By: smartymetrics. June 02, 2025

Introduction

The Flare blockchain is a layer-1, EVM-compatible network designed to enhance decentralized applications (dApps) by providing secure and decentralized access to data from other chains and the internet. It features two native interoperability protocols: the State Connector, which enables the acquisition of event information from other blockchains and the internet in a secure and scalable manner, and the Flare Time Series Oracle (FTSO), which provides decentralized price and data feeds to dApps on Flare. Flare’s native token, FLR, powers network operations, while its variants, WFLR (Wrapped FLR) and sFLR (staked FLR), support governance, staking, and transactions. Key tokens in the Flare ecosystem include wETH, USDT, USDC, flrETH, sFLR, and FAssets (e.g., BTC, XRP, DOGE), which are integral to its DeFi applications.

Kinetic is a lending protocol on the Flare blockchain that allows users to lend, borrow, and use various digital assets as collateral. It supports a wide range of tokens, including wETH, USDT, USDC, flrETH, sFLR, and FAssets like BTC, XRP, and DOGE. Kinetic’s dynamics are driven by supply and demand interest rates, collateral ratios, and liquidation mechanisms, ensuring a stable and secure lending environment. Developed in collaboration with Rome Blockchain Labs, Kinetic integrates with Flare’s FTSOv2 for decentralized price feeds and FAssets to expand the range of supported tokens. Its mission is to deliver a cutting-edge lending and borrowing solution on Flare, prioritizing user access, yield generation, and protocol sustainability.

This report analyzes user behavior on the Kinetic protocol using data from a Dune dashboard as of June 2025. It focuses on transaction patterns, wallet activity, and the impact of Flare blockchain events, providing a thorough understanding of user engagement and retention on Kinetic.

Key Takeaways

-

Total Active Wallets: 23,737 wallets are actively engaged in Kinetic, indicating substantial user adoption.

-

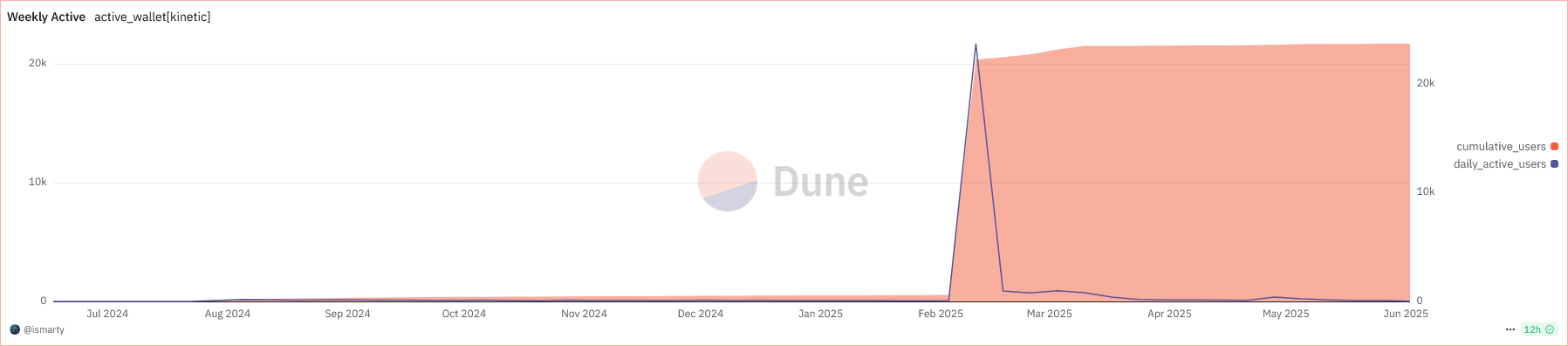

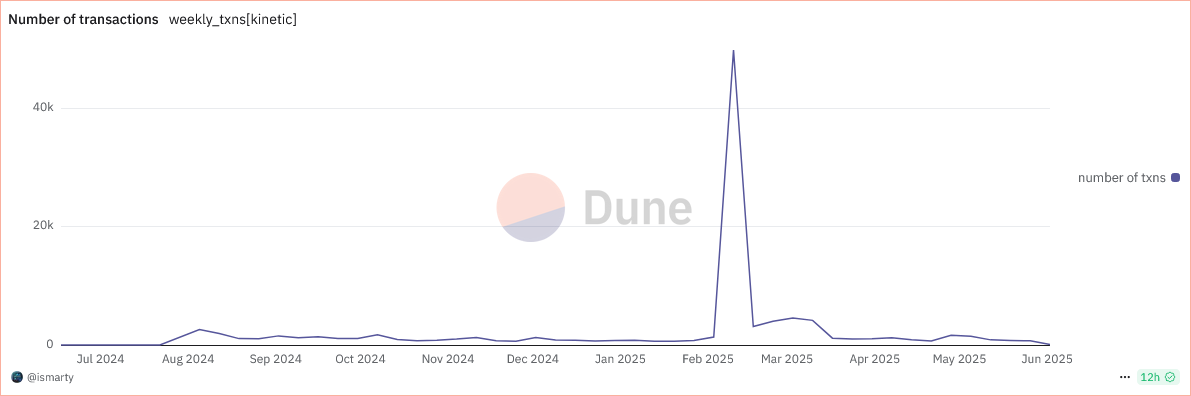

Weekly Active Wallets: Fluctuations observed, with a significant spike in early February 2025, likely driven by Flare events.

-

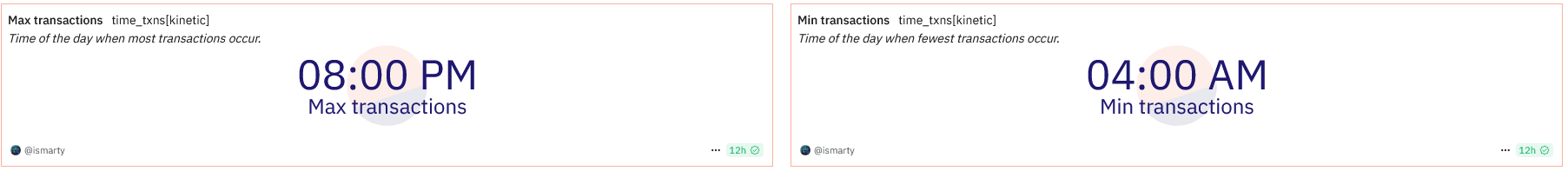

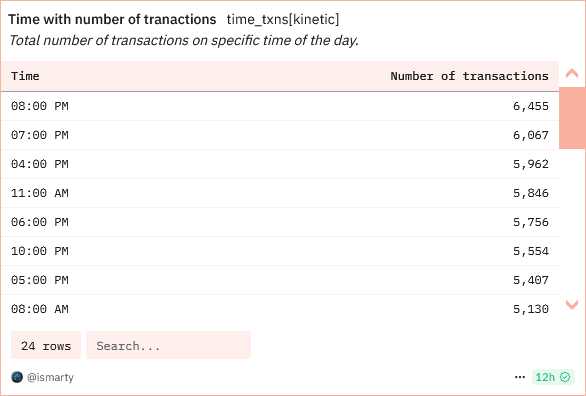

Transaction Patterns: Peak transactions at 08:00 PM (6,455) and minimum at 04:00 AM (3,046), suggesting evening user activity.

-

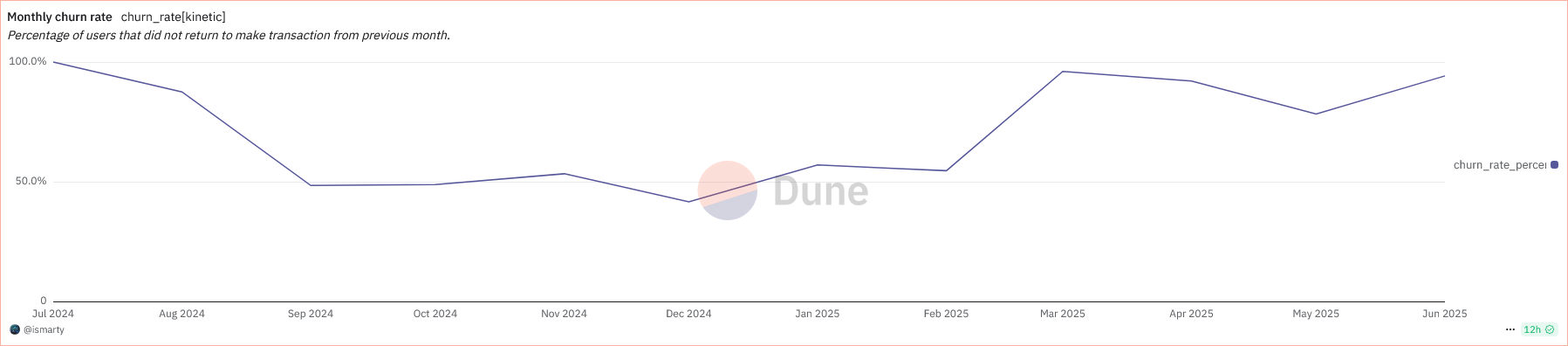

Monthly Churn Rate: Varies from 48% to 100%, stabilizing around 90% from March 2025, indicating retention challenges.

-

Event Impact: The spike in February 2025 correlates with the Flare Fair Quest and FAssets incentives, driving increased user engagement.

Executive Summary

This report examines user behavior on the Kinetic lending protocol on the Flare blockchain, utilizing data from a Dune dashboard as of June 2025. With 23,737 active wallets, Kinetic demonstrates strong adoption, with peak transaction activity at 08:00 PM and a notable increase in users and transactions during February 2025, coinciding with Flare’s Fair Quest and FAssets incentives. The analysis reveals evening engagement peaks, potential time zone influences, and retention challenges indicated by variable churn rates. Stable token prices support consistent lending and borrowing, while the impact of blockchain events highlights the effectiveness of incentives in boosting user activity. The report underscores the importance of understanding user behavior for optimizing protocol performance and enhancing user retention strategies.

Detailed Analysis

Total Active Wallets

Kinetic has 23,737 active wallets, reflecting robust adoption on the Flare blockchain. This substantial user base indicates trust in Kinetic’s stability and utility, particularly given its integration with Flare’s ecosystem.

Weekly Active Wallets

The dashboard’s area chart for weekly active wallets shows fluctuations from July 2024 to June 2025, with a significant spike in early February 2025. This spike aligns with the Flare Fair Quest, launched on February 7, 2025 , which incentivized users to engage with dApps on Flare, including Kinetic. The event’s tasks, such as lending and staking, directly contributed to increased wallet activity, highlighting the effectiveness of gamified incentives in driving user participation.

Minimum Transactions Time

The fewest transactions occur at 04:00 AM, with 3,046 transactions recorded. This low activity during early morning hours is typical for global DeFi platforms, as users are generally less active during off-peak times. This pattern is consistent across many blockchain ecosystems and does not appear to be influenced by specific events or protocol dynamics.

Monthly Churn Rate

The monthly churn rate on Kinetic fluctuates significantly from July 2024 to June 2025, ranging from 48% to 100%, and stabilizes around 90% from March 2025. This high churn rate indicates that approximately 90% of users do not return after their initial engagement, highlighting a significant retention challenge for the protocol. Several factors may contribute to this trend:

-

Unfavorable Interest Rates: Users might find more competitive lending or borrowing rates on other DeFi platforms, prompting them to leave Kinetic.

-

Liquidations: Users who face liquidations due to volatile collateral values may abandon the platform after losing assets.

-

Competition: The crowded DeFi lending space, with established protocols like Aave and Compound, may draw users away if Kinetic’s offerings are less attractive.

To address these retention issues and reduce churn, Kinetic could implement the following solutions:

-

Offer Competitive Rates: Adjust interest rates to be more attractive compared to competitors, encouraging users to stay and engage long-term.

-

Provide Risk Management Tools: Introduce features like collateral management alerts or liquidation buffers to help users avoid losses and maintain trust in the platform.

-

Introduce Incentives: Launch loyalty programs or reward mechanisms (e.g., staking bonuses or token rewards) to motivate users to continue using Kinetic over time.

These strategies aim to enhance user satisfaction and loyalty, stabilizing the churn rate and fostering a more sustainable user base.

Maximum Transactions Time

Peak transactions occur at 08:00 PM, with 6,455 transactions recorded. This evening peak suggests that users are most active after work hours, possibly managing their DeFi positions or participating in events. This pattern can inform protocol optimizations, such as adjusting liquidation thresholds during high-activity periods to minimize user impact.

Number of Transactions

The line chart for weekly transactions from July 2024 to June 2025 shows a significant spike in early February 2025, correlating with the Flare Fair Quest. This event incentivized users to engage with Kinetic through tasks like lending and staking, significantly boosting transaction volume. The spike highlights the effectiveness of gamified incentives in driving user activity.

Time with Number of Transactions

The table of transactions by time of day shows peaks in the evening, with 08:00 PM recording 6,455 transactions. This reinforces the observation that users are most active after work hours, likely due to time zone differences or personal schedules. Understanding these patterns can aid in optimizing system performance and scheduling maintenance during low-activity periods.

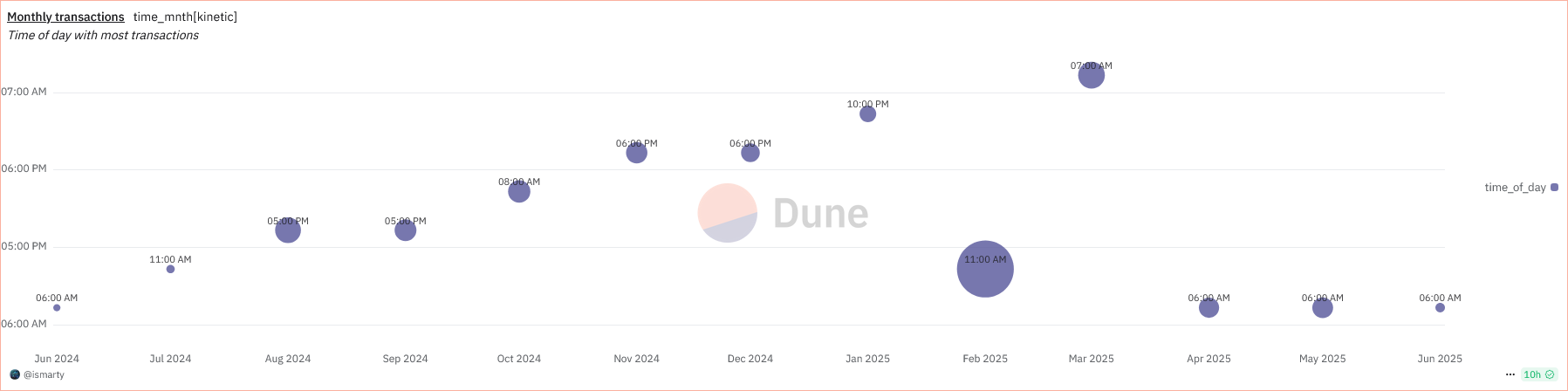

Monthly Transactions

The scatter chart for monthly transactions by time of day from July 2024 to June 2025 shows consistency in peak hours, with highest activity around 06:00 AM to 11:00 AM across most months. This stability in user behavior can be leveraged for load prediction and resource allocation, ensuring smooth protocol operation.

Correlation with Flare Blockchain Events

The Dune dashboard reveals a significant spike in user activity and transactions on Kinetic during the week of February 10-12, 2025. This period coincides with the launch of the Flare Fair Quest on February 7, 2025 , a gamified campaign designed to incentivize users to engage with dApps on the Flare network, including Kinetic. The Flare Fair Quest offered rewards for completing tasks such as lending and staking, which directly align with Kinetic’s core functionalities.

Additionally, the FAssets Beacon Quest, another incentive program, was active around this time, encouraging users to explore and utilize FAssets on the Flare network. FAssets, which include wrapped versions of non-smart contract tokens like BTC, XRP, and DOGE, are integral to Kinetic’s lending and borrowing operations.

The combination of these events likely drove the observed increase in weekly active wallets and transaction volumes on Kinetic. The Flare Fair Quest, in particular, reported over 20,000 participants engaging with Kinetic, further supporting the correlation between the events and the user behavior spike.

This analysis highlights the effectiveness of gamified incentives and reward programs in boosting user engagement within DeFi protocols. However, the subsequent stabilization of the monthly churn rate around 90% from March 2025 suggests that while events can drive short-term activity, sustaining long-term user retention requires ongoing efforts such as competitive interest rates, user education, and protocol enhancements.

Areas for Growth

Kinetic has several opportunities to expand Flare’s ecosystem and boost engagement, including a focus on retention:

-

Feature Expansion: Adding advanced DeFi options like flash loans or yield farming could attract power users seeking higher yields or liquidity solutions.

-

Partnerships: Collaborating with other DeFi protocols or networks could enhance Kinetic’s utility and cross-platform appeal.

-

Market Expansion: Supporting more tokens or entering new markets could broaden Kinetic’s user base as Flare’s ecosystem grows.

-

Improving User Retention: Addressing the high churn rate by offering competitive interest rates, risk management tools, and user incentives could retain existing users and encourage long-term engagement, driving overall growth.

Risks to Monitor

Several risks could impact Kinetic’s performance, with retention emerging as a key concern:

-

Regulatory Changes: Evolving DeFi regulations might impose restrictions, limiting Kinetic’s operations or user access.

-

Competition: Rival protocols like Aave or Compound could outpace Kinetic if they offer superior features or rates.

-

High Churn Rate: The stabilization of the churn rate at 90% from March 2025 poses a significant risk to Kinetic’s growth. Without strategies to retain users, such as competitive rates or incentives, the protocol may struggle to maintain its user base and achieve long-term success.

Future Outlook

Kinetic’s future is promising, with potential for growth if key challenges are addressed:

-

User Growth: With 23,737 active wallets currently, feature expansions and Flare’s unique capabilities could attract more users.

-

Innovation: Leveraging Flare’s FTSO for decentralized price feeds could position Kinetic as a leader in secure lending solutions.

-

Ecosystem Integration: Stronger ties with Flare and other protocols could enhance utility and engagement.

-

Addressing Retention Issues: Implementing strategies like competitive rates, risk management tools, and incentives could significantly improve user retention. If successful, this could lead to substantial user growth, solidifying Kinetic’s position as a top lending protocol on Flare.

Conclusion

The analysis of the Dune dashboard for the Kinetic protocol on the Flare blockchain provides valuable insights into user behavior and the impact of blockchain events on engagement. With 23,737 active wallets and peak transaction activity at 08:00 PM, Kinetic demonstrates strong adoption and evening user engagement. The significant spike in activity during February 2025, correlating with the Flare Fair Quest and FAssets incentives, underscores the effectiveness of gamified rewards in driving user participation. However, variable churn rates indicate retention challenges, necessitating strategies to enhance user loyalty and protocol utility. As Kinetic continues to evolve, leveraging its partnerships and integrating upcoming metrics, it has the potential to become a cornerstone of the Flare DeFi ecosystem.

Upcoming Metrics

The dashboard lists upcoming metrics, including Borrow/Borrowers, Lending/Suppliers, Liquidation, and Profitability. These metrics will provide deeper insights into Kinetic’s lending dynamics, helping to assess protocol health and user engagement more comprehensively. Once available, they will enhance the understanding of user behavior and protocol performance.

References

评论 (0)