You’ve probably seen airdrop announcements to Binance Alpha traders and are considering becoming one. Maybe you are part of a crypto project that has decided to joing the Binance Alpha listing, and you are frustrated that some Binance Alpha trader who doesn’t care about the project is getting an airdrop allocation. I’ve crunched the numbers, and I’d like to help you decide if it’s worth your time and money. Let’s dive in.

Binance Alpha is a platform introduced in mid-December 2024 by Binance to shine a spotlight on early-stage crypto projects with the possibility of being listed on the Binance Exchange.

Three Parties Are Involved in This Crypto Trinity

-

The Binance Alpha traders who get airdrops, access to exclusive TGE events, and various trading rewards.

-

Binance, which gets the trading fees and possibly new users.

-

Projects, which get high trading volumes and exposure, plus a possible listing on Binance Spot.

Token Claims

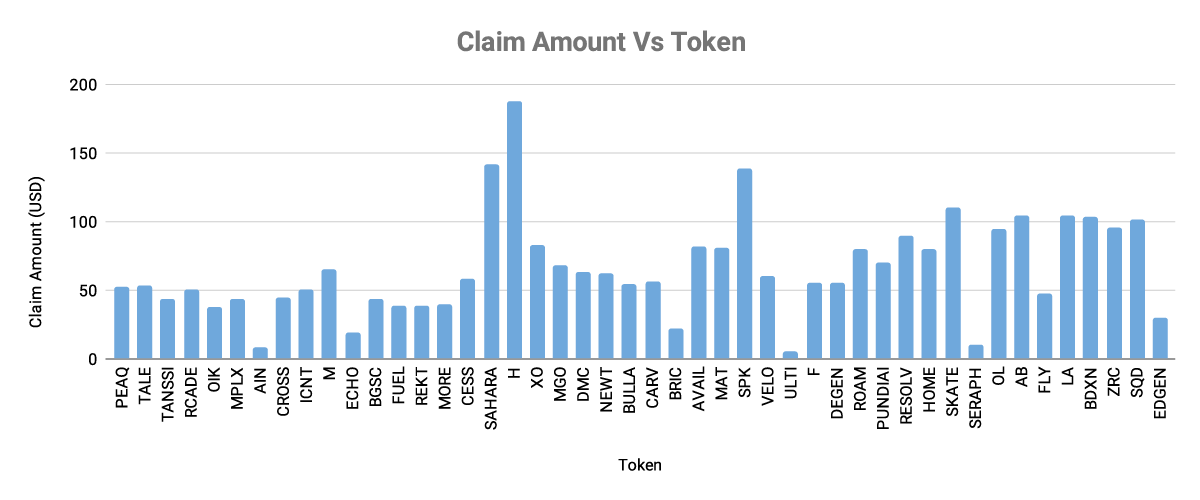

Let’s see how the projects listed performed in terms of airdrops to Binance Alpha traders.

The chart above shows data from June 2, 2025, to July 12, 2025, and not from the start of the Binance Alpha program (because I have a life 🙂). In this time, 47 token projects distributed airdrops through claims.

Key Findings

-

Typical reward: Most claims cluster between $50–$65 USD, with a median of $56. For the claim amounts, I used the listing price.

-

Top earners: H → $187, SAHARA → $141, SPK → $139

-

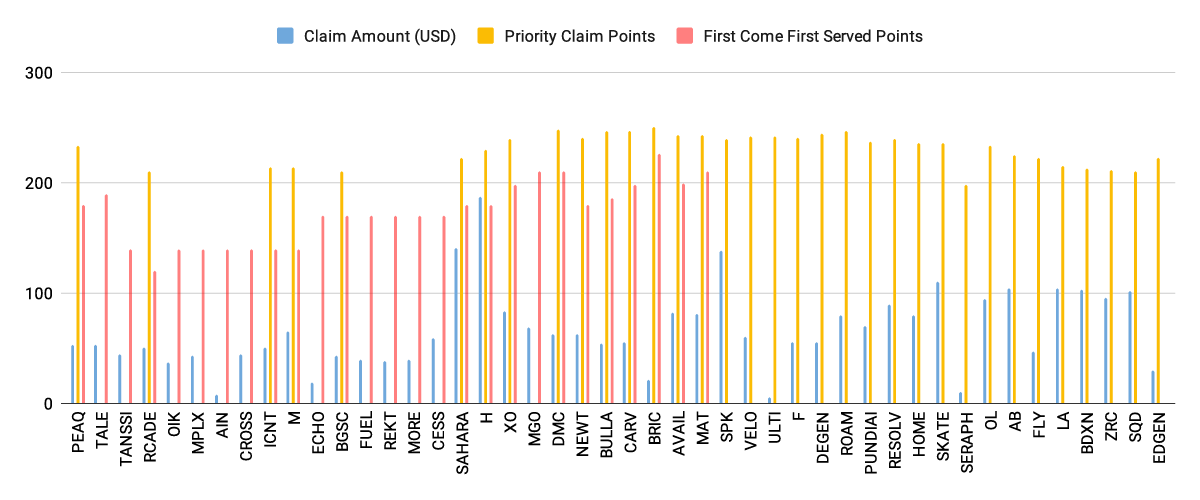

Points correlation: Higher points tend to correlate with higher USD claims, but not perfectly (e.g., BRIC had high points but low USD).

Crunching the Numbers

Now that we’ve reviewed project performance, let’s calculate the costs to determine if this endeavor is worthwhile. The highest points required during this period were 251 for the BRIC claim, which surprisingly offered only $22 upon listing. We’ll use 251 as our target.

Binance Alpha Points are earned through two main activities:

-

Balance Points: Earned by holding eligible tokens in your Binance Exchange and Wallet.

-

Holdings between $100 and $1,000: 1 point/day

-

$10,000 to $100,000: 3 points/day

-

Over $100,000: 4 points/day

-

-

Volume Points: Earned by purchasing Alpha tokens. Only purchases count; selling does not affect points.

-

$2: 1 point

-

$4: 2 points

-

$8: 3 points

-

$16: 4 points

-

$32: 5 points

-

$64: 6 points

… and so on.

-

This follows a geometric progression. 2^n = required volume, n being the number of points. We’ll earn at least one point daily from the balance, so let’s target 250 points. Achieving 250 points in a single day would require a trading volume of approximately 2^250 dollars, which is astronomically large and infeasible, even with automation. The 0.01% trading fee on such a volume would result in exorbitant costs (approximately 2^250 × 0.0001).

So, let’s consider accumulating points over a month: 250 ÷ 30 ≈ 8 points/day, equating to a $256 daily trading volume, which is achievable. If only it were that simple — each point expires after 15 days, complicating things. Recalculating: 250 ÷ 15 ≈ 16 points/day. To earn 16 points, we need a daily trading volume of 2^16 = $65,536. With a 0.01% trading fee, that’s about $6.55/day, or $98.25 over 15 days. To profit, we’d need an airdrop claim above this amount, and BRIC didn’t meet this threshold.

Fortunately, traders can choose which airdrops to claim, so skipping BRIC and retaining the 15 points deducted per claim could be wise. More profitable claims during this period, like H, SAHARA, and SPK, required fewer points. There’s also the First Come, First Served option, which requires nearly half the points of Priority Claims, but it’s dominated by bots, making manual claims as effective as a fart in a hurricane.

One strategy is to hold tokens after claiming rather than selling immediately. For example, Memecore (M), with a claim amount of $65, reached a value of $900 at its recent all-time high. However, this is an exception—most tokens lose value significantly after listing

Risks

The usual trading risks apply, amplified here due to low liquidity and the potential for liquidity removal or other issues, as seen with ZKJ, KOGE, and recently BR. These risks could lead to significant losses during trading.

Conclusion

With this data and the accompanying charts, you can make an informed decision about participating in Binance Alpha. See you in the trenches.

评论 (0)