2.2 Private Market

Due to these challenges, most projects avoid public offerings altogether, leading us back to a funding environment reminiscent of the pre-ICO era, where early funding is primarily limited to private deals.

Retail investors find it increasingly difficult to access early funding rounds, and even within the VC market, participation is often limited to a few top-tier firms, unlike the open participation seen during the 2021 bull market.

2.3 CEX Dominance

CEXs hold substantial influence over token sales and TGE. Many projects aim to list on top-tier exchanges post-token sale for liquidity and wider investor access. However, listing fees can range from hundreds of thousands to millions of dollars, and listing on Binance, for example, may require significant BNB staking and a substantial portion of total token supply. These high entry barriers make it difficult for smaller startups and can negatively impact tokenomics sustainability.

2.4 Low Float, High FDV

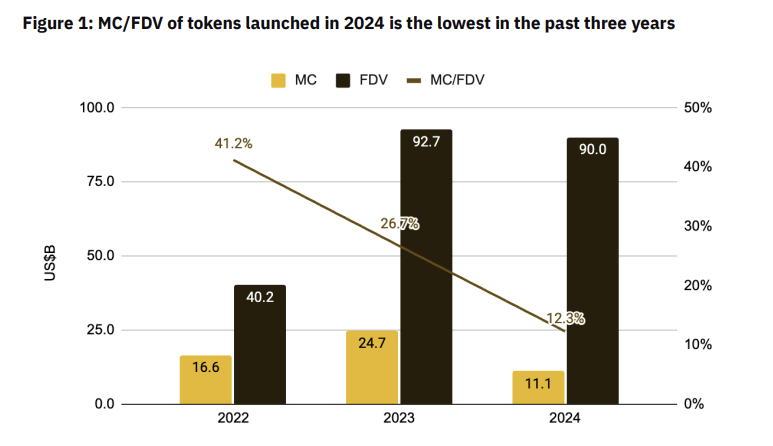

(Source: Binance Research)

The gap between MC and FDV at TGE has continued to grow in the crypto market. These Low Float, High FDV tokens start with low circulating supply, making it easier to achieve high FDV. However, as locked tokens gradually unlock, sell pressure increases, causing substantial dilution for existing token holders.

Why do so many recent token sales and TGEs follow the Low Float, High FDV trend despite its drawbacks? This is largely linked to VC funding. As the crypto industry grew, substantial VC funding inflated valuations. VCs hold significant token shares and are incentivized to list projects at higher valuations to maximize returns at TGE.

2.5 Weak Community

The current token sale and airdrop mechanisms hinder meaningful community building. In early ICOs, investors were aligned with the project’s vision, but later on, they became mostly mercenary investors seeking quick financial gain. Today’s token distribution landscape faces similar issues. Poorly designed token sales and airdrops attract less committed community members. For a project, having token holders who are aligned with its vision is much more advantageous than speculative investors.

2.6 Low Value-Add per Dollar Invested

Funding isn't just about financial support; startups often look to VCs and investors for strategic value-add. For startups, it's beneficial to receive not only funding but also valuable support.

However, there’s a dilemma. Raising significant funds from a few top-tier VCs may limit the value added relative to dollars invested. Conversely, receiving funds from a large number of angel investors might bring more value-add but makes ongoing communication and coordination difficult.

3. Legion: MIGA with MiCA

3.1 Make ICO Great Again (MIGA)

Legion is a transparent, merit-based, and compliant Web3 fundraising platform that leverages both on-chain and off-chain data. It aims to tackle the current challenges in token sales through its core features.

3.1.1 Addressing Regulatory Risk

One of Legion’s primary attractions is its adherence to regulatory frameworks, especially under the MiCA regulation, which allows compliant early-stage token offerings accessible to the public. But what exactly is MiCA?

MiCA, short for Markets in Crypto-Assets, is a regulatory framework established by the EU to oversee crypto assets. Approved by the EU Parliament in April 2023 and published in June, it will be gradually implemented. By June 2024, regulations for asset-referenced and e-money tokens will take effect, followed by rules for crypto-asset service providers (CASPs) in December 2024.

MiCA defines crypto-assets as "a digital representation of value or rights transferable and stored electronically using distributed ledger technology.” It classifies assets into three categories:

-

Utility Token: Provides access to goods and services.

-

Asset-Referenced Token: Maintains stable value by referencing other values or rights, though not necessarily as stable as e-money tokens.

-

E-Money Token: Maintains stable value by referencing a single official currency.

Legion, as a MiCA-compliant CASP, can publicly offer utility tokens to retail and qualified investors. While MiCA regulates in the EU, token sales are also possible outside the EU, with the exception of U.S. investors due to SEC regulations. Support for accredited U.S. investors may be added in the future under Reg D 506(b).

3.1.2 Legion Scores

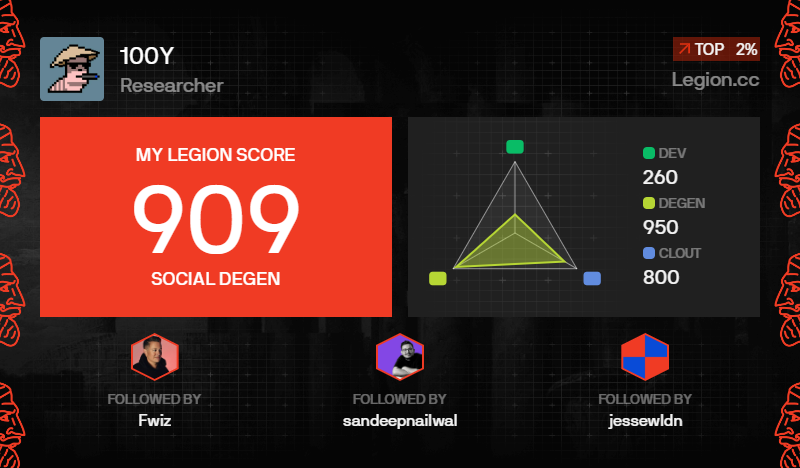

Legion assesses investors’ Legion Scores based on various activities both on-chain and off-chain, ranging from social media (e.g., X) to development (e.g., GitHub). The Legion Score, which ranges from 0 to 1000, provides several benefits:

-

Bot Filtering: By incorporating KYC and activity tracking, Legion can exclude bots.

-

Investor Filtering: Projects can tailor their token allocations to preferred investor profiles, such as high Legion Score holders or active contributors to Github. This selection process helps projects maximize value for invested funds. However, low scores don’t restrict participation; Legion’s model suggests offering broad access with higher caps for high-scoring investors.

-

Encouraging Accountability: Legion Scores reflect investors' post-sale activities, rewarding consistent contributions to projects and discouraging bad actors, thus building a more engaged community.

The Legion Score comprises several subcomponents:

-

Clout Score: Social influence.

-

Dev Score: GitHub activity.

-

Chain Score: On-chain activity.

-

Interaction Score: Engagement with projects and other investors.

-

Endorsement Score: Recommendation level from team, founders, and community.

Score calculation is not based purely on follower counts or GitHub activity but also considers the quality of engagement, following the EigenTrust algorithm for reputation management.

3.1.3 Project Vetting

Legion aims to ensure high-quality project offerings by focusing on project vetting. Initially, Legion staff, led by Delphi Labs, will oversee centralized project sourcing. Over time, partners like Cyber Fund, Alliance DAO, and LongHash Ventures, as well as Legion Scouts (users), will participate in decentralized project vetting.

3.1.4 Project Basecamp & Listing Support

Legion offers valuable support even beyond token sales.

-

Project Basecamp: Post-sale, projects and investors can communicate through a private hub called Project Basecamp. This feature allows closer communication between projects and investors, addressing the issue of limited engagement typical in angel investments. Though not part of the initial version, it will be available later.

-

Listing Support: Legion assists projects with token listings. Given the high entry barriers for token listings, Legion plans to enable trading on multiple DEXs across different blockchains post-launch and eventually secure simultaneous DEX and CEX listings through partnerships.

3.2 Introducing the Legion Platform

https://x.com/legiondotcc/status/1851641778367349024

On October 31, 2024, the Legion platform officially launched. Anyone can sign up easily using an email or Google account, with a crypto wallet automatically created and linked to their account. Through the platform, users can effortlessly invest in projects and track their progress.

By connecting GitHub, Twitter, and Web3 wallets to their Legion account, users can generate a Legion Score based on Dev, Degen, and Clout scores. In the future, additional points will be awarded based on activities within the platform. The Legion Score is expected to provide users with diverse investment opportunities. (P.S. — It looks like I may need to brush up on development skills to raise my Legion Score)

4. Looking Ahead

Having participated in many token sales and experienced various platforms, I believe Legion is close to the ideal model. By adhering to MiCA regulations and mitigating regulatory risk while leveraging Legion Score (based on both off-chain and on-chain data), Legion can help startups build an authentic, engaged community right from the start.

Here are some final thoughts and questions about Legion:

-

Value Creation: Strong communities can positively impact token prices, but in the end, a project’s success depends on its ability to build meaningful value. High standards must be set for projects onboarding to Legion. I wonder if Legion can attract top-tier projects as opposed to the 2nd-tier ones commonly seen on other platforms.

-

Legion Token Governance: The Legion Token’s utility includes rewards for key participants, project token payouts to stakers, Legion Score boosts, and staking for Legion Scout eligibility. These functions align well with the platform’s direction. However, governance is essential for Legion’s growth. Given typically low on-chain governance participation, Legion needs a robust incentive structure to encourage user engagement in governance.

-

Business Model: Legion takes a portion of the funds raised by projects as fees. While CEXs follow a similar model, it’s crucial that Legion maintains fair fee structures for project onboarding.

-

Preventing Abuse: Despite using sophisticated algorithms and concealing them, every platform faces abuse challenges. Legion must quickly detect and adjust for any abusive behaviors on the platform.

-

Social Media Support: Currently, only Twitter is used to calculate Clout scores. It would be beneficial if other platforms like Farcaster and Telegram were supported in the future.

-

Multichain DEX: Legion has announced liquidity across multiple networks at TGE, but the whitepaper doesn’t provide specifics. With limited initial token supply, Legion needs a clear plan to manage liquidity fragmentation across networks.

-

Reputation Migration: In Web3, wallets serve as identity markers but are vulnerable to hacks. If a user’s wallet is compromised, it would be helpful if Legion provided a feature to migrate reputation to a new wallet.

评论 (0)