Throughout 2021, the DeFi landscape witnessed an unprecedented surge in growth, with a plethora of new protocols making headlines across various media outlets. Financial data streams serve as the bedrock for decentralized platforms offering innovative products such as synthetics and insurance. However, the full potential of Web 3.0 remains somewhat constrained by the limited range of available data types. This is precisely where RedStone Oracles step in, heralding a paradigm shift by storing non-traditional data on Arweave and seamlessly delivering it to all EVM-compatible chains. Smart contracts deployed on a diverse array of blockchains, including the flagship Ethereum network, leverage data provided by RedStone's oracles to inform critical decisions related to contract execution and command activation. Consequently, platforms and enterprises leveraging smart contracts directly depend on oracles to source real-time data from the outside world. A prime illustration of such data points could be the precipitation levels in a specific region or the electoral vote tally garnered by a political faction.

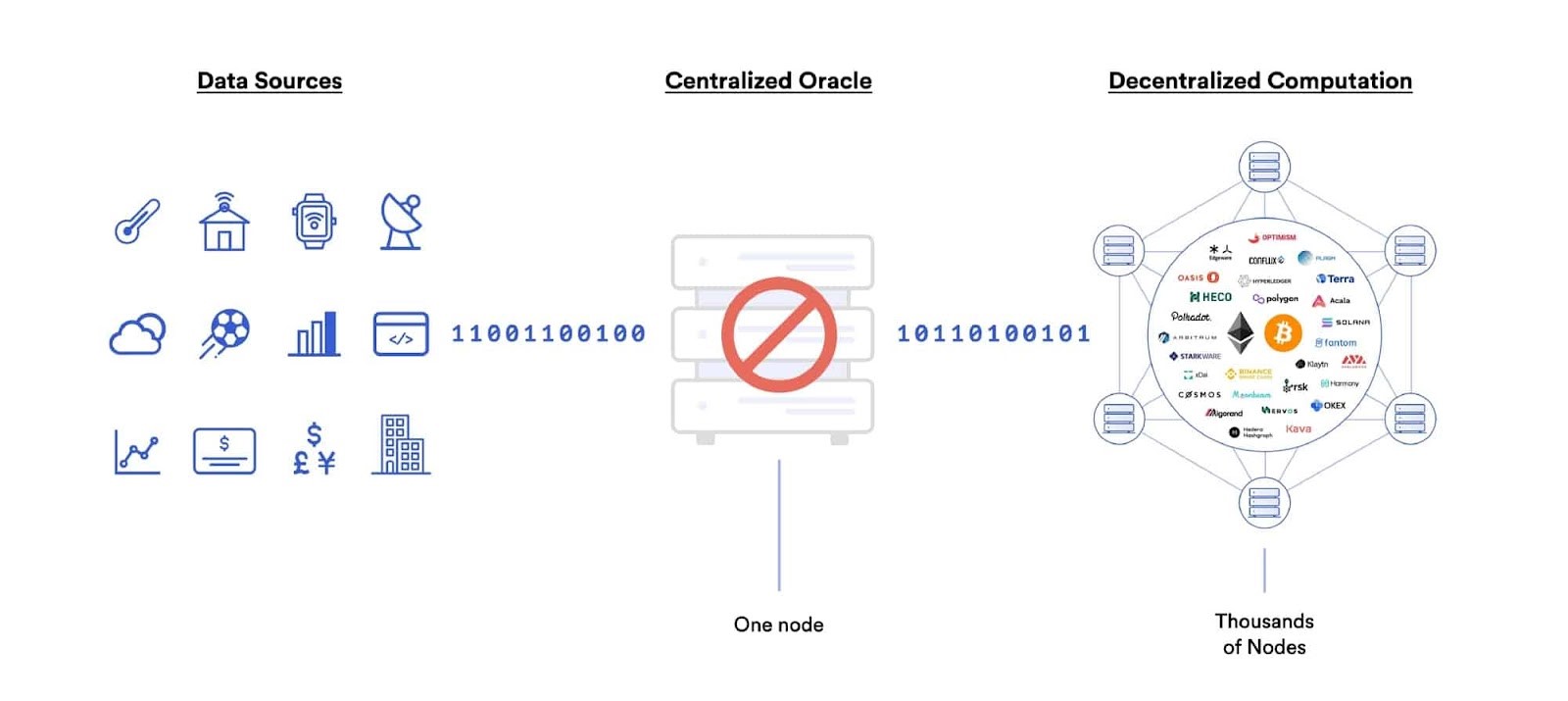

Nevertheless, conventional centralized and third-party oracles diverge from the core tenets of blockchain technology and decentralization. The external data they furnish lacks determinism and synchronization, rendering it arduous to attain consensus among network nodes. Moreover, the inherent risks of linking to a potentially compromised external environment deter many from embracing such models. This conundrum, commonly known as The Oracle Problem, encapsulates the challenges and complexities surrounding data integration within decentralized ecosystems.

Since its inception, RedStone has quickly risen to prominence within the DeFi community, earning widespread acclaim and backing from prominent industry figures. Collaborations with leading entities like EigenLayer, ABDK, Peckshield, AltLayer, Monad, and others showcased on the project's social media platforms underscore RedStone's reputation for dependability and integrity. These partnerships underscore RedStone's dedication to advancing growth and innovation in the DeFi sphere, unlocking a plethora of possibilities and avenues for decentralized finance.

In the ever-evolving realm of decentralized finance (DeFi), the pivotal role of Oracle systems cannot be overstated. Serving as vital conduits connecting blockchain networks with external data sources, Oracles are indispensable in furnishing essential information to smart contracts and dApps. However, conventional Oracle systems grapple with a myriad of challenges, including resource inefficiencies, scalability constraints, and dependence on centralized entities. Recognizing these obstacles, the RedStone team embarked on a mission to develop a groundbreaking solution that not only rectifies the deficiencies of existing Oracle systems but also aligns with the demands of contemporary DeFi protocols.

RedStone sets itself apart from conventional Oracle systems by incorporating a series of distinctive features that enhance efficiency, transparency, and decentralization:

-

Discontinuation of continuous on-chain data delivery: RedStone enables data providers to forgo constant on-chain data transmission, thereby reducing resource consumption and alleviating network congestion.

-

Self-service provision of authenticated Oracle data: Users retain the freedom to independently deliver verified Oracle data throughout the chain, promoting decentralization and diminishing reliance on intermediaries.

-

Integration with the Streamr Decentralized Network: RedStone harnesses the Streamr decentralized network for secure and reliable dissemination of authenticated Oracle data to users, ensuring reliability and resilience.

-

Token-Based Incentives for Data Providers: RedStone incentivizes data providers to maintain data integrity and uninterrupted service through token rewards, nurturing a dynamic and sustainable ecosystem. Note: The RedStone token is not yet available. Caution is advised against potential scammers offering RedStone tokens for sale.

Token Characteristics:

The RedStone token plays a pivotal role in facilitating the seamless transmission of accurate and reliable data from external sources to blockchain networks.

Token Utility:* *

Tokens serve as a mechanism to encourage collaboration within decentralized systems and align incentives among participants. RedStone fosters a culture of data sharing by incentivizing contributors to consistently create, publish, and verify data with diligence.

Token Locking Mechanism: Providers must present a comprehensive Service Level Agreement delineating the nature, origin, and update frequency of the data provided. In case of agreement breaches, penalties are imposed in the form of tokens. Providers are also required to allocate and lock a specific number of tokens for a predetermined period to instill trust in future claims. These locked tokens remain within the ecosystem, serving as a valuable metric for users to identify the most reliable providers.

Security Recommendations

It is crucial to exercise caution and due diligence when making alterations to the getUniqueSignersThreshold function in your contract. Ensure that any modifications are thoroughly understood before implementation to avoid potential risks.

When developing timestamp validation logic, especially in scenarios like synthetic DEX, where caching current values in contract storage is essential to prevent arbitrage attacks, make sure to verify the security and robustness of the implementation.

To enhance the security of your contract, consider implementing a secure upgrade mechanism using a multi-sig or DAO system. This will provide flexibility and resilience against vulnerabilities that may arise during upgrades or changes to the contract.

Stay vigilant by regularly monitoring the RedStone data services registry and promptly adapting signer authorization logic in your contracts in response to any changes. As a valued client, you will receive updates and notifications from us regarding any modifications.

Recommendations

Strive to design your contracts in a way that minimizes the need for multiple data feed requests within a single transaction. This can help enhance efficiency and reduce gas costs.

When setting the required number of unique signers, aim for around 10 to strike a balance between security and cost-effectiveness.

Performance Benchmarks

For detailed insights into performance metrics, refer to the benchmark script and reports available for reference.

In summary, RedStone blockchain offers a revolutionary approach to Oracle design, addressing the shortcomings of traditional systems with its modular structure, decentralized framework, and focus on data integrity and user empowerment. This innovative project is poised to transform the landscape of decentralized finance, opening up new possibilities for the DeFi sector. Stay tuned for an upcoming article diving into the ambassador program of this exciting initiative.

Tokenized Dispute Resolution Framework:

To effectively manage disputes related to data quality, a robust fallback dispute resolution mechanism is essential. One innovative approach is the implementation of token-based systems, where appointed jurors are incentivized for aligning with the majority decision and face penalties for supporting the losing side.

Strategic Market Development Initiatives: During the early stages of development, tokens can be allocated to data providers as a way to incentivize their participation and stimulate market growth until there is a sufficient demand from data consumers.

Overall, the tokenomics strategy of RedStone is designed to incentivize data sharing, uphold data integrity, and foster a resilient ecosystem for accessing external information on blockchain networks. This approach aims to promote transparency, reliability, and sustainability within the decentralized data marketplace.

评论 (0)