In the ever-evolving landscape of DeFi, rigorous testing and validation are critical to the success of new protocols. Recently, we hosted an exciting trading competition on the alpha deployment of RFX, an onchain permissionless derivatives trading protocol. This event provided a unique opportunity to validate and stress-test our infrastructure before beta launch, ensuring robustness and reliability beyond smart contract auditing and internal testing. Even though the competition utilized test tokens, it was designed to simulate real-world conditions and reward both trading performance and high usage.

Competition Overview

The RFX trading competition on our alpha deployment was more than just a test run. It was a strategic initiative to push our protocol to its limits under competitive conditions. Participants were given test tokens, allowing them to trade without financial risk while contributing to the protocol’s stress-testing. The competition aimed to balance two crucial aspects of trading: profitability and activity. Therefore, the reward structure was designed with a 40/60 weighting between Profit and Loss (PnL) and trading volume.

The Competition Reward Algorithm

Our goal was to create a fair and comprehensive evaluation system that would highlight the best traders while promoting high usage of the protocol. Here’s how the reward algorithm worked:

Data Collection and Preparation

We collected data on each participant’s trading performance, focusing on two main metrics: PnL percentages and trading volumes. These metrics were crucial for evaluating both the effectiveness of trading strategies and the overall activity on the platform.

Normalization

To compare PnL and trading volume fairly, we normalized both metrics. Normalization scales the data between 0 and 1, enabling a balanced comparison. This step was essential for integrating the two metrics into a single scoring system:

$$$

Normalized x = x − min(x) / max(x) − min(x)

$$$

This was applied to both the PnL percentages and trading volumes.

Scoring

Each participant’s score was calculated using a weighted sum of their normalized PnL and trading volume. We assigned a 60% weight to PnL and a 40% weight to trading volume. This weighting ensured that both profitability and trading activity were appropriately rewarded, reflecting our dual focus on effective trading and high engagement:

$$$

Score = (0.6 × Normalized PnL) + (0.4 × Normalized Volume)

$$$

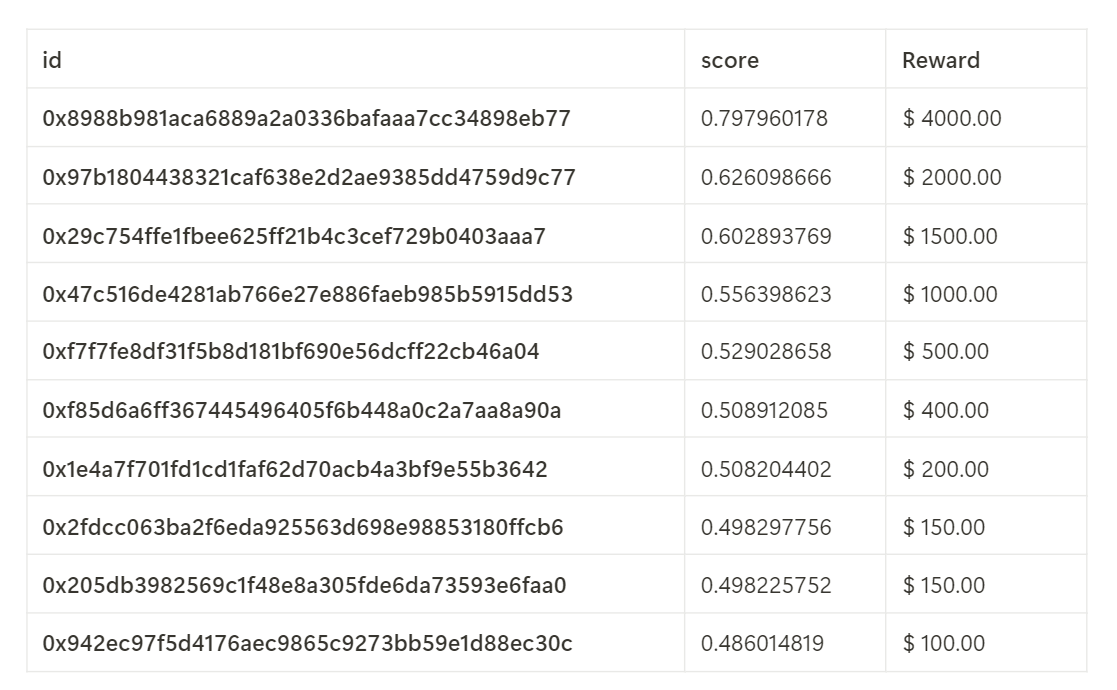

Identifying Top Users

After calculating the scores, we sorted the participants to identify the top users. The top 10 performers were highlighted as the winners of the competition, showcasing a mix of their superior trading skills and active participation.

Results & Insights

The competition yielded valuable insights into the performance and resilience of the RFX protocol. By rewarding both profitable trading and high trading volumes, we encouraged participants to engage deeply with the platform, pushing its capabilities to the limit. The diverse strategies employed by traders provided a comprehensive stress test, helping us identify potential areas for improvement and optimization.

Moving Forward

The RFX alpha deployment trading competition was a significant milestone in our journey towards launching beta. The competition’s success demonstrated the protocol’s robustness and the community’s enthusiasm for on-chain perpetual trading. The insights gained will inform further refinements, ensuring that RFX is ready for a seamless and secure beta launch.

As we prepare for the beta, we are excited to continue fostering a vibrant and skilled trading community. The competition has not only validated our protocol but also set the stage for future innovation in the DeFi space. Stay tuned for more updates as we push the boundaries of decentralized finance with RFX.

评论 (0)