The testnet of Goemon, a platform dedicated to trading cryptocurrency options, is now live. On Goemon, you can trade options contracts with some of the leading crypto assets on the market.

The platform stands out for its ability to provide returns from the DeFi (Decentralized Finance) market in conjunction with options trading.

What is an option?

An option is an investment contract signed by the involved parties. An option contract states that the buyer has the right to exercise the purchase or sale of a certain asset by a certain future date at a pre-established price.

For example, suppose the price of a particular cryptocurrency is $90. Investor John believes that the price of this cryptocurrency should appreciate. With this in mind, he buys a call option at a strike price of $70. For this, he paid a premium of $5.

If the price rises to $100 by the expiration date, John can exercise the option to buy the cryptocurrency for $70 and make a profit.

The options market is considerably more complex than the conventional spot market. To trade in this market, it is important that the investor has financial knowledge and really understands how to structure a position.

The options market can be used both as a way to hedge against high volatility and to leverage positions. This depends on how the investor wishes to operate.

Read More: Call Option Beginner's Guide

DeFi yields

The DeFi market has grown exponentially over the years. The native protocols of the DeFi market are able to provide native yields for its operators.

The financial mechanisms that promote yields in the DeFi market are similar to those of the traditional market. However, all of this is done in an automated way, without the need for a central authority.

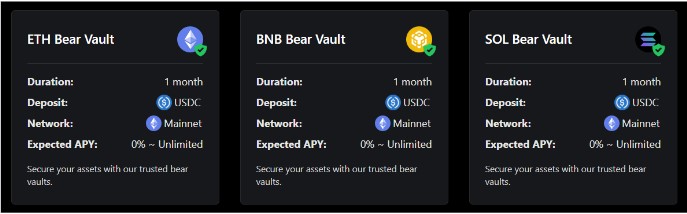

In particular, Goemon is able to provide native yields by integrating DeFi protocols. Several DeFi protocols are being analyzed for integration into Goemon, but Pendle stands out.

Pandle is able to provide yields through a structure similar to the zero-coupon bonds found on the traditional market. Pendle offers an innovative approach by allowing users to earn income, but in the DeFi environment.

A zero-coupon bond is usually purchased at a discount and the return is obtained by selling it at full value at expiration. The DeFi version of this mechanism on Pendle allows investors to buy cryptoassets at a lower price than the subjacent asset.

Structuring these mechanisms can certainly be complex for average users. However, this is made easier with Goemon, which is able to unite the options market with the potential of DeFi yields.

About Goemon

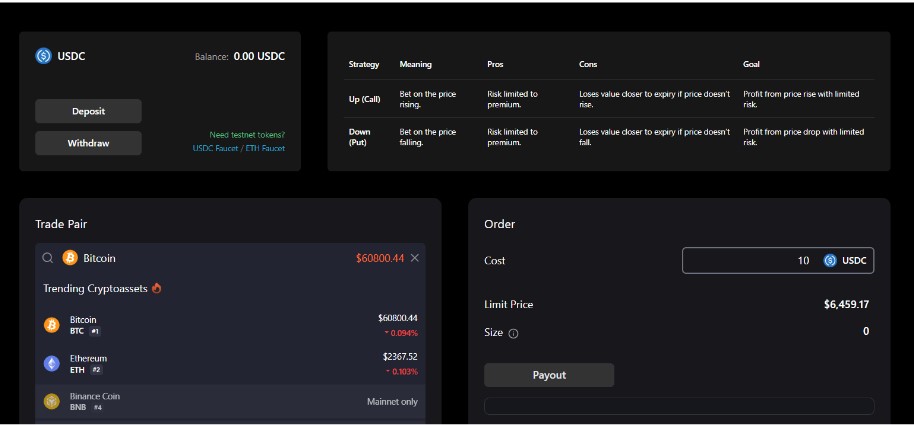

Goemon provides a platform for trading cryptocurrency options with a simple and intuitive user interface, as can be seen in the image below. In just a few trades, you can familiarize yourself with the platform's tools.

Access Testnet and test the main functionalities.

Find out more about the project:

Twitter: https://x.com/goemon_xyz

评论 (0)