Solana has long been praised for its high throughput and low latency, offering developers a fast and affordable blockchain infrastructure. Among its many innovations, OpenBook stands out as a core protocol enabling the creation of on-chain orderbook markets—a crucial component for more granular, transparent trading.

But behind the scenes, there’s a hidden cost: OpenBook Market ID, the very identity needed to deploy an orderbook, comes with unexpected friction. For developers and builders new to the ecosystem, deploying it can be both costly and technically challenging.

So, what exactly is OpenBook ID, and why does it matter?

What Is OpenBook ID?

OpenBook ID is essentially the on-chain identity required to create and operate a market using the OpenBook protocol. Without it, the entire orderbook infrastructure—placing bids/asks, matching orders, executing trades—won’t function.

Solana-native DEXs like Raydium and Orca rely on this setup to offer a more CEX-like trading experience. Unlike AMMs (automated market makers), OpenBook gives users full control: you can place limit orders, view the full depth of market, and fine-tune your execution.

In short, OpenBook ID powers a more precise and transparent trading system.

Why OpenBook Matters

Orderbooks offer several critical advantages over AMMs:

-

Transparency: All buy and sell orders are visible to everyone on-chain, allowing users to make informed decisions;

-

Precision: Traders can set custom prices and execute with minimal slippage;

-

Liquidity Sharing: Multiple markets can share the same liquidity pool;

-

High-Frequency Ready: Built on Solana’s high-speed infra, order execution is fast and cheap.

This makes OpenBook ideal for advanced strategies like arbitrage, derivatives, and options trading. But here’s the catch:

The Friction: Costs, Complexity, and Risk

While powerful, deploying OpenBook ID doesn’t come cheap—especially for indie teams or solo builders.

-

On-chain Fees: Creating a market means spinning up several accounts on-chain, and although it might not sound like much, the cost can still be surprisingly steep for those just getting started.

-

Technical Hurdles: You’ll need to manage multiple PDAs (Program Derived Addresses), use Solana CLI or SDKs, and navigate a non-trivial deployment flow.

-

Error-Prone: One small mistake during deployment and your SOL is gone—with nothing to show for it.

For new builders, the experience can feel more like solving a blockchain puzzle than building a product.

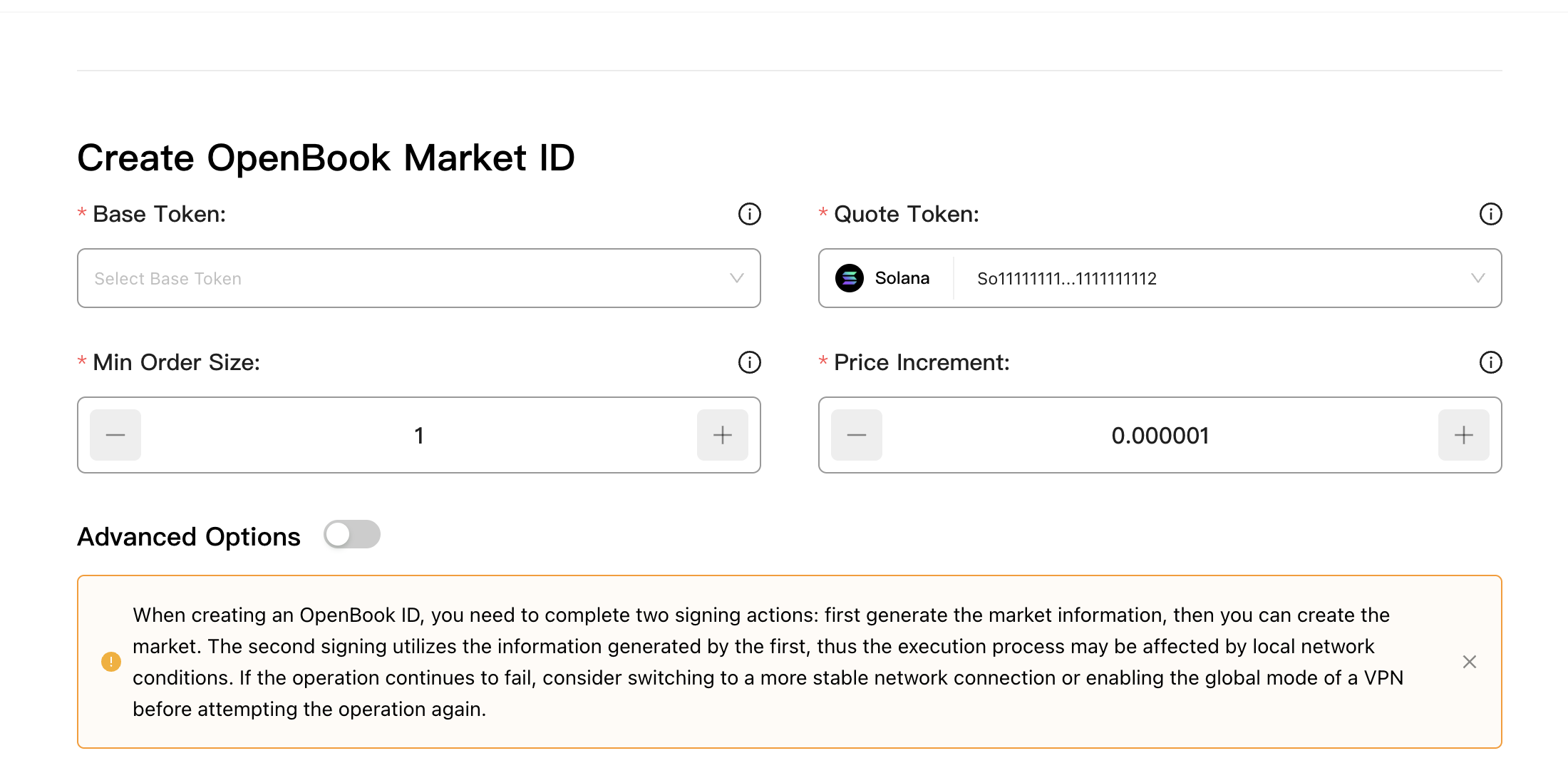

SlerfTools: Simplifying OpenBook Market Deployment

This is where SlerfTools comes in.

As a one-stop toolkit for launching Solana-native tokens and markets, SlerfTools lets anyone deploy an OpenBook Market ID with a few clicks—no SDK knowledge needed. The process is optimized, automated, and costs around 0.39 SOL, significantly lower than typical manual deployments.

In a world where time and precision matter, tools like SlerfTools lower the barrier for experimentation and innovation

The Bigger Picture: From Complexity to Composability

OpenBook ID is more than a tech spec—it’s a signal that Solana DeFi is evolving toward more composable and professional-grade infrastructure. But we can’t ignore the frictions: cost, complexity, and knowledge gaps.

The good news? With tools like SlerfTools emerging, we're witnessing a shift from “developer-heavy” to “creator-friendly.”

If Solana wants to be the chain of choice for DeFi and on-chain finance, this is exactly the kind of evolution we need: less gatekeeping, more participation.

评论 (0)