'Crypto fixes this'

When I got into crypto in 2017, I truly and deeply believed that the technology was going to change the world for the better. It would make transactions seamless and instant while bringing billions of unbanked individuals on-chain. This is the true power of crypto. 'Crypto fixes this' was a phrase used everywhere on Crypto Twitter when there was a problem in the real world. For many years, we tried to tokenize practically everything, from ride-sharing, health, voting, video games, advertising, real estate, and more. To some degree, there are benefits, but at its core, most of it was too early to tell. Much of it was just a cash grab. I will also be truthful here when I say I was also interested in the financial gains that would come from crypto adoption. It was definitely a big part of what kept me involved, but there is no denying that I believed in the technology.

The Divergence

As the years went by, my belief slowly started to fade away. I began to make life-changing money while simultaneously doubting what we were really building here. The original vision of Satoshi Nakamoto changed so drastically that I truly started seeing the divergence. First, the 2017 Bitcoin forks, which divided and cemented Bitcoin ideology, and then the NFT bubble in 2022 when Bored Apes were selling for $400k and every celebrity with a platform was launching their own shit NFT collection. I realized at that moment that Satoshi never really wanted this to happen in the first place. This was not what we came here to do.

Looking back, you can see all those 'fancy' narratives that were supposed to bring in 'the masses,' but in reality, most of them were simply facades with no real substance. I’m laughing now, recalling all those narratives: NFT,NFTFi,LSDFI,GAMEFI,SOCIALFI,AI,ORDINALS,DePin,DeFi — the list goes on and on, and it just never stops. Most of these were simply pointless from the beginning.

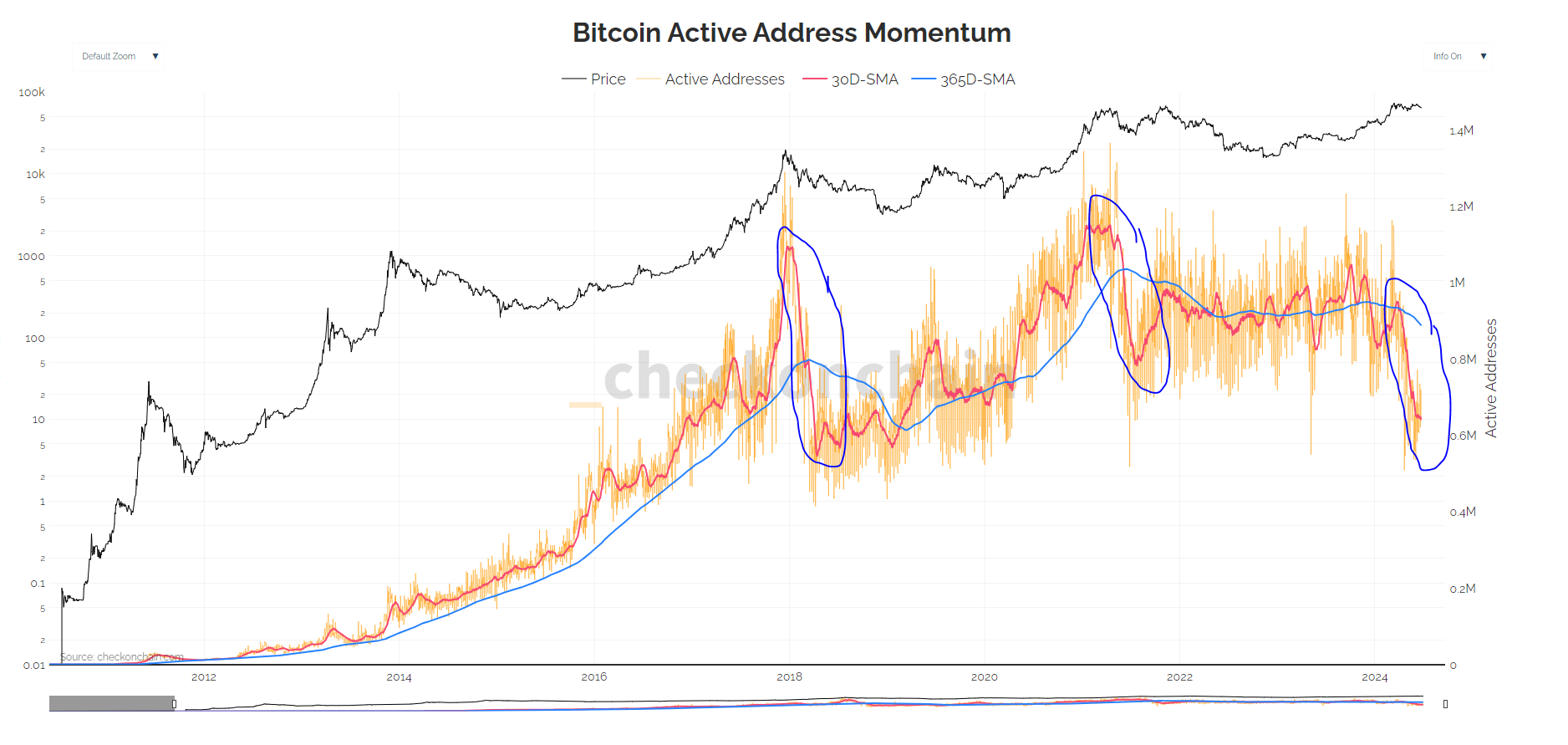

On-Chain Activity is dead

Now in June 2024, On-chain activity is no where to be seen and Ethereum Gwei is at 1. But.. But.. “Muhhhh L2!!” if you truly believe that the activity you see is organic you definitely need an awakening. With airdrop farming the entire game has changed, the majority of what you see is fake. I personally have +35 wallets farming each major protocol, and made over +20,000 Tx only in the last 3 months, and the funny part is that I’m considered a small whale in this Farming Game. Again, I will ask you to go check Bitcoin’s Active Addresses, it’s sitting at 2018 all-time low. Think how crazy that is.

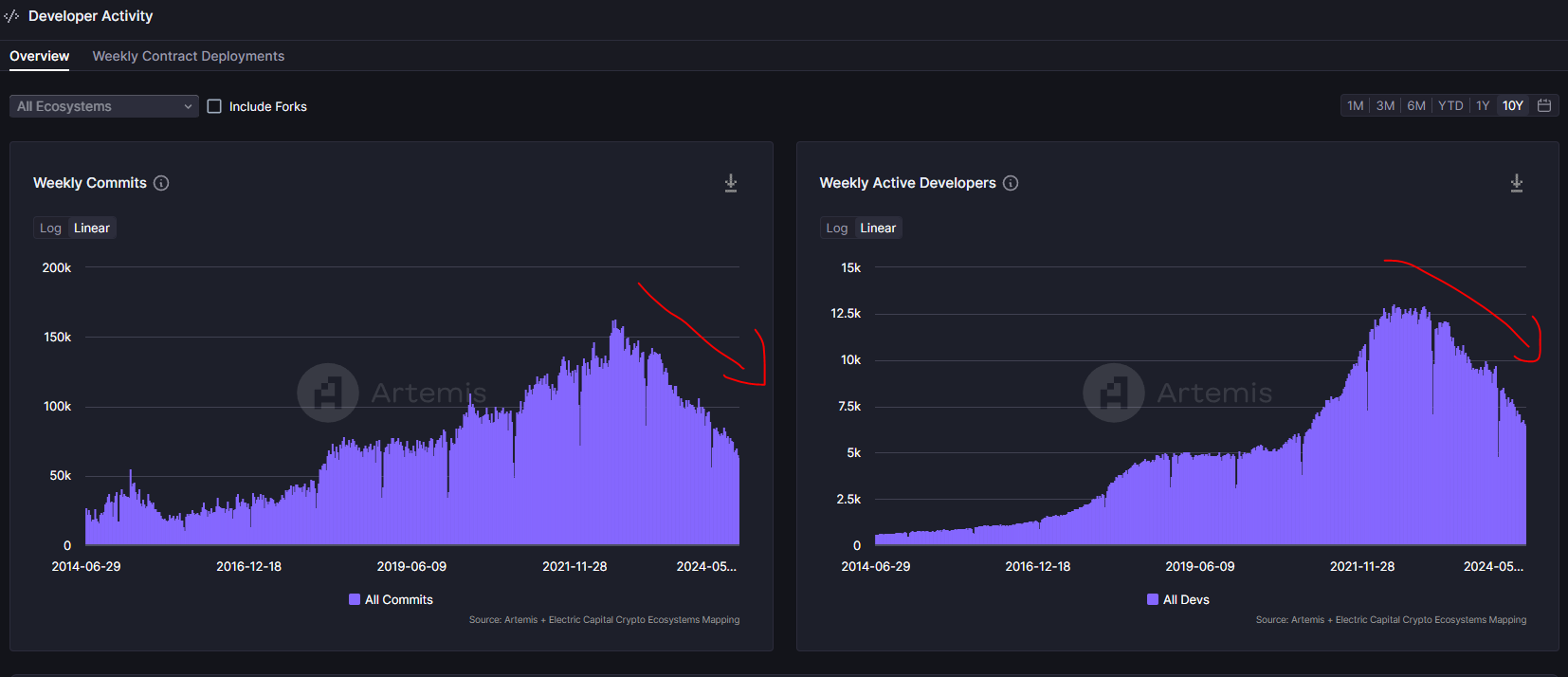

Where the Devs at?!

But but but… The Devs must be busy cooking something, right?! I urge you to look at GitHub activity and you will be amazed. Even though we are sitting near ATH, developers have never been lower. Since peaking in 2022, developers have dropped by -50%, and this downward trend continues falling as we speak. This really blew my mind!

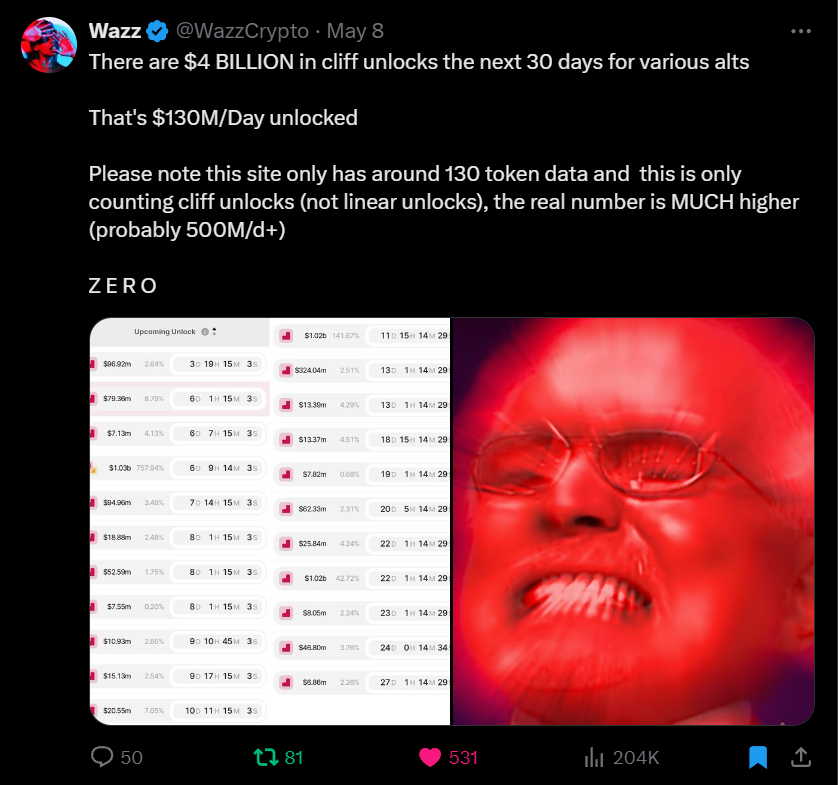

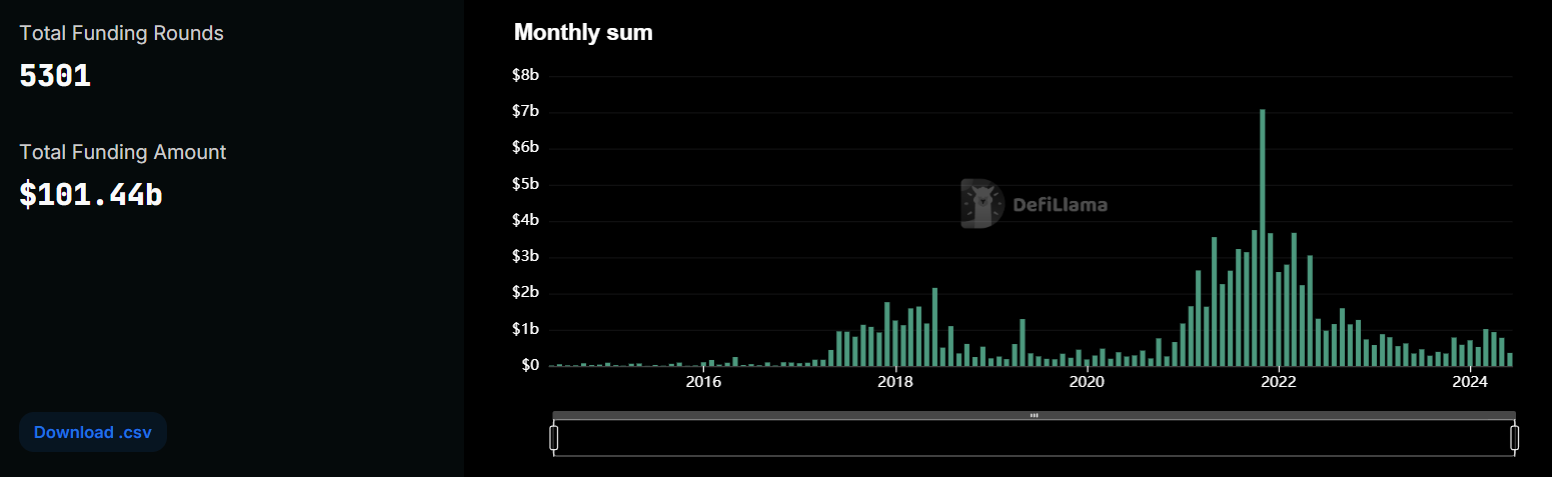

The Incoming Token Unlocks (+$100B)

The mini-airdrop bubble created in the last six months generated so many low-float/high-FDV altcoins that are just now starting their token unlocks. Moving forward, many estimate that we have over $100 billion of token inflation (outflow) hitting the market within the next 24 months. This is ridiculous. In comparison, we only had about $15 billion of new inflow that occurred for Bitcoin’s ETF, and this broke many records in the ETF space in terms of pace of growth. My point here is that, whether you like it or not, we cannot simply brush aside the amount of token unlocks that will put a ceiling on crypto’s potential wealth effect for this cycle.

The lack of clear Narrative & Consumer Product

The capital raised from the VC bubble in 2021-2022 was centered around the lack of infrastructure. In the last cycle, the public mainstream was here, but we lacked the infrastructure to support growing adoption (extreme gas fees, lack of bridge options, poor UI/UX, etc.). Today, we have much better infrastructure, but what’s really missing is a consumer product that would bring the masses on-chain, just like NFTs did. I believe the lack of a compelling narrative caused by an entire market cycle focused on infrastructure is the root cause of why we have memecoins trading at billions today. Memecoins are not anything new; they do not create anything productive. I believe they are extractive to the entire space and again remove us from the original vision of why crypto truly exists.

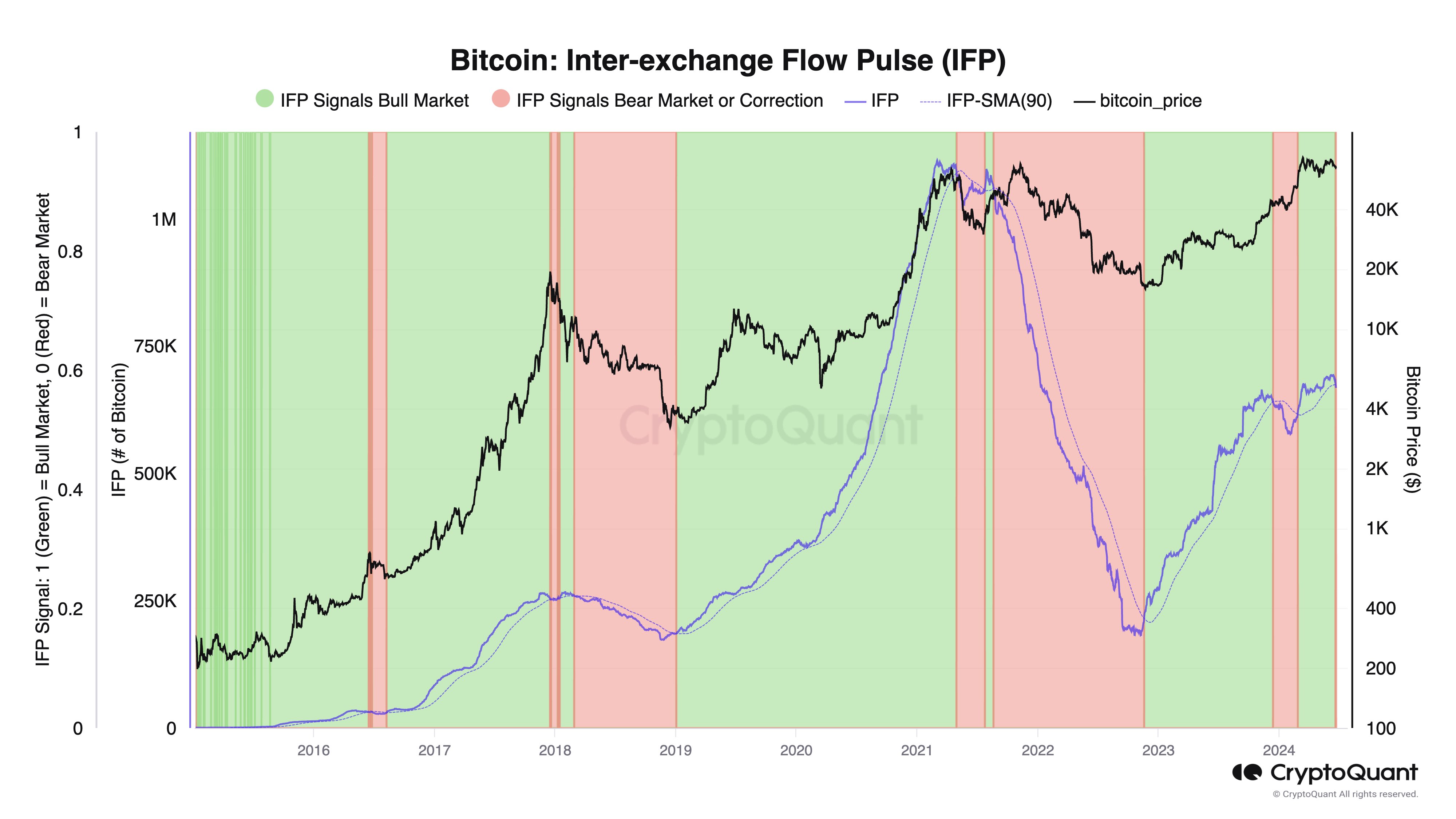

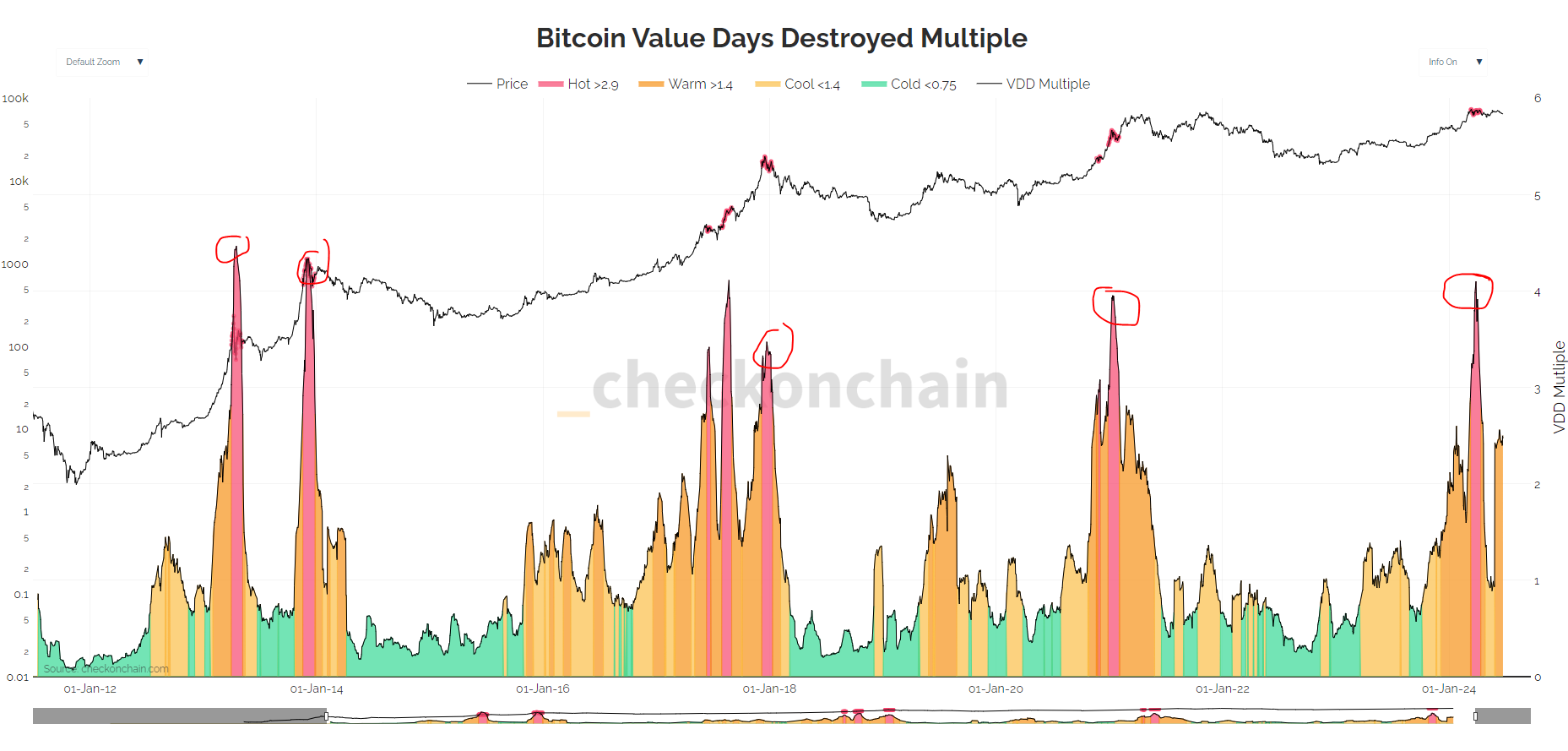

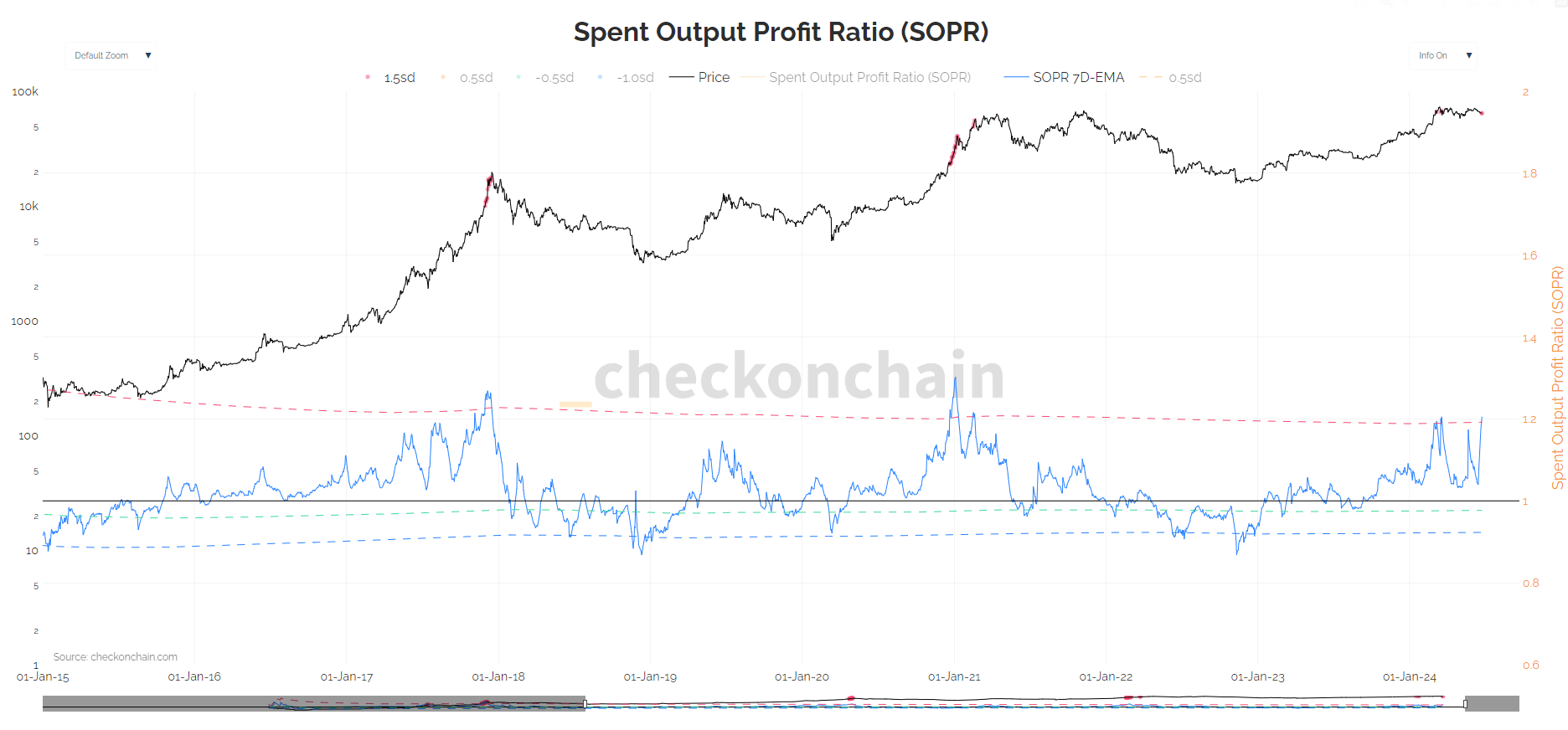

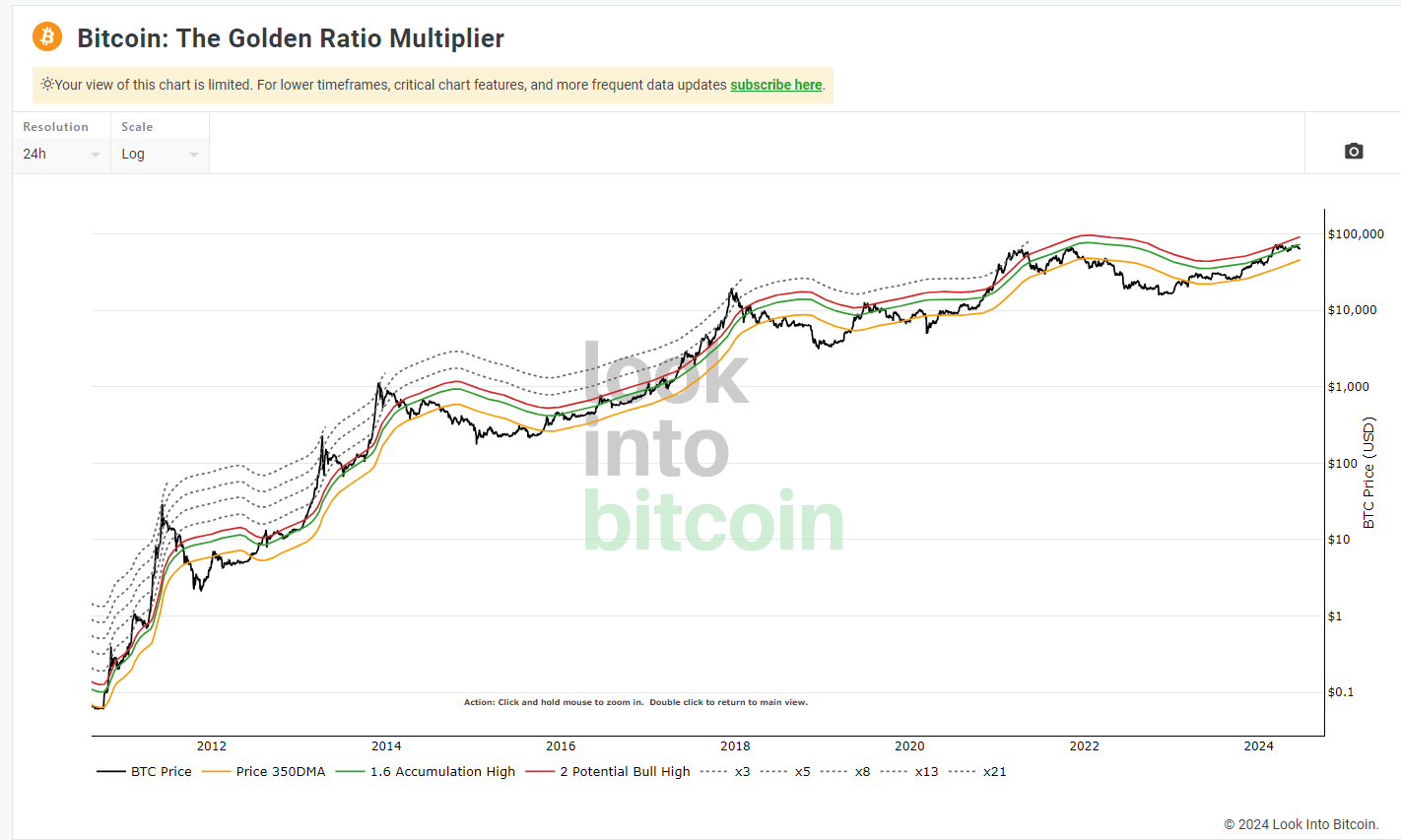

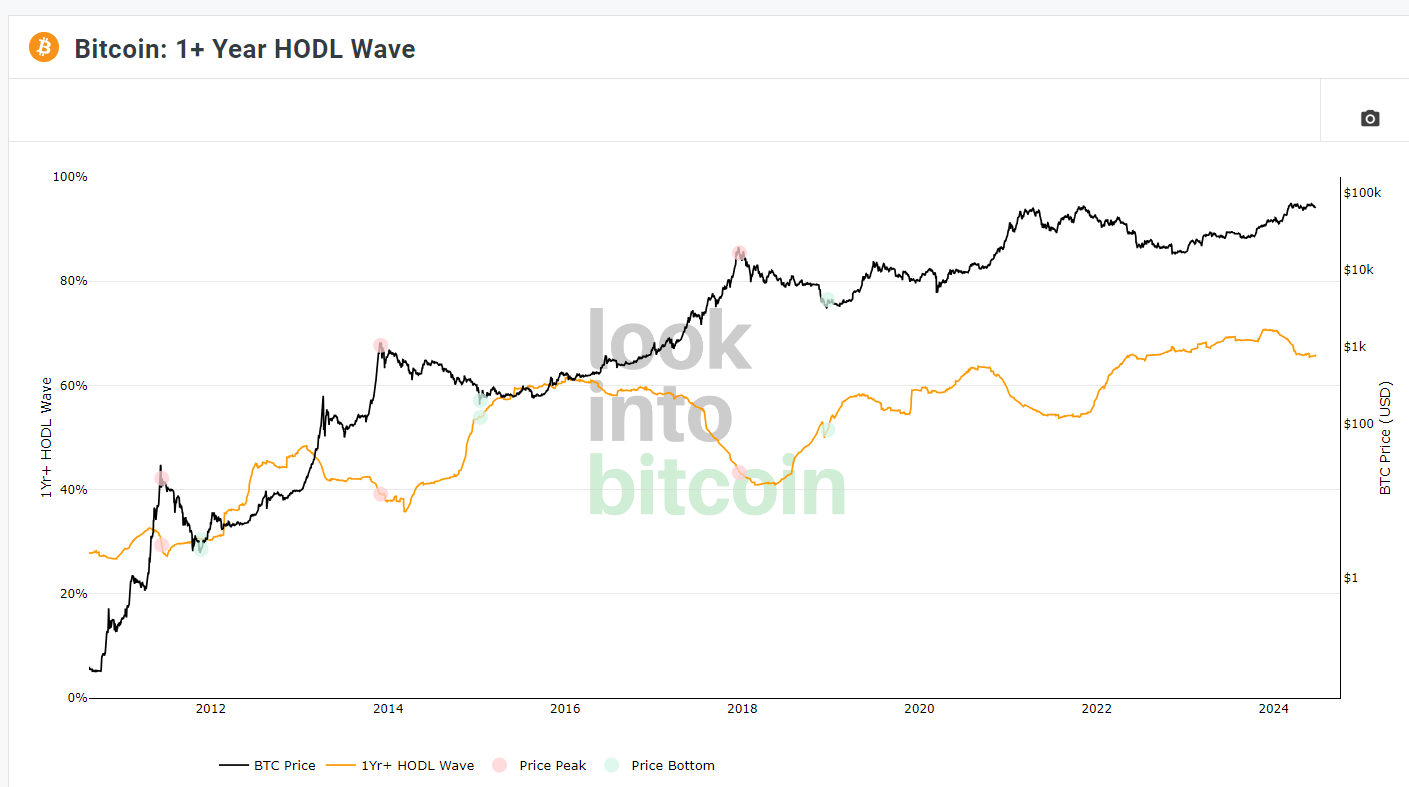

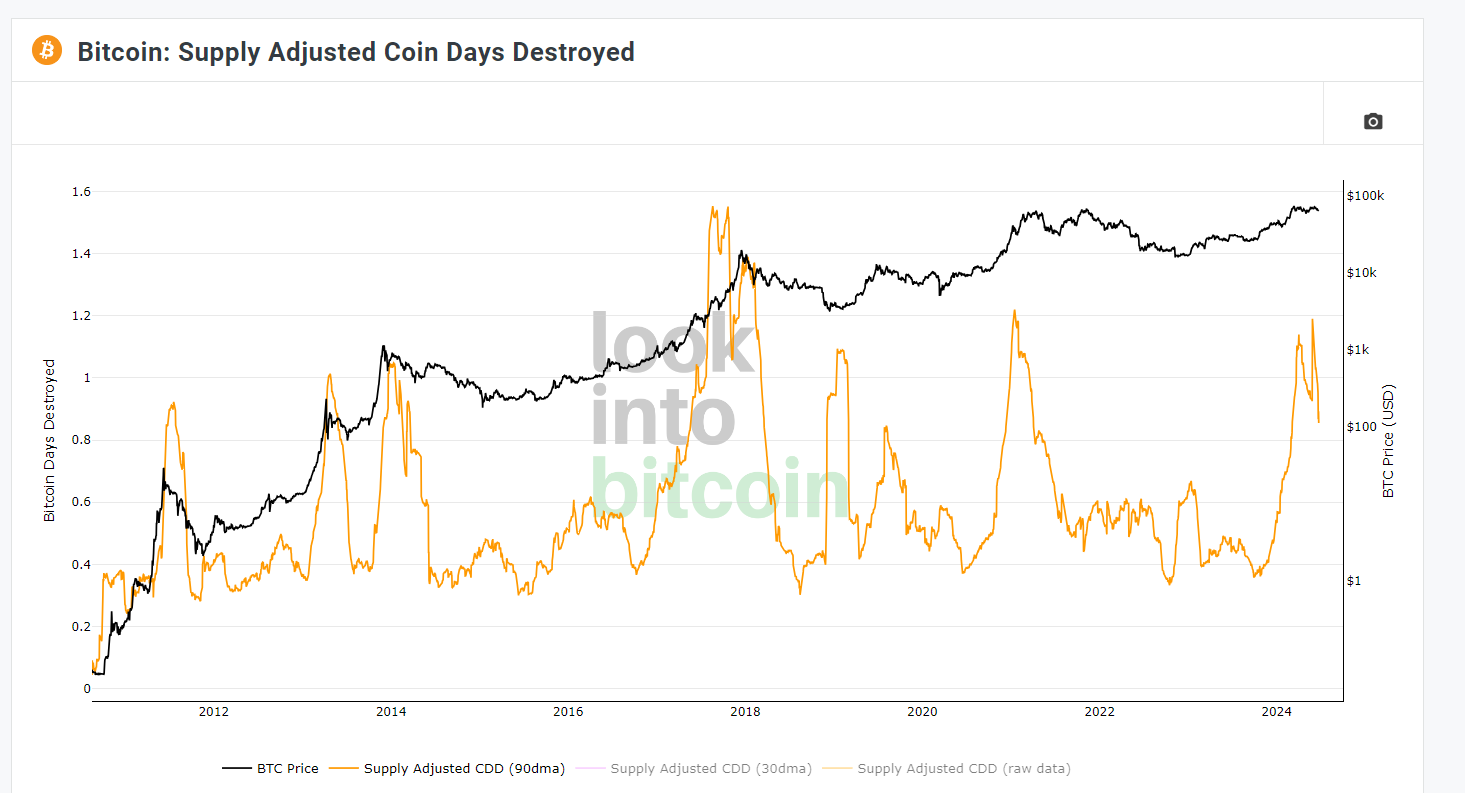

On-Chain Indicators Flashing Red🚩

At last, one of the most important pillars of why I’ve been feeling this way is looking at On-chain indicators... Many have started flashing red regarding a possible Cycle top.

评论 (0)