TL;DR Version

-

The primary cause of the recent decline is the panic triggered by the German government’s Bitcoin sell-off and the Mt. Gox compensation.

-

The German government will continue selling until all holdings are liquidated, which is expected to conclude by next week at the latest.

-

The impact of the remaining sell-off by the German government is unlikely to cause further sharp declines. Bitcoin prices will fluctuate at current levels until the event concludes.

-

This is a one-time event with no long-term implications for future market development.

-

Despite the imminent resolution of this impact, attention should be given to changes in ETF buying behavior and its effect on buffering capacity.

What Happened to Bitcoin on July 5th?

Since the beginning of July, Bitcoin’s price has been on a downward trajectory, even falling below $54,000 on July 5th. Although it quickly rebounded above $58,000 due to strong market expectations, the downward trend resumed, and prices hovered around $57,000.

The market’s panic, reflected in significant declines over the past few weeks, has led to a 11% drop in Bitcoin last week, with ETH and SOL also experiencing substantial losses. This panic has sparked discussions about whether the bull market’s peak has passed. This article aims to clarify the main reasons for the recent decline and provide analysis and interpretation of future developments.

German Government’s $3 Billion Bitcoin Sell-off

The recent decline is mainly driven by two factors:

-

The German government’s massive Bitcoin sale.

-

Compensation for the decade-long Mt. Gox Bitcoin theft incident.

Due to the length of the article and the urgency of the situation, this analysis will focus on the German government’s Bitcoin sale.

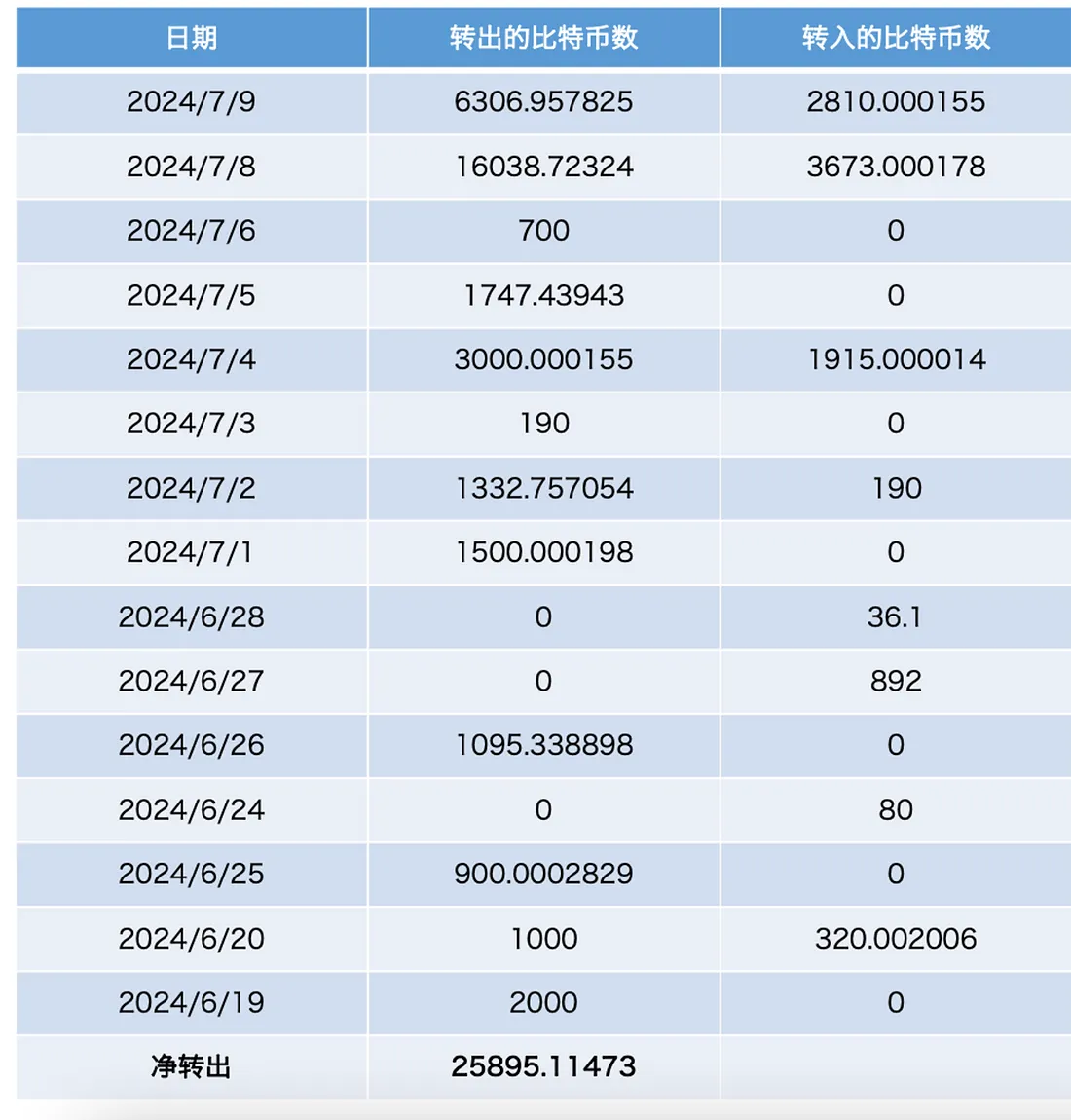

On-chain data from Arkham shows that the German government began transferring Bitcoin to exchanges on June 19th and continued selling, with nearly 27,000 Bitcoins transferred by July 10th. The government still holds approximately 22,846 Bitcoins, worth around $1.3 billion.

The story traces back to the early 2000s, before the emergence of streaming sites like Netflix. A Berlin real estate dealer collaborated with a Polish programmer to develop the piracy site Movie2k.to, serving English and German-speaking regions. Operating between 2008 and 2013, it was one of the top 20 most-visited sites in Germany before being shut down in 2013. The site’s operators used their earnings to purchase large amounts of Bitcoin at costs below 100 euros per coin.

In January 2024, the German Saxony state official website announced the seizure of nearly 50,000 Bitcoins from the Movie2k.to operators. These Bitcoins, transferred to a government wallet provided by the Federal Criminal Police Office, were handed over by the operators after their capture. On-chain data confirms that 49,857 Bitcoins were transferred to the German government’s address on January 16th, worth approximately $2.2 billion at the time.

After holding these Bitcoins for several months, the German government began selling them on June 19th, causing market prices to decline.

Future Market Trends Analysis

Given the market turmoil caused by this incident, German MP Joana Cotar has repeatedly called for the government to halt the sell-off and suggested converting the remaining Bitcoins into “strategic reserve funds.” Will the government stop selling the remaining $1.3 billion worth of Bitcoins?

This is not the first time Germany has seized and disposed of Bitcoins in economic investigations. In August 2020, the Saxony Integrated Investigation Unit (INES) announced the seizure of 2,700 Bitcoins from a Movie2k operator, which were later sold for approximately 38.6 million euros in 2023.

Looking at Bitcoin’s historical prices, it can be inferred that the German government sold all the seized Bitcoins within six months at an average price of around $15,000 per coin. According to Saxony’s local media reports, seized assets can be disposed of after a corresponding judgment, with proceeds included in the national budget. Therefore, disposing of these Bitcoins is a normal process with incentives for local governments and police.

Based on this information, it is concluded that (1) the German government is likely to sell all seized Bitcoins; (2) the sell-off pace will not slow down due to market turmoil but may accelerate to achieve an “emergency sale” until all Bitcoins are sold; (3) similar future incidents will take several months to process, depending on the judgment speed.

How Long Will the Remaining Bitcoin Sell-off Last? How Significant Will the Impact Be?

The author predicts that the German government will complete the sell-off by July 14th at the earliest, using both exchange sales and OTC methods to minimize market impact.

On-chain data shows that the Saxony police have been transferring BTC to Coinbase, Kraken, Bitstamp, and likely B2C2 since June 19th. As of this writing, the government has sold nearly 27,000 Bitcoins in three weeks, completing more than half of the sell-off. The government is speeding up the sell-off, and the primary counterparties have increased from four to six. The author estimates the sell-off will be completed by next week at the latest.

Impact Analysis

The author believes the German government’s Bitcoin sale is a one-time event, with the impact largely dissipated.

The event’s impact is twofold: market sentiment and the actual effect of the sell-off volume.

Market Sentiment Impact

Since June 19th, Bitcoin has fallen about 12%, with a maximum drop of 17% on July 5th. The government’s non-linear selling strategy has exacerbated panic, but daily transfers to exchanges are limited to about 10,000 Bitcoins, worth no more than $600 million. The daily trading volume of Bitcoin, ranging from tens of billions to $100 billion, should absorb the government’s daily sell-off.

The July 5th decline was driven by the dual panic of Mt. Gox compensation and the government’s sell-off news. However, after July 5th, the extreme fear did not materialize, and market sentiment has recovered. Although the government has increased its selling pace, the market’s reaction has stabilized.

Sell-off Volume Impact

The $3 billion in Bitcoin held by the German government is digestible by the market. The government must sell gradually, reducing market impact. The use of OTC methods to assist liquidation further minimizes the impact.

Currently, the government has transferred Bitcoins to institutional traders like Flowtrades and Cumberland, indicating a shift from direct exchange sales. The remaining $1.3 billion in Bitcoins, with 1/3 to 1/2 sold OTC, would leave a market impact of $600 million, with a daily sell-off impact of $100-$200 million.

Conclusion

In conclusion, the author predicts the German government’s Bitcoin sale will end shortly without prolonging the process. The sell-off impact is absorbable by ETF inflows, and the incident does not alter the market’s fundamentals. The approval of ETH spot ETFs, interest rate cuts, a potential shift in US government crypto policy due to elections, and potential policy easing will continue to support Bitcoin’s growth expectations.

However, this event serves as a warning to Bitcoin investors. Like the Movie2k operators, others may hold large amounts of low-cost Bitcoins. Other governments also hold significant Bitcoin reserves. According to Arkham, individuals hold 57% of the 21 million Bitcoins, while governments hold 2.7%, with the US government holding over $12 billion and the UK government holding over $3.3 billion. Crypto investors should monitor on-chain dynamics and analyze holding addresses to prepare for potential black swan events and seize opportunities from crises.

References:

-

Anklage gegen Betreiber der illegalen Internetplattform movie2k

-

Nach Beschlagnahmung in Sachsen: Was passiert mit den 50.000 Bitcoins?

The content of this article is for informational purposes only and does not promote or endorse any business or investment activities. Readers are advised to strictly adhere to the laws and regulations of their respective regions and refrain from participating in any illegal financial activities. This article does not provide any trading access, guidance, or issuance channel direction related to virtual currencies or digital collectibles, including their issuance, trading, and financing.

Without permission, the content of 4Alpha Research is prohibited from being reproduced or copied. Violators will be pursued for legal responsibility.

评论 (0)