Aave’s platform not only facilitates lending and borrowing digital assets but also introduces a versatile feature: the SWITCH option for both supplied and borrowed assets. This functionality shines when adjusting strategies in response to changing APYs or seeking more favorable lending and borrowing conditions.

If you want to know more about supplying and borrowing on Aave, read my article “Aave simplified: Supply, Borrow and Grow”.

What you will find in this article:

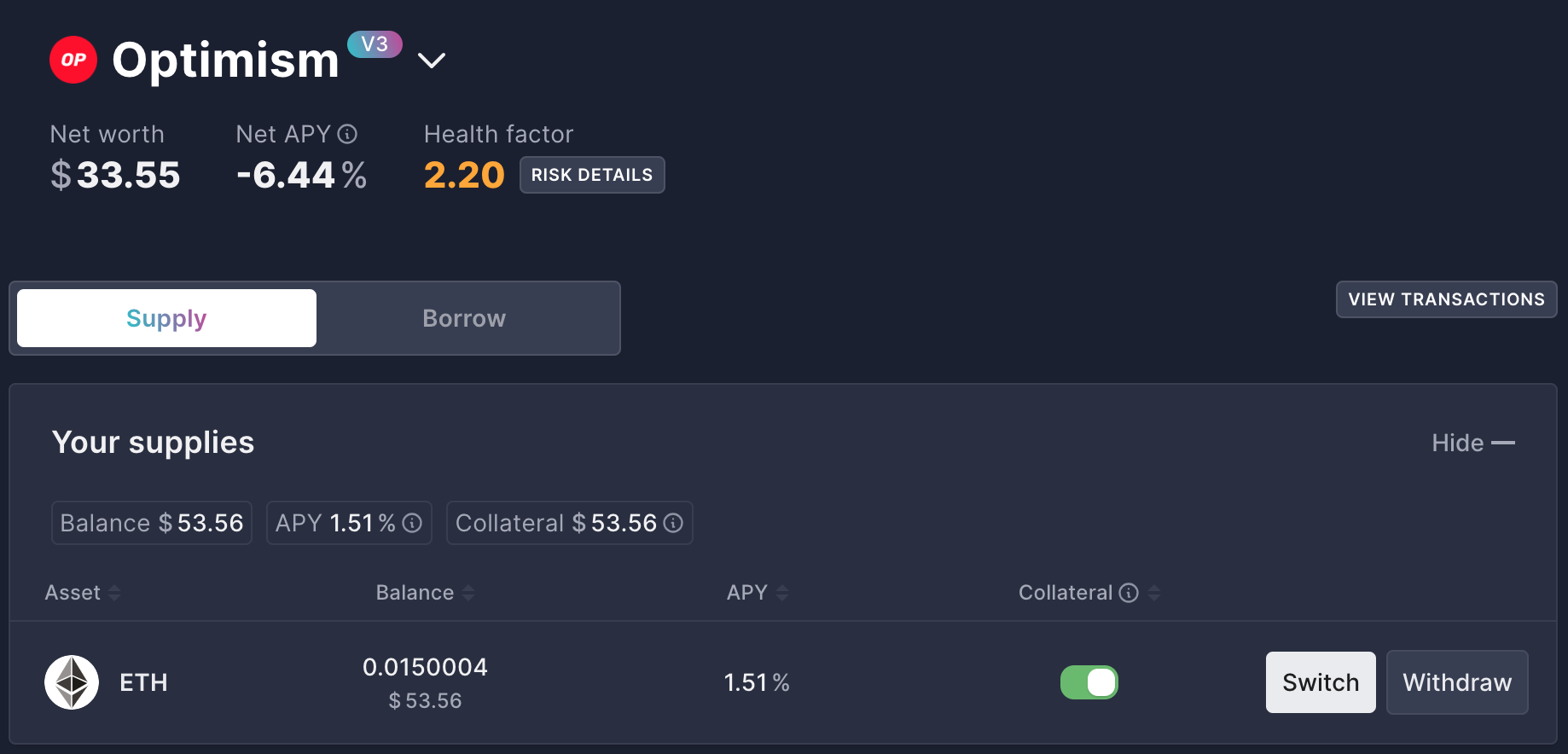

SWITCHING SUPPLIED ASSETS

If the APY on your supplied asset diminishes or you spot another asset with a higher return potential, here’s how to switch:

1)Navigate to “Supply” from the Dashboard on Aave’s main page.

2)Click on the “Switch” button.

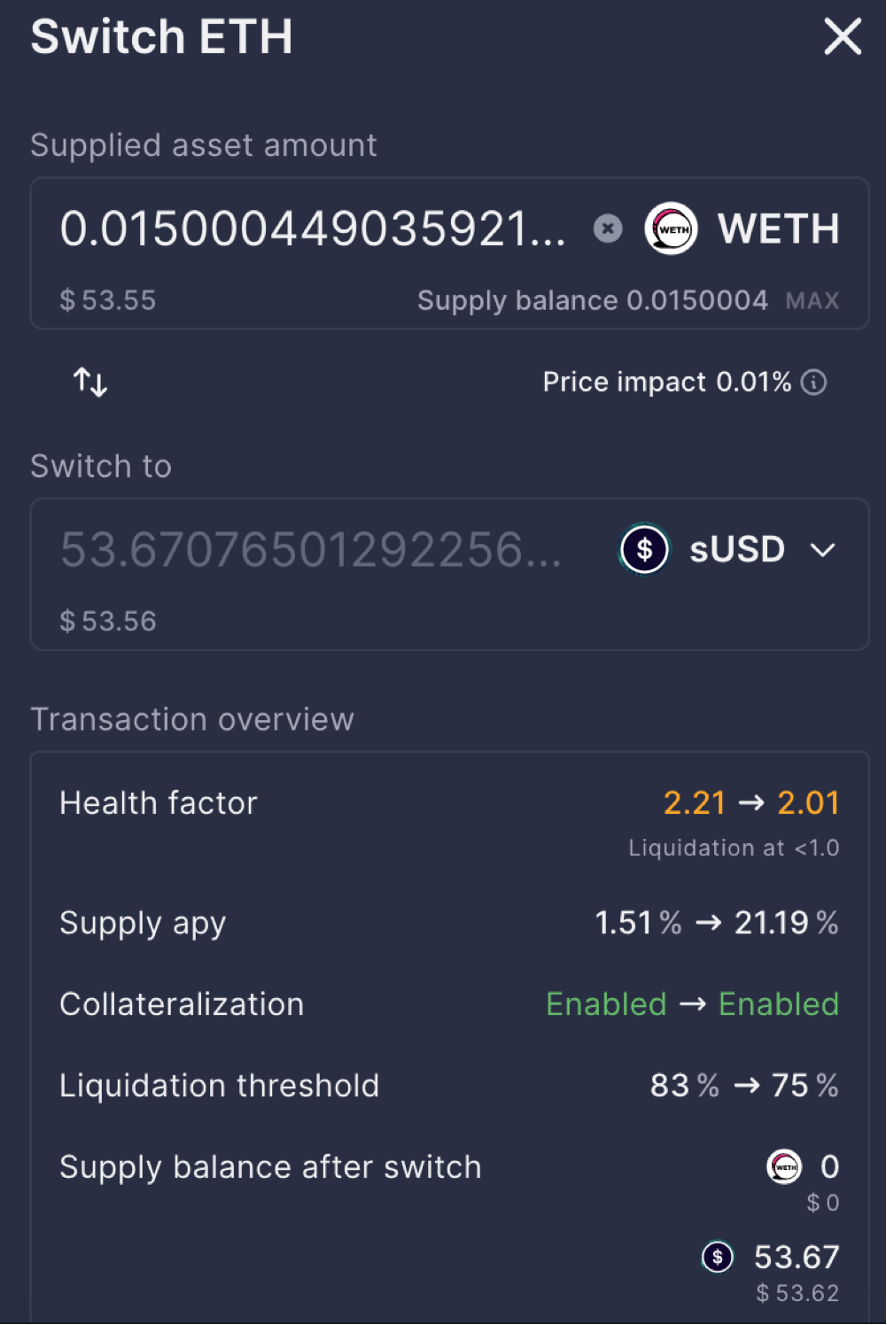

3)Determine the amount of the supplied asset you want to switch. You can opt for any amount up to the total supplied.

4)Select the asset you want to switch to in the “Switch to” field.

5)The “Transaction overview” provides essential information such as changes in the Health Factor, Supply APY and Liquidation Threshold. It’s crucial to monitor these metrics closely to avoid liquidation.

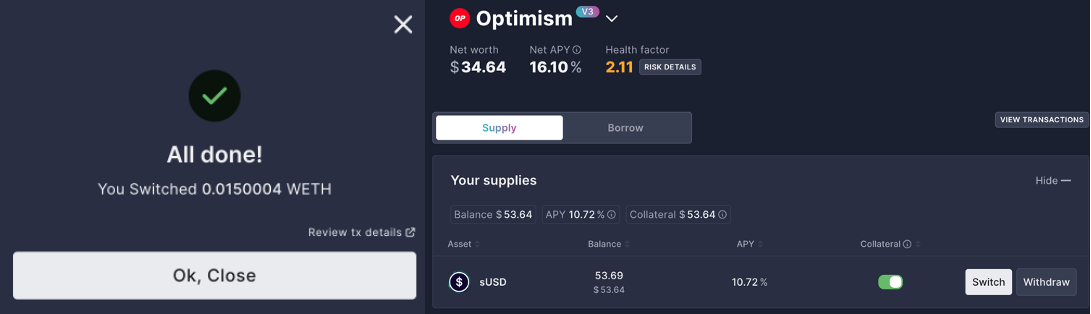

6)Adjust slippage, approve the transaction and complete the switch.

Alternatively, withdrawing the total supplied amount, swapping the tokens, and initiating a new supply in the desired asset in an option. However, Aave’s SWITCH simplifies the process significantly.

SWITCHING BORROWED ASSETS

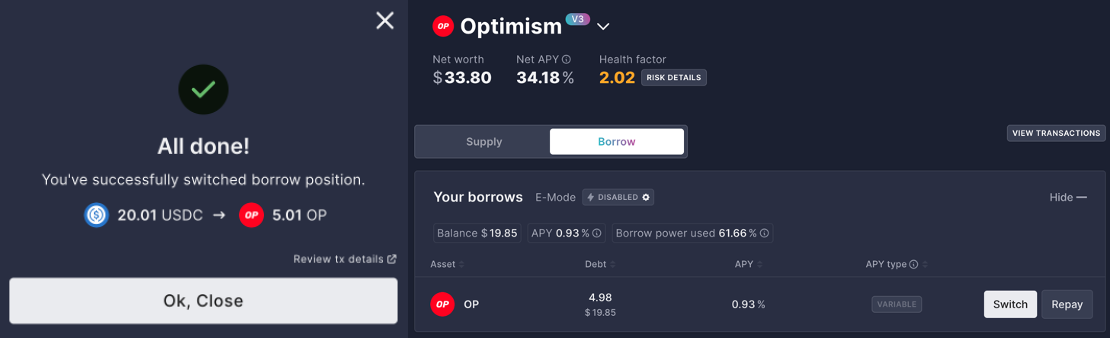

Similarly, should you encounter a borrowable asset with a lover debt APY, switching can optimize your debt conditions:

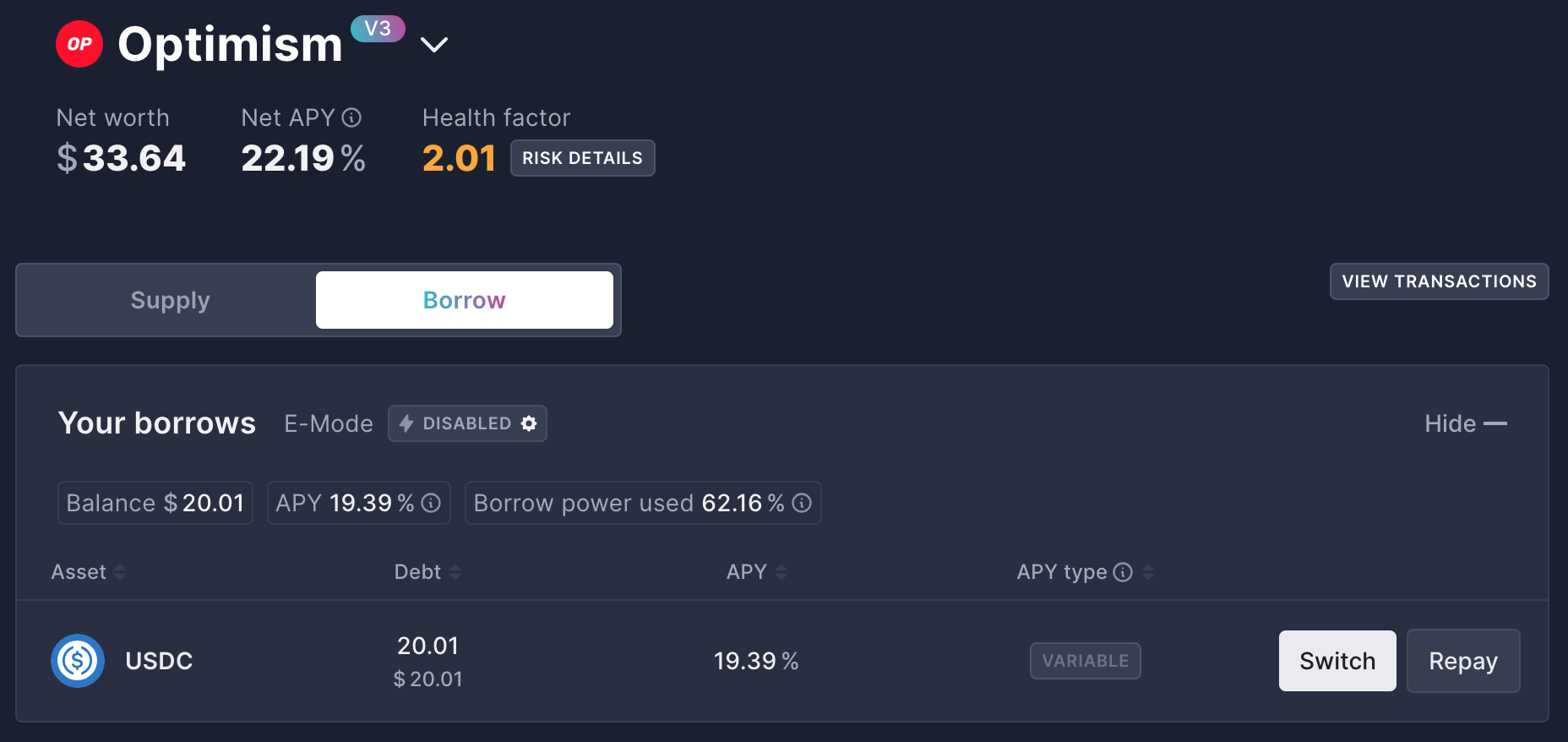

1)From the Dashboard, select “Borrow”.

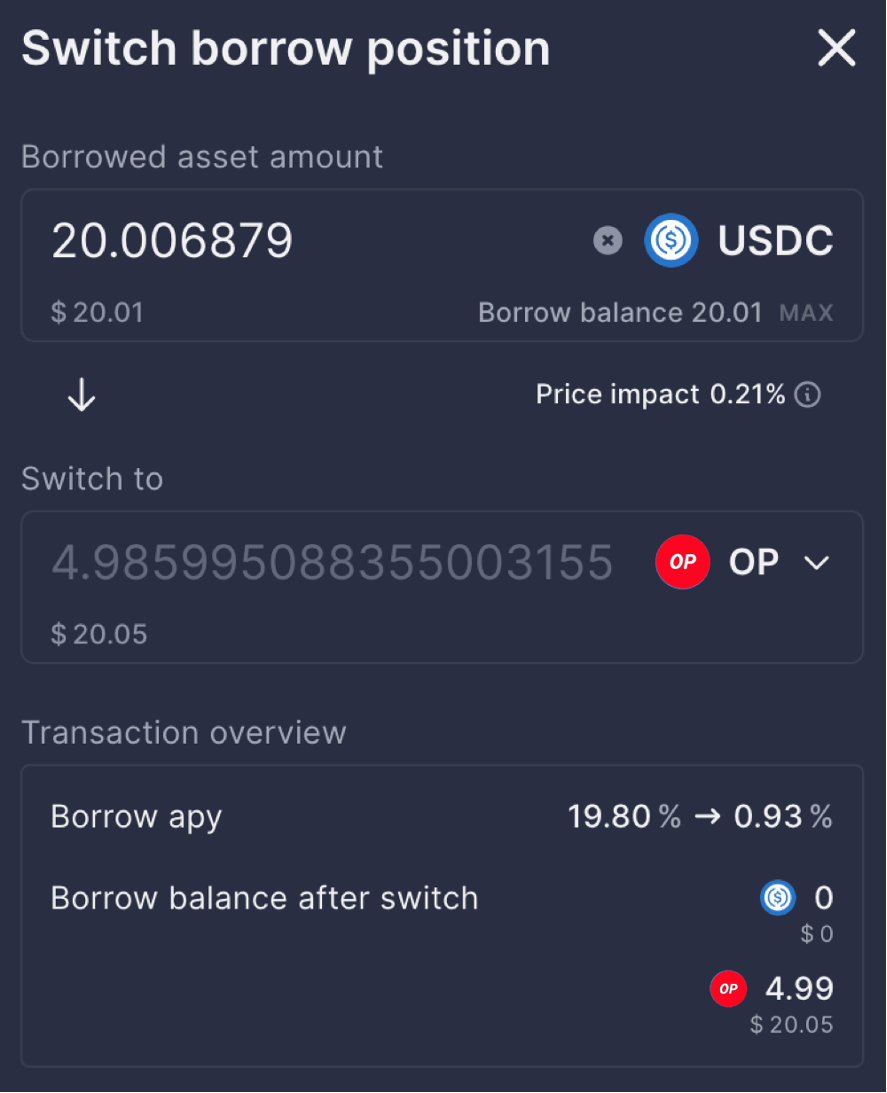

2)Click the “Switch” button.

3)Choose how much of the borrowable asset you wish to switch. The maximum is the total borrowed amount.

4)In the “Switch to” section, pick the new asset for your debt.

- Aave provides details on changes in Borrow APY and the Borrow balance post-switch in the Transaction Overview.

6)Adjust the slippage tolerance, approve and proceed with the switch.

The SWITCH feature on Aave offers flexibility in managing your digital assets, allowing you to adapt to market dynamics efficently. Wheter optimizing returns on supplied assets or minimizing costs on borrowed ones, SWITCH provides a streamlined approach to adjusting your portfolio on the fly.

Lynn Brooke

This article serves educational purposes and is not financial advice. We encourage you to do your own research and be responsible for your actions in the financial space.

评论 (0)