Like Ron Burgundy and his milk, endlessly printing money is a bad choice.

Everyone knows this. This is not new news. Yet, we still do it. All the time. Everywhere. And it’s precisely why all currencies, throughout history, have either devalued significantly, or died. Programmable money offers us the chance to create new currencies that act differently. The basic idea here is a “yield-bearing” stablecoin pegged to CPI, that rewards users when inflation rises, to maintain purchasing power. A key part of that is designing a token that while survive for the foreseeable future (decades, etc), thru various market cycles. A fundamental driver of a token’s long-term viability thus lies in how you construct your collateral/reserves that back the token and its inflation-offsetting rewards. Backing stables solely with t-bills or gold or any singular asset opens up holders to undue risk when market conditions inevitably shift. Something more robust is needed.

In an ideal world, you would want a stablecoin backed by a basket of assets with uncorrelated yields that perform in any market environment. The king of this is Ray Dalio, Bridgewater and the famed All-Weather/Risk Parity portfolio, which strives to perform in any market condition, for all time. Years ago I became fascinated with Dalio and read everything I could find online about his market philosophy and investing strategies. With All-Weather, Ray (and lots of other smart people at BW) set out to create an investment vehicle that would maintain its value and perform in all market conditions. It aims to perform in rain, sleet, snow or shine. Stablecoins should act similarly.

To create our “all-weather” stablecoin, one that can last the test of time and maintain its value through any market condition, we should stand on Dalio’s shoulders and build collateral that mimics the all-weather fund.

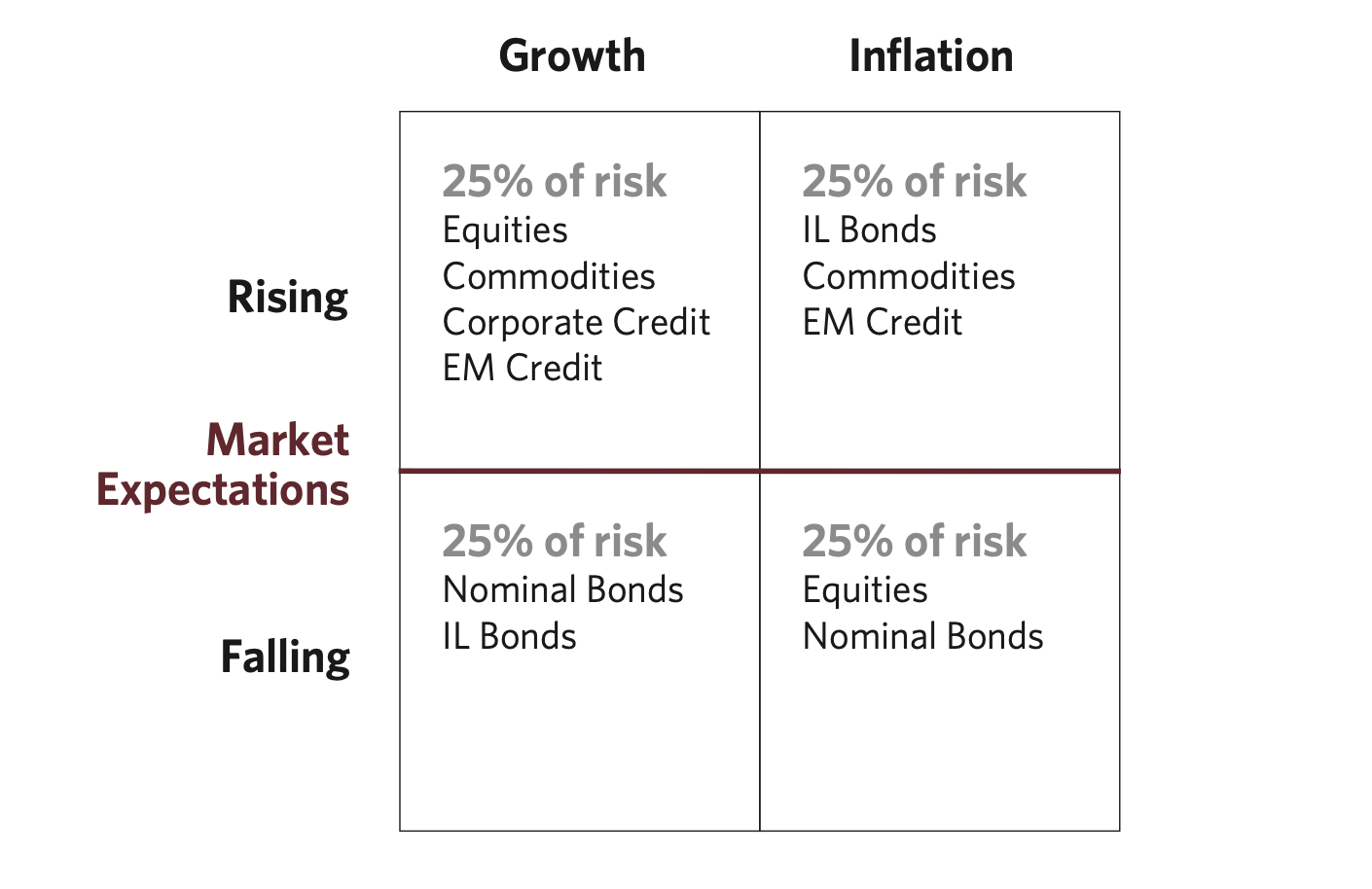

Here’s how we do that:

All Weather Stablecoin Collateral

Keeping it high level, the basic idea is fairly simple: diversification. Don’t just park stablecoin collateral in t-bills. Rather, spread out the risk amongst different asset classes that perform in various environments. Dalio’s “special sauce” is in his view of the markets (i.e. the economic machine), how markets move through cycles and then how different assets perform better/worse based on where we are in the cycle. Dalio believes (and I agree) this is driven by the creation and contraction of credit and money.

There are 2 primary cycles:

(1) the Short Term Debt Cycle (8-15 years), and

(2) the Long Term Debt Cycle (50-75 years)

Throughout each cycle there are periods of growth, contraction, inflation and deflation. Bridgewater invests according to what stage of the cycle we are in. Problem is, you probably can’t predict what will happen, when. Or what stage of the cycle we’re in. At least, I know I can’t. So, let’s not even try.

Instead, we can balance our risk across different asset classes whose fundamental drivers are best suited to different stages of the cycle, defined as:

-

Rising Growth (good for equities, credit, commodities and emerging market debt);

-

Falling Growth (good for nominal and inflation-linked bonds);

-

Rising Inflation (inflation-linked bonds, commodities, EM debt); and

-

Falling Inflation (nominal bonds and equities).

Onchain Part:

This is where is gets fun. We can create a close enough representation of the above balanced portfolio for our collateral with a suite of onchain RWAs. Up until recently, this was not possible. But today, we can now buy a basket of tokenized treasuries, real estate, gold and stocks. The specific construction of the basket will weigh heavily towards the safest of assets, but also add diversification for token holders with onchain stocks and gold.

And there you have it.

An inflation resistant stablecoin, backed by an “all-weather” basket of onchain RWAs.

Super simple, right?

Obviously, not! This is just a high level overview, and much more would be needed to bring this to life. But this is the way to create money that maintains its value and provides yield to offset inflation in any market environment.

Anything else will devalue and die.

评论 (0)