In airdrop land everyone is more than aware of the large EVM based airdrop projects such as the large funded L2 like zkSync, base, Linea, Zora, and Scroll.

But much fewer people highlight and talk about the tokenless protocols and ecosystems outside of the EVM bubble. Today we are going to look at and give some examples of airdrop that fall within the “Non-EVM” sector of airdrop land.

This edition is going to be referring to a lot of other people guides and content opposed to me writing out tutorials for each project because each of these creators have done a good job of creating guide and there isn’t much point in me just repeating in what they have written and pretending its my own work.

1/ Bitcoin ecosystem - Stacks

Stacks is basically an L2 on top of Bitcoin that is currently the top layer for defi activity on Bitcoin with currently over 55M TVL

Quick summary on stacking DAO by shady go give him a follow on twitter

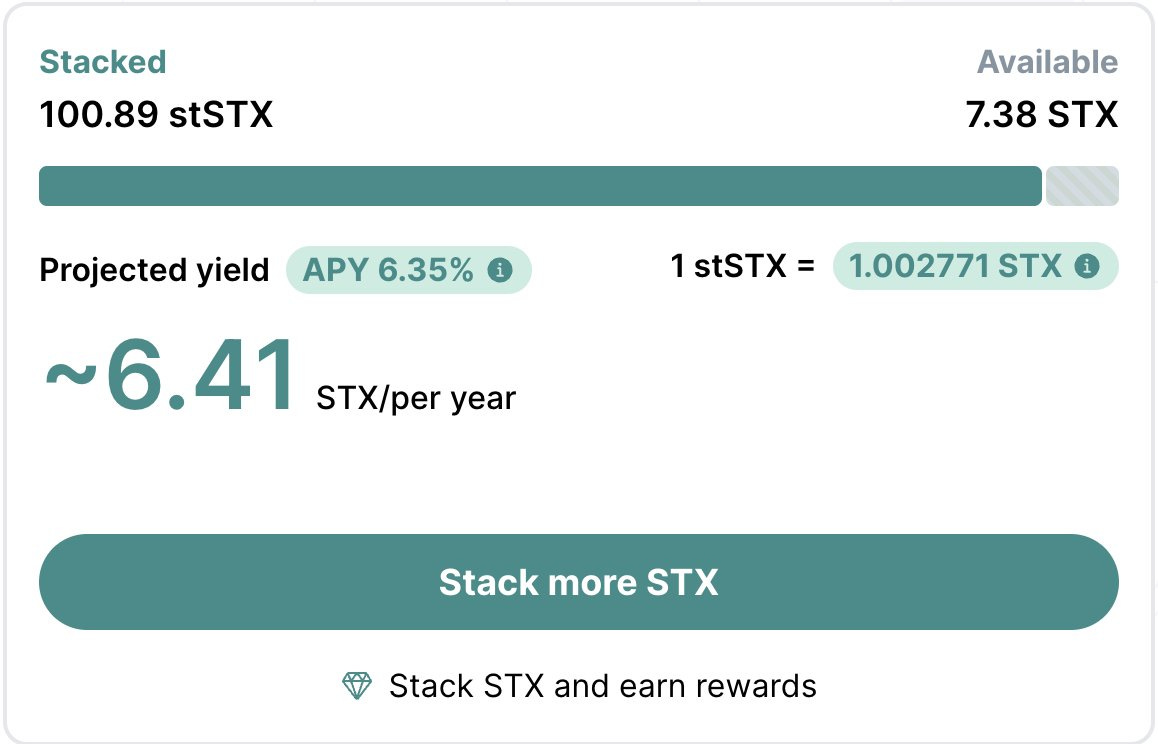

“Staking DAO is the best place for liquid staking on Stacks. It is basically Jito but on Stacks. They released their points system on January 16th and it works as follows:

-

1 point per stSTX per day.

-

1.5 points per stSTX used in DeFi per day.

-

2.5 points per stSTX locked on stableswap per day staked on Bitflow.

You also get a unknown multiplier for holding a Stacking DAO Genesis NFT so I recommend buying one as they are pretty cheap right now (≈20 STX floor).”

This thread by 0xWelfare is also a good guide on how to get started

TLDR - use a bitcoin wallet like Xverse or Leather and get BTC on that wallet

bridge to the bitcoin L2 / stacks

stake Stacks or LP it, bonus points if you hold thier NFt and you get people to use your ref code

Why I like this play - bitcoin L2 = more niche and underfarmed, not super difficult to interact with (there will be perceived difficult because most people wont want to downloads a new wallet and bridge to a new chain which = edge), very passive once you get set up = low maintenance/time cost in the future

2/ Aptos Ecosystem

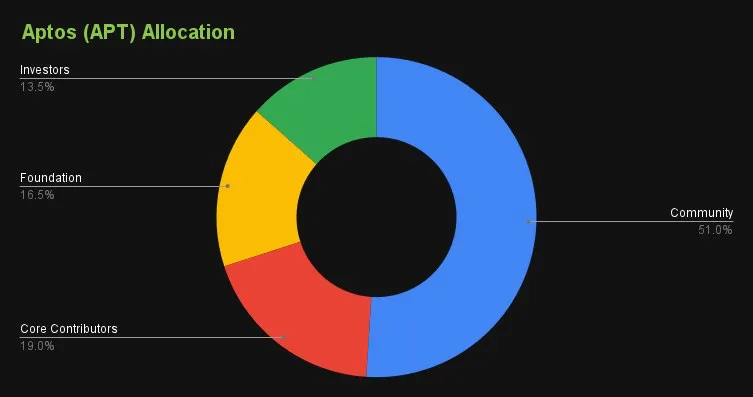

TLDR - “Back in 2022, Aptos airdropped just 2% of their supply to the community, which was around $1500 per wallet. However, a whopping 51% of the tokens are reserved for the community, which can be pretty big considering how underfarmed it is”.

Thesis

Its not unlikely that they repeat the Optimism playbook with multiple additional rounds of airdrop down the line. Its been a while since the first drop and if there is a good-sized airdrop in Round 2 people are going to FOMO and rush into the ecosystem to get in on future rounds

They airdropped to a total of 110k addresses in their first round while the daily active users currently is only 100k

This imo = underfarmed

This great thread by Axel basically goes over everything you need to know about positioning yourself

you dont have to do everything in this guide such as making a multisig but I would do all of the Defi related activities especially with those projects that are tokens (which is basically all of them)

To quote Axel this is basically a summary of what youll be doing

Summarizing the DeFi activities:

-

We swapped and provided liquidity on Liquidswap.

-

We staked APT for governance participation.

-

We liquid staked at Amnis.

-

We lent and borrowed at Aries.

-

We limit traded at Kanalabs and others.

Overall summary

We Bridge via Layerzero

We Swap / LP / Lend & Borrowed

We Staked APT and will participate in Voting

We created Multi SIG

We traded NFTs and minted .apt domain

Why I like this play - Large amount of airdrop to distribute + relatively low wallet competition + not in current attention+ mindshare due to large time gap since last drop = underfarmed

you also get to interact with multiple tokenless protocols on Aptos many of which have hinted/soft confirmed of a future token (Ex. Pontem, using LayerZero bridge to bridge into and out of Aptos)

Gas is also very cheap taking only around $5 in APT to complete the entire route outlined by Axel

3/ Ronin - Staking $ RON

Pixels recently had the token launch after their extensive play to airdrop campaign, many early participants and grinder earned $10k +

But what is even more interesting is that Pixel is partnered and integrated on Ronin the gaming based chain by the creator behind Axie Infinity

Here is a snippet from their recent announcement

@pixels_online team is gifting 20 million $PIXEL to $RON Stakers

10 million right now and the second half in around one month: stay tuned for the exact date and time.

https://x.com/Ronin_Network/status/1759031852227060085?s=20

1 $RON: 183.34 $PIXEL

55 $RON: 675.75 $PIXEL

684.64 $RON: 2,315.77 $PIXEL

8317.4 $RON: 3,955.11 $PIXEL

For reference $ PIXEL launched at around $0.5-0.60 so the minimum amount was worth around ~$100

This event is significant because it now sets prescedent that $ RON stakers acan potentially be eligible for token airdrops from games being launch and support on Ronin

This was reflected in the market from the $ RON staking contract seeing a 4x in activity and the $ RON price rising over 20%

Technically Ronin is EVM compatible but it felt different and niche enough to be included in this list

How to position

1/ Download the Ronin wallet (as always use official links from project twitter to find website and other resources like their official wallet)

2/ Get funds on Ronin, this has to be by either using their Official Bridge or buying on a CEX that has $ RON and then withdrawing directly to your RON wallet

You get 5 free swaps into $ RON/ day so if you don’t already have gas on Ronin when your bridging ETH from ETH mainnet that’s ok

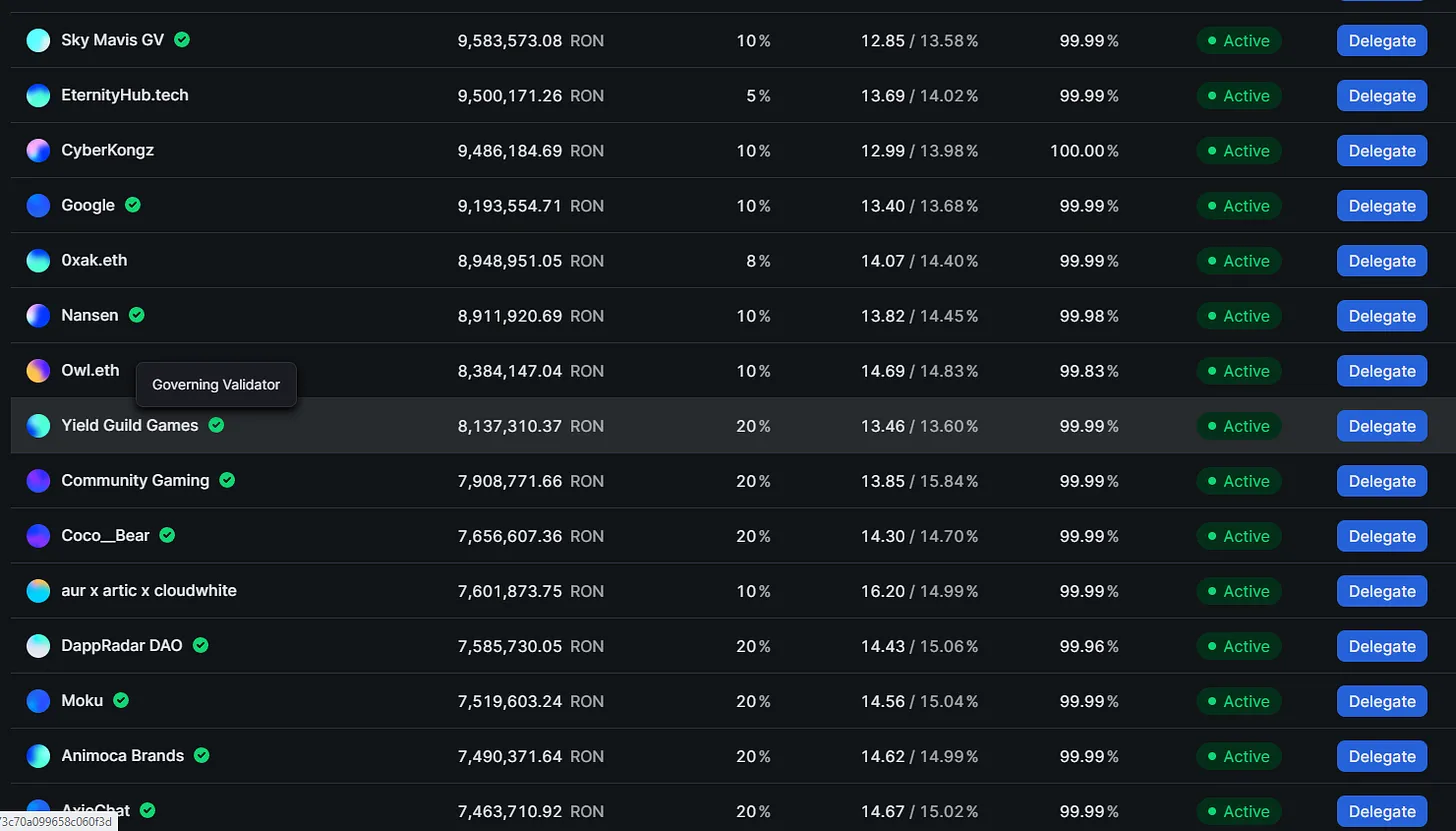

3/ Stake RON with a validator

I pick validators that didn’t charge more than 10% fees and were outside the top 5 and ideally at least one of those was a governing validator (they have a green check beside their name), Sky Mavis GV, CyberKongz, Yield Guild Games, Nansen, Animoca Brands, all seem like decent options

4/ Figure out your staking strategy

the thresholds of staking 1, 55, ~684, and 8317 RON gives us some ideas of potential future thresholds we can use to make our staking strategy

As always I recommend taking a multi wallet tiered approach to hedge your risk or potential outcomes you cant predict

Use this strategy as a guideline based on your situation not a hard rule you have to follow

Low staking wallet - just over 5 RON on 5-10 different wallets

I very surprised that a minimum of 1 RON was used as a threshold and dont expect it to be this low in the future so we use a minimum of 5 instead to front run that

Medium staking wallet - 60+ RON on 5+ different wallet

we front run the last 2 lowest threshold of 55 by and extra 10% of 60+

You could also hedge by making some of these 60+ RON wallets into 100+ RON staking wallets if you want to hedge in case the minimum of 100 RON is used in the future

So “high staking wallet” = 1-2 wallets at 101+ RON staked

For the other thresholds of 684 RON and 6317 RON its not even close to worth it

for over 12x the amount of RON staked at 684 your only getting around 4X the amount of Pixel

and for another 13x RON on top of that for the 6317 tier your getting less than 2x the pixel of the previous tier

Once again we see that’s it always better to have more medium to low wallets than fewer high ranking wallets

Optional - get a ronin ID/.ron username

like ENS but on Ronin only ~$5 per year if your not getting a premium domain with a short amount of characters, good way to potentially stand out as a “high quality” user

Why I like this play - gaming focused = more niche passive staking play + less attention/mindshare compared to the other top “ stake to airdrop” projects like Celestia and Dymension

Ronin has a large amount of funding to onboard more games in the future and have been doing so for the last 1.5 yrs with many games still to hit their main launch that may also come with a token

评论 (0)