$25 million, almost gone. One entity, 51% of the vote.

No reentrancy bug. No flash loan . No technical bug. Just raw, uncut governance capture. This wasn’t a hack. It was the system behaving exactly as designed.

What unfolded at Compound Finance in July 2024 wasn’t a one-off governance spat. It was a definitive stress test for DAO security. The instigators? A powerful delegate bloc known as the "Golden Boys." Their method? Acquiring and concentrating COMP voting power through delegation and exchange-fueled wallets. Their goal? To redirect $25M in COMP from the DAO treasury into a yield-bearing vault they fully controlled.

The fallout was immediate: accusations of a hostile takeover, public outcry from major stakeholders, and a scramble to contain the damage. What followed wasn’t a code patch , it was crisis diplomacy and a centralized rollback in a system built to be decentralized.

A DAO Asleep at the Wheel

Compound, like many DAOs, had quietly drifted into a state of governance inertia. Participation was low, engagement spotty, and the checks on concentrated power largely theoretical.

Over time, voting rights pooled into the hands of a few dominant actors. With enough delegated tokens, a single motivated group could steer the ship with little resistance.

Compound’s governance had no meaningful guardrails against capture. The threshold to pass proposals wasn’t unreachable. All it took was coordination, capital, and timing.

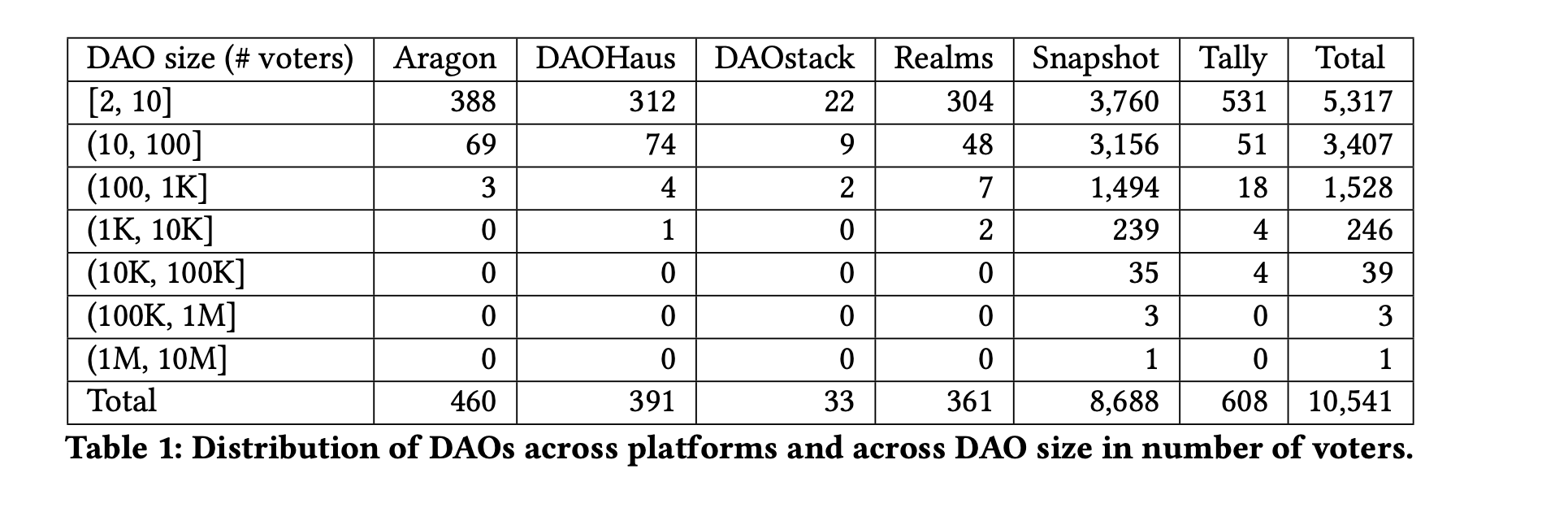

A landmark study analyzing 30,000 DAOs revealed that most suffer from low participation and short lifespans, with voting power becoming increasingly concentrated as communities grow.

Delegation as a Governance Exploit

Enter the "Golden Boys", a pseudonymous bloc led by a figure named "Humpy," who had been associated with previous controversial proposals.

Here’s how the sequence unfolded:

An initial proposal 247 to grant 92,000 COMP was submitted with little advance discussion. Compound’s security advisor, Lewellen Michael, quickly flagged it. Despite evident red flags, his post drew just six comments. Only a few contributors, like PGov , Monet-Supply and Wintermute raised concern.

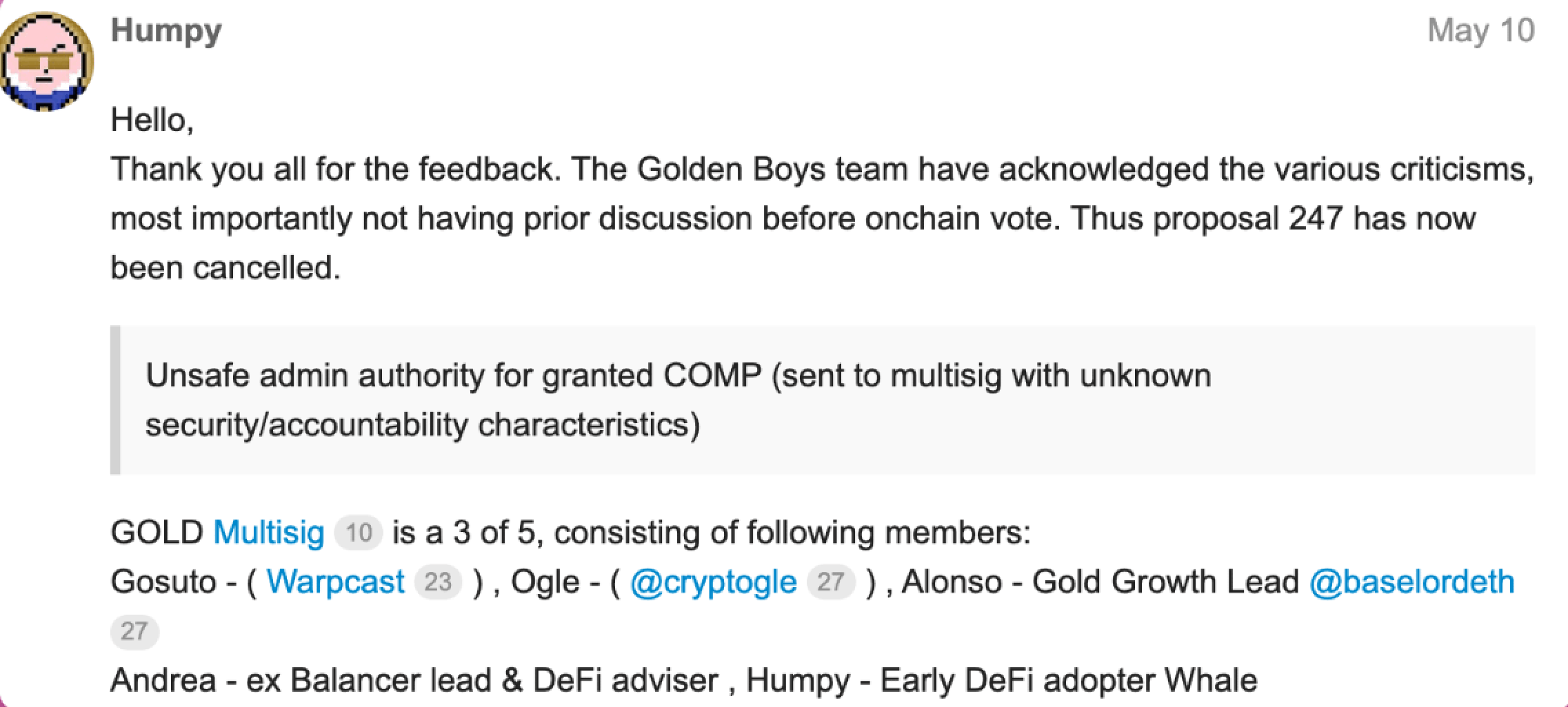

Humpy responded by withdrawing the proposal.

A second version followed. It garnered even fewer comments. just four public responses from Stable Lab, Wintermute, bryan colligan, and Michael again .

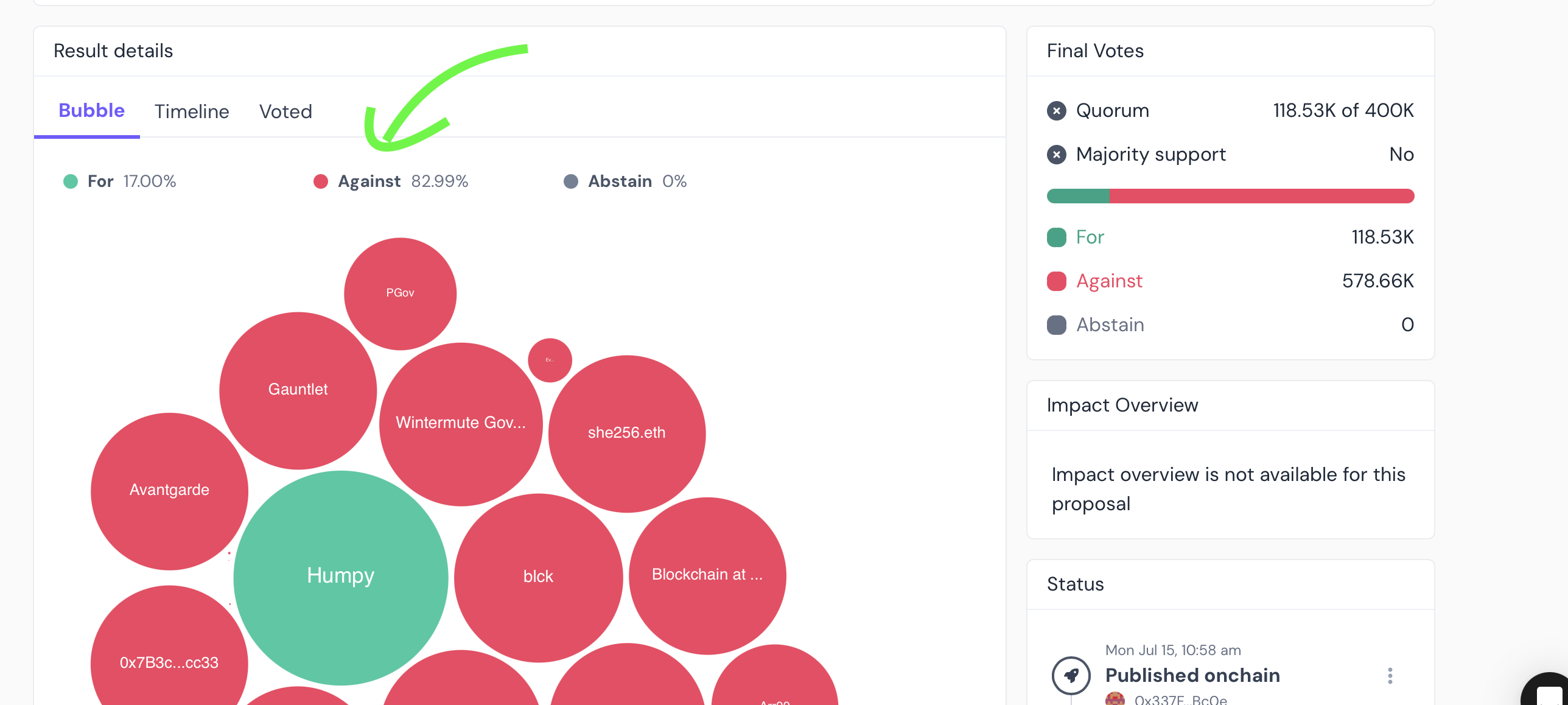

The proposal 279 failed.

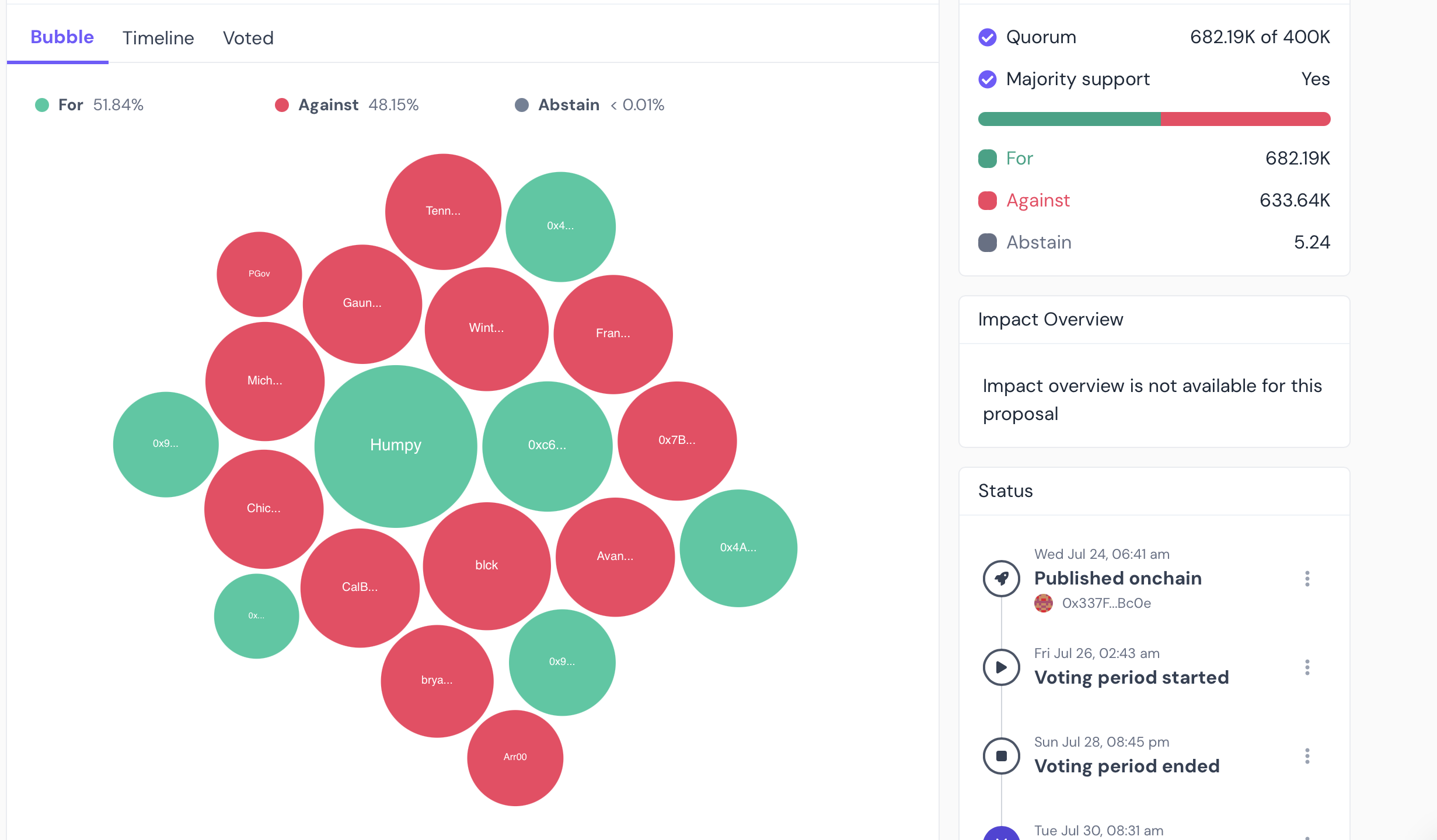

But then came a third proposal 289. This one asked for 499,000 COMP

It passed. With participation from just 57 wallets.

This wasn’t an isolated pattern. Participation in Compound governance had been low for some time. Discussions on the forum regularly received minimal engagement. Even high-impact decisions, like launching a USDT market , had slipped through with little pushback.

Much of the DAO’s activity originates from Gauntlet. Their role as proposal driver is supported by a service contract.

This incident raised a key question: if a single voting bloc can push through a major treasury move, what mechanisms are in place to prevent deeper risks to user funds?

It’s a reminder , not just for Compound, but for every DAO, that decentralization only works when communities are awake and engaged.

A DAO Reacts

The Compound community erupted.

Major stakeholders like Gauntlet, Wintermute, and Consensys labeled it a governance attack.

“Someone had a really strong opinion that was outside social norms, and they did the requisite legwork necessary to get it to pass. Many of the people that you should expect to vote no on something like this didn’t show up.” Said Dennison Bertram, CEO of Tally, reportedly put it in a past interview quoted by Yahoo Finance .

Centralization to the Rescue

And then, in a dramatic twist, Compound didn’t fix this through protocol mechanics.

It fixed it through diplomacy and centralized negotiation.

On July 30, Bryan Colligan (Compound’s growth lead at AlphaGrowth) announced an alternative proposal following direct dialogue with Humpy. In exchange for rescinding Proposal 289, the Compound Growth Program proposed a revamped staking mechanism: distribute 30% of all current and future market reserves to COMP stakers.

Humpy agreed. So did Gauntlet, Wintermute and others .

Proposal 289 was officially canceled.

The price of COMP rebounded 6% within 12 hours. But the reputational damage was already done. A protocol celebrated for its decentralization had averted a crisis through human backchanneling and centralized coordination.

The Real Vulnerability: It's Not in the Code

This attack didn't rely on reentrancy or underflow. It relied on:

-

Tradable voting power

-

Low participation

-

Misaligned incentives

"The real vulnerability was in the human coordination layer."

Smart contract audits can't catch that. And that's why governance-layer exploits are the next frontier in DeFi security.

When the Multisig Is the Fail-Safe

In the wake of Proposal 289, a community member alextnetto, who floated drastic options: transfer admin to a trusted multisig, strip voting rights from the goldCOMP delegatee, or even mint a new governance token excluding those involved.

“If this doesn’t pass, Humpy will be capturing the DAO.” alextnetto

These proposals revealed the paradox:Decentralization’s fallback was centralized action.

“If DAOs rely on social coordination and emergency powers to undo bad proposals… are they truly decentralized?”

Your Security Perimeter Just Expanded

As a blockchain security researcher, I’ve focused on the protocol layer: gas griefing, reentrancy, storage collisions. But the Compound attack proved that security isn't just technical. It's systemic.

We now need:

-

Incentive modeling

-

Governance stress tests

-

Delegation attack simulations

-

On-chain behavioral monitoring

Security isn’t just about smart contracts. It’s about power.

The Attack Blueprint: How to Capture a DAO

This wasn’t just a Compound story. It could’ve happened to Venus, LayerBank, or any protocol with:

-

Liquid governance tokens

-

Passive voters

-

Undelegated thresholds

Here’s the playbook:

-

Accumulate tokens across multiple wallets.

-

Delegate to controlled addresses to concentrate voting power.

-

Propose treasury movement under the guise of "investment" or "growth."

-

Secure just enough votes to meet quorum.

-

If unchallenged, drain millions.

In this case, attackers stood to gain 92,000 COMP (5% of the treasury). That’s enough to sway markets, buy more votes, and repeat the cycle.

This is a snowball exploit, one vote powers the next.

The Call to Arms

For DAOs:

-

Implement tiered quorum thresholds for high-stakes proposals

-

Enforce delegation sunsetting.

-

Add anti-whale dilution mechanics

-

Mandate governance process audits

For Security Researchers:

-

Expand your surface area. Audit governance flows.

-

Simulate whale attacks. Map delegate dynamics.

For Investors & Users:

-

Demand transparency on voting distribution

-

Push for hardcoded anti-capture controls

-

Treat governance like a smart contract: trustless, testable, resilient

Compound didn’t break. It worked as designed. And that’s the problem.

The Golden Boys didn’t cheat. They optimized. The system let them. Until it didn’t.

The next DAO might not be so lucky.

评论 (0)