Crypto often talks about how it’s defining the evolution of work, after all it’s the future of finance! That seems to imply we can compare the industry to web2’s rise. However, at the same time it began as an exercise in self-sovereignty which it still holds in high regard. So perhaps it makes more sense to view the space as an emerging market?

If so, we can expect that the goal should be to ramp up “exports” to the rest of the market. To get a sense of how this worked historically, we can look to recent cases of emerging markets thriving and see what lessons can be gleaned. What we come across is some combination of trade and capital barriers, that act as levers for industrial policy. Let’s focus on the past 50 years in East Asia.

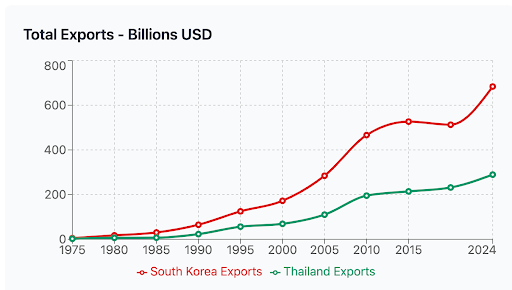

In South Korea, the government took a strong hand in guiding its industrial growth, with strict capital controls in the 1960s-80s. The result speaks for itself: picture rice paddies changing into urban centers within 20 years. It liberalized gradually, once it was becoming a developed economy. Korean exports have been the envy of many a trade nationalist, sporting a 50% trade balance with the US.

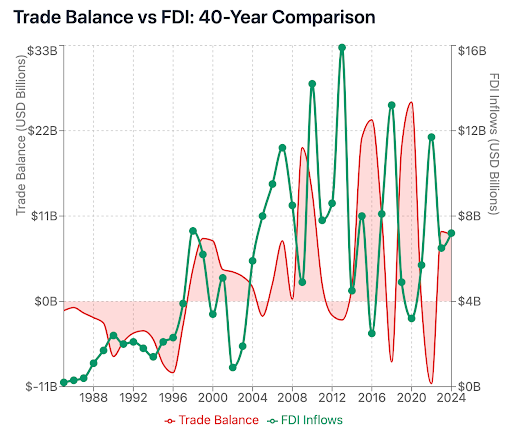

Now take a look at Thailand in the following chart. We see mostly a negative trade balance until the mid 90s, when investment also began to take off. While exports were rising, the FDI inflow took off even faster even surpassing Korea at one point. It basically was liberalizing all at once, responding to global pressures to open up, buttercup. The result was a devastating debt and currency crisis in the late 90s, and Bangkok was patient zero for the financial contagion.

Still today, we see South Korea with higher exports, even with fewer people. Meanwhile, Thailand remains volatile. Of course there are many differences between these two but clearly the controls served some purpose for their foresightful planners in those early years?

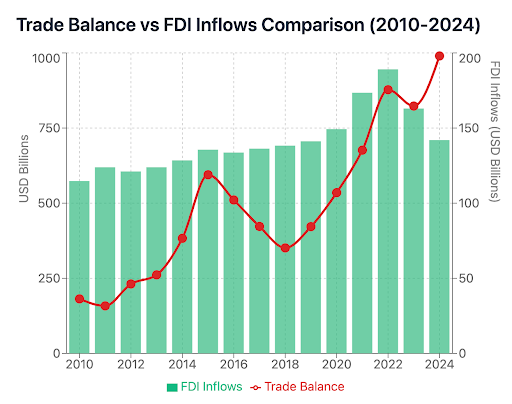

Plus, we’ve been ignoring the king of them all: China. The CCP’s legendary controls have kept FDI mostly in check, while simultaneously creating the conditions for the largest export engine the world has ever seen. So why are they so effective?

One effect of restricting removal of capital is that it ensures the investors want to be in it for the long term. If investment outpaces development of high value exports, we get rampant speculation in real estate, which can’t be sustained w/o more cash flows from somewhere. To this day, many countries have citizenship req’ts to own property.

This commitment makes it harder to pull out capital, which can lead to the currency getting crushed by the stampede. Most importantly, they can cause investment to be directed where the leaders think it will most benefit their country. Western capitalism argues that the markets can always do better, but one cannot dispute they tend to be somewhat shortsighted.

There are downsides as well, as where banks with good connections can get in easier. In general, the authorities can exert substantial influence, because national capital controls are by definition centralized.

In crypto, we believe in freedom and decentralization, so clearly we oppose blanket bans or obstacles. We can still ask about what makes sense on an organizational level, and evidence is mounting that coding restrictions into token contracts will be beneficial in many ways.

What we’ve seen so far is the pure unrestricted model, with freely trading tokens whether or not there’s an actual cash flow (ha!) or even product behind it. Every so often, this brilliant setup leads to bursts of speculation and brutal meltdowns, with digi-wealth evaporating as fast as memes fly around. This, shall we say, is not an ideal growth-centric scenario.

One (and we might soon start to say only) solution is to cultivate reputational tokens to take their place. For a token to be considered reputationally symbolic, it will by necessity be restricted to immediate buying and selling. Otherwise, it is to be considered money-like, and taking on the associated properties of money. In fact, we should call on-chain reputation by some non-token term, and this writer proposes emblem as the equivalent term.

Here then, we see how an organization can set up capital controls for itself, while still managing its own internal capital freely and openly. It does so by coding its own restrictions, like which internal contracts the reputational emblem is allowed to move between. In effect, it allows for pursuit of long term goals that create the most value for the rest of society, not just ourselves.

评论 (0)