On November 6, 2017, a developer known as "devops199" accidentally triggered a bug that permanently locked 513,774 ETH across 587 Parity multi-signature wallets. In the now-infamous GitHub issue, they wrote simply: "I accidentally killed it." The private keys to these wallets still worked perfectly, users could prove they owned the funds, but a deleted library contract meant the money was frozen forever. At today's prices, that's about $1.3 billion lost not to hacking or lost keys, but to rigid smart contract architecture. This catastrophic failure highlighted a fundamental problem: blockchain accounts are too inflexible for real-world use.

The Origin Story

When Satoshi Nakamoto designed Bitcoin, the goal was simple: create digital cash that no government could control. The solution was elegant: one private key equals one account. Lose your key? That's your problem. The protocol doesn't care, code is law.

This unforgiving design made sense for cypherpunks and early adopters. But as blockchain technology evolved from digital gold to programmable money, the limitations became obvious. Ethereum's founders realized users needed more than just send and receive functionality. They wanted to trade tokens, interact with smart contracts, and build complex financial operations.

Yet even Ethereum kept the same basic account model. Your account was still just a private key with a balance. The protocol dictated that you must use ECDSA signatures, pay gas in ETH, and follow rigid transaction formats. Smart contracts could be programmed to do anything, but user accounts remained frustratingly simple.

The Breaking Point

By 2020, the cracks were showing everywhere. DeFi summer brought millions of new users who immediately hit walls. Need to trade your USDC? First, buy ETH for gas. Want to set a spending limit? Too bad. Lost your private key? Your funds are gone forever.

The community had built incredible financial infrastructure, but accessing it felt like using DOS commands in the age of smartphones. Power users adapted by using multiple wallets, hardware devices, and complex operational security. Regular users simply gave up or lost money trying.

Meanwhile, traditional finance was moving in the opposite direction. Banks added biometric login, spending controls, and instant recovery options. The gap between Web2 and Web3 user experience was becoming a chasm.

Understanding Account Abstraction

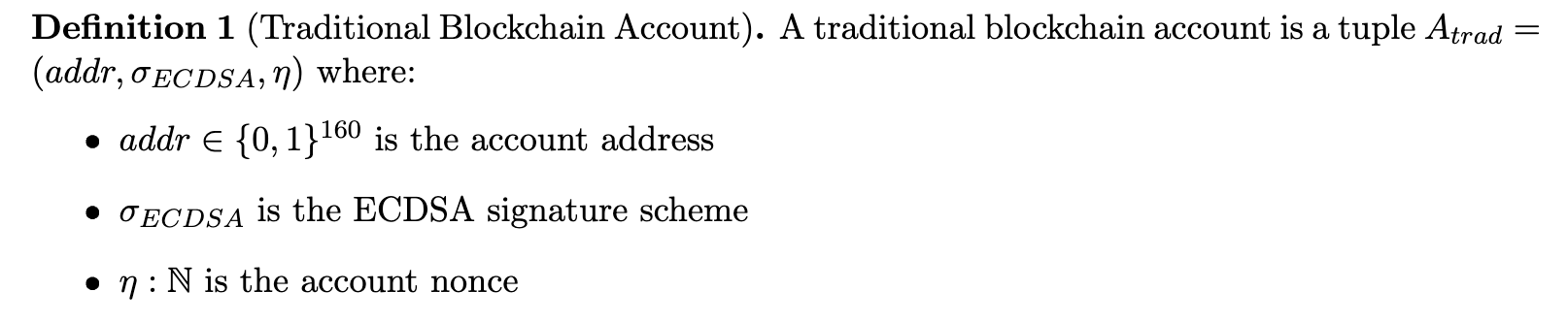

Before we dive into solutions, let's understand what Account Abstraction actually means. In simple terms, traditional blockchain accounts are like very strict bank accounts with rigid rules:

Think of it like a bank that only accepts one type of ID card, and you must follow their exact rules. You get an address (like your account number), you can ONLY access it with one specific type of key (ECDSA signature), and the system tracks how many transactions you've made.

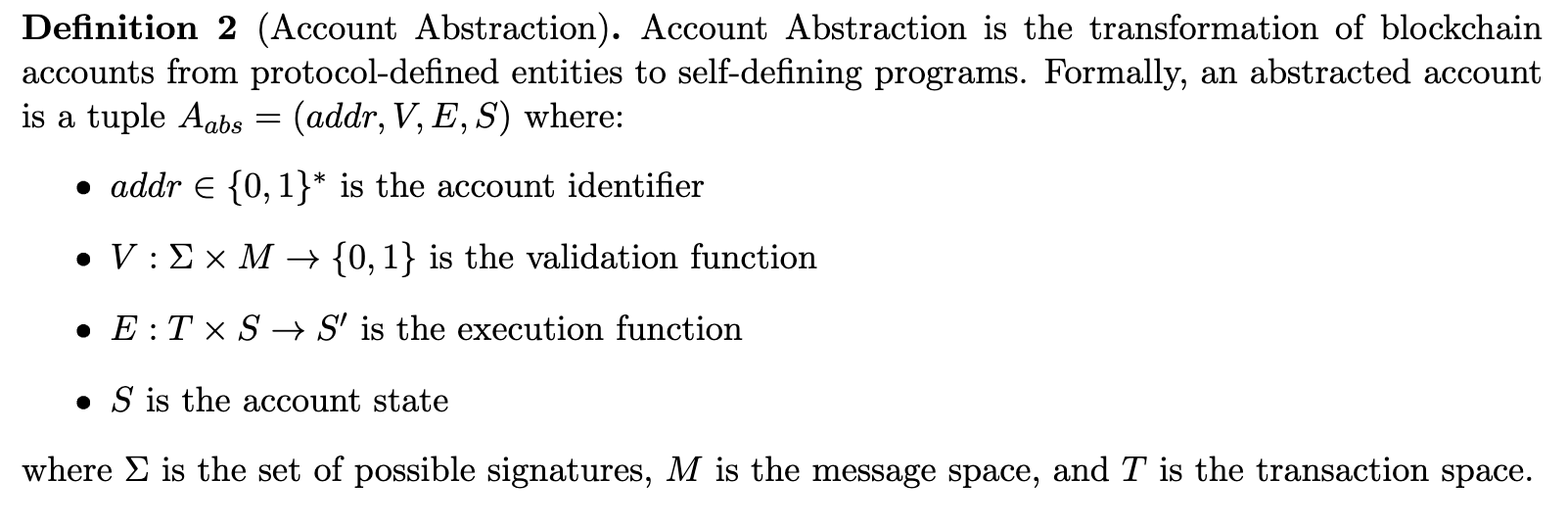

Account Abstraction transforms this rigid system into something programmable:

In plain English, your account upgrades from a basic lock to a smart lock that you can program however you want. You still have an address, but now YOU decide what counts as a valid signature, YOU decide how transactions work, and your account can even remember things.

How This Changes Everything

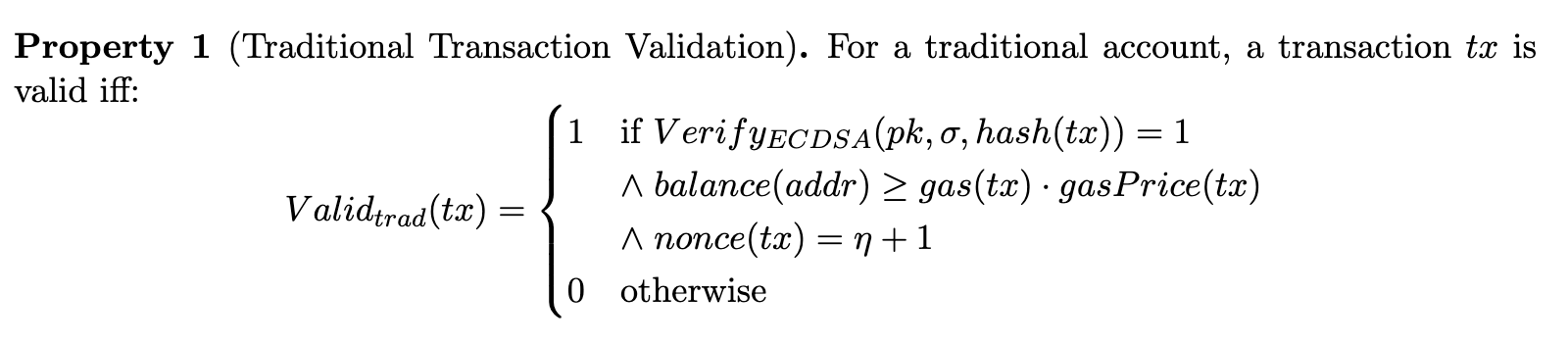

The difference becomes clear when you look at how transactions work:

In the traditional system, you must sign with your private key, have ETH for gas, and use the right nonce. No exceptions. It's like a vending machine that only accepts exact change in one type of coin (say an Australian 50 cent piece).

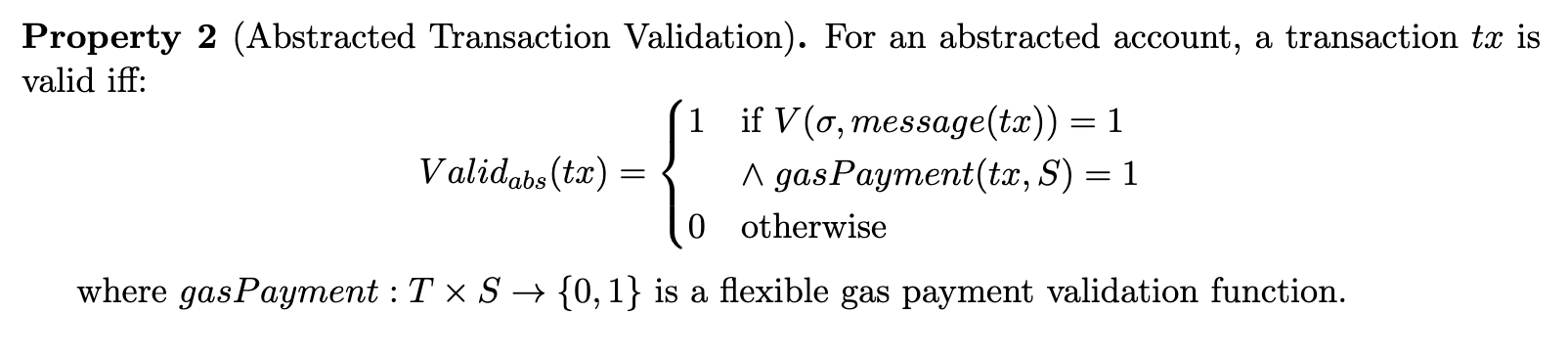

With Account Abstraction, your account decides the rules. Want to use Face ID? Program it. Want to pay gas in USDC? Program it. Want two people to approve large transactions? Program it.

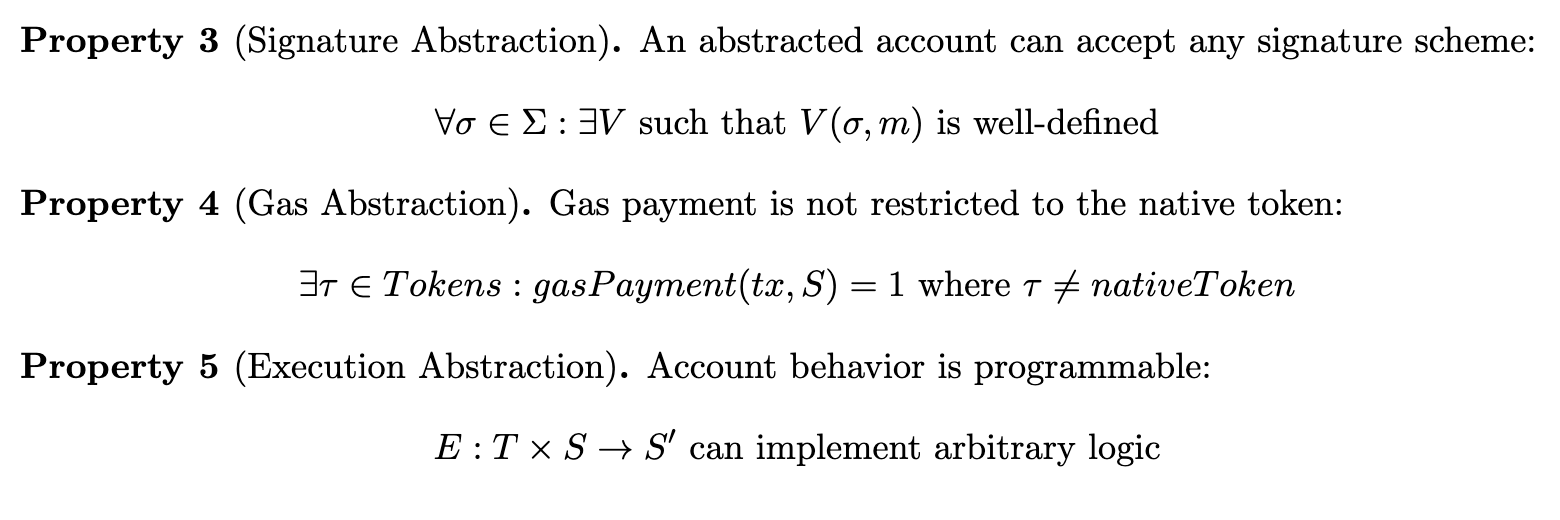

This flexibility unlocks three superpowers:

-

Signature Abstraction: Use ANY signing method - fingerprints, social logins, multiple signers

-

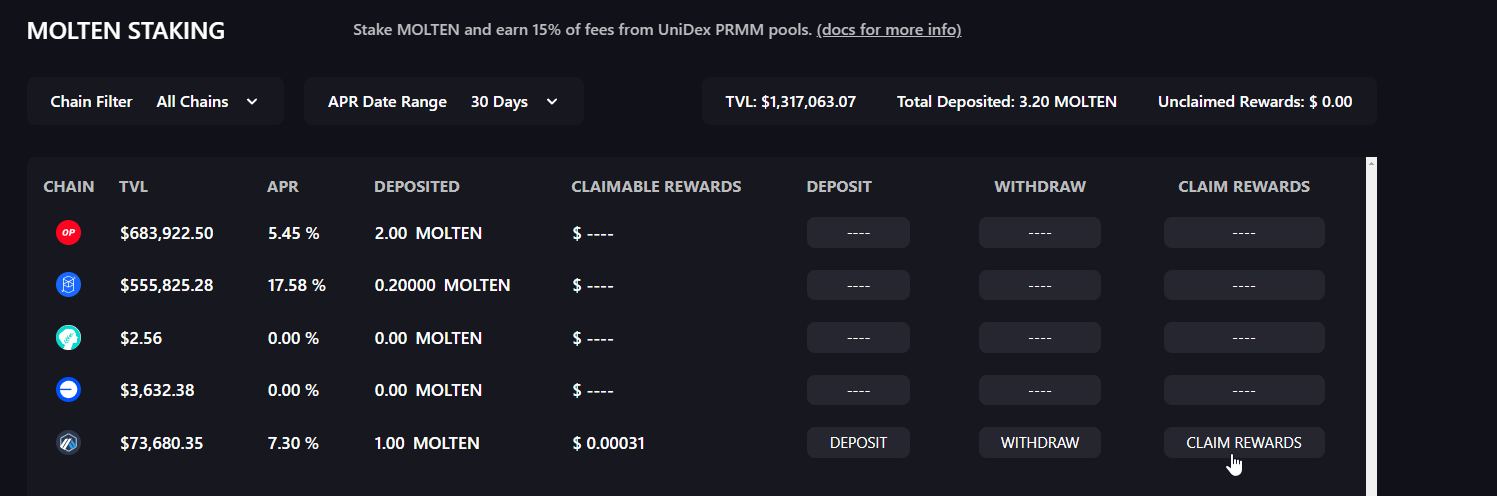

Gas Abstraction: Pay fees with ANY token - USDC, FUEL, or have someone else pay (like a sponsor)

-

Execution Abstraction: Program any behavior - spending limits, automated trading, recovery options

A Different Approach

While Ethereum and other chains struggled to retrofit Account Abstraction onto existing architectures, a new generation of blockchains emerged with a different philosophy. What if Account Abstraction wasn't an afterthought but the foundation?

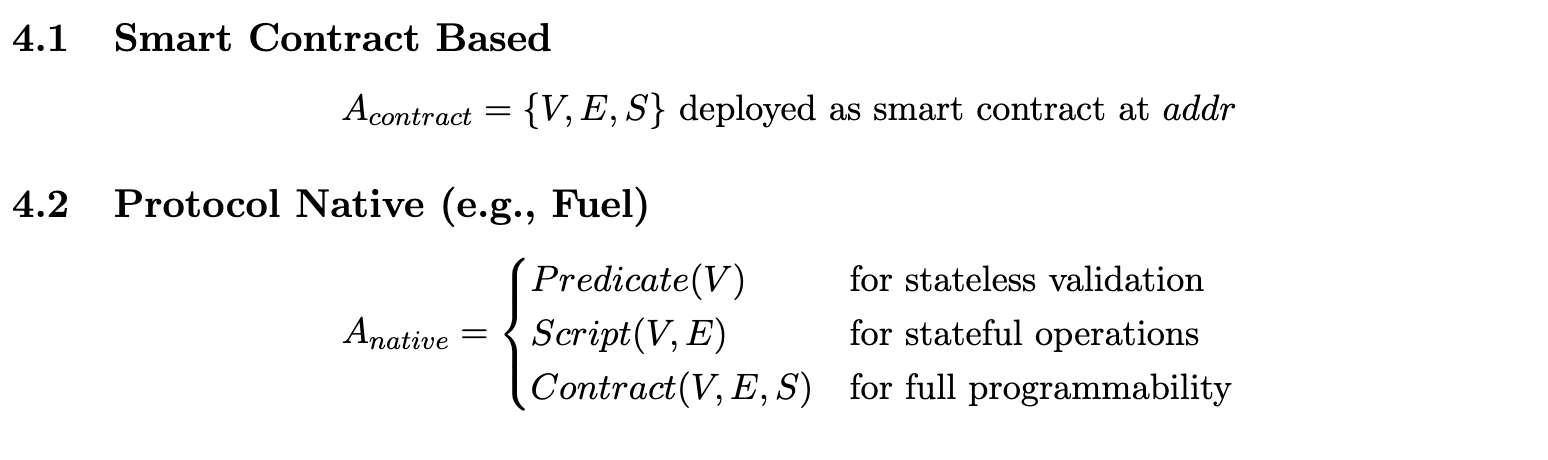

Fuel Network took this radical approach. Instead of forcing developers to deploy complex smart contracts just to enable flexible accounts (4.1 below), Fuel built Account Abstraction directly into the protocol layer. This was a massive rethinking of how blockchain accounts should work, and its payed off, the unlock enables complex logic to take place with huge reductions in state bloat.

On Fuel, you get three ways to implement Account Abstraction (4.2 above):

-

Predicates: Simple rules like "if this signature matches, allow the transaction"

-

Scripts: More complex logic for sophisticated operations including interacting with contracts

-

Contracts: Full programs with memory for maximum flexibility

Think of it as the difference between adding smartphone features to a flip phone versus building an iPhone from scratch.

Why Native Matters

This architectural decision transforms what's possible. When Account Abstraction is native to the protocol, features that feel clunky elsewhere become seamless. Cross-chain signatures work naturally because the protocol doesn't assume a specific signature scheme. Gas abstraction is efficient because the execution layer understands flexible payments for gas. Complex wallet logic doesn't compete with DeFi transactions, Fuel's parallel execution processes both simultaneously, while predicates validate without consuming state resources.

Consider a practical example: the ZapWallet lets you use your existing Ethereum wallet to sign transactions on Fuel, a completely different blockchain than the original public/private key was intended for. No wrapper contracts. No complicated relayers. Just native support for any signature scheme you want to use. This is only possible when Account Abstraction is baked in from the start.

The Future is Flexible

The evolution from rigid accounts to programmable ones isn't just a bump in version upgrade. It's a necessary step for blockchain adoption. Users shouldn't need to understand private key cryptography to use digital money. They shouldn't lose everything from a single mistake. They shouldn't need the base asset just to move their other assets or do an operation on chain.

Fuel's approach shows what's possible when we stop treating Account Abstraction as an add-on and start treating it as essential infrastructure. By providing multiple paths to implement AA; predicates for efficiency, scripts for flexibility, contracts for complexity, developers can not only build wallets that make life easier for users, but also build cool trading mechanics.

The math and formal definitions above prove this isn't just wishful thinking. It's a rigorous approach to solving real problems. But more importantly, it's about making blockchain technology work for humans, not the other way around.

The question isn't whether Account Abstraction will become the standard. It's whether blockchains will adapt quickly enough to meet user expectations. Those built with AA from day one, like Fuel, aren't waiting for the future. They're building it.

评论 (0)