The Bitcoin network has long been the gold standard for decentralized finance, offering a robust, censorship-resistant platform for peer-to-peer transactions. But as Bitcoin evolves, so do its challenges—particularly around transaction fees, miner centralization, and the growing use of OP_RETURN outputs. A recent analysis by Bitcoin developer Jimmy Song sheds light on the surge of non-standard OP_RETURN transactions, revealing systemic issues that affect users, miners, developers, and layer-2 (L2) solutions. At EQLZR, we’re building a Gas Prediction Marketplace to address these challenges without requiring changes to the Bitcoin protocol. In this blog, we’ll dive into the current state of OP_RETURN transactions, their impact on the ecosystem, and how EQLZR will empower all stakeholders while offering investors a unique opportunity to capitalize on Bitcoin’s fee volatility.

The Surge of OP_RETURN Transactions: A Growing Challenge for Bitcoin

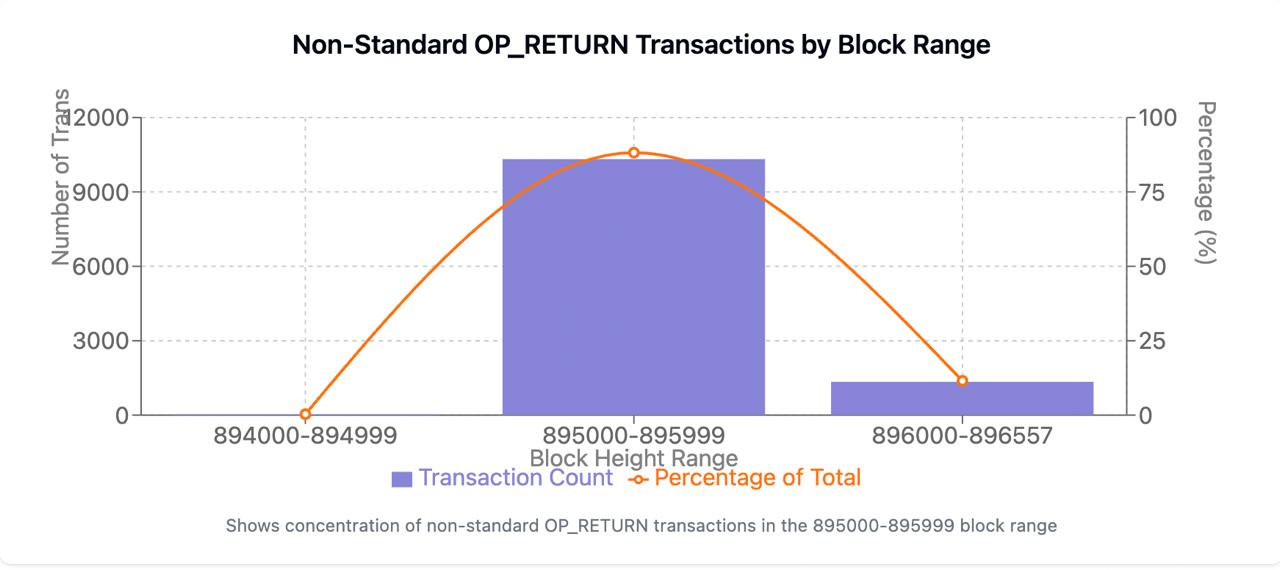

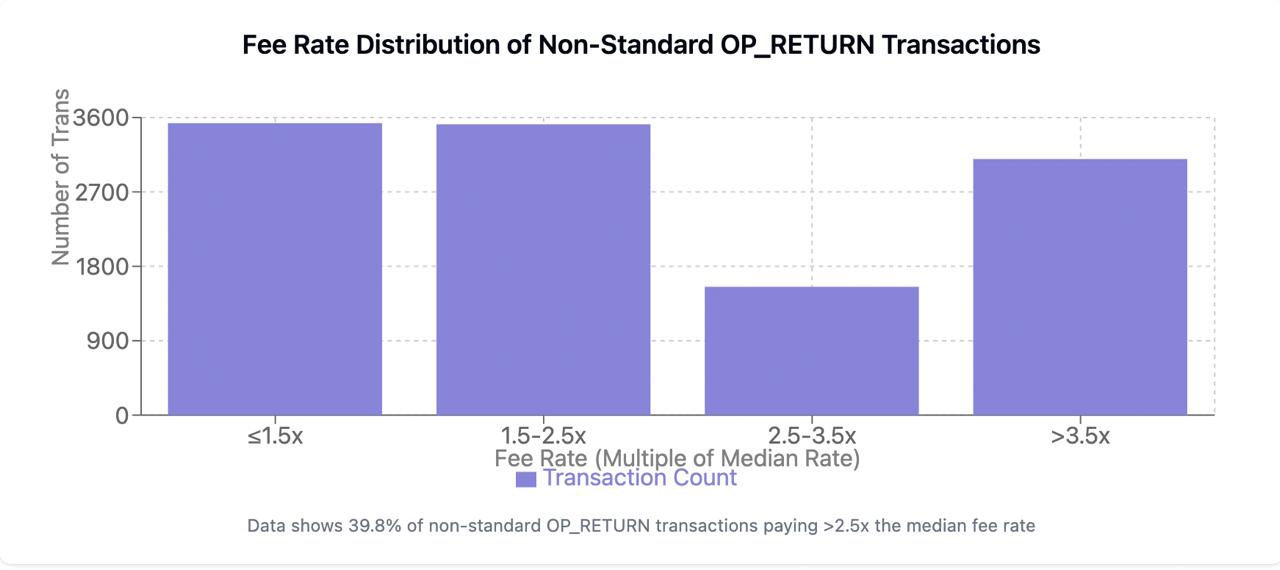

OP_RETURN is a Bitcoin script opcode that allows users to embed small amounts of metadata (up to 80 bytes under default mempool policies) in transactions, often used for timestamping, smart contracts, or anchoring data for layer-2 solutions. However, a recent trend of non-standard OP_RETURN transactions (with sizes > 83 bytes) has led to a dramatic increase in their volume. Jimmy Song’s analysis of 11,700 such transactions since block 894289 reveals the ripple effects on the Bitcoin network:

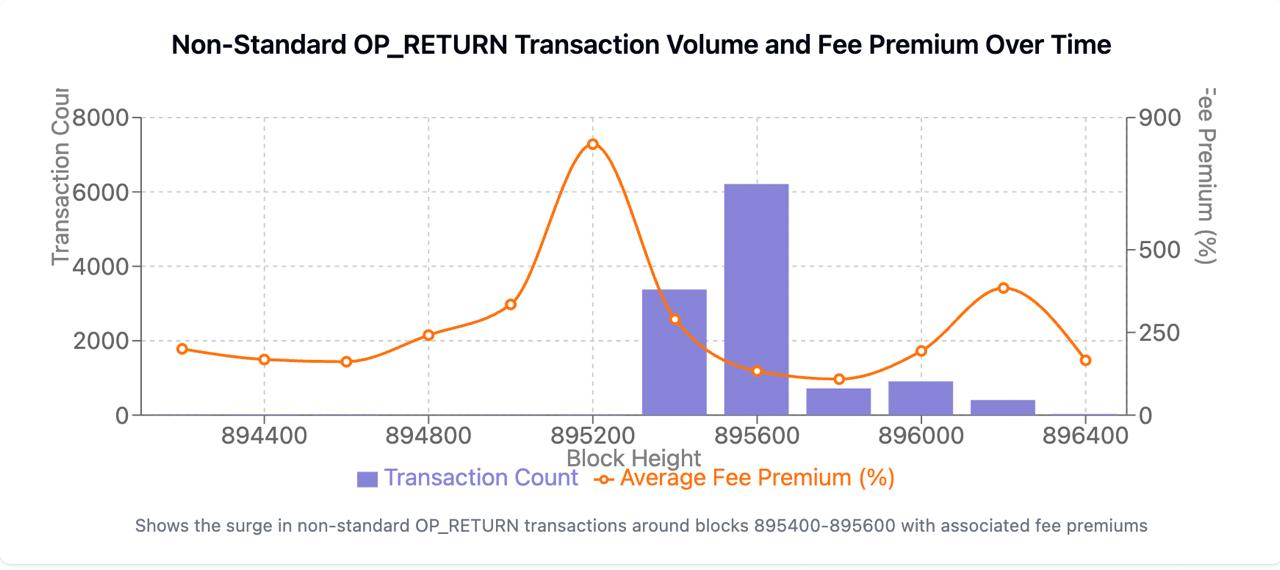

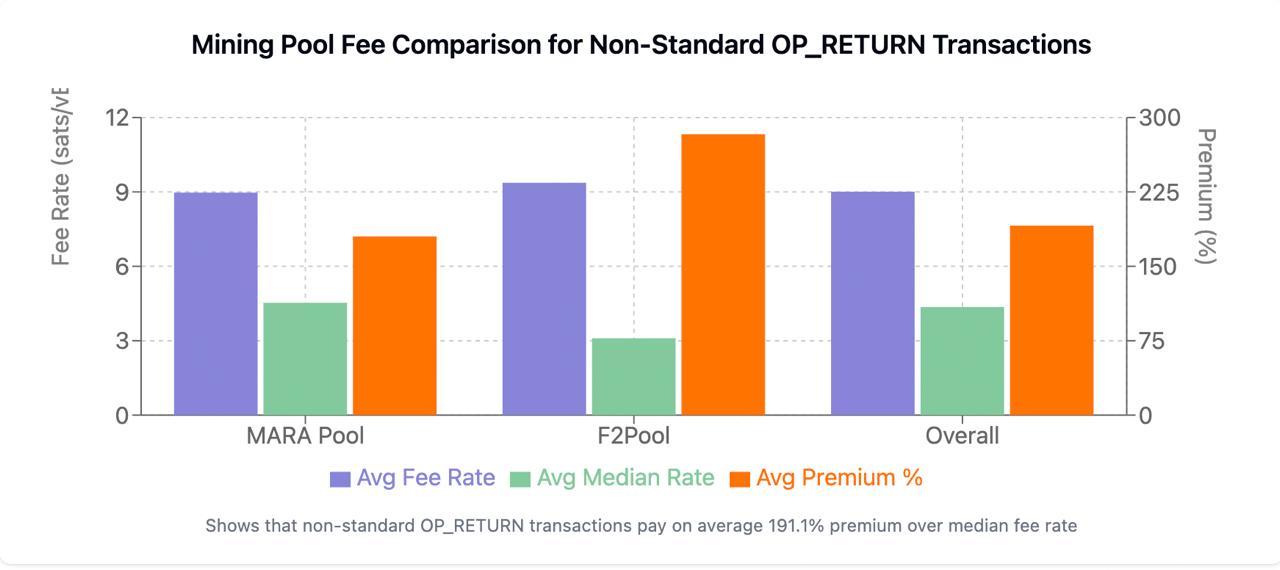

- Crowding Out Regular Transactions: These non-standard OP_RETURN transactions are paying a premium—on average, 191% more than the median fee rate, or nearly triple the typical rate. For example, 3,094 transactions paid over 3.5x the median fee rate, incentivizing miners to prioritize them over regular transactions. This creates a bottleneck: regular transactions, such as simple payments or funding channels for L2s like the Lightning Network, are either postponed or excluded entirely when blocks fill up with high-fee OP_RETURN outputs. In extreme cases, blocks could become saturated with OP_RETURN transactions, leaving little room for other use cases.

- Fee Market Distortion: The high fees associated with these transactions exacerbate fee volatility, making it harder for users to predict costs. Blocks with median fee rates of 0 (e.g., block 896467 in Song’s dataset) further skew the market, as OP_RETURN transactions paying even modest fees appear disproportionately expensive. This volatility pushes regular users to either overpay to compete or wait indefinitely for confirmation, undermining Bitcoin’s utility for everyday transactions.

The Bitcoin Magazine article from May 15, 2025, highlights the ongoing debate around OP_RETURN limits. Developers like Peter Todd argue for removing these limits to let miners freely include consensus-valid transactions, while others like Luke Dashjr push for stricter filters to curb perceived spam (e.g., NFT inscriptions like Stamps). Regardless of the outcome, the current surge in OP_RETURN transactions is putting pressure on the network, with significant downstream effects.

The Centralization Risk: Small Miners and Pools Left Behind

The dominance of large mining pools in processing these OP_RETURN transactions raises serious concerns about centralization:

-

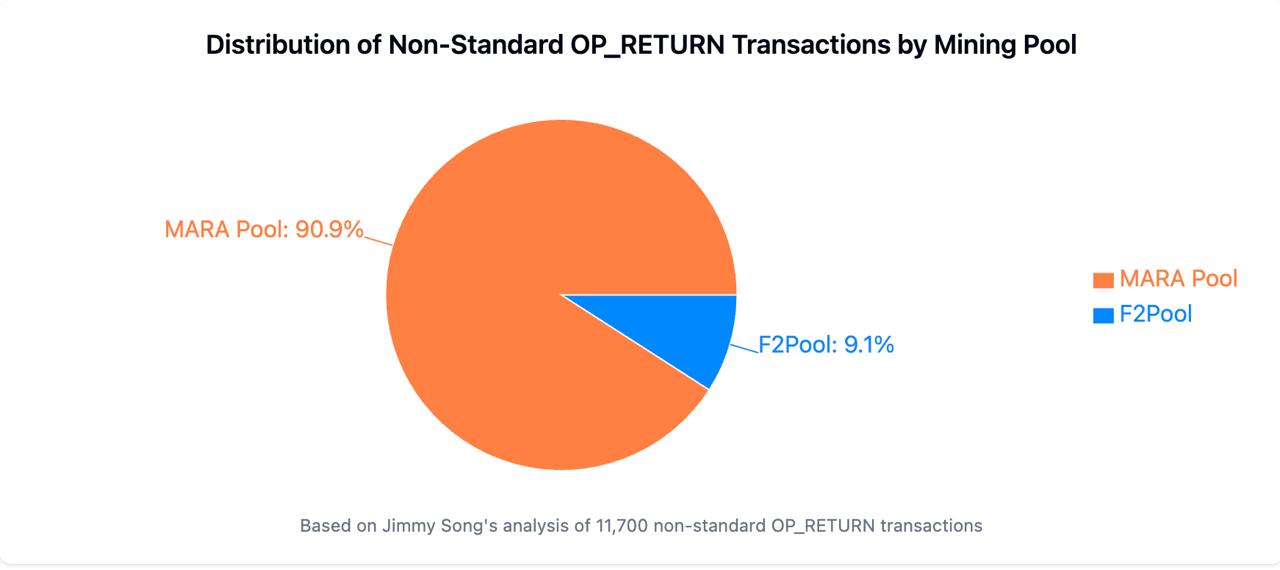

MARA Pool’s Overwhelming Share: Song’s data shows that MARA Pool mined 10,636 of the 11,700 non-standard OP_RETURN transactions (90.9%), while F2Pool accounted for just 1,064 (9.1%). This imbalance suggests that larger pools are either more willing to mine non-standard transactions or have direct arrangements (e.g., private mempools) to prioritize them, likely due to the high fees they offer.

-

Impact on Smaller Miners and Pools: Smaller miners and pools, which lack the infrastructure or hash rate to compete, are increasingly marginalized. They miss out on the lucrative fees from OP_RETURN transactions, reducing their revenue and making it harder to sustain operations. The Bitcoin Magazine article warns that censoring non-standard transactions could drive more activity to private mempools, further harming small miners by obscuring fee estimation and transaction selection processes. Song’s data indicates this trend may already be underway, as MARA Pool’s dominance suggests off-chain coordination that smaller players can’t access.

This centralization threatens Bitcoin’s decentralized ethos, concentrating power in the hands of a few large pools and undermining the network’s resilience.

The Ripple Effect: On-Chain Apps and L2s Struggle to Anchor to Bitcoin Mainnet

The surge in OP_RETURN transactions doesn’t just affect individual users and miners—it also impacts developers building on-chain applications and layer-2 solutions that rely on Bitcoin for security and finality:

-

On-Chain App Developers: Developers using OP_RETURN for real-world use cases—such as timestamping documents, embedding smart contract metadata, or notarizing data—face higher fees and unpredictable confirmation times. For example, a developer embedding a hash in an OP_RETURN output for a supply chain tracking app might need to pay 3x the median fee rate to compete with non-standard transactions, increasing costs and delaying operations.

-

Layer-2 Solutions: L2s like the Lightning Network, Stacks, or RSK often use OP_RETURN to anchor their state to the Bitcoin mainnet, ensuring security and immutability. However, the high fees and block space competition from non-standard OP_RETURN transactions make this anchoring process more expensive and less reliable. An L2 operator might find their anchor transaction delayed for hours or even days, disrupting user experience and potentially compromising the L2’s security model.

-

Real-World Use Cases at Risk: Imagine a healthcare app using OP_RETURN to notarize patient records on Bitcoin for auditability. The app’s transactions could be deprioritized as miners chase the higher fees from non-standard OP_RETURN outputs, delaying critical updates and eroding trust in the system. This isn’t just a technical issue—it’s a barrier to Bitcoin’s adoption in real-world applications.

EQLZR: Empowering Stakeholders Without Changing Bitcoin’s Protocol

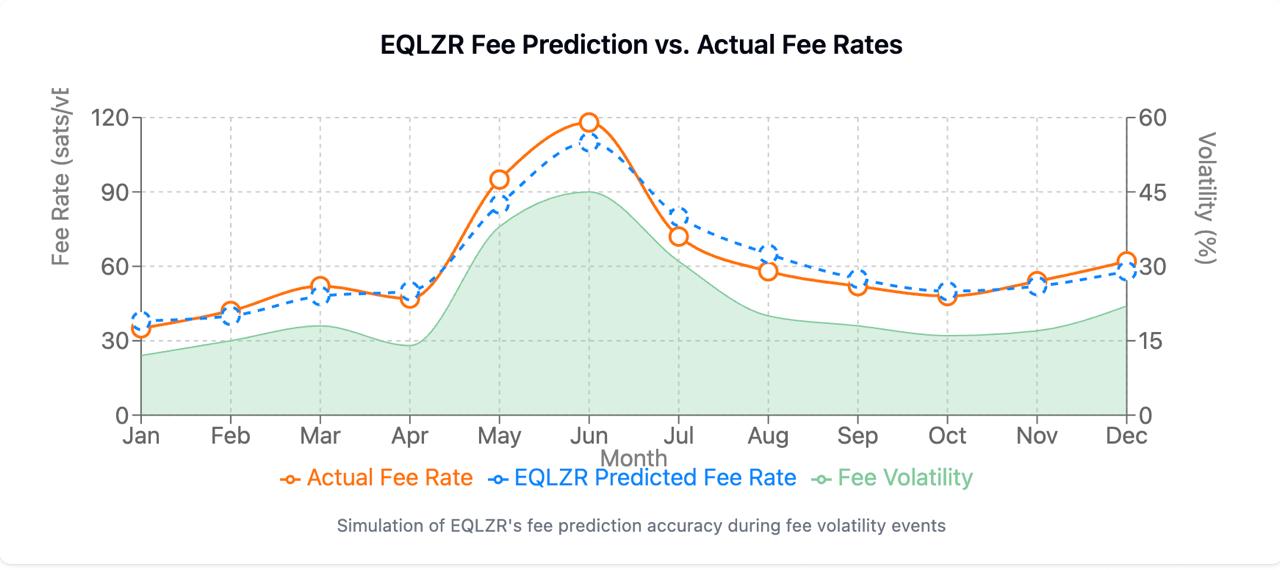

At EQLZR, we’re building a Gas Prediction Marketplace to tackle these challenges head-on, abstracting fee volatility and empowering all Bitcoin stakeholders—users, miners, developers, and L2s—without requiring any changes to the Bitcoin protocol. Here’s how EQLZR will make a difference:

For Users: Fight Fee Volatility with Risk-Neutral Trades

EQLZR will help users combat fee volatility by enabling risk-neutral trades on fee derivatives. By leveraging predictive analytics and market mechanisms, we’ll allow users to hedge against fee spikes, ensuring they can get their transactions confirmed at a predictable cost.

- Impact: A user sending a regular payment in 2026 will use EQLZR to trade a fee derivative that offsets the risk of a 191% fee premium, as seen in Song’s OP_RETURN transactions. They’ll secure a confirmation at a stable cost, even amidst competition from high-fee OP_RETURN outputs.

For Miners: Stable Revenue Through Downside Protection

EQLZR will help miners and pools cover any possible downside risk by offering derivatives that ensure stable revenue. This will protect smaller miners from the volatility caused by large pools like MARA Pool dominating the fee market, allowing them to operate with confidence.

- Impact: A small miner in 2027 will use EQLZR to purchase a derivative that guarantees a minimum revenue per block, mitigating the risk of missing out on high-fee OP_RETURN transactions. This stability will help them compete with larger pools and sustain their operations.

Abstracting Fee Volatility for All

By providing predictive analytics and derivative trading, EQLZR will abstract the volatility of Bitcoin’s fee market, ensuring all stakeholders can operate with confidence. Whether you’re a user sending a payment, a miner building a block, or a developer anchoring an L2, EQLZR will make fees predictable and manageable—without touching Bitcoin’s core protocol.

A Golden Opportunity for Investors: Betting on Bitcoin Fee Volatility

The volatility in Bitcoin’s fee market, as highlighted by Song’s analysis, isn’t just a challenge—it’s an opportunity. Investors looking to capitalize on this volatility can find a unique entry point with EQLZR:

-

Fee Volatility as an Asset Class: EQLZR will explore mechanisms for users to hedge against fee volatility, such as “forward” pricing for transaction inclusion. Investors can bet on these instruments, profiting from fluctuations in Bitcoin’s fee market.

-

EQLZR’s Role: As a leader in fee prediction, EQLZR will provide the data and infrastructure for these financial products, creating a new market for investors. For example, an investor in 2026 might use EQLZR to predict a spike in OP_RETURN-driven fee premiums, buying a derivative that pays out if fees exceed 2x the median—a scenario Song’s data suggests is increasingly likely.

-

Why Now?: With OP_RETURN transactions on the rise and the Bitcoin community debating policy changes, fee volatility is here to stay. Investors who join EQLZR early will be well-positioned to profit from this emerging trend, all while supporting a solution that strengthens Bitcoin’s ecosystem.

Why EQLZR is the Best Solution: Our Unique Selling Proposition

EQLZR stands out as the ideal solution for Bitcoin’s fee challenges due to our unique strengths:

-

Protocol-Agnostic Innovation: Unlike solutions requiring Bitcoin protocol changes (e.g., EIP-1559-style base fees), EQLZR operates at the application layer, ensuring compatibility and rapid deployment. We’ll deliver value without waiting for contentious network upgrades.

-

Data-Driven Precision: Leveraging datasets like Song’s (e.g., fee rate distributions, miner behavior), EQLZR will offer unparalleled accuracy in fee predictions. Our machine learning models will adapt to evolving trends, such as the rise of non-standard OP_RETURN transactions.

-

Stakeholder-Centric Design: EQLZR is built for all Bitcoin users—individuals, miners, developers, and L2s. By addressing the specific pain points of each group, we’ll create a more inclusive and efficient ecosystem.

-

Transparency and Decentralization: We’re committed to reducing centralization risks, such as those posed by MARA Pool’s dominance in Song’s data. By empowering small miners and providing transparent fee insights, EQLZR will uphold Bitcoin’s decentralized ethos.

-

Investor Appeal: Our exploration of fee volatility derivatives positions EQLZR as a pioneer in a new financial market, offering investors a chance to profit while supporting Bitcoin’s growth.

No other solution combines predictive analytics, stakeholder empowerment, and financial innovation like EQLZR. We’re not just solving a problem—we’re building a future where Bitcoin’s fee market works for everyone.

Conclusion: A New Era for Bitcoin Transactions

The surge in non-standard OP_RETURN transactions, as revealed by Jimmy Song’s analysis, underscores the urgent need for a better approach to Bitcoin’s fee market. From crowding out regular transactions to marginalizing small miners and hindering on-chain apps and L2s, the challenges are real—but so is the solution. EQLZR’s Gas Prediction Marketplace will empower all stakeholders with predictable fees, transparent insights, and tools to thrive in a volatile market. For investors, this is a chance to bet on Bitcoin’s fee volatility and support a transformative platform.

Join us in shaping the future of Bitcoin. Sign up for the EQLZR waitlist today and be among the first to experience a new era of transaction predictability.

Join the EQLZR Waitlist Now: www.eqlzr.xyz

Disclaimer: This blog contains forward-looking statements about EQLZR’s upcoming platform and its potential impact on the Bitcoin ecosystem. These statements are based on current data, trends, and our development roadmap as of May 16, 2025. Actual outcomes may vary due to changes in market conditions, technological advancements, or other factors. EQLZR is currently in beta and not yet live; features and timelines are subject to change. Investing in fee volatility derivatives involves risks, and investors should conduct their own due diligence.

评论 (0)