Introduction

Decentralized finance (DeFi) has transformed the financial landscape by enabling open and permissionless access to financial services. Traditional lending protocols, while effective, often leave room for improved capital efficiency and risk management. This article introduces a new lending protocol model that integrates maturity features and leveraged liquidity management to address these gaps. By allowing users to leverage their deposits and participate in liquidity provision, our model aims to maximize utility and returns for both lenders and liquidity providers.

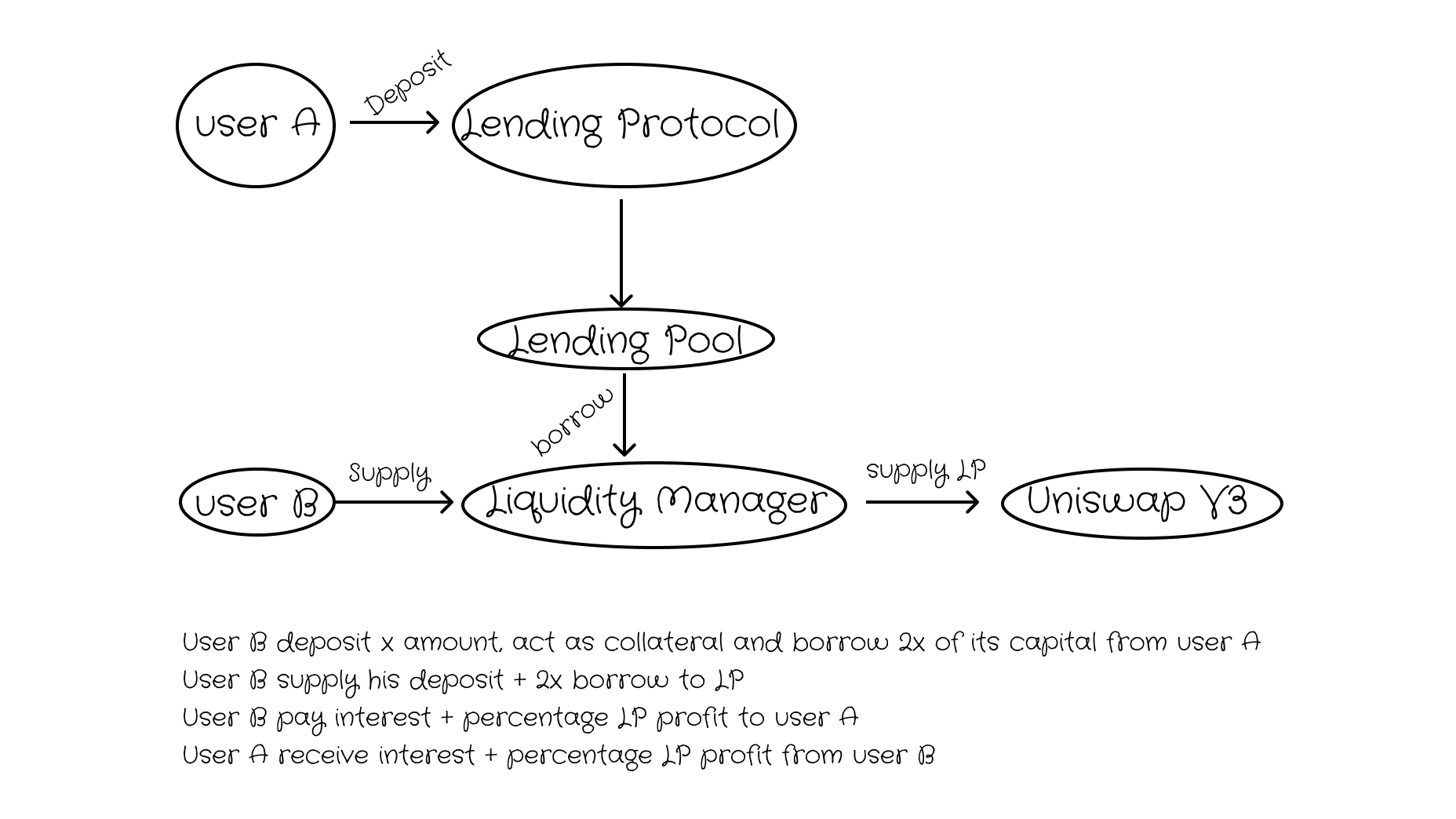

The Idea

The core idea is to give more use cases to idle funds that are being lent out. By allowing these funds to be borrowed by liquidity providers (LPs), we can use the initial deposit as collateral. For example, a user deposits $100 and leverages it to 2x. If the user selects the ETH/USDT pair, they can provide liquidity worth $200 in total, but with concentrated liquidity, this might not be in a 1:1 ratio. The exact distribution will depend on the current prices and the range within which liquidity is concentrated.

Operational Mechanics

-

User A deposits funds into the Lending Protocol:

- The deposited funds go into a lending pool.

-

Lending Pool allocates funds to the Liquidity Manager:

- The Liquidity Manager borrows funds from the pool to facilitate leveraged liquidity provision.

-

User B acts as a Liquidity Provider (LP):

-

User B deposits a certain amount, which acts as collateral.

-

User B then borrows additional funds (2x of their deposit) from the lending pool.

-

-

Providing Liquidity on Uniswap V3:

-

User B supplies the borrowed funds along with their own deposit to a liquidity pool, e.g., ETH/USDT on Uniswap V3.

-

Due to concentrated liquidity, User B can specify a price range where they want to provide liquidity, optimizing for higher fees.

-

-

Profit Distribution:

-

User B pays interest on the borrowed amount and shares a percentage of the liquidity provision profits with User A.

-

User A receives both interest and a share of the LP profits.

-

Benefits

For Lenders (User A):

-

Increased APR due to additional earnings from liquidity provision profits.

-

Stability from locked funds, as lenders cannot withdraw anytime they want.

For Liquidity Providers (User B):

-

Ability to leverage their positions, maximizing potential profits.

-

Access to additional capital to provide liquidity, enhancing market efficiency.

Risks and Mitigation

Risks:

-

Liquidation: LPs must actively monitor their positions to avoid liquidation. If the position value drops below a certain threshold (e.g., 80% of the combined collateral and loan value), liquidation occurs.

-

Active Management: Constant monitoring and adjusting positions are required.

Mitigation:

- Redistribution of Liquidated Positions: Liquidated positions are redistributed among lenders, mitigating their risk and ensuring a fair distribution of assets.

Comparison with Traditional Models

Normal Borrowers:

- Provide only interest payments to lenders.

Leveraged Borrowers:

-

Contribute both interest payments and a percentage of their liquidity provision earnings (e.g., 10%) to lenders.

-

Offer higher APR and more efficient use of idle funds.

Conclusion

Integrating a lending protocol with leverage liquidity providers presents a compelling way to enhance capital efficiency and provide stability within the DeFi ecosystem. By allowing idle funds to be utilized for leveraged liquidity provision, both lenders and borrowers stand to benefit significantly. We welcome feedback and further discussion on this innovative model.

评论 (0)