On Sunday, the Wall Street Journal broke a story about Paxos receiving a Wells Notice regarding their BUSD product, alleging that it is a security. On Monday, the NY’s DFS announced that they had ordered Paxos to suspend the minting of new BUSD. BUSD is a top ten stablecoin and a white labeled version of Paxos USD. Paxos is a regulated New York trust company. If the SEC wins the case, most stablecoins in their current form would likely qualify as securities.

Why BUSD?

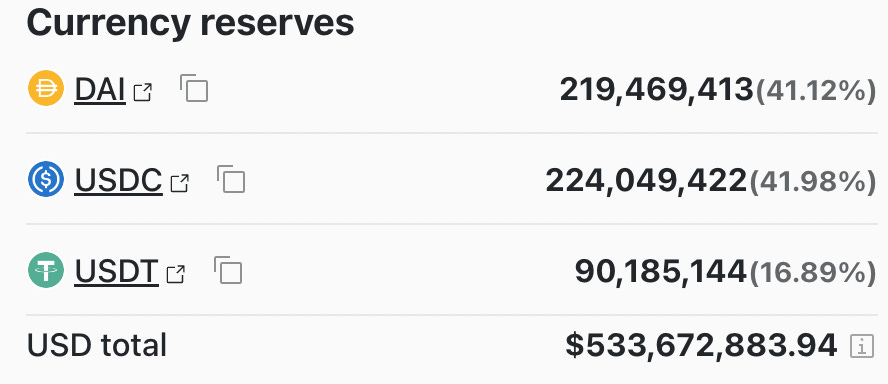

Much of the BUSD in circulation isn't actually 1:1 backed. All of the BUSD on BSC (Binance's L1) is allegedly backed by BUSD on ETH held by Binance. This means in theory that there are up to 1.5 units of BUSD out there for each dollar held by Paxos. This Wells notice may be a feint designed to test Binance's solvency while encouraging stablecoin companies to circle the wagons and self-regulate. In essence, the SEC may be filing a suit they know they will lose but expect the suit to have a positive impact on the industry. Binance, the largest offshore exchange, is a natural target for an American regulatory body.

If the intent is to change how stablecoins are regulated, it seems much easier to build an argument around DAI being a security than BUSD. DAI's role in purchasing liquidated collateral for a discount could be viewed as creating an expectation for profit. DAI, however, is widely viewed as highly innovative and decentralized.

There is a widespread belief that stablecoin issuers share profits made on the float with groups that help drive distribution. The existence and nature of the backroom deals is something that the public can only speculate on. Presumably, the SEC has knowledge of these arrangements which may be impacting their behavior. If Paxos is paying Binance "simple interest" on the BUSD Binance holds, this may trigger the "expectation of profit clause" of the Howie test as they could argue that token holders are a related party or beneficiary.

What does this mean for Tristero?

Ultimately, stablecoin FUD is good for a decentralized stablecoin clearing house. There is meaningful risk with allowing a party who owes money to also custody the receipts needed to claim that money. As we saw with FTX and Terra, withdrawals/bridges were suspended to essentially hold assets hostage during times of crisis. In short, regulatory uncertainty will lead to more groups self custodying assets. Curve's volume has increased five fold during this incident.

Likely Impact

There are a few things we're watching closely over the next few months:

1) Paxos' response: Paxos can choose to fight this or cut their losses.

**2) Binance's stability: **This is likely the "FTT" moment for Binance in terms of maximum pressure on liquidity.

3) Circle's response: In theory, Circle may choose to circle the wagons with Paxos or side with the regulators against their competitor.

4) Justice Department: Stablecoins have meaningful AML implications. While the SEC is civil, we expect the Justice department to eventually take a position here.

5) If Paxos cuts its losses or the SEC does win, we expect it to drive a shift to offshore stablecoins. Tether settled with the NY's DFS. We think this would ultimately negatively impact American consumers by eliminating "safe" options and eroding the oversight of American regulators. This may however be good for decentralization as offshore exchanges will likely be viewed as less trustworthy than domestic ones, leading to more demand for decentralized services. An indication that this process may already be starting is the fact that USDC is trading at a meaningful discount to Tether on Curve (as demonstrated by the imbalances in the 3pool).

评论 (0)