Brazilian Open Finance, formerly known as Open Banking, has experienced remarkable growth in just four years since its launch by the Central Bank of Brazil (BCB). By March 2025, the number of users who consented to data sharing reached 49.15 million, a 75% surge compared to early 2024. This expansion resulted in an impressive 73.82 million active consents and 3.15 billion API calls per week, solidifying Brazil's position as one of the most advanced Open Finance ecosystems globally, as recognized by entities like Open Banking Excellence and the Global Open Finance Index. However, this rapid evolution has not been without its challenges, as companies had to adjust their product development to meet new regulatory requirements, impacting short-term outcomes.

The Momentum of Growth in Brazil

The dynamism of Open Finance reflects a broader transformation in Brazil's financial landscape. It currently encompasses 24.6% of Brazil's banked population, an 8.9% increase since the last report, accompanied by a 14.2% growth in the number of banked individuals. This advancement isn't limited to retail consumers; the business sector has also shown strong engagement, with nearly 950 companies officially adopting Open Banking by June 2024. Notably, 36% of fintechs are developing products wholly or partially based on Open Finance, and a Capgemini study indicated that 53% of companies are either ready to join or have already joined the ecosystem, with 60% complying with current regulations.

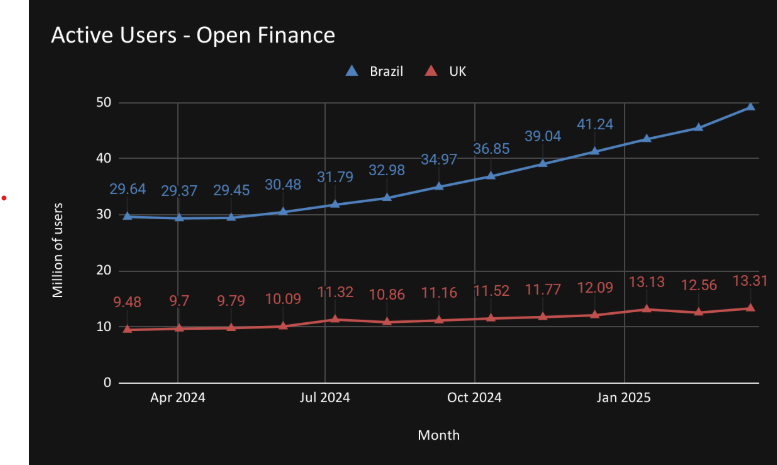

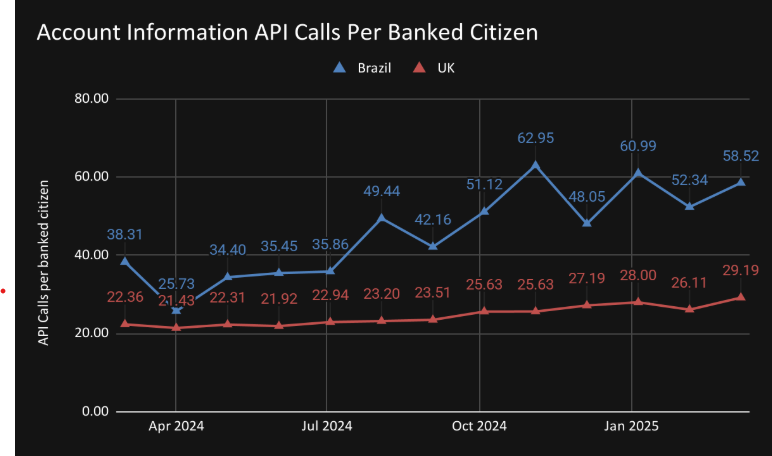

In an international comparison, Brazil has surpassed the UK in user adoption. By March 2025, the British ecosystem, despite being an early pioneer, had 13.31 million active users, representing only 27% of Brazil's total. While the UK's growth has plateaued, Brazil continues its upward trajectory, boasting significantly higher engagement rates—API calls per banked person are 29 times greater than in the UK. However, Brazil still needs to advance in Payment Initiation (PI) API usage, where the UK records 1.7 calls per banked person compared to just 0.2 in Brazil, although Brazil's figure has quadrupled over the past year. The implementation of the fourth phase of Open Finance is expected to further boost service integration and enhance the user experience, particularly in payments.

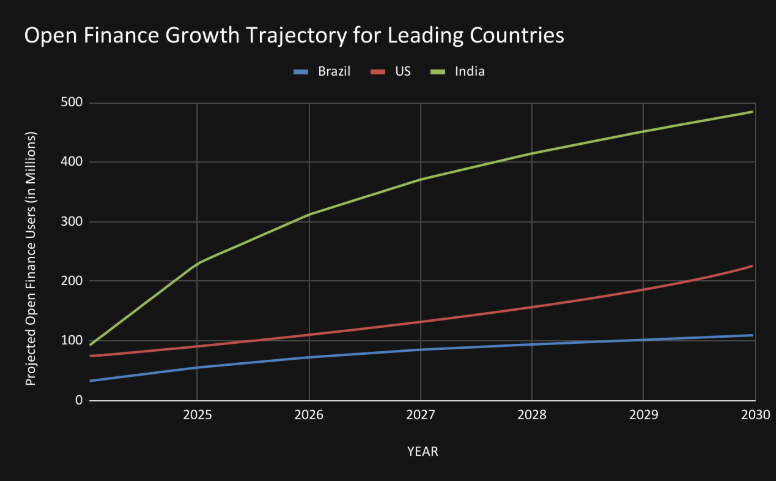

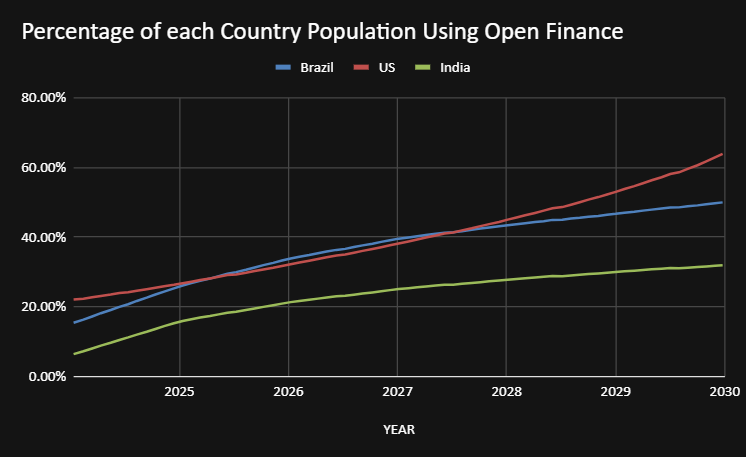

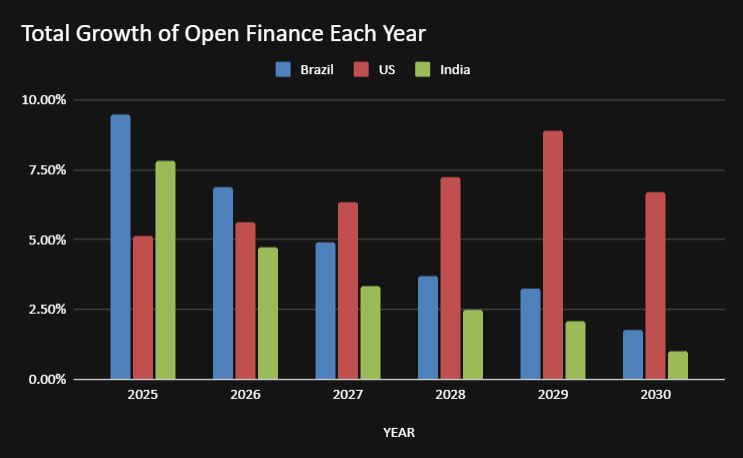

The Brazilian experience aligns with a broader global trend, with other emerging markets, such as India, also accelerating their Open Finance initiatives. India, with its India Stack system, officially launched in 2021, projects reaching 479 million users by 2030. Brazil, for its part, expects to reach 107 million, positioning itself alongside the United States as future leaders of Open Finance. In terms of population penetration by 2030, Brazil anticipates reaching 50%, while India is expected to have less than half its population engaged, and the US could surpass 60%. The driving forces behind this growth vary: in the US, innovation is fueled by market fragmentation and consumer familiarity with fintech tools; in India, the approach is centralized, with mandatory participation and strong investment in digital infrastructure and user education. Brazil, while sharing India's regulatory focus, still lacks comparable public education initiatives. Investing in raising awareness and demonstrating the benefits of Open Finance to users could further accelerate adoption and solidify Brazil's global leadership role.

The Fundamental Role of Regulation

Despite strong user growth in 2024, expectations for Brazilian Open Finance were even higher, and regulation played a critical role in shaping these outcomes. Five major resolutions were introduced or updated throughout the year. Normative 441 was replaced by Normative 575, which imposed stricter monitoring and data reporting requirements for companies. Additionally, Joint Resolution 10/2024 mandated certain companies to immediately join Open Finance, regardless of their internal readiness. While this initially disrupted development timelines due to the need to prioritize compliance, most firms managed the transition effectively.

Other important resolutions—406, 407, 429, and 443—primarily focused on payment systems but remain essential to the Open Finance framework. These directives facilitated the implementation of new payment methods within the ecosystem and, despite temporarily slowing momentum, were crucial for building a sustainable foundation. Payment Initiation (PI), which previously struggled with unclear rules, now has a clear regulatory framework through the combination of Resolutions 406, 407, 429, and 575. This has enabled the establishment of four PIX models:

-

Scheduled PIX: Allows users to input payment information once, with the system executing the transaction at the scheduled time, becoming mandatory for all payment institutions under Open Finance.

-

PIX by Approximation: The latest innovation enabling contactless payments without QR codes, aligning with current consumer habits, given that 67.2% of merchant transactions are already contactless and 82% involve mobile phones.

-

Automatic PIX: A significant evolution that automates payments with flexible amounts, without the need for user confirmation. The payee sets the amount, and the transaction is processed automatically via Open Finance.

These payment models are boosting competition and efficiency in the market, and Resolution 429 reinforces this vision by allowing any company offering payment services to participate, reflecting the core values of Open Finance.

The Future of Open Finance: Next Steps and Innovations

Looking ahead, the global Open Finance ecosystem is poised for continued expansion, marked by deeper integrations and innovative developments. Interoperability and cross-border functionality are central to upcoming transformations. One of the most discussed ideas within international circles is the creation of an "international PIX": a system that could enable real-time cross-border payments by leveraging each country’s Central Bank Digital Currency (CBDC). Although major economies such as the United States and China have shown limited enthusiasm, Brazil is actively pursuing this agenda, seeking to export its regulatory and technical standards to position its Open Finance model as a global reference.

The evolution of Open Finance varies by region, shaped by local regulatory frameworks, consumer behavior, and infrastructure readiness. While such diversity makes global forecasting difficult, Brazil’s trajectory remains promising. According to market specialists, the number of Open Finance users in the country could reach 200 million in the coming years, virtually encompassing the entire banked population. Such growth would place Brazil among the most comprehensive Open Finance ecosystems in the world.

Two major advancements are expected to drive this next phase: the expansion of PIX-connected digital wallets and the widespread adoption of automatic PIX. The former directly aligns with the Open Finance principle of creating seamless payment journeys. With wallet-bank integration, users will be able to authorize instant payments with a single tap, without leaving the app or interrupting their digital experience. This frictionless process is expected to become significantly more common in the near term. The second innovation, automatic PIX, represents a structural shift in recurring payments, eliminating the costs associated with current automatic debit operations (which hover around R7toR 8, even when failed). By enabling automatic debits without user confirmation and with customizable values, this solution is expected to lower costs, stimulate market competition, and create new financial service models.

Another promising development on the horizon is the “guaranteed PIX”. Still under discussion by the Central Bank of Brazil, this mechanism would allow consumers to make purchases or access liquidity immediately, while guaranteeing that the seller receives payment at a future date, much like a credit function, but settled through the PIX infrastructure. According to the BCB and statements from the Federation of Banks (Febraban), guaranteed PIX would combine the speed of PIX with the security of traditional credit operations. The payer could schedule the payment or even divide it into installments, while the receiver is assured of the amount by a financial institution acting as guarantor. This innovation is seen as a strategic evolution of Open Finance, providing users with flexibility and access to credit while preserving the efficiency and low cost of the PIX ecosystem.

Conclusion

In just four years, Brazil’s Open Finance system has undergone substantial transformation. The period spanning 2024 and early 2025 brought key regulatory changes aimed at organizing and modernizing the ecosystem. Earlier rules like Normative 441 were updated for better applicability, and new resolutions supported the integration of technological innovations such as PIX-based payment methods.

Despite some short-term hurdles, the sector still experienced remarkable growth, with a 75% rise in user adoption, 3.15 billion weekly API calls, and an 8.9% gain in market penetration, underscoring the initiative’s momentum. On the global stage, Brazil leads in user numbers but still trails in some advanced functionalities. The UK, for instance, remains ahead in payment capabilities, while the US thrives on private-sector innovation. India, leveraging its scale and inclusive policies, is poised to become the world’s largest Open Finance ecosystem.

Brazil sits strategically between these models, balancing regulation and innovation. To maintain and expand its leadership, the country must not only continue refining its regulatory approach but also invest in public education. Raising user awareness and demonstrating tangible benefits will be essential to unlocking the full potential of Open Finance—both in Latin America and globally.

If you like this content, you can find a deeper discussion about the state of crypto on our Open Finance paper, or if you are an entrepreneur with a Web3 / Fintech / Embedded Finance product, contact us, we are investing!

DISCLAIMER: This material is provided to you for informational purposes only. This is neither an offer to sell nor a solicitation of any offer to buy any securities in any fund managed by Iporanga Ventures (the “company”), nor is it an offer to provide investment advisory services. And the targeted performance contained herein is provided for illustrative purposes only and is not intended to serve as, and must not be relied upon by any person as, a guaranty, an assurance, a prediction of a definitive statement of fact, a probability or as investment advice.

评论 (0)