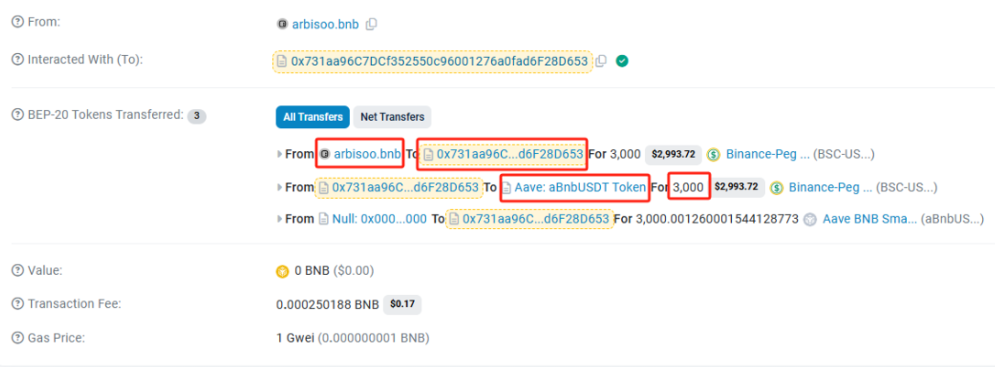

Arbitrage Process

1. Arbisoo transferred $3000 into the AAve address for arbitrage (Dec-22-2024 01:10:30 PM UTC).

2. Executed the contract to return the arbitrage profit of $3004 to Arbisoo (Dec-23-2024 05:50:43 AM UTC).

Annualized Return Calculation

Arbitrage Duration: 28.5 hours = 1.1875 days

Profit: $4

Cost: $3000

Annualized Return = Actual Profit / Principal / (Investment Duration / 365)= 4 / 3000 / (1.1875 / 365) = 41%

Arbisoo Profitability Outlook

Arbisoo has currently invested a total of $700,000 in AAVE and other similar DeFi arbitrage platforms for stable arbitrage operations. Below is a detailed analysis of its profitability outlook:

Investment Scale and Strategy:

-

The $700,000 investment is divided into two parts. One part (around $300,000) is used for stable arbitrage, aiming to generate continuous returns through precise market timing and platform features.

-

The other $400,000 is used for risk-free arbitrage via funding rates, ensuring stable returns even in a volatile market environment, thus further lowering the risk.

Annualized Return Performance:

-

Stable Conservative Annualized Return: The current annualized return consistently ranges from 39% to 67%, indicating that Arbisoo’s arbitrage strategy is not only effective but also has strong risk resilience. Regardless of short-term market fluctuations, Arbisoo is able to maintain relatively stable profit performance.

-

Funding Rate Arbitrage: Through precise management of funding rates and arbitrage, Arbisoo has also demonstrated excellent capability in the risk-free arbitrage domain. This strategy allows funds to generate returns without significant risks, thereby enhancing the overall investment return.

Profitability Outlook:

-

Continuous Stable Returns: By combining stable arbitrage and funding rate arbitrage, Arbisoo can provide investors with relatively favorable returns while ensuring risk control. In the current market environment, an annualized return of 39%-67% is considered a relatively efficient level of return.

-

Market Expansion Potential: As the DeFi ecosystem continues to grow and mature, Arbisoo will be able to flexibly adjust between multiple platforms and strategies, further enhancing its profit potential. Particularly in areas like liquidity and funding rates, Arbisoo has rich operational experience and a leading advantage, which could result in a larger market share in the future.

Risk Management and Capital Safety:

-

Arbisoo’s arbitrage strategy incorporates robust risk control measures to ensure capital safety and profitability even in high-volatility markets.

-

By diversifying investments across multiple platforms and strategies, Arbisoo can effectively reduce the risk associated with individual markets or platforms, thereby further enhancing the stability of the investment portfolio.

评论 (0)