Whew, another week in the world of crypto. As always, a lot happened, making it challenging to cut through the noise and spot trends early. The fast-paced nature of the cryptocurrency market brings constant changes, from new meme trends and price fluctuations to regulatory updates, technological advancements, and significant market events.

It can be overwhelming to keep up with everything, so what I typically do is look at on-chain data to identify potential trends, then I turn to twitter to find social evidence that supports my narrative thesis, and vice versa. So with that, lets take a look at what I’m seeing in the market:

Solana vs. Base summer

So towards the end of last month, I started seeing more and more posts spotlighting Base and its ecosystem for summer. The key developments that fueled this narrative appear to be the Coinbase Smart Wallet integration and the ETH ETF, which is expected to improve retail onboarding to Base and boost value to Ethereum’s ecosystem.

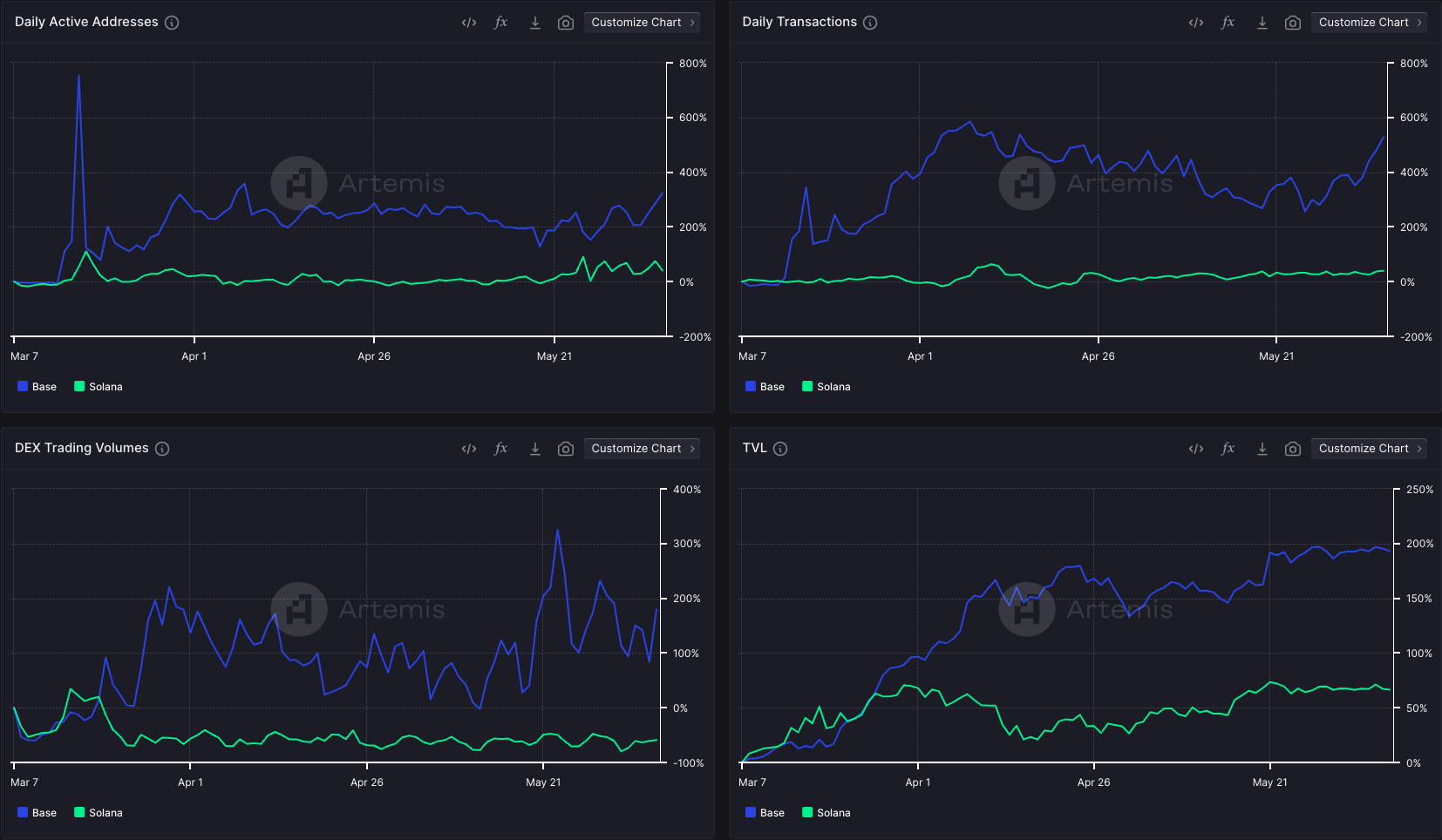

If we take a look on-chain, we can see that Base has experienced a greater percentage change in DAU, daily transactions, and DEX trading volume compared to Solana. In other words, despite Solana having higher absolute figures, Base is showing a faster rate of growth, especially towards the end of May.

Personally, I think both ecosystems will perform well throughout the summer, but one major pain point with Solana is the sheer number of tokens being minted each day. There are over 10,000 tokens being minted each day in Solana, which means that liquidity is fragmented that much more.

For Base, it seems like liquidity is more concentrated to a handful of higher quality projects and there is just less choice overload bias.

I don’t recommend full porting to Base, but I think it is a good time to move some funds, if you haven’t done so already, and pick up a few good memes and high-quality projects. I expect to see more and more retail users onboard to Base over the summer, and memes are always a great vehicle for retail liquidity.

评论 (0)