In the third quarter, the crypto market largely moved sideways. Bitcoin’s price rose by 5.7%, from around $62,000 to $65,600, fluctuating between $54,000 and $68,000 over the past three months. In contrast, Ether, the second-largest cryptocurrency by market capitalization, saw a 22.6% price drop during Q3, settling around $2,650. Some market participants attribute this decline to the modest launch of the Ethereum ETF, as unlike the Bitcoin ETF, Ether did not experience the anticipated price boost. Potential reasons include declining on-chain activity and persistently high transaction fees on the Ethereum blockchain.

BlackRock attributes the subdued interest from institutional investors to a lack of awareness and growing competition from alternative Layer-1 platforms like Toncoin, Tron, and Solana. Nonetheless, Ethereum remains a leader in smart contracts, boasting the highest number of applications and developers, the highest 30-day average revenue from fees, and the most assets locked in smart contracts. Despite lower-than- expected inflows into the Ethereum ETF, it quickly surpassed the $1 billion mark in assets under management — a milestone that typically takes years for most ETFs to reach, according to BlackRock.

In Q3 2024, four key events stand out as having influenced recent market dynamics and are likely to shape the future. First, the former giant exchange Mt. Gox, which ceased operations in 2014, began its initial partial repayments to affected customers. This led to heightened volatility in July, with noticeable price drops. Overall, about 142,000 Bitcoin are expected to be repaid to affected customers by October 2025.

The interest rate hike in Japan, announced on July 31, 2024, added further volatility to the capital markets and significantly weakened the yen carry trade. As a result, certain traditional market indices and Bitcoin’s price temporarily dropped by up to 20%. Nevertheless, prices largely recovered in the days that followed.

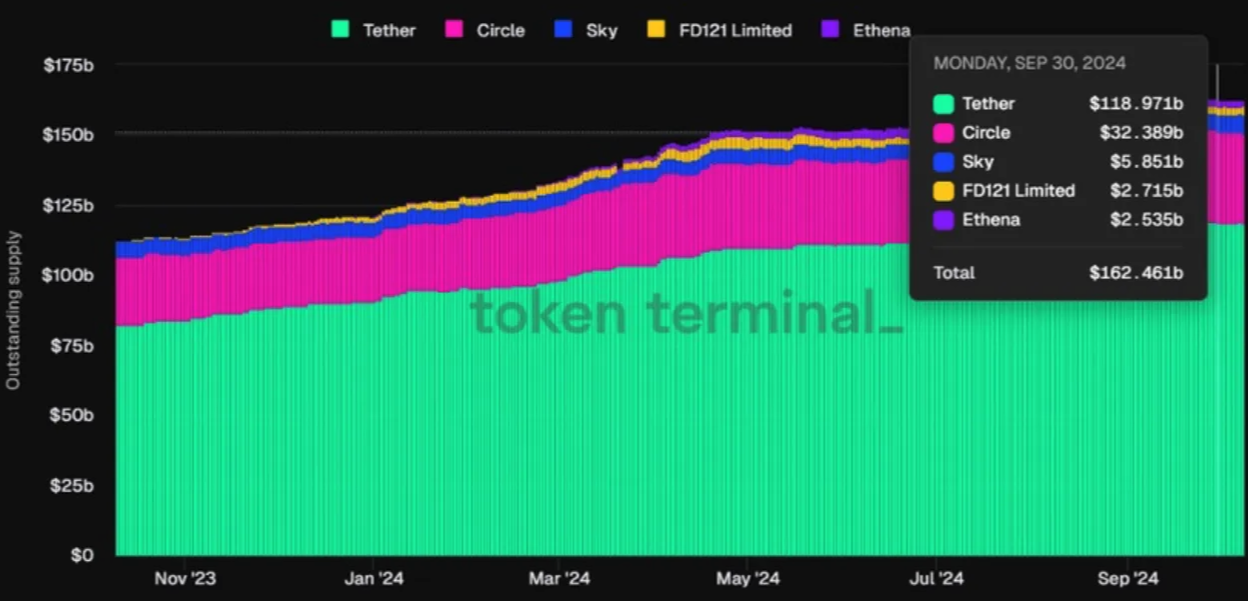

Tether Holdings, the company behind the stablecoin Tether (USDT), reported an impressive record profit of $5.2 billion in the first half of 2024. By comparison, BlackRock — the world’s largest asset manager — earned $5.5 billion in profit for the entirety of 2023. Tether attributes its success to targeted investments in U.S. Treasury bonds and Bitcoin, achieved with a lean team of fewer than 100 employees. By the end of Q3 2024, Tether’s managed assets reached a remarkable $119 billion.

Meanwhile, Ethena announced plans to develop a new stablecoin backed by a highly liquid BlackRock fund, highlighting a trend toward more diversified stablecoin options. A chart illustrates the rapid increase in total global stablecoin issuance, with Tether retaining a dominant lead, followed closely by competitor Circle. Year-over-year, the circulating supply of stablecoins has surged by over 40%, representing more than a $50 billion increase.

In September, the Federal Reserve announced its first interest rate cut in four years, reducing rates by 50 basis points. This move spurred price increases, particularly across technology stocks and cryptocurrencies.On the on-chain activity front, several noteworthy developments emerged. In the third quarter, the Layer-2 platform “Base” saw remarkable growth, with monthly active users rising from 7.5 million to 22.4 million (+198%). This surge solidified the Coinbase-developed blockchain’s lead among Layer-2 solutions by user count. Meanwhile, its main competitor, Arbitrum One, experienced a significant decline in users (-65.5%), though it remains the leader in transaction volume. During this same period, Base also boosted its daily transactions to 5.1 million (+59%), further establishing itself as the top platform in this metric.

VC Investments in Blockchain and Crypto

In Q3 2024, venture capital investments in the blockchain and crypto sectors totaled $2.4 billion across over 320 funding rounds. After a strong July ($1 billion) and August ($785 million), investment volumes fell to $607 million in September, marking a 22% decrease from the previous month. This decline reflects investor caution in response to economic and geopolitical uncertainties.

Noteworthy investment areas included DeFi and AI. In August, around 25% of total investments were directed toward DeFi projects, while AI-related projects received roughly 15% of the allocated capital. September saw infrastructure and DeFi projects dominate, capturing more than half of the total investments.

In the U.S., venture capital investment in the crypto sector showed strong recovery after a slump in November 2023. By July 2024, crypto investments accounted for an impressive 6.1% of all U.S. VC deals, signaling a steady upward trend toward the record highs of 2022, when crypto investments comprised nearly 9% of all U.S. VC transactions.

This growth is partly driven by regulatory advancements, such as the launch of the Bitcoin ETF, which have bolstered investor confidence. The crypto industry is now outperforming robust sectors like enterprise software and climate technology, reinforcing the long-term upward trajectory and the ambitious goals of a diverse range of projects.

Check out the European Blockchain Convention Startup Battle Recap; AI, Analytics, and Infrastructure:

About Crypto Diva

I’m already in the Future… Meet me there! Blockchain Technology is my passion and I have dedicated my career and research path to DeFi. My ultimate goal is to encourage more female professionals in the DeFi industry.

As the Sales and Marketing Manager of coinIX & COINVEST, I’ve got the privilege of being in close contact with Blockchain investment firms, as well as the innovative web3 projects which are creating the foundations the future financial world. I love to make the impossible possible and i’m willing to go the extra mile for that. Be my companion in my DeFi journey and I’ll show you everything.

Peace & Love,

Your Crypto Diva

Stay in touch with me:

评论 (0)